Lithium spot costs have plummeted by round 90% since 2022, resulting in important mine closures and market shifts worldwide. Nevertheless, CATL’s current shutdown in Jiangxi, China, stands out as probably the most vital closures to this point. What led to this determination, and the way has it impacted the worldwide lithium business?

CATL Shuts Down Main Lithium Mine Amid Plunging Costs

Jiangxi province, situated in southeastern China, accounts for about 5% to six% of the worldwide lithium provide. Regardless of its giant reserves, CATL’s Jiangxi mine has confronted monetary pressure because of rising manufacturing prices and falling costs. In response to BMO (Financial institution of Montreal) analysts, mining lepidolite has develop into unprofitable as a result of, regardless of its excessive lithium content material, lepidolite is expensive to transform into usable lithium.

CATL has remained aggressive by using its totally built-in business modelwhich incorporates refining, cathode energetic materials (CAM) manufacturing, and battery manufacturing. Nevertheless, the corporate couldn’t maintain the present market stress. The closure of this lepidolite mine, a key supply of lithium carbonate, has precipitated vital disruptions out there. Moreover, CATL is contemplating pausing one among its three lithium carbonate manufacturing traces in Jiangxi.

CATL’s Mine Closure and Its World Impression: UBS Evaluation

This information has garnered vital consideration throughout the lithium market. In response to UBS Lithium Analyst Sky Han, this mine accounts for roughly 5% of the world’s main lithium provide and about 20% of China’s provide. The mine was anticipated to extend manufacturing from 60,000 tons of lithium carbonate equal (LCE) in 2024 to 95,000 tons in 2025, positioning it because the fifth-largest lithium mine globally.

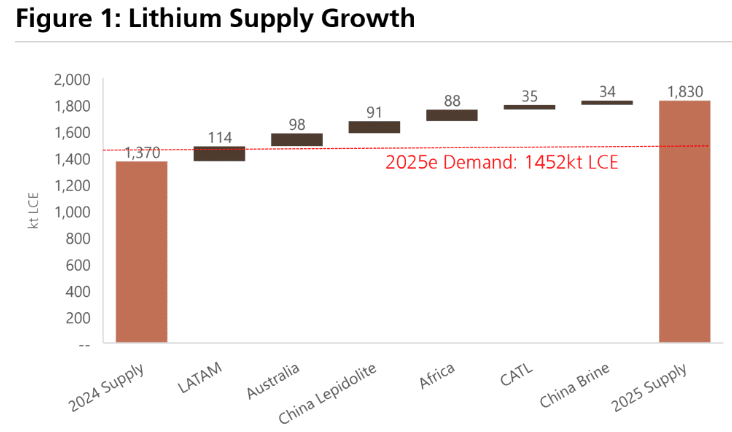

Whereas the closure is notable, it isn’t anticipated to drastically alter the general market surplus for 2025. Nevertheless, a tighter provide scenario may develop if different lepidolite producers in China comply with go well with.

Consultants believed that built-in lithium producers like CATL would navigate falling lithium costs successfully by means of their downstream operations. Nevertheless, current developments recommend that even vertically built-in corporations would possibly battle in a low-price atmosphere. Experiences from China and Africa point out that the challenges are substantial, with vertically built-in corporations additionally dealing with difficulties.

Supply: Wooden Mackenzie, Firm Filings, UBSe.

What Lies Forward for Lithium Costs?

The suspension of the mine will scale back China’s month-to-month lithium carbonate output by 8%, or roughly 5,000 to six,000 tons, in accordance with UBS analysts. With diminished output from one among China’s largest mines, consultants anticipate that lithium prices may stabilize, doubtlessly providing aid to struggling producers. The numerous value outcomes embody:

- Costs may stabilize between $10,000 and $11,000 per ton, reflecting world money prices. The higher restrict is pushed by CATL’s value base, estimated at $10,968 per ton.

- Conversion prices of round $3,000 per ton may push spodumene costs as much as as excessive as $1,000 per ton within the close to time period, in comparison with present spot costs of about $730 per ton.

Whereas CATL’s closure may positively affect pricing, extra provide reductions can be mandatory to handle the anticipated market surplus in 2025. The evolving scenario in China’s lepidolite provide can be essential. Analysts stay cautious in regards to the progress of Africa’s lithium provide, and the seaborne spodumene worth, somewhat than the GFEX, can be crucial for Australian lithium producers ramping up manufacturing.

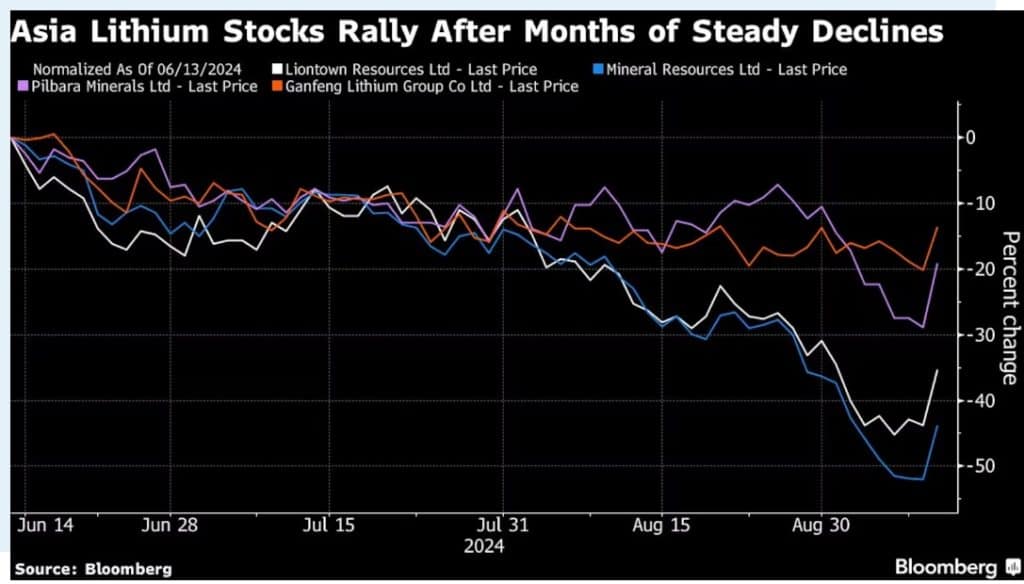

For now, analysts suggest promoting shares like IGO, LTR, PLS, and Ganfeng, whereas sustaining a impartial stance on corporations like Albemarle (ALB), Livent (LTM), and Tianqi. They’re extra optimistic about Qinghai Salt Lake and PMET. Falling lithium prices have led to mine closures and venture delays globally.

The mine in Yichun Metropolis, Jiangxi province, had considerably boosted China’s lithium provides. Now, CATL faces the troublesome determination to chop again.

CATL’s Transfer Drives Inventory Surge

CATL’s determination has already impacted the worldwide market. Opposite to expectations, shares of several global lithium companies have seen beneficial properties. Moreover, the closure has eased oversupply considerations, resulting in a surge in lithium costs and a lift in inventory efficiency for producers all over the world. As an illustration, Bloomberg reported that shares of Albemarle jumped as a lot as 17% in New York, whereas SQM noticed a 12% rise. In Australia, Pilbara Minerals Ltd. shot up by 16%, and Tianqi Lithium Corp. climbed by 16% in Hong Kong.

Following the CATL announcement, lithium carbonate futures on the Guangzhou Futures Alternate rose by 5.5%, hitting 76,700 yuan per ton ($10,700), though they continue to be down 27% for the 12 months.

A number of lithium producers in Australia, together with Arcadium Lithium Plc and Core Lithium Ltd., have shut down high-cost websites because of plummeting costs. World Lithium Assets Ltd. is lowering prices at its promising venture because it faces a longer-than-expected worth hunch. Moreover, Albemarle has paused its world growth plans in response to the continuing worth drop. This was reported by Bloomberg.

Supply: Bloomberg

Analysts from Guotai Junan Securities Co. predict that lithium costs would possibly rebound by 2026, and lithium shares may begin rising six to 9 months earlier than the commodity’s worth improves.

Alice Yu, lead metals & mining analysis analyst at S&P World Commodity Insights, said,

“There is a stronger signaling effect from CATL’s cut. As the world’s largest battery producer, its mine-side suspension reinforces the expectation of a prolonged weakness in downstream demand.”

In conclusion, as lithium costs proceed to plunge, CATL’s actions are essential for stabilizing the availability chain. The corporate is adjusting its operations to navigate the powerful market situations, hinting at doable shifts within the business’s lithium manufacturing methods within the coming months.