Business giants, BHP, Rio Tinto and Qantas, will make investments A$80 million (USD$53 million) in Silva Capital’s Silva Carbon Origination Fund, the first shut from these basis traders. The fund is designed to supply entry to large-scale, high-integrity carbon credit from nature-based tasks in Australia centered on reforestation and sustainable agriculture.

Silva Capital, a three way partnership between Roc Companions and C6 Funding Administration, focuses on growing high-integrity carbon abatement tasks to provide Australian Carbon Credit score Items (ACCUs). The Silva Carbon Origination Fund is their first enterprise. The fund targets mixed-use agricultural and environmental planting tasks throughout Australia to provide ACCUs at a big scale.

Australian Carbon Credit score Items (ACCUs) are issued by the Australian authorities’s $3 billion Emissions Discount Fund (ERF) to help the nation’s purpose of decreasing carbon emissions by 43% from 2005 ranges by 2030.

The ERF primarily grants credit to tasks centered on deforestation prevention, native forest regeneration, and methane assortment from landfills. These credit may be offered to the federal government or corporations aiming to satisfy their emissions discount targets. Excessive-emission industries, equivalent to mining and aviation, are more and more buying carbon credits to offset their environmental influence.

Rio Tinto is Leveraging Carbon Credit For Its Decarbonization Objectives

Jonathon McCarthy, Rio Tinto’s Chief Decarbonisation Officer, emphasised the corporate’s dedication to decarbonizing its operations. He famous that the funding within the Silva Carbon Origination Fund will assist meet compliance obligations by means of high-integrity carbon credit.

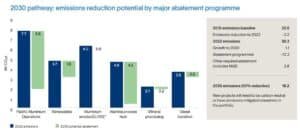

Rio Tinto goals to retire 3.5 million carbon credit yearly by 2030, protecting 10% of its baseline emissions. This elevated deal with the Voluntary Carbon Market (VCM) helps its 2030 local weather targets, particularly after acknowledging it might miss 2025 decarbonization targets.

In 2023, its Scope 1 and a pair of emissions have been secure at 32.6 million tonnes of CO2 equal (tCO2e), with Scope 3 emissions at 578 million tCO2e. Rio Tinto plans to extend carbon credit score procurement to 1.7 million tCO2e by 12 months’s finish and commit 500,000 hectares to NBS by 2025.

For 2024, Rio Tinto has allotted an estimated $750 million for decarbonization efforts, together with capital and operational expenditures, offsets, and Renewable Power Credit (RECs). Nonetheless, the corporate has revised its complete expenditure estimate for assembly its 2030 local weather targets, decreasing it from $7.5 billion to $5-6 billion.

The corporate expects to extend its carbon credit score procurement, primarily by means of Australian Carbon Credit score Items (ACCUs).

What Function Do Carbon Credit Play in BHP’s Emission Discount?

Graham Winkelman, BHP’s Vice President of Local weather, remarked that whereas BHP is actively pursuing structural greenhouse fuel emission reductions from its operations, carbon credit will play a task in attaining its decarbonization targets.

The world’s largest mining firm, expects its carbon emissions to develop within the brief time period and acknowledges the necessity for fast technological options and carbon credit to satisfy its 2050 web zero purpose.

Whereas on monitor for its 2030 emissions discount goal, BHP admits attaining web zero by 2050 might be difficult. The corporate goals for a 30% discount in Scope 1 and a pair of emissions by 2030 however doesn’t embody Scope 3 emissions, which contain its prospects’ emissions, like these from steelmakers.

To attain its 2030 decarbonization targets, BHP plans to speculate $4 billion, with the bulk directed towards decreasing diesel use in haul vehicles, electrical energy, and fuel emissions. Diesel accounts for about 50% of the corporate’s air pollution, whereas methane contributes over 14% of its operational greenhouse fuel emissions.

The ACCUs can even assist the mining big in assembly compliance obligations beneath the Safeguard Mechanism Act.

Why Qantas is Investing within the Silva Carbon Origination Fund

Qantas’ funding within the Silva Carbon Origination Fund will support in assembly its local weather targets by securing high-quality, nature-based carbon credits.

The airline is financing its funding by means of its Local weather Fund, a A$400 million initiative established final 12 months to help the corporate’s decarbonization efforts. The fund can even enhance the Australian carbon credit score market, providing social and financial advantages to native communities.

Andrew Parker, Qantas’ Chief Sustainability Officer, emphasised that high-integrity carbon offsets might be essential for hard-to-abate sectors like aviation. He additional stated that:

“We expect the demand for carbon offsets to continue to grow into the future and it’s going to take partnerships across industries to enhance the overall availability of high-quality, high-integrity carbon credits.”

This transfer builds on Qantas’ broader local weather efforts, together with its latest investments within the Sustainable Aviation Gasoline Financing Alliance (SAFFA) and a Queensland biofuel manufacturing facility in partnership with Jet Zero Australia and LanzaJet.

The Focus of The Carbon Fund

The fund’s technique consists of investing in agricultural land to develop large-scale carbon sequestration tasks by reforesting cleared areas whereas sustaining the land’s productiveness for farming. These tasks combine sturdy carbon credit score methodologies, improve farming actions for native communities, and promote habitat restoration and biodiversity safety.

Silva Capital Co-Managing Director, Brad Mytton, highlighted that sustainable agriculture is central to the fund’s funding technique. He famous that the Silva Carbon Origination Fund goals to create a portfolio of combined farming land with vital cover cowl, producing a big quantity of high-integrity carbon credit. Mytton additional acknowledged that:

“The Fund has been designed to appeal to both corporate investors seeking to access carbon credits and institutional investors seeking portfolio diversification…”

Backed by trade heavyweights, the Silva Carbon Origination Fund might play a pivotal position in advancing Australia’s carbon credit score market and supporting the nation’s formidable local weather targets.