Amid the heated controversy over carbon offsets and renewable vitality carbon credit, Xpansiv buying and selling platform CBL reported record-breaking developments.

The week noticed a big commerce on Xpansiv’s CBL platform, with 39,414 tons of classic 2023 ACR CCP-approved United States Landfill Gasoline credit buying and selling at $7.15 per metric ton. This transaction was notable as the most important and highest-priced commerce of the week. It’s also one of many largest CCP-tagged credit score transactions since ICVCM’s methodology approval in June.

From India to Indonesia: VCM Sees Dynamic Trades and Worth Shifts

The Xpansiv CBL market additionally noticed exercise with 3,500 classic 2019 hydro credit from India and classic 2016 Keo Seima REDD credits from Cambodia, traded at $2.00. Classic 2020 Katingan Peatland Restoration credit from Indonesia had been matched at $4.90, whereas a 100,000-ton block of classic 2017 Katingan credit traded OTC at $3.25.

The info supplied by Xpansiv, a number one environmental commodity trade, displays the dynamic and evolving nature of those carbon credit markets.

Different Key Traits

VCM Quantity:

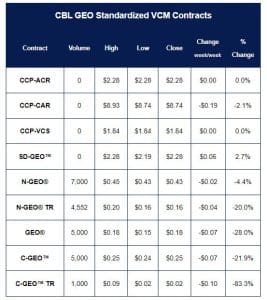

Complete VCM quantity on the CBL platform was 107,324 credit, with 78,423 matched on display. Moreover, 812,000 tons had been traded by way of CBL GEO futures on CME Group.

Futures Market Motion:

The December CBL N-GEO futures noticed a slight drop, shedding $0.03, following a earlier sharp sell-off. Nonetheless, the CBL GEO futures December contract rose by 64% to shut at $0.23.

Paris Olympics Rewrites the Playbook on Sustainability

The Paris Olympics, which concluded just lately, set new information in sustainability alongside its excessive attendance and world engagement. The organizing committee efficiently diminished Scope 1, 2, and three carbon emissions by half in comparison with the Rio and London video games.

The occasion organizers purchased 1,472,550 metric tons of carbon credits from 13 totally different initiatives, specializing in offsets in Africa and France. These carbon offsets are from numerous initiatives together with cookstoves, solar energy, mangrove restoration, forestry, and clear water entry.

In line with reporting by S&P World Commodity Insights:

“The organizers of the sporting event have already bought 1,472,550 mtCO2 of carbon credits from 13 different projects, data from the 2024 Olympics showed.”

CBL Market Snapshot

Key presents included Katingan REDD credit from Indonesia and cookstoves credit from Somalia and Rwanda, with costs starting from $0.75 to $5.00.

I-REC Markets: Photo voltaic initiatives in India and Uganda confirmed bids and presents, with indicative pricing famous at $3.50 for Ugandan photo voltaic credit.

North American Compliance Markets Hit Highs

In North American compliance markets, PJM REC buying and selling on the CBL platform reached a document notional worth, with practically $14 million traded over two weeks. Key transactions included Virginia and Pennsylvania Tier I credit and Maryland photo voltaic credit. This exercise additional underscored the rising significance of carbon credit and renewable energy certificates in reaching world decarbonization targets.

This abstract highlights the numerous trades, market actions, and sustainability efforts noticed in environmental markets. The Xpansiv knowledge underscores the rising position of carbon credit and renewable vitality credit in world decarbonization efforts.