COP29, held in Baku, made a serious breakthrough in world local weather motion throughout its opening day. Practically 200 governments agreed on a framework underneath Article 6.4 of the Paris Settlement. This deal units up a UN-led world carbon market, permitting nations and corporations to commerce carbon credit extra effectively. The aim is to create a stronger demand for carbon creditsparticularly to fund local weather tasks in growing nations.

COP29 President Mukhtar Babayev referred to as the settlement a “game-changing tool” to assist local weather motion in much less rich nations. He additionally urged all nations to proceed working collectively to make extra progress in the course of the summit, noting that:

“By matching buyers and sellers efficiently, such markets could reduce the cost of implementing NDCs (Nationally Determined Contributions) by 250 billion dollars a year.”

A New Period for Carbon Buying and selling

Article 6 of the Paris Settlement outlines how nations can work collectively to scale back greenhouse fuel emissions. Article 6.4 introduces a worldwide carbon buying and selling system, managed by a UN physique. This technique will let nations and corporations commerce emissions discount credit generated from tasks worldwide.

The brand new system replaces the older Clear Growth Mechanism (CDM) from the Kyoto Protocol. It goals to be extra clear and efficient, making certain that carbon credit are credible and priceless.

In October 2024, Article 6.4 Supervisory Physique finalized guidelines for the way tasks will work underneath this technique. These embody requirements for carbon removing tasks and emissions discount strategies. The system will let corporations in a single nation earn credit for decreasing emissions and promote them to corporations out of the country, fostering world cooperation.

Challenges and Pushback

Regardless of the breakthrough, reaching an settlement wasn’t straightforward. Some nations and teams raised issues about how choices have been made. The Coalition for Rainforest Nations (CfRN), representing a number of growing nations, argued that Article 6.4 Supervisory Physique bypassed correct procedures.

Kevin Conrad, CfRN’s Government Director, stated the physique adopted guidelines with out first getting approval from the Convention of the Events (CMA), which oversees the Paris Settlement. As a compromise, the ultimate textual content used softer language, like “take note,” to acknowledge the foundations with out absolutely endorsing them. This wording sends a message that future choices should observe correct processes.

Regardless of these points, Babayev assured contributors that extra discussions on Article 6.4 would proceed. Negotiations can even deal with Article 6.2, which offers with how nations trade carbon credits immediately.

Strengthening Carbon Markets With New Guidelines

The brand new world carbon market goals to unravel issues which have plagued carbon buying and selling previously. Older programs typically confronted criticism for missing transparency and effectiveness, which led to low demand and falling prices for carbon credits.

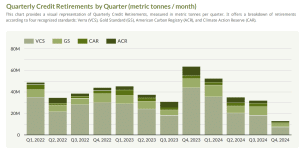

The chart under reveals the quarterly credit score retirements, which symbolize demand, falling and are decrease this yr than prior years.

With clear guidelines and a centralized construction, Article 6.4 hopes to revive confidence in carbon markets. Sebastien Cross, Chief Innovation Officer at BeZero Carbon, referred to as the settlement a serious win for COP29. “This framework provides the tools we need to make carbon markets work better,” he stated.

The carbon finance sector is optimistic that this transfer will assist revitalize buying and selling.

The settlement additionally advantages undertaking builders by giving them clear tips to observe. International locations can align their local weather insurance policies with worldwide requirements, making it simpler to satisfy their emission discount objectives.

Financial and Environmental Advantages

A global carbon market might convey vital financial and environmental good points. For one, it would present new funding alternatives for local weather tasks, particularly in growing nations that want monetary assist.

By making a market-driven system, Article 6.4 encourages companies to scale back emissions in cost-effective methods. Firms that cut back extra emissions than required can promote their additional credit for revenue. In the meantime, these struggling to satisfy their targets can buy carbon credits to make up the distinction.

This technique not solely helps reduce world emissions but additionally helps sustainable improvement in poorer areas. It additionally permits nations struggling to satisfy their goal by buying carbon credit.

What’s Subsequent?

The Article 6.4 framework is just the start. The following steps embody registering undertaking methodologies and establishing operational tips, anticipated to be in place by mid-2025. Throughout this era, the Supervisory Physique will deal with finalizing particulars to make sure the system operates easily.

Nonetheless, vital work stays to deal with issues about market integrity and inclusivity. Some stakeholders fear {that a} centralized system might drawback smaller or less-developed markets. Policymakers should make sure the system is truthful and accessible to all contributors.

Whereas there are nonetheless challenges forward, this settlement units the stage for stronger worldwide cooperation. By establishing a UN-backed carbon market, the deal guarantees to spice up demand for carbon credit and direct funding to vital local weather tasks.

As COP29 continues, leaders will work to refine this technique and sort out different essential local weather points.

Disclosure: House owners, members, administrators, and staff of carboncredits.com have/might have inventory or possibility positions in any of the businesses talked about: .

Further disclosure: This communication serves the only real function of including worth to the analysis course of and is for info solely. Please do your personal due diligence. Each funding in securities talked about in publications of carboncredits.com entails dangers that would result in a complete lack of the invested capital.