Join daily news updates from CleanTechnica on e mail. Or follow us on Google News!

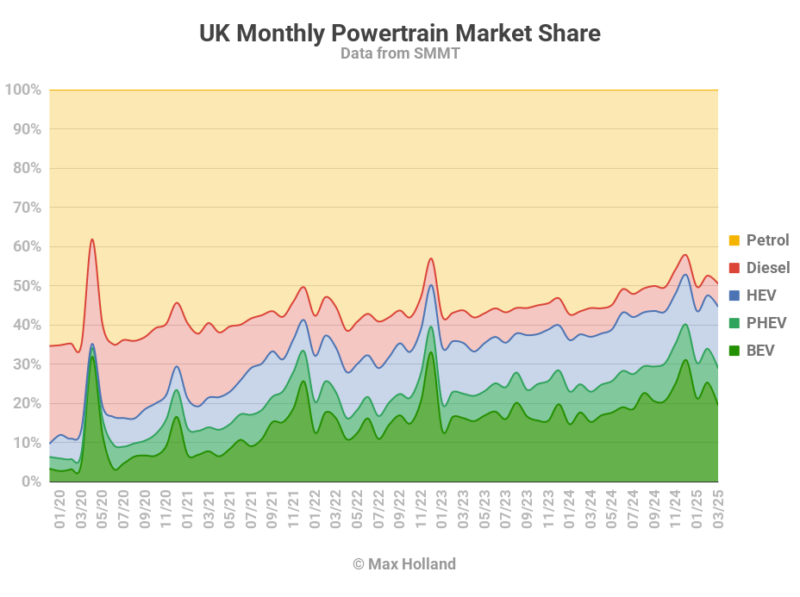

March noticed plugin EVs take 28.9% share of the UK auto market, up from 22.9% year-on-year. BEVs grew quantity by 43% YoY, whereas PHEVs grew 38%. General auto quantity was up some 12% year-on-year, at 357,103 items. Tesla was the UK’s main BEV model in March.

March’s gross sales totals noticed mixed plugin EVs take 28.9% share of the UK auto market, with full electrics (BEVs) taking 19.4%, and plugin hybrids (PHEVs) taking 9.5%. These examine with YoY shares of twenty-two.9% mixed, 15.2% BEV, and seven.7% PHEV.

It’s pretty regular for BEV share to take a dip in March of every 12 months. As a result of March is the primary month in every year that car license plates truly present the present 12 months (“xx25 xxx”), people who plan to get a brand new automobile in a given 12 months (and present it off as “new” to their mates) usually make the leap in March. Thus March is often the largest general auto gross sales month of the 12 months, and can be a chance for manufacturers and sellers to filter older inventory.

Since we’re in a know-how transition, promoting previous inventory usually means ICE autos are over-represented, so plugin share sees a slight dampening within the month in comparison with say a February or a Could. Regardless of this, the precise BEV gross sales quantity in March elevated healthily YoY, up 43.2% to a brand new single-month file of 69,313 items. PHEVs additionally bought an honest bump, up 37.9% YoY, to a brand new quantity file of their very own – 33,185 items.

One other issue this March was that the “Expensive Car Supplement” tax is now (from April 1st) levied on BEVs with MSRP of £40,000 or over. So March was the final likelihood to keep away from this tax, making a pull ahead impact forward of the deadline. Thus we must always count on to see April and Could with a slight hangover in BEV registrations and share. The arrival of the brand new Tesla Mannequin Y Juniper in Could and particularly in what are prone to be massive (end-of-quarter) volumes in June, ought to see BEV share again on a extra constructive observe by that time.

Recall additionally that the ZEV mandate has a headline goal of “28% ZEV” in 2025, up from “22% ZEV” in 2024. In actuality that ought to translate into an precise BEV market share of round 24% to 25% this 12 months, so we will count on to see month-to-month BEV share steadily ramp up throughout H2 because the December deadline approaches.

Most In style BEV Manufacturers

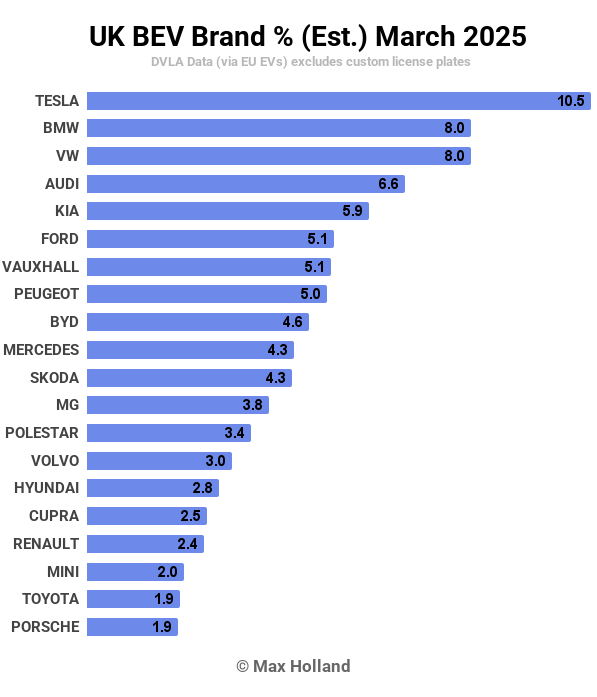

Tesla was as soon as once more the UK’s greatest promoting BEV model in March, taking 10.5% of the BEV market. Observe that the Mannequin Y Juniper isn’t but promoting within the UK, its deliveries are scheduled to start in Could.

In second place was BMW with 7.99% share, only some items forward of Volkswagen, with 7.97%.

Mini, Peugeot, and Mercedes dropped from final month’s 4th, fifth, and sixth spots (respectively), and Audi, Kia, and Ford every stepped up by a number of locations to fill these spots.

The remainder of the highest 20 didn’t see any very notable strikes, besides maybe that BYD climbed a couple of spots and is now in eighth spot (from twentieth in full 12 months 2024). This appears to narrate to a big batch cargo of the BYD Seal sedan, which noticed file UK quantity in March, and should have been within the high 10 greatest promoting BEV fashions (our mannequin information is barely patchy, so it’s exhausting to say for positive). Skoda additionally noticed a bounce of 5 spots in comparison with February, and this seems to be primarily because of the quantity debut of the brand new Elroq, which ranked inside the highest 20 fashions.

Recall that the UK’s RHD market usually sees very irregular batch shipments, giving considerably erratic month-to-month totals, and consequent rankings that generally resemble a recreation of snakes and ladders.

As talked about, our mannequin information is patchy, with many fashions initially registered as “unknown” and taking a number of weeks to resolve. Nonetheless, the information does already level to the Kia EV3 once more being within the high 5 BEV fashions in March (after a slight dip in February). The Renault 5, which we expect arrived in February (with round ~160 items), took a break in March with simply round ~60 items. Its shut rival, the Citroen e-C3, did handle to step up quantity to round ~300 items in March, an honest outcome this early in its ramp-up (following its January UK debut). There’s nonetheless no clear file of the Hyundai Inster as of time of writing, however we will absolutely count on its UK debut quickly.

The Dacia Spring noticed a wholesome ~700 items in March, its highest ever UK quantity (its debut was in October 2024). Its closest rival, the Leapmotor T03 had solely seen a handful of showroom items registered in February, however managed to step as much as ~60 items in March, so let’s regulate it. The competitors at this financial system finish of the market will assist hold all of the pricier segments sincere – each of those fashions have worth tags beneath £16,000!

The brand new MG S5 compact-mid SUV appears to have made its UK debut in March, although with only a few preliminary items for now. For extra on the specs of this mannequin, see my recent Norway report. MG is a well-liked BEV model within the UK, so it will likely be fascinating to regulate the brand new MG S5 over the approaching months.

Right here’s a take a look at the 3-month model rankings:

Tesla stays in first place for now. For the reason that new Mannequin Y will solely arrive in Could, it’s attainable that Tesla could take a momentary dip in April, giving Volkswagen or BMW (now in second and third spots) an opportunity to momentarily catch up.

After a quiet This autumn 2024, Kia got here again to its common power in Q1 2025, largely due to the brand new EV3 proving extremely popular (it’s already within the high 5 BEVs of Q1).

I had earlier promised to check This autumn 2024 model efficiency to Q1 2025 (once we had the information), to see if we may expose these laggard manufacturers which needed to make a final minute rush to fulfill the 2024 ZEV mandate. The stand outs are Honda, Mini and Renault, and to a lesser extent, Ford. The distinction is muddied by the truth that all these manufacturers now need to gear up for the even tighter 2025 mandate, so their “Damascene Conversion” was truly seen in late 2024, slightly than between 2024 and 2025.

Honda, nonetheless, does stand out. Its 2024 This autumn BEV quantity was 741 items. Anybody care to have a guess as to Honda’s 2025 Q1 BEV quantity? Leap within the feedback under to put your bets (no peeking at on-line information sources earlier than commenting please – simply have an sincere punt).

Outlook

The UK auto market had its greatest March since 2019, and has lately been on a modest restoration streak. The general UK financial system noticed one other up-tick in This autumn 2024 (newest information), with 1.5% YoY growth in GDPfollowing on from a Q3 determine of 1.2%. This places it in a greater spot than most different European friends. Inflation was at 2.8% in February (newest), with rates of interest now at 4.5%. Manufacturing PMI fell to 44.9 factors in March, from 46.9 factors in February.

What impact the current adjustments in international commerce tariffs may need is anybody’s guess. The UK tends to be a capital-flight vacation spot, so it’s attainable that it might see funds coming during which have been previously parked within the US.

The ZEV mandate proved itself largely efficient in its first 12 months of operation (2024), and can seemingly achieve this once more, with its tighter targets, this 12 months. In fact the business will whine to have these targets relaxed, and name for incentives to fulfill this “difficult and costly” goal. They’ve lately been proven to be dishonest brokers, with the legacy auto makers, along with their UK lobby, the SMMT, recently being found guilty of illegal cartel behaviour and deceiving consumers.

What are your ideas on the UK EV transition? Are you available in the market for a BEV, or watching the rise of any specific manufacturers? Please be part of within the dialog within the feedback under.

Whether or not you may have solar energy or not, please full our latest solar power survey.

Chip in a couple of {dollars} a month to help support independent cleantech coverage that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Wish to promote? Wish to counsel a visitor for our CleanTech Speak podcast? Contact us here.

Join our every day e-newsletter for 15 new cleantech stories a day. Or join our weekly one if every day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy