Join daily news updates from CleanTechnica on electronic mail. Or follow us on Google News!

It looks as if yesterday that Ron Corio informed me at a lunch with engineers that vitality storage would be the subsequent large factor since solar energy. It was years in the past. Properly, improvement occurred rapidly, time glided by, and now it’s right here to remain. Residential vitality storage installations simply hit an all-time excessive, and US grid-scale vitality storage is approaching fierce.

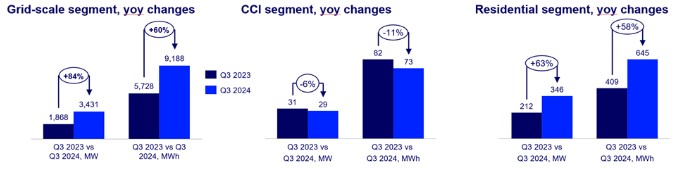

With a record-breaking 346 MW of residential storage inbuilt Q3 2024 — a 63% enhance over the earlier quarter — the residential vitality storage market has reached an all-time excessive. Regardless of constraints in home battery provides, California, Arizona, and North Carolina led the way in which in progress, putting in 56%, 73%, and 100% extra family storage vitality in Q3 than in Q2. Trying again extra broadly, the residential market set a brand new all-time quarterly file.

The grid-scale section of the U.S. vitality storage trade achieved a brand new Q3 file as effectively, with 3,431 megawatts (MW) and 9,188 megawatt-hours (MWh) deployed because the market continued its strong enlargement. A complete of three,806 MW and 9,931 MWh have been deployed, an 80% and 58% enhance over knowledge from the earlier yr, in accordance with the latest U.S. Energy Storage Monitor report from the American Clear Energy Affiliation (ACP) and Wooden Mackenzie, which was issued at present.

“We are seeing the energy storage industry fill a real need across the country to provide reliability in an affordable and efficient manner for communities,” stated John Hensley, SVP, Markets and Coverage Evaluation for ACP. “With 64 GW of new energy storage expected in the next four years, the market signal continues to be clear that energy storage is a critical component of the grid moving forward.”

The markets for vitality storage in Texas and California are exhibiting no indicators of slowing down

In Q3, each states’ grid-scale vitality storage deployments have been robust, demonstrating their continued adoption of storage as a grid answer. Due to its emphasis on longer-duration vegetation, California delivered probably the most GWh of latest installations, with almost 6 GWh added, and Texas tripled installations from the earlier quarter, with almost 1.7 GWh added. Installations in Arizona, Colorado, Florida, and Vermont additionally occurred in Q3, indicating a nationwide need for grid-scale storage deployment.

“The rapid energy storage deployment we’re seeing in the United States not only enhances reliability and affordability but also drives economic expansion. This additional storage capacity is helping meet increasing energy demand and is supporting growing industries like manufacturing and data centers,” stated Noah Roberts, ACP’s VP of Power Storage. “Energy storage is crucial for energy security and to help outpace rising demand.”

Residential and grid-scale industries will drive future progress

With grid-scale installations anticipated to greater than double by 2028, and thus attain a cumulative energy capability of 63.7 GW, and family installations reaching 10 GW throughout the identical time interval, the grid-scale and residential segments will proceed to dominate the market. With 29 MW put in, community-scale, industrial, and industrial (CCI) numbers stayed steady and decreased by simply 4% from the earlier yr.

“We have seen consistent growth in the market this year, especially in the grid-scale segment,” stated Nina Rangel, senior analysis analyst at Wooden Mackenzie. “Overall, storage installations will grow 30% in 2024, signaling the industry’s strongest year yet. However, it will be difficult to keep this pace. Between 2025 and 2028 we are projecting an annual average growth rate of 10%, as early-stage development constraints continue.”

Though regular progress is anticipated, Allison Weis, world head of storage at Wooden Mackenzie, identified that there are some unknowns surrounding the incoming presidential administration as a result of protectionist insurance policies like increased tariffs and modifications to sure tax credit could also be carried out.

“While there might be potential opportunities in a new pricing environment for domestic manufacturers in terms of competition, any major shifts in tax incentives or increased tariffs could outweigh benefits and have an impact on new project development,” stated Allison Weis, world head of storage for Wooden Mackenzie.

Supply: The American Clear Energy Affiliation (ACP), US Energy Storage Monitor

Chip in a number of {dollars} a month to help support independent cleantech coverage that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Discuss podcast? Contact us here.

Join our each day e-newsletter for 15 new cleantech stories a day. Or join our weekly one if each day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy