Join daily news updates from CleanTechnica on electronic mail. Or follow us on Google News!

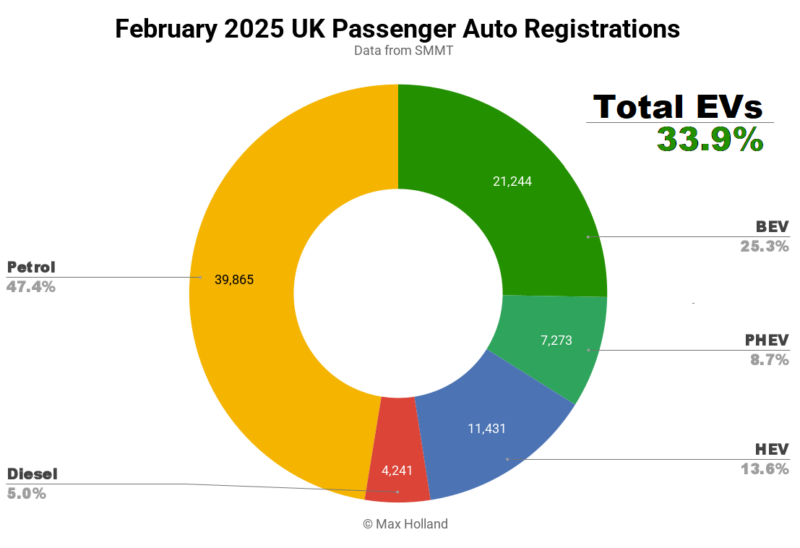

February’s auto market noticed plugin EVs take 33.9% share within the UK, up from 24.8% year-on-year. BEVs grew in quantity by 42% YoY, with PHEVs shut to twenty% development. Total auto quantity was 84,054 items, nearly flat YoY. The UK’s main BEV model in February was Tesla, with two of the highest 3 general best-selling automobilesand 18.5% share of the BEV market.

February’s gross sales totals noticed mixed plugin EVs take 33.9% share within the UK, with full electrics (BEVs) taking 25.3%, and plugin hybrids (PHEVs) taking 8.7%. These examine with YoY shares of 24.8% mixed, 17.7% BEV, and seven.2% PHEV.

The large change in BEV market share year-on-year was partly a results of baseline results. Just a few manufacturers have been at a really low ebb final February, and reappeared in respectable quantity this February (particularly Mini, Volkswagen, Peugeot, Ford, and Renault) every contributing not less than 500 additional items (>1,000 within the case of Mini and Volkswagen). These non permanent irregularities can typically occur within the UK’s right-hand-drive market (served by batch shipments), particularly in a modest quantity month like February.

There’s additionally presently an anticipated pull-forward of BEV gross sales forward of April’s introduction of the “expensive car tax” (applying to BEVs for the first time). This has given February’s BEV volumes a lift. There’ll clearly be a consequent hangover in April and Could.

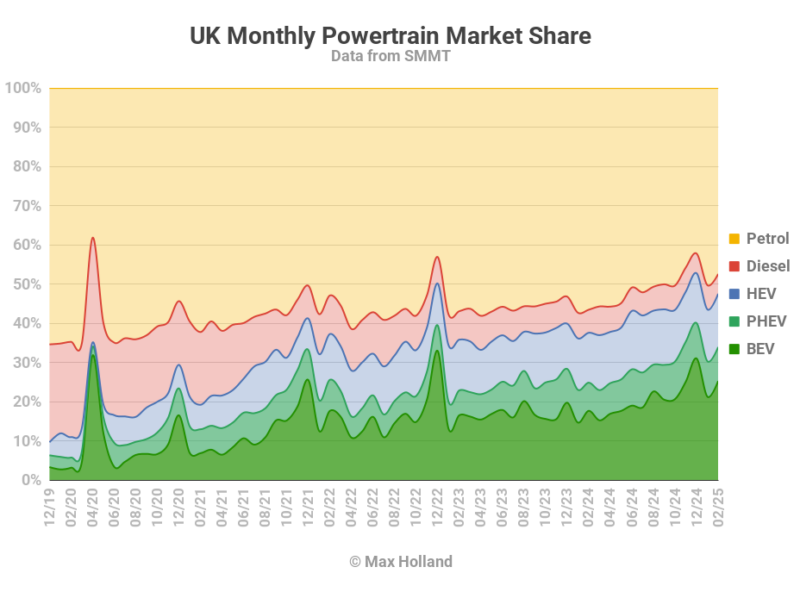

I’d usually say that we’d subsequently have to attend until Q3 to get a clearer image of the “settled” powertrain shares for 2025. However by the top of Q3, the December deadline for the ZEV mandate will probably be looming, and strongly shaping the BEV market. In brief, 2025 will see a number of ups and downs on the journey to assembly the 12 months’s ZEV mandate of “28% ZEV”, however the business will doubtless get there ultimately.

February noticed a file low market share of diesel-only automobiles, at simply 5.0%, down from 5.9% YoY.

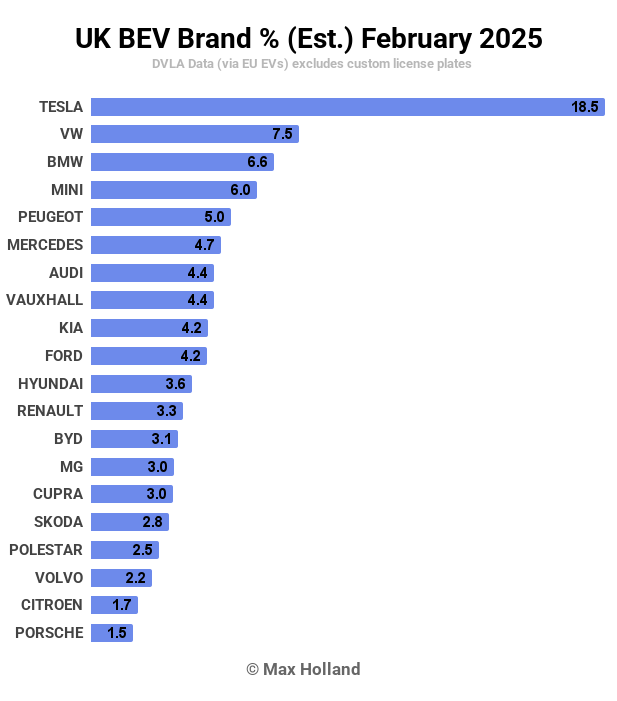

Most Standard BEV Manufacturers

Tesla was the UK’s main BEV model in February, with 18.5% of the nation’s BEV market. Tesla’s unit quantity elevated by nearly 20% YoY. In keeping with SMMT knowledge, the Mannequin Y and Mannequin 3 took quantity two and three spots (respectively) in the general auto market in February.

In second place was Volkswagen model, with 7.5% of the UK market. BMW model got here in third with 6.6%.

There have been no nice surprises within the high 20. Tesla was again to respectable volumes after its January lull, and Mini picked up a number of spots additionally. Most manufacturers have been down on quantity in comparison with January, which is regular on condition that February is the bottom quantity month of the 12 months.

We don’t have very dependable mannequin knowledge, however it seems that the brand new Renault 5 lastly made its UK buyer supply debut in February, with near 160 items registered. The unique Renault 5 was pretty fashionable within the UK, and the brand new BEV has already received reward and awards from UK reviewers, so there’s loads of curiosity. The Renault 5 begins from £22,995 within the UK for the 40 kWh variant (310 km WLTP).

The Renault’s closest competitor, the Citroen e-C3, which arrived in January with just some items, stepped as much as over 140 items in February. The Citroen begins from £21,995 within the UK, so the competitors between these two ought to be wholesome.

One other phase competitor, the brand new Hyundai Inster, could (or could not) have debuted within the UK in February – the DVLA knowledge (by way of EUEVs) does record an “unknown” Hyundai BEV mannequin at 49 items, which could possibly be the Inster (although might simply be incorrectly categorized items of different Hyundai fashions). Different potential phase rivals embrace the Fiat Grande Panda, and Vauxhall Frontera. All of those sub-compacts will compete for consideration within the below-£25,000 value level, so let’s see how they get on.

In the meantime, the Dacia Spring, at an excellent lower cost level of £14,995, continued to promote fairly effectively, with round 150 items in February. Its closest competitor, the Leapmotor T03 (£15,995), has already registered some showroom items and is offered to check drive, although it seems that buyer deliveries haven’t but formally begun.

The brand new Audi S6 / A6 e-tron continued to develop within the UK, with round 325 items in February, a superb end result for Audi.

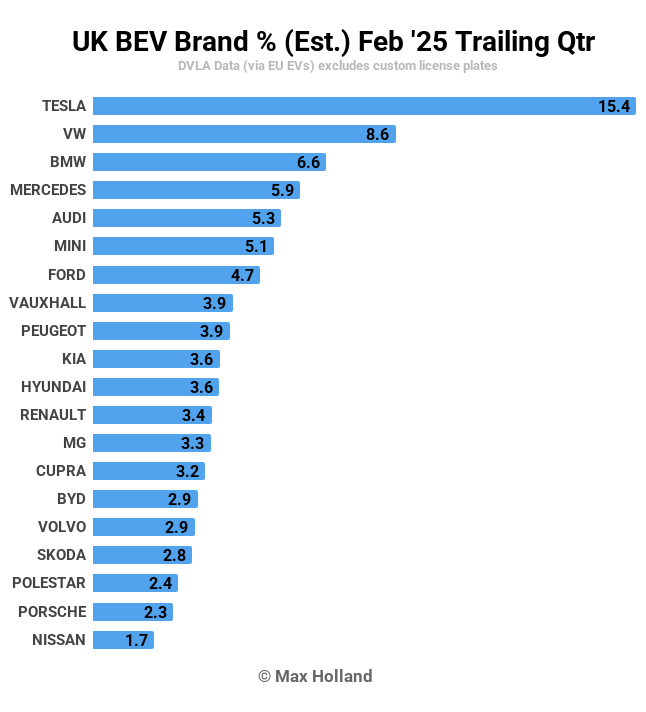

Let’s now take a look on the 3-month model rankings:

Tesla nonetheless has a transparent lead within the 3-month rating, with 15.4% share of the UK BEV market, greater than the 2 runners-up mixed. Volkswagen model comes second with 8.6%, and BMW is in third with 6.6%.

Amongst the pretty predictable high 20, discover that Ford is now typically displaying up within the high 10, due to the ZEV mandate. Having lengthy been one of many UK auto market’s hottest general manufacturers, it now has to promote respectable numbers of BEVs.

This can be a large change from a few years in the past, when Ford was solely promoting low tons of of Mach-e items monthly. Now the model sometimes registers not less than 1,000 items monthly, led by the Ford Explorer. The ZEV mandate is clearly working to prod these laggard legacy manufacturers into taking motion.

Outlook

UK auto market quantity has been general comparatively steady over the previous 12 months or so, sometimes solely seeing YoY variations (up and down) within the vary of 1% to three%, albeit nonetheless fairly far down from the pre-2020 ranges (as are most different European markets). The broader UK macroeconomy in all fairness regular, with modest (however not less than optimistic) 1.4% YoY GDP growth as of Q4 2024. Inflation has lately crept again as much as 4%, and rates of interest are at 4.5%. Manufacturing PMI was at a low of 46.9 factors in February, a fall from January’s 48.3 factors, and from current optimistic territory in mid 2024.

As talked about above, there are numerous non permanent influences shaping the UK BEV share in these months, and we received’t get a lot of an opportunity to see a “default” market share this 12 months earlier than we attain the end line. Nonetheless, with increasingly inexpensive BEV fashions arriving – largely as a result of the ZEV mandate is forcing legacy auto to supply them – it appears clear that the mandate is workingand 2025’s larger bar will probably be mirrored in actual progress within the EV transition this 12 months.

What are your ideas in regards to the UK’s auto market, and the transition to EVs? Please leap into the feedback part beneath to affix the dialog.

Whether or not you could have solar energy or not, please full our latest solar power survey.

Chip in a number of {dollars} a month to help support independent cleantech coverage that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Discuss podcast? Contact us here.

Join our every day e-newsletter for 15 new cleantech stories a day. Or join our weekly one if every day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy