The lithium market continues to face vital challenges as detailed within the S&P World Commodity Insights report for August 2024. The report highlights the intricate interaction between world macroeconomic tendencies, shifting demand patterns within the electrical car (EV) sector, and the corresponding impacts on the provision and pricing of this crucial battery steel.

World EV Market Slows as Shopper Confidence Wanes

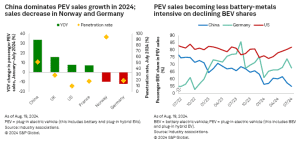

The worldwide marketplace for plug-in electric vehicles (PEVs) is experiencing notable fluctuations, with a 2.2% lower in gross sales throughout main markets in July 2024 per S&P Global information. This decline is pushed by a number of elements, together with:

- weakening shopper confidence,

- a seasonal demand lull within the Northern Hemisphere, and

- the imposition of upper tariffs, significantly within the European market the place gross sales fell by a steep 29.9%.

The European market’s downturn is reflective of broader macroeconomic uncertainties, together with considerations in regards to the U.S. economic system probably slipping into recession and chronic sluggishness in China’s economic system.

A MESSAGE FROM Li-FT POWER LTD.

This content material was reviewed and authorised by Li-FT Energy Ltd. and is being disseminated on behalf of CarbonCredits.com.

Lithium Deposits That Can Be Seen From The Sky

Why Li-FT Energy? One of many quickest growing North American lithium juniors is Li-FT Energy Ltd (TXSV: LIFT | OTCQX: LIFFF | FRA: WS0) with a flagship Yellowknife Lithium project positioned within the Northwest Territories. Three causes to contemplate Li-FT Energy:

RESOURCE POTENTIAL | EXPEDITED STRATEGY | INFRASTRUCTURE

China, nonetheless, stays a dominant power within the PEV market. PEVs accounted for 51.1% of all new automobile gross sales in July within the nation, marking a report penetration fee. But, this progress isn’t with out its challenges.

The PEV market in China is turning into much less battery-metals intensive because the share of battery electrical automobiles (BEVs) throughout the gross sales combine declines.

BEVs, which use bigger batteries and subsequently eat extra metals, made up solely 54.9% of China’s PEV gross sales in July, down from 67.4% a 12 months earlier. Moreover, China’s PEV market progress is more and more coming on the expense of margins. Chinese language automakers are participating in fierce worth competitors to take care of market share amid weak home demand and low shopper confidence.

EV Battery Blues

The worldwide slowdown in PEV uptake has had vital repercussions for the battery production sector. This results in the cancellation of a number of high-profile tasks within the U.S. and Europe.

Notably, Common Motors Co. has suspended development of its third battery plant in Michigan, a collaboration with LG Power Resolution Ltd., whereas Umicore SA has halted development of a battery supplies plant in Ontario and postponed investments in battery recycling vegetation in Europe. Umicore cited delays within the ramp-up of buyer contracted volumes, which have been pushed again by no less than 18 months.

The imposition of upper tariffs in numerous areas has additional sophisticated the worldwide PEV market outlook. The EU and U.S. tariffs, supposed to encourage native manufacturing and scale back dependence on Chinese language BEV imports, have dampened short-term gross sales potential and added to the prices handed on to shoppers.

China’s BEV exports have additionally been affected, declining for a second consecutive month in June 2024, with a 29.1% drop month-over-month. The European Fee’s latest adjustment of the top-line tariff fee from 48.1% to 46.3%, together with a discount in Tesla’s tariff fee from 30.8% to 19%, highlights the continued uncertainties surrounding commerce insurance policies and their affect in the marketplace.

Provide Cutbacks Sweep the Market as Lithium Costs Plummet

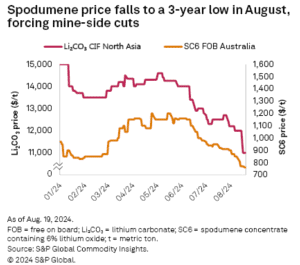

With this slowing development in plug-in EVs, the lithium market can be dealing with renewed provide challenges as costs proceed to drop. The Platts-assessed spodumene focus FOB Australia worth plummeted by 15.6% in August, reaching $760 per metric ton, the bottom stage since June 2021.

This vital lithium price drop has led to a wave of provide curtailments, as producers wrestle to take care of profitability. As an illustration, Albemarle Corp. introduced it could solely function one in every of its two lithium hydroxide processing traces at its Kemerton refinery in Australia, successfully eradicating 22,000 metric tons of lithium carbonate equal capability from the market. The corporate additionally halted work on increasing its manufacturing capabilities, deferring investments in new tasks in Canada and Argentina.

The decline in lithium prices is being pushed by a mixture of things, together with rising demand headwinds and a persistent market surplus. Regardless of comparatively delicate provide cuts within the March quarter, ongoing mission ramp-ups, significantly by rising suppliers in Zimbabwe, Argentina, and Brazil, have contributed to the oversupply.

July export information from main lithium-producing international locations signifies a month-over-month drop in seaborne lithium and cobalt provide as producers reply to the market surplus.

The lithium carbonate CIF Asia worth additionally fell by 9.8% in August, reaching $11,000 per metric ton, the bottom stage since April 2021. At these worth ranges, many lithium producers are prone to scale back their output, because it turns into economically unviable to proceed manufacturing.

Service provider lithium carbonate refineries, particularly, are anticipated to reduce their operations as a result of adverse margins in August, a pointy distinction to the small optimistic margins seen in July.

S&P World Lithium Worth Forecast

With lithium and cobalt prices hitting new multi 12 months lows in August, S&P World Commodity insights have revised its 2024 worth forecasts downward. The forecast for lithium carbonate CIF Asia has been decreased by 1.1% to $12,627 per metric ton. This displays the continued challenges out there, together with a persistent oversupply and weak demand.

These worth changes underscore the numerous pressures dealing with the lithium and different electric metal markets, the place producers are grappling with decreased profitability and market uncertainties. The downgrades mirror a cautious outlook for these crucial battery metals because the business navigates a fancy financial setting.