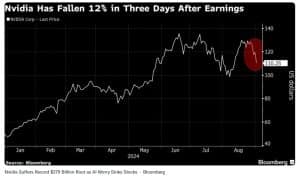

On September 3, NVIDIA confronted a surprising $279 billion market cap loss in a single buying and selling day. As issues over artificial intelligence development mounted and fears of a U.S. antitrust probe emerged, the chip maker’s inventory plummeted by 9.5%. This marked the largest single-day worth loss for a U.S. firm in historical past. Whereas Nvidia’s place as a market chief stays intact, the huge sell-off has prompted deeper questions on AI’s future and inventory market volatility.

Contained in the Stunning Drop in Nvidia’s Inventory Worth

NVIDIA’s fall wasn’t only a random market fluctuation, relatively it was pushed by a number of key occasions. Analysts issued warnings that the AI boom is likely to be overstated, sparking fears that its latest inventory surge was unsustainable.

Moreover, Bloomberg highlighted the U.S. Division of Justice’s antitrust investigation fueled additional concern, main buyers to unload shares. It additionally defined that the DOJ probe remains to be in its early levels, and no formal criticism has been filed but. The company is investigating whether or not Nvidia creates limitations that make it harder for purchasers to change to different AI chip suppliers.

Bloomberg has thrown mild on another excuse. Effectively, the broader market sentiment additionally performed a task within the huge share plummet. Financial uncertainty in China, sluggish U.S. manufacturing information, and inflation worries contributed to a risk-averse atmosphere. Buyers, already cautious, have been fast to react to the corporate’s potential regulatory challenges.

MOST RECENT: NVIDIA Crushes Q2 and Cuts Emissions but Shares Still Slide

AI Rise and Returns, What Buyers Are Speaking About?

This dramatic decline has sparked appreciable skepticism round AI. We found from media experiences that main monetary analysts like JPMorgan and BlackRock counsel that the AI hype might have reached its peak. It’s a paradox as a result of though the tech giants survive on AI, they concern actual returns from AI funding may take years.

This actuality verify has compelled buyers to reevaluate the lofty valuations which have pushed tech shares to near-record ranges. Nvidia’s latest earnings report, which did not meet sky-high expectations, solely added to the sense that AI might not ship fast income.

Nonetheless, the inventory market is a fickle place, and this record-breaking fall has left an enduring influence. As AI develops, it’s clear that firms like Nvidia will face rising scrutiny, each from buyers and regulators.

Regardless of Dwindling Shares, AI and Information Facilities are the Silver Lining

Regardless of the huge sell-off, Nvidia’s management stays optimistic concerning the firm’s future. CEO Jensen Huang reassured buyers that Nvidia’s core strengths in AI and GPU expertise will proceed to drive development. Huang pointed to Nvidia’s strategic partnerships and product improvements as proof that the corporate is well-prepared to bounce again.

Betting on power effectivity

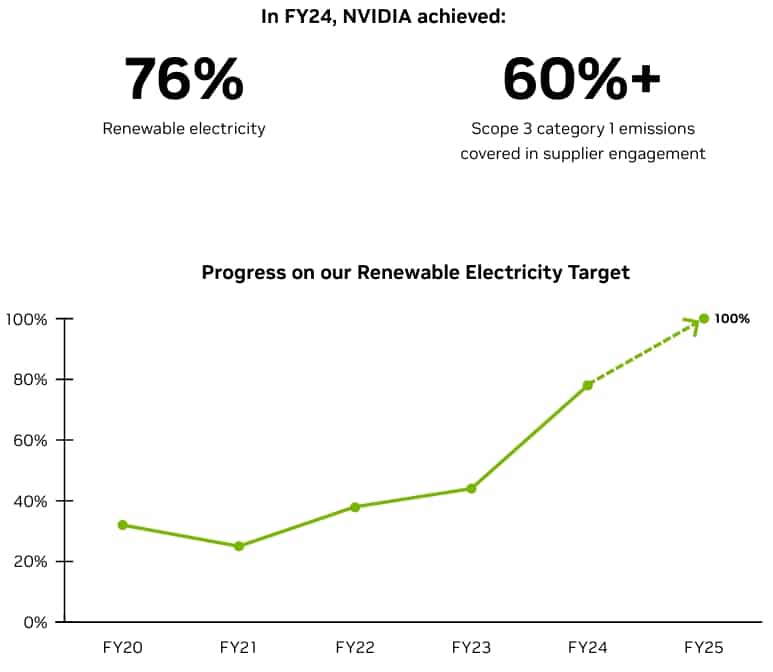

From an NVIDIA blogwe found its newly launched CUDA-powered accelerated computing is reworking industries by drastically lowering power use whereas boosting efficiency. By migrating from conventional CPUs to energy-efficient GPUs, firms are seeing as much as 66x quicker processing speeds and big power financial savings. This shift is especially necessary for data-heavy duties like AI, 6G analysis, and scientific computing.

The advantages prolong past velocity. NVIDIA estimates that if all AI, high-performance computing (HPC), and information analytics workloads switched to GPUs, information facilities may save as much as 40 terawatt-hours of power yearly. That’s equal to the power utilized by 5 million U.S. properties every year.

Supply: NVIDIA

Supply: NVIDIA

The weblog has given utmost significance to the sustainability issue that these GPUs are promising. They clarify GPU acceleration presents round 20x extra energy efficiency than CPUs. It achieves this by ending duties quicker and coming into a low-power state, thereby chopping complete power use whereas sustaining high efficiency.

Supply: NVIDIA

As an example,

“The NVIDIA GB200 Grace Blackwell Superchip is estimated to offer 25X better energy efficiency over the prior Hopper generation for massive LLMs, while CPUs have not demonstrated an ability to effectively run larger or massive LLMs.”

Over the previous decade, NVIDIA’s AI computing has seen a 100,000x enchancment in power effectivity, serving to companies meet sustainability targets. Furthermore, firms working workloads on NVIDIA’s platform expertise 10-180x velocity enhancements throughout duties like information processing and laptop imaginative and prescient. This has fueled a 154% improve in NVIDIA’s data center income year-over-year, pushed by robust demand for its Hopper structure and upcoming Blackwell platform.

As AI fashions evolve and demand grows, NVIDIA’s energy-efficient options will proceed to play a key position in lowering the carbon footprint of data centerssupporting a extra sustainable future for tech.