China and Indonesia partnered for a collection of enterprise agreements value $10 billion through the Indonesia-China Enterprise Discussion board in Beijing on Sunday. This high-level discussion board adopted a Saturday assembly between China’s President Xi Jinping and Indonesia’s President Prabowo Subianto. Reuters revealed that the leaders expressed their plans for strategic financial progress throughout sectors like meals, clear tech, biotechnology, and urgent points associated to water conservation, maritime sources, and mining, notably nickel.

Notably President Prabowo Subianto stated,

“We must give an example that in this modern age, collaboration — not confrontation — is the way for peace and prosperity.”

The joint assertion additional defined their plans to broaden cooperation throughout new power automobiles, lithium batteriesphotovoltaic initiatives, and the digital economic system. In addition they dedicated to advancing the worldwide power transition, securing mineral sources, and stabilizing provide chains.

Indonesia’s Nickel Surge: Recent Billion-Greenback Offers from China

Indonesia’s nickel trade was a big matter of dialogue through the assembly. The nation, which leads international nickel manufacturing at all times has been a serious funding hub for Chinese language companies.

On this regard, the newest information is that Chinese language battery supplies producer GEM Co., Ltd putting a groundbreaking take care of Indonesia’s PT Vale to construct a high-pressure acid leaching (HPAL) plant in Central Sulawesi. The settlement with a deal worth of $1.42 billion, will make sure the nickel plant maintains nickel provides which is essential for battery-grade supplies.

Transferring on, Tsingshan Holding Group and Zhejiang Huayou Cobalt, the 2 main Chinese language firms, proceed to dominate Indonesia’s nickel industry. Their investments replicate religion in Indonesia as a distinguished provider of uncooked supplies for EVslithium-ion batteries, and different inexperienced applied sciences.

Elaborating this additional, Bloomberg reported that Zhejiang Huayou Cobalt Co. is pursuing $2.7 billion in financing for its battery-nickel plant in Indonesia. The financing deal, backed by Ford Motor Co., is being coordinated by HSBC Holdings Plc and Customary Chartered Plc, who’re inviting further banks to take part.

The Pomalaa plant, positioned in Southeast Sulawesi, will use high-pressure acid leaching (HPAL) expertise to provide battery-grade nickel for electrical automobiles. Notably, it’ll have a capability of 120,000 tons of nickel yearly, making it one in every of Indonesia’s largest HPAL initiatives.

Each nations contemplate the timing of those offers a boon to the droop nickel market. Presently, nickel prices are weak as a consequence of low demand within the stainless-steel market and sluggish progress of the EV sector.

The Ever-Increasing Indonesian Nickel Business

Indonesia has at all times attracted overseas funding to spice up its home nickel manufacturing. The nation sees this as important for enhancing and including worth to its huge pure sources. Regardless of these market pressures, Indonesia and China stay dedicated to their long-term objectives, with Indonesia flagging its nickel industry as an integral a part of its financial technique.

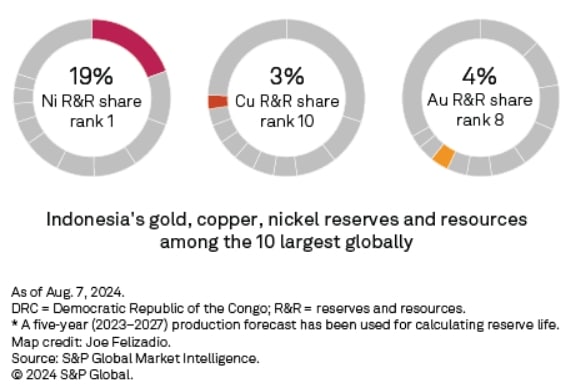

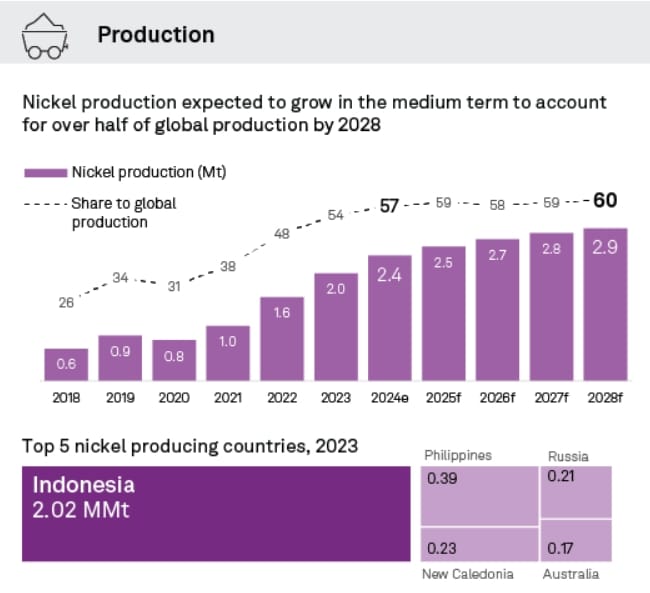

As one of many high producers of metallic commodities—together with gold, copper, cobalt, and particularly nickel—Indonesia produced over half of the world’s mined nickel in 2023. Indonesia’s cost-effective nickel trade spurred main shifts within the nickel market. Whereas nickel costs have dropped since final 12 months, the nation nonetheless maintained a resilient and regular manufacturing.

Based on S&P International Commodity Insights, Indonesia’s mined nickel manufacturing is anticipated to attain 2.1 million metric tons in 2024. This worth is greater than 50% of the anticipated international output and greater than 2X its 2020 ranges.

Supply: S&P International Commodity Insights

Nonetheless, the fast enhance might ultimately end in a worldwide provide scarcity, pushing costs again up to $28,000 per metric ton.

New Ventures in Tech, Journey, and Commerce

China and Indonesia should not limiting their partnerships to the sources sector. Credible media businesses reported that GoTo Gojek Tokopedia, a distinguished Indonesian expertise firm, signed agreements with China’s Tencent and Alibaba to bolster Indonesia’s digital infrastructure.

These partnerships can advance cloud providers and foster native digital expertise. It additionally indicators a long-term funding in Indonesia’s digital economic system and bettering digital literacy and infrastructure at massive.

Notably, President Subianto envisions remodeling Indonesia’s tech panorama with investments in probably the most superior sectors like AI and cloud computing.

Reuters reported, along with high-level trade offers, China and Indonesia agreed to streamline journey and visa insurance policies, introducing measures like multi-entry long-term visas. It will allow extra bilateral exchanges, enterprise journeys, and tourism.

Moreover, the nations additionally agreed to deepen commerce in agricultural merchandise, together with recent coconuts. Apparently, President Subianto additionally secured export agreements throughout his go to. This growth of agricultural exports creates new alternatives for Indonesian farmers whereas fulfilling China’s demand for tropical produce.

Total, it’s evident that President Subianto’s choice to decide on China as its first state go to exhibits the nation’s sturdy intention to deepen ties with Beijing.

Supply: China, Indonesia seal $10 billion in deals focused on green energy and tech | Reuters