Nickel, a key part in electrical car (EV) batteries and stainless-steel, is experiencing vital adjustments in provide dynamics and pricing. Current actions by Nickel Industries and market reactions to international financial situations paint an image of each challenges and alternatives within the nickel sector.

Nickel Industries Strategic Strikes in Indonesia

Nickel Industries, an Australian firm, may turn out to be one of many largest nickel useful resource holders on the planet with its strategic acquisitions in Indonesia.

In August 2024, the corporate signed agreements to buy the Sampala mission and secured a 51% stake within the Siduarsi mission. These strikes come amid a extreme nickel ore scarcity in Indonesia. This has led to a staggering 45% rise in native nickel prices since late 2023.

In response to Justin Werner, Managing Director of Nickel Industries, this acquisition is essential for mitigating the impression of ore shortages and the excessive costs related to them.

The Sampala mission boasts a big useful resource of 2.3 million metric tons of contained nickel metallic, together with 200,000 metric tons of cobalt. Werner expects this useful resource to increase dramatically, doubtlessly reaching as much as 10 million metric tons of nickel metallic. As soon as that occurs, it will likely be among the many prime 5 identified nickel resources globally.

With plans to begin transport ore by the top of 2025, Nickel Industries goals to make sure a self-sufficient ore provide for its operations within the Morowali Industrial Park.

As well as, the Siduarsi mission has revealed an preliminary useful resource of 52 million dry metric tons at a promising nickel grade of 1.1%. This useful resource is anticipated to develop, and there are projections that the entire contained nickel may double. Nickel Industries’ sturdy place in Indonesia positions it as a key participant within the international nickel market.

World Worth Shifts and Market Impression

Whereas Nickel Industries is making headlines with its acquisitions, broader market tendencies are affecting nickel costs globally.

- The London Steel Trade (LME) just lately reported that nickel costs fell to $15,873 per metric ton by the top of October 2024. This decline adopted a short surge to a four-month excessive of $18,153 per tone earlier within the month.

The drop was largely attributed to a scarcity of investor enthusiasm following China’s current stimulus measures, which didn’t meet expectations for extra aggressive financial help.

China is the world’s largest client of commercial metals, and its financial well being is important for nickel costs. After the Chinese language central financial institution introduced its stimulus bundle on September 24, 2024, investor confidence briefly elevated, resulting in increased nickel costs.

Nonetheless, as particulars of the bundle emerged and manufacturing exercise in China remained weak, investor sentiment shifted, inflicting costs to retreat.

Information from S&P World Commodity Insights maps intimately main market occasions impacting LME 3M nickel costs proven under.

Including to this volatility, shares of Russia-origin nickel in LME warehouses elevated considerably, rising 19.6% month over month, per S&P World evaluation.

This surge in stock happens regardless of an LME ban on new deliveries from Russia in response to geopolitical tensions. Because of this, a mixture of elevated nickel stocks and diminished investor confidence has put downward stress on LME nickel costs.

Indonesia’s Manufacturing Technique in Focus

Indonesia stays a pivotal participant within the international nickel panorama. The nation’s power and mineral assets minister indicated that the federal government plans to control nickel ore manufacturing to take care of a steadiness between provide and demand.

Such technique is especially vital given the challenges posed by a brand new home mining approval system that has led some producers to import nickel ore from the Philippines, the second-largest nickel producer.

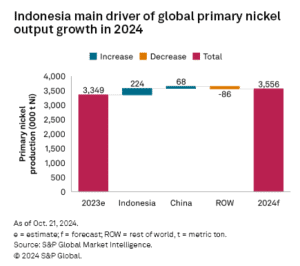

Curiously, regardless of the tight provide scenario, Indonesia’s major nickel output elevated by 14.5% year-over-year through the first eight months of 2024. The most important nickel producer can also be making an attempt to shift away from China-based possession to qualify for the U.S. Inflation Discount Act of 2022.

This pattern highlights the nation’s potential to drive international nickel production growth. As Indonesia continues to handle its manufacturing ranges rigorously, it may possibly preserve its standing as a number one provider within the nickel market.

How Do Future Nickel Costs Look Like?

Trying forward, S&P World analysts have revised their value forecasts for nickel. Following the October value fluctuations, the forecast for the LME nickel value within the December quarter has been upgraded to $16,583 per ton. This displays a decline in comparison with the earlier yr.

Nonetheless, ongoing discussions in China about issuing vital quantities of debt to stimulate progress may enhance investor sentiment and help nickel costs within the close to future.

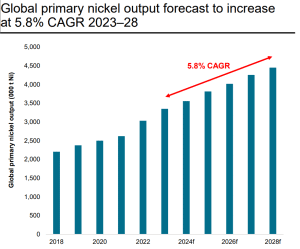

Projections present a surplus within the international major nickel output over the following 4 years, rising yearly at nearly 6%. But, Indonesia’s evolving mining insurance policies and manufacturing methods introduce uncertainties that would have an effect on this outlook.

The current developments in each Nickel Industries and the broader nickel market underscore the dynamic nature of this important metallic trade. The way forward for nickel will rely not solely on native manufacturing methods in Indonesia but additionally on international financial situations and investor confidence.