The oil and fuel sector are buzzing with exercise as fairness offers acquire momentum. It’s because this yr has witnessed a superb quantity of investments, underscoring a vibrant market eager to drive power innovation and navigate the shifting traits. From main acquisitions to key partnerships, these offers are influencing the longer term course of the power business.

Deal Exercise Sees Slight Uptick with Give attention to Sustainability

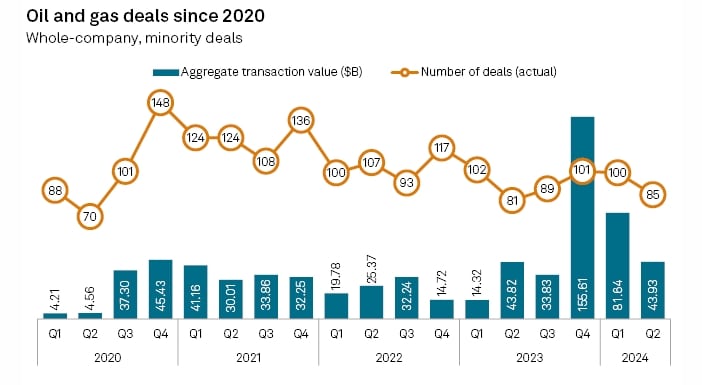

In accordance with S&P International, within the latest quarter, the oil and fuel business recorded 85 whole-company and minority-stake offers, totaling $43.93 billion. This represents a modest improve from the identical interval in 2023, which noticed 81 offers valued at $43.82 billion.

supply: S&P International

The rising deal exercise highlights a pattern towards integrating environmental sustainability into the business’s funding methods.

Q2 2024’s High 5 Oil and Fuel Tech Fairness Offers: CB Insights Snapshot

The next corporations have topped the listing launched by CB Insights this yr.

1. HIF International Secures $164 Million Funding for eFuels Initiatives

Extremely Revolutionary Fuels (HIF) International, the electrofuel large secured a $164 million funding this Might to fund its eFuels tasks from its present shareholders and a brand new companion, Japanese power firm Idemitsu Kosan. Whole funding goes to $424 million.

Cesar Norton, President & CEO of HIF International, expressed enthusiasm in regards to the partnership, stating,

“We are excited to welcome Idemitsu as a new partner in our mission to power the world with renewable energy. This collaboration goes beyond financial support; it symbolizes our shared commitment to a greener future. We’re grateful to our shareholders for their continued support as we develop eFuels facilities globally that could recycle 25 million metric tons of CO2, equivalent to the emissions of over 5 million cars.”

Susumu Nibuya, Government Vice President, and COO of Idemitsu Kosan talked about that Idemitsu is concentrating on e-methanol, blue ammonia, and sustainable aviation fuel (SAF) to attain carbon neutrality by 2050.

This funding marks step one in a broader four-part collaboration, which incorporates monetary backing, eFuels buy agreements, market improvement in Japan, and establishing CO2 provide chains.

2. ICEYE Secures $136M in Collection D Funding Spherical

ICEYE Ltd. is a Finnish firm and a spin-off from Aalto College’s Radio Expertise Division makes microsatellites. Exactly it’s a chief in artificial aperture radar (SAR) satellite tv for pc know-how. This April, it secured $93M in progress funding to develop its SAR satellite tv for pc constellation and product choices.

This oversubscribed spherical builds on the corporate’s February 2022 Collection D, bringing complete funding to $438M. ICEYE skilled robust progress in 2023, ending the yr with over $100M in income. The brand new funding will drive the subsequent section of growth, specializing in:

- Rising demand for its Missions enterprise, with rising curiosity from governments for protection and civil purposes utilizing next-gen SAR satellites.

- Increasing SAR knowledge providers to supply revolutionary merchandise for monitoring Earth’s modifications, day, or evening, in any climate.

- Accelerating progress in its Options choices, with vital funding in Flood Insights, Wildfire Insights, and future peril-based evaluation for presidency and business use.

CEO Rafal Modrzewski emphasised the help from new investor Solidium, highlighting belief in ICEYE’s mission to guide the worldwide SAR market. The corporate’s achievements and clear targets intensified traders’ religion. Notably, the deal was facilitated by Citigroup.

3. Aether Fuels Raises $34M to Revolutionize Sustainable Aviation and Transport

Aether Fuels, a pacesetter in local weather know-how, secured $34 million in Collection A funding from a worldwide group of traders. AP Ventures led the spherical, joined by Chevron Expertise Ventures, CDP Enterprise Capital, and Zeon Ventures. Earlier traders, together with Xora Innovation, TechEnergy Ventures, Doral Vitality-Tech Ventures, Foothill Ventures, and JetBlue Ventures, additionally participated.

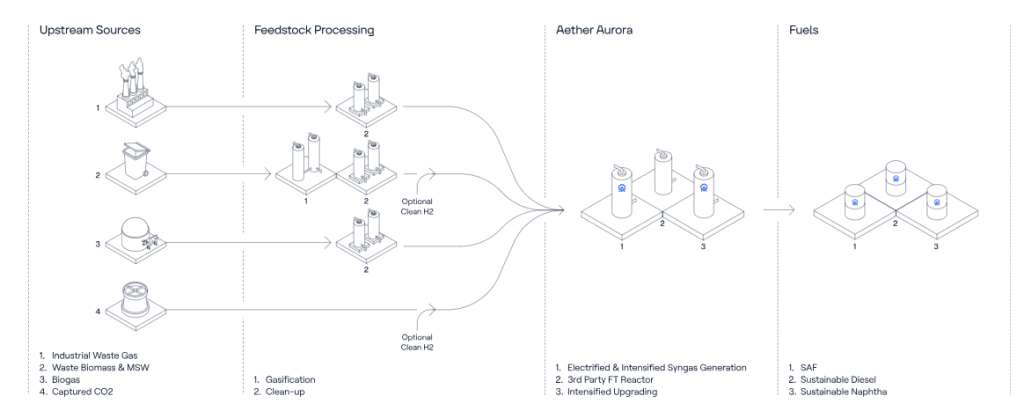

With this funding, Aether goals to hurry up the event of Aether Aurora, its superior know-how for producing sustainable aviation and shipping fuels.

The press launch additional highlighted that Aether Aurora with its companion GTI Vitality will use Fischer-Tropsch’s superior course of to spice up gas manufacturing and make it price efficient. This versatile know-how can flip various kinds of waste carbon into jet gas and different liquid fuels, fixing provide points that different sustainable aviation gas strategies face.

Aether Aurora’s distinctive capability to create sustainable fuels from any feedstock:

supply: Aether

Considerably, Aether will even use the brand new funding to develop its R&D and plant capability within the U.S. and Southeast Asia for SAF and different liquid fuels in partnership with strategic allies.

4. SENCO Invests in Strohm with $32M Fairness Surge in Thermoplastic Pipeline Innovation

This yr, on June 19, SENCO Hydrogen Capital, a personal fairness agency identified for its concentrate on hydrogen and energy transition investments, introduced a big $32 million (€20 million) fairness funding in Strohm, a Dutch firm famend for its revolutionary pipeline know-how, which they name it Thermoplastic Composite Pipelines (TCPS).

The funding goals to spice up Strohm’s progress, notably in hydrogen and carbon capture utilization and storage (CCUS). This partnership can be centered on decreasing the carbon footprint of pipeline infrastructure, aiming for a extra sustainable power future.

Martin van Onna, CEO of Strohm says,

“Strohm is a pioneer in the development of TCP and has set itself the goal of significantly reducing CO2 emissions in the pipeline infrastructure sector. “The partnership with SENCO enables us to further scale our technologies and continue our successful expansion, especially in the field of energy transformation around hydrogen and CCUS”

This deal is a part of a broader €30 million capital improve in Strohm, with present shareholders like Chevron Expertise Ventures, Shell Ventures, and Evonik Enterprise Capital additionally collaborating. Collectively, these corporations are advancing revolutionary applied sciences that help low-carbon power options.

5. LiveEO Raises $27 Million to Revolutionize Local weather Threat Administration

This June, LiveEO, a pacesetter in remodeling satellite tv for pc knowledge into actionable insights, has raised $27 million (€25 million) in a Collection B funding spherical led by NordicNinja and DeepTech & Local weather Fonds (DTCF). This funding will speed up the event of LiveEO’s AI-driven options and develop its crew.

NordicNinja is the most important Japanese-backed VC in Europe, and it’s centered on deep tech, local weather tech, and digital society options. DTCF is financed by the German Future Fund.

LiveEO turns uncooked satellite tv for pc knowledge into insights that assist companies handle local weather dangers and enhance resilience. The platform is trusted by main corporations like Deutsche Bahn and Community Rail to watch and shield belongings. The brand new funding will additional improve LiveEO’s mission to make industries extra sustainable whereas addressing local weather challenges.

Daniel Seidel, co-founder, and co-CEO of LiveEO, elaborated on the corporate’s mission to leverage satellite tv for pc knowledge for planetary safety and industrial sustainability. He famous that the brand new funding will speed up this mission, serving to companies worldwide navigate local weather, environmental, technological, and regulatory challenges.

Nonetheless, CB Insights had a whole listing of corporations that secured good investments and contributed to a fruitful quarter this yr.

International Funding & Offers: Regional Insights

As we will see from the picture Europe dominating the house in Q2 2024, with 9 huge offers totaling to $0.2 billion adopted by Latin America.

The strategic investments made this yr clearly outlines a vibrant future for the oil and fuel business. As sustainability positive aspects traction throughout numerous industries, the numerous developments in pure power sources and know-how will undoubtedly scale back carbon emissions and create a greener world.