Join CleanTechnica’s Weekly Substack for Zach and Scott’s in-depth analyses and high level summariesjoin our daily newsletterand/or follow us on Google News!

Final Up to date on: thirteenth Might 2025, 10:01 am

April noticed plugin EVs take 28.8% share in Germany, up from 18.4% 12 months on 12 months. BEVs volumes have recovered from their incentive-cut trauma, and PHEVs are additionally up. General auto quantity was 242,728 items, flat YoY. One of the best-selling BEV in April remained the Volkswagen ID.7.

The April auto market noticed mixed EVs take 28.8% share in Germany, with full electrical automobiles (BEVs) at 18.8% share and plugin hybrids (PHEVs) at 10.0%. These evaluate with YoY figures of 18.4% mixed, 12.2% BEV and 6.2% PHEV.

This can be a good outcome for BEVs, transferring forward of France on market share, which is a shock contemplating that Germany now not has any BEV buy incentives (while France nonetheless does). We should see whether or not this progress might be sustained over the long run. I doubt it, since a lot of the legacy auto producers are nonetheless solely making as few BEVs as guidelines require them to. And the EU-zone emissions rules have just been watered down.

As I preserve banging on about, we may be reaching a degree the place momentum is constructing on the demand aspect for inexpensive (and competent) BEVs which customers have seen within the wild and now know are attainable. Initially these extra mass-market BEVs have been supplied with a purpose to meet the unique (tight) 2025 emissions rules. Despite the fact that these rules have not too long ago been softened, the producers have proven their hand to customers, and there’s no going again.

I bear in mind the latest creation of affordable-and-competent sub-€25,000 BEVs (Renault 5, Citroen e-C3, Fiat Panda, Hyundai Inster, LeapMotor T03, and the BYD Dolphin Surf coming quickly) and much more choices sub-€30,000 (Opel Frontera, Renault 4, Citroen e-C3 Aircross, Opel Corsa, Fiat 500, BYD Dolphin), and loads of compelling choices within the low €30K vary (Skoda Elroq, MG4, BYD Atto 2, and so on.).

That these inexpensive BEVs have “been seen in the wild” implies that — even when some legacy automakers have been to attempt to restrict their manufacturing volumes — many customers who’ve been ready to get right into a BEV will anyway simply wait patiently and in the meantime not purchase an ICE automobile as a substitute. And the likes of Hyundai and BYD should not going to play together with the laggards by slow-walking their very own inexpensive fashions.

Put merely (if my tackle that is appropriate), actual competitors for worth BEV choices is now beginning to form the market, and the foot-draggers might now not have the ability to constrain the tempo of the EV transition. Maybe that is wishful pondering, however let’s keep watch over it (a number of of the fashions talked about above at the moment are within the high 20 rankings, with extra coming).

In April, combustion-only share continued to slip to near-record lows, with petrol-only hitting 27.5% share and diesel-only at 15.5%.

Finest Promoting BEV Fashions

For the fourth consecutive month, the Volkswagen ID.7 was the most effective promoting BEV in Germany, with 3,133 items registered. The ID.3 got here in second place, with 2,989 items (its greatest quantity in 10 months), and the Volkswagen ID.4/ID.5 got here third, with 2,629 items.

Remarkably, the highest 10 was virtually a white-wash for Volkswagen Group, with solely the BMW iX1 (in seventh spot) spoiling the get together.

Altogether, Volkswagen Group fashions made 21,300 gross sales, over 47% share of the passenger BEV market. If we add within the Ford Explorer and Capri, that are each based mostly on Volkswagen Group’s MEB platform, that share will increase to 49.7%.

Probably the most important climber in April was the brand new Skoda Elroq, which took a outstanding 4th spot in solely its fourth month of quantity deliveries, up from ninth spot in March. Additional again, the Fiat 500 climbed 12 ranks to eleventh place, with its highest quantity in 9 months (1,045 items).

The brand new Hyundai Inster, additionally in solely its fourth month of quantity deliveries, climbed to twelfth spot (1,043 items), from 18th in March. Additional again in 18th and nineteenth spots, the Opel Corsa and MG4 (respectively) noticed their greatest performances in a number of months, every with over 2× their latest common volumes.

Simply outdoors the highest 20, the Renault 5 took a slight dip to 686 items (from its excessive of 1,070 in March). Although, that is possible resulting from allocation priorities (of restricted out there volumes), moderately than any important dip in demand. Its competitor, the Citroen e-C3, noticed slowly rising quantity, with 394 items in April (from 370 in March).

When it comes to different newish fashions which continued to climb; the Opel Frontera, which quietly launched in late 2024 with just a few items, noticed its first huge quantity month, with 321 registrations in April (rating thirty fifth). Its cousin, the Fiat Panda, additionally noticed its first important volumes, 147 items. The BYD Atto 2 additionally noticed its first correct volumes, 262 items in April (having beforehand seen solely “sample” volumes since first showing in January).

There have been two debutants in April. Most spectacular in quantity phrases was a direct 321 items for the brand new Ford Puma EV, a BEV model of the prevailing (and wildly common) ICE Puma, a small (4,214 mm) crossover. The Puma EV presently has an MSRP from €36,900, however higher offers might be discovered, and I anticipate that extra inexpensive trims could also be supplied as soon as the shiny-new vibe cools off a bit.

To compete in the long run, it might have to start out beneath €30K, which ought to be attainable on condition that the battery is a modest 43.6 kWh (usable). Observe that regardless of the modest battery, effectivity is first rate, giving a variety of 347 km (WLTP) and charging is spectacular, with 10–80% recoverable in 23 minutes. Pricing-wise, this can be a case of Ford intentionally not making the Puma too aggressive, as a result of they’re possible not but fascinated with producing enormous numbers, preferring to tug their toes.

The opposite April debutant was the brand new Renault 4, the marginally bigger and “SUV” styled sibling of the already very profitable Renault 5. The Renault 4 is 4,143 mm in size, in comparison with the three,920 mm of the Renault 5 — although, solely 63 mm taller and truly 12 mm narrower. General this implies the frontal space is barely bigger, and thus the WLTP vary score is sort of the identical, at 409 km (for the 52 kWh variant). It additionally has the identical 33-minute 10–80% DC charging speeed.

If I perceive the web site appropriately, the beginning MSRP of the Renault 4 in Germany is presently €29,400, which is a few €1,500 greater than the Renault 5 is presently supplied for. Each variations look like solely supplied with the bigger 52 kWh (usable) battery in Germany for the time being. Although, the Renault 5’s web page mentions that the smaller battery (40 kWh usable) can be supplied later.

If and when that occurs, later this 12 months, the beginning MSRP ought to drop by round €2,500 for the Renault 5, and presumably by an identical quantity for the Renault 4. Nonetheless, I’ve heard that some markets (e.g., the UK) might solely provide the Renault 4 with the bigger battery, so we should keep watch over it.

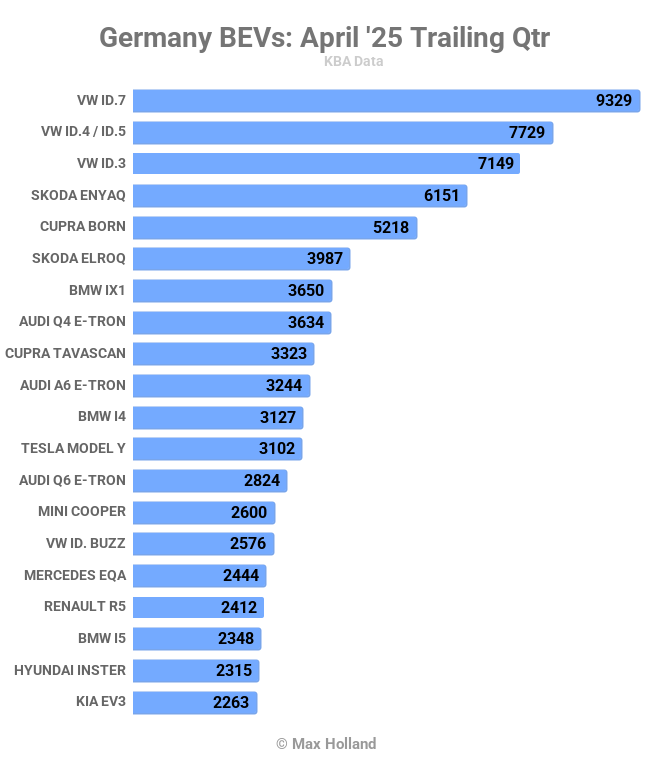

Let’s flip to the 3-month rankings:

After 4 strong months within the month-to-month pole-position, the Volkswagen ID.7 has a good lead within the trailing-3 chart. At this level, as with April’s rankings, solely the BMW iX1 prevents Volkswagen Group fashions from making a clear sweep of the highest 10. One other BMW, the i4, is in eleventh, and 2024’s general chief, the Tesla Mannequin Y, is in twelfth.

The largest climber was the Skoda Elroq, which had solely simply arrived within the prior interval (November to January) and has bought virtually 4,000 items over the previous three months, taking sixth place. Based mostly on April’s efficiency, it nonetheless has additional to climb.

One other huge climber was the Audi A6 e-tron, which had a sluggish preliminary few months after its June 2024 debut however hit enormous volumes from February onwards, netting 3,244 items (and tenth place) on this newest interval.

Additional again, robust climbers embody the Renault 5 in seventeenth (from twenty seventh beforehand), the Hyundai Inster in nineteenth (from forty fifth), the Kia EV3 in twentieth (from twenty ninth), and the Citroen e-C3 in thirty fourth (from 67th). Even the LeapMotor T03 is climbing since its November launch, now in thirty ninth, from 56th beforehand.

Let’s see what the desk seems like in a month or two from now. Will the Tesla Mannequin Y’s refresh and manufacturing ramp enable it to compete close to the highest once more, or are these days gone? Will the Skoda Elroq displace the ID.3? What secure positions will the Renault 5 and Hyundai Inster have the ability to climb to? Inside the highest 15? Inside the highest 10?

Manufacturing Teams

Within the trailing-3-month group chart we are able to see that Volkswagen Group is stronger than ever, with 58,060 items, representing 47.4% of the BEV market (up from 44.4% within the prior 3 months).

BMW Group stays in second, although with share dropping to 11.7% (from 14.7% prior).

Due to the Inster and the EV3, Hyundai Motor Group has climbed two spots to third, with share rising to eight.1% (from 6.1% prior).

Stellantis has additionally made an enormous push not too long ago, throughout a variety of older fashions (although notably the Fiat 500 and Opel Corsa) in addition to the newcomers (Fiat Panda, Opel Frontera, Citroen e-C30, LeapMotor T03). This allowed the group to climb from seventh to 4th, and greater than double share to 7.6% (from 3.6%).

Mercedes Group dropped a few ranks, as did Tesla, whereas Renault Group and Geely held place.

Outlook

Though April’s auto market was flat YoY, the year-to-date quantity is down some 3% over final 12 months. Luckily, BEV gross sales are up some 43% YTD — though, from the depressed baseline of early 2024 (the inducement lower trauma).

The broader German financial system suffered one other quarterly contraction in Q1 2025, with unfavourable 0.2% YoY GDPwhich continues the identical unfavourable 0.2% in This autumn 2024. Inflation fell to 2.1% in April from 2.2% in March, and ECB rates of interest diminished to 2.4% in mid April. Manufacturing PMI in April was 48.4 factors, barely improved from March’s 48.3 factors.

Anybody aware of Volkswagen Group’s interior workings, please tell us what’s behind this notable push in BEV volumes over the previous month or so. Is it a decoupling to keep away from “Trump’s Tariffs,” and funneling items into the home market that may in any other case have gone to the US? Or maybe Volkswagen Group has merely determined to get critical about BEV manufacturing in Europe?

What about my speculation that the not too long ago launched competent-but-affordable BEVs — now that they’re out of the bag — will begin to give important momentum to the demand aspect of the auto market? Will we now have to attend for BYD to indicate as much as actually see change begin to occur? Please share your ideas and views within the dialogue beneath.

Whether or not you have got solar energy or not, please full our latest solar power survey.

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Discuss podcast? Contact us here.

Join our day by day e-newsletter for 15 new cleantech stories a day. Or join our weekly one on top stories of the week if day by day is just too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy