The World Financial institution, by means of its main arm, Worldwide Financial institution for Reconstruction and Improvement (IBRD), has issued a 9-year bond value USD 225 million. This bond helps carbon removal by funding reforestation in Brazil’s Amazon rainforest.

Unlocking the World Financial institution’s Carbon Removing Bond

Jorge Acquainted, Vice President and Treasurer, World Financial institution, famous,

“A variety of partners and financing tools are needed to support the Amazon and help the people there pursue better livelihoods, protect its incredible biodiversity, and safeguard its global role in mitigating climate change.”

Notably, that is the largest bond issued by the World Financial institution thus far, instantly linked to reforestation efforts within the Amazon and promising improbable returns. As talked about within the press releasebuyers will earn a return by means of a set coupon and a variable element tied to Carbon Removing Models (CRUs). Moreover, the reforestation tasks in Brazil will generate these credit.

Moreover, buyers hail this bond as distinctive. This implies it connects their monetary returns to precise carbon elimination, not like earlier bonds tied to carbon credit score gross sales from emission avoidance.

The important thing function of this bond is that ~ USD 36 million will help Mombak, a Brazilian firm. Mombak will use the funds to reforest land within the Amazon with native timber, boosting biodiversity and supporting native communities. This bond introduces an progressive strategy to mobilizing personal capital for reforestation finance.

Their Carbon Credit Increase International Markets

Final 12 months, the World Financial institution unveiled its plans to develop high-integrity international carbon markets, serving to 15 nations generate revenue by preserving their forests. To call a number of, Chile, Costa Rica, Ghana, and Indonesia had been the collaborating nations. The financial institution expects these nations to generate over 24 million carbon credits in a 12 monthsdoubtlessly incomes as much as $2.5 billion by 2028.

The initiative is led by the World Financial institution’s Forest Carbon Partnership Facility (FCPF), specializing in environmental and social integrity. Since 2018, the FCPF has pioneered carbon-crediting programs, guaranteeing credit are distinctive, measurable, and everlasting. Third events rigorously monitor and confirm these credit primarily based on World Financial institution customary.

Can this Bond Convey Excessive Returns and Save the Amazon Rainforest?

Jorge Acquainted has been assertive of this historic transaction. He believes it demonstrates eagerness of personal buyers to hyperlink their monetary returns to constructive outcomes in the Amazon. Moreover, the promising returns sign rising curiosity on this construction and the expansion of supported sectors.

Primarily, the bond is 100% protected, guaranteeing buyers’ cash is secure. The USD 225 million raised will fund the World Financial institution’s international sustainable improvement efforts. As a substitute of receiving full common curiosity funds, buyers will permit a portion to help Mombak’s reforestation tasks by means of a take care of its hedge companion HSBC. Furthermore, these tasks align with the World Financial institution’s targets within the Amazon however aren’t funded by IBRD loans.

The Carbon Removing Models (CRUs) generated by these tasks will likely be offeredand a share of the income will likely be paid to bondholders as CRU Linked Curiosity. As well as, buyers will obtain a assured minimal curiosity cost. If the tasks succeed as anticipatedbondholders might earn extra in comparison with related World Financial institution bonds.

Greg Guyett, CEO of International Banking & Markets, HSBC commented,

“We are pleased to work alongside the World Bank on this innovative bond which aims to support the reforestation of thousands of hectares of the Brazilian Amazon rainforest. We are committed to helping our clients fund sustainable development projects that make a difference in the climate challenge. It was a privilege for HSBC to structure the transaction and act as sole lead manager on the World Bank’s largest-ever outcome bond issuance to date.”

Bolstering Traders’ Confidence

Distinguished funding companions embody Mackenzie Investments. T Rowe Value, Nuveen, Rathbone Moral Bond Fund, and Velliv.

Traders take into account this bond to have the potential for enticing monetary returns with measurable constructive impacts. They count on important advantages by means of carbon elimination, biodiversity enhancement, and job creation.

Hadiza Djataou, Vice President, Portfolio Supervisor, Mounted Earnings, Mackenzie Investments has considerably remarked,

“This transaction, in partnership with Mombak, gives a landmark alternative in nature constructive funding whereas supporting land stewardship ideas. We consider the bond’s distinctive construction will show to be each a robust funding and a catalyst for additional innovation within the sustainable fixed-income market.“

Decoding World Financial institution’s Curiosity in Brazil

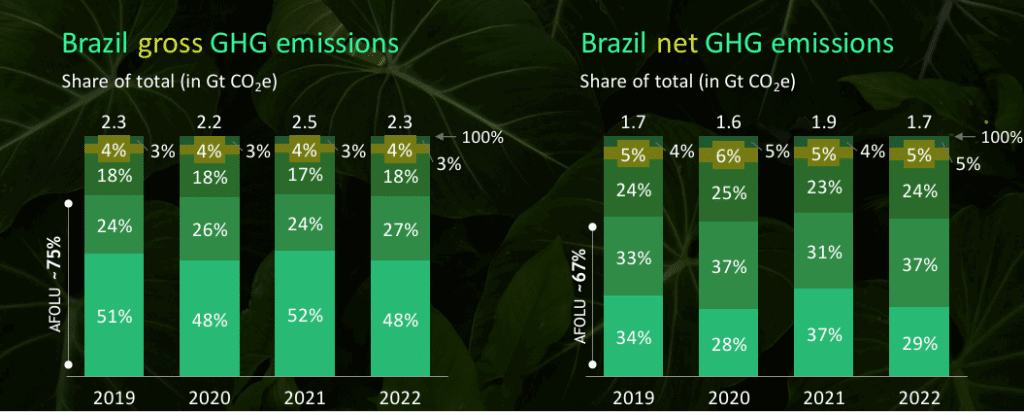

GHG emissions in Brazil surpassed 2.3 billion MtCO₂e in 2022, a decline of over 8% compared to the earlier 12 months. The nation’s climate-aligned investments are anticipated to whole $2-3 trillion by 2050. Brazil’s newest local weather report predicted this.

Supply: Brazil 2024 Local weather Report

Curiously, AP information revealed that in 2022, Amazon timber held 56.8 billion MtCO₂e, making the Amazon a enormous carbon sink. Nevertheless, local weather specialists have proven a purple flag over the continued deforestation that would shift the Amazon from a carbon sink to a carbon supply. This is likely one of the the reason why Brazil has change into a sizzling spot for atmosphere preservation actions, notably the Amazon rainforest.

Talking of Brazil, the World Financial institution’s reference to the nation is just not one thing new. In 2022, it analyzed how Brazil might meet its local weather targets and backed progressive tasks. It included a whopping US$ 500 million Local weather Finance Answer. This initiative aimed to develop sustainability-linked finance and assist the personal sector entry the carbon credit score market.

The World Financial institution introduced the Amazon reforestation bond on June 14. They initially left the precise principal worth undecided however have now confirmed it.