Company patrons proceed to depend on conventional carbon credit score buying strategies. In the meantime, potential patrons of carbon elimination credit want extra training earlier than committing to those newer choices. This 12 months’s NASDAQ survey revealed that despite the fact that corporations are eager about CDR credit, a significant proportion is unaware of the most recent applied sciences like enhanced rock and coastal weathering, enhanced coastal weathering, ocean alkalinity enhancement, and many others.

The survey revealed:

- Help for maximizing the affect of carbon credit score purchases elevated from 25% in 2023 to 27% in 2024.

- Help for offsetting emissions with carbon elimination credit decreased from 24% in 2023 to 22% in 2024.

CDR: A Important Instrument for Reaching Web Zero

Carbon dioxide elimination (CDR) is essential for corporations striving for internet zero. Since Nasdaq’s first International Web Zero Pulse survey, the voluntary carbon market (VCM) has developed with new company suggestions, up to date SBTi tips, and U.S. authorities recommendation. The VCM permits corporations to voluntarily buy credits that fund initiatives lowering emissions.

It’s a well-known proven fact that limiting world warming to 1.5°C nonetheless requires eradicating large quantities of CO2. One other proof is the palpable rising warmth that emphasizes the urgency.

Nevertheless, with rising issues about greenwashing, corporations are being extra cautious. This creates a chance to discover new CDR credit score choices with higher threat safety. Corporations should additionally carefully study their shopping for preferences for each conventional and new carbon elimination efforts.

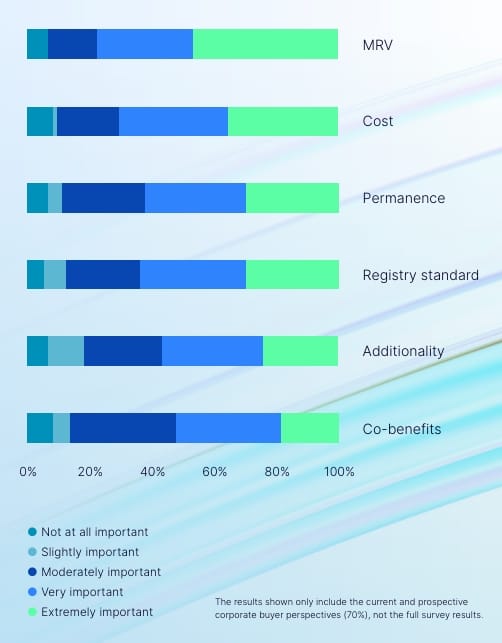

Corporations want to guage the significance of the next standards earlier than shopping for carbon elimination credit.

From June to July 2024, Nasdaq ESG Advisory carried out a survey targeted on company patrons to discover market demand. The survey coated three key themes to assist scale the VCM and drive CDR adoption.

1. Company Web Zero Alignment

Corporations are more and more adopting different methods to scale back their emissions, however some emissions stay past their management. That is the place they want carbon dioxide elimination (CDR).

- Presently, 40% of company patrons perceive their firm’s path to lowering emissions between 2024 and 2030. Additionally they give significance to CDR.

- About 30% anticipate to chop emissions by as much as 40% with out utilizing CDR credit, whereas 31% plan to scale back emissions by as much as 60% by 2030 earlier than turning to CDR.

By 2050, the variety of corporations aiming for 80% or larger will turn out to be 3X. This means that CDR credits play a significant function in these efforts, with 87% of company patrons recognizing their significance of their net-zero methods.

Furthermore, B2C corporations are extra concerned and use CDR as a key a part of their technique. This additionally exhibits the rising shopper demand for sustainable instruments.

2. Carbon Credit Buy Methods

Extra corporations, together with those who haven’t been energetic in carbon markets earlier than, at the moment are planning to purchase carbon credits. Previously, some corporations have bought carbon credit to offset emissions, however now much more are displaying curiosity. This highlights rise in company demand for carbon credit.

Survey findings reveal a rising pattern towards buying carbon discount, avoidance, and elimination credit. The power and supplies sectors, particularly industries like cement, metal, and chemical compounds, are main this shift. These sectors are hard-to-able and face appreciable challenges to lowering their emissions. Thus, making carbon elimination credit a key a part of their mitigation technique.

Moreover, company sectors at the moment are aligning their carbon credit score shopping for plans with their total sustainability objectives with a sturdy technique in place. One other attention-grabbing issue is- company patrons are inclined to favor regionally sourced carbon credit. The report confirmed that this pattern is very sturdy in Canada and Asia-Pacific, the place about two-thirds of respondents favor to buy native credit.

NASDAQ revealed,

- Whereas in 2024, lower than 10% of respondents anticipate to abate 80% or extra of their emissions with CDR, this will increase by 1.5x in 2030 and 2x in 2050.

This upward pattern is especially noticeable amongst sectors like data know-how, monetary companies, shopper staples, and utilities.

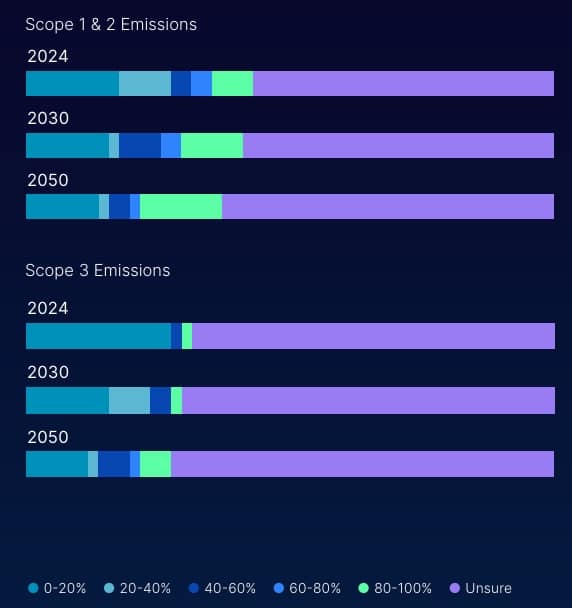

Understanding the Scope of Emissions

Many corporations are unsure about how carbon dioxide elimination will match into their plans for lowering present emissions and sooner or later. A big variety of respondents in current surveys expressed doubts about their understanding of how a lot of their Scope 1 and a pair of emissions will be lowered by means of CDR.

That is the explanation why they hesitate to make use of carbon dioxide elimination (CDR) till they’ve considerably reduce their emissions. Corporations not together with CDR of their technique usually give attention to slicing emissions first.

One other advanced state of affairs is lowering Scope 3 emissions, which embody the most important portion of an organization’s whole emissions however are sometimes the toughest to deal with. Consequently, corporations having strong data of this platform are utilizing CDR to deal with these difficult Scope 3 emissions.

Nevertheless, despite the fact that corporations are dealing with uncertainties of their emissions profiles, CDR can be essential to satisfy their sustainability objectives.

The next determine signifies the anticipated share of an organization’s emissions to be abated utilizing high-quality carbon elimination credit.

3. Carbon Market Dynamics

The report has thrown mild on how corporations’ decarbonization and carbon credit score methods are influenced by altering insurance policies and laws. Whereas carbon removals had been largely unregulated, rising issues from stakeholders have caught the eye of regulators. Because of this, the voluntary carbon markets at the moment are beneath extra scrutiny.

Since final 12 months’s survey, a number of main insurance policies had been launched by the SECCalifornia Air Sources Board (CARB), Federal Commerce Fee (FTC), and European Fee (EC). These climate-related insurance policies are placing stress on each private and non-private corporations.

In truth, 72% of respondents reported feeling the affect, particularly from the SEC’s Local weather Disclosure Guidelines and California’s AB-1305.

Curiously, a deeper look reveals regional variations. Canadian respondents mentioned these insurance policies immediately have an effect on their carbon credit score methods. Quite the opposite, fewer U.S. (72%) and European (60%) respondents felt the identical affect. U.S. and Canadian corporations are primarily targeted on the SEC’s Local weather Disclosure Guidelines and California’s AB-1305.

In Europe, 33% of corporations are extra targeted on EU laws, which ban greenwashing and require corporations to confirm environmental claims earlier than selling them.

Clearer regulatory requirements will improve transparency for U.S. and EU corporations relating to their decarbonization and carbon credit score plans. With out these tips, corporations might hesitate to make use of carbon removals to offset residual emissions as a result of issues over potential anti-greenwashing lawsuits.

Rising Curiosity in Carbon Credit Schooling

Company patrons are displaying elevated curiosity in studying extra about carbon removals. The current survey of NASDAQ revealed that 80% of respondents need extra training on the subject. Many corporations are turning to exterior specialists to assist them make knowledgeable selections about carbon credit score purchases.

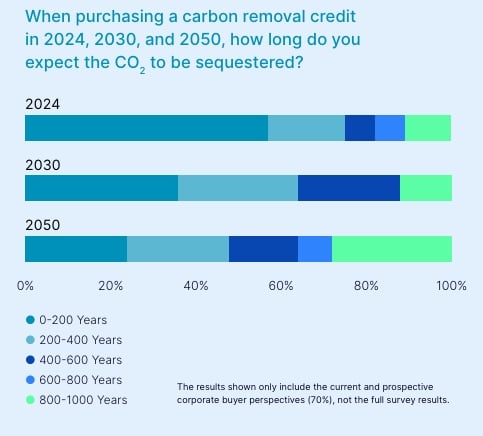

Carbon credit score registries like Puro.earth set standardized protocols and observe credit to make sure market credibility. For 62% of company patrons, these registries and requirements play a key function of their buying selections.

Subsequently, that is turning into essential as they navigate the complexities of various carbon elimination strategies, resembling terrestrial, technological, and ocean-based choices. Moreover, company patrons are more and more anticipating carbon credit to supply long-term CO2 storage. This exhibits a transparent shift in direction of prioritizing everlasting options for carbon elimination.

From CDR to carbon credit to carbon offsetsunderstanding all these components is vital for constructing efficient decarbonization methods for the company sector. And NASDAQ’s report is an ideal information to that.

From CDR to carbon credit to carbon offsetsunderstanding all these components is vital for constructing efficient decarbonization methods for the company sector. And NASDAQ’s report is an ideal information to that.

Supply: Information and Visuals collected from 2024 NASDAQ Global Net Zero Pulse.