The US’ purpose to interrupt China’s grip on the worldwide provide of uncommon earth minerals faces quite a few hurdles. In a distant subject exterior Houston, Texas, plans are in place for a uncommon earth processing plant by Lynas Uncommon Earths, an Australian firm.

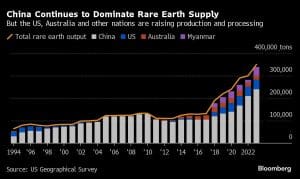

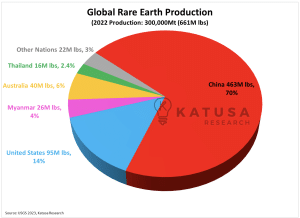

Regardless of its potential significance, this plant is only one step within the US’s bigger, multibillion-dollar effort to problem China’s monopoly, which controls roughly 70% of the world’s uncommon earth output and over 90% of its refining capability.

US Funding: Gradual Progress in a Excessive-Stakes Race

Rare earth elements are important parts in numerous high-tech functions like smartphones, wind generators, and navy gear.

The Texas plant, set to be constructed by Lynas, is a part of a rising US initiative to cut back reliance on China for uncommon earths. For the 149-acre (60 hectares) website, Lynas has secured greater than $300 million in contracts from the Pentagon. If all goes in response to plan, this facility will probably be operational inside 2 years, contributing considerably to the US’s uncommon earth processing capability.

This plant represents only a fraction of the billions of {dollars} in subsidies and loans pledged by the US and its allies to foster home uncommon earth manufacturing. The American authorities has more and more considered the event of a home uncommon earths provide chain as a matter of nationwide safety. It goals to interrupt China’s near-total management over refining and manufacturing.

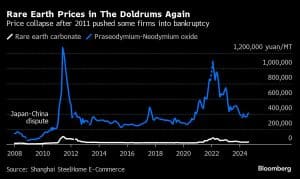

Nevertheless, whereas the intention is evident, market situations current a major problem. Since 2022, the worldwide costs for uncommon earth parts have slumped. That is primarily because of a rise in provide from China and a slowdown in its home financial system.

This decline has raised doubts in regards to the long-term monetary viability of many new initiatives exterior China. Thus, the prospect of building a strong, unbiased provide chain stays unsure.

Market Volatility Threatens New Uncommon Earth Ventures

Regardless of world demand for uncommon earth parts, their extraction and processing stay fraught with financial and environmental challenges. Uncommon earths aren’t really “rare” however are seldom present in concentrations excessive sufficient to justify environmentally intensive mining operations.

There are 17 chemically associated parts on this class, every with properties crucial to manufacturing electronics, renewable energy parts, and protection know-how.

Present market situations pose a menace to new entrants. In response to MP Supplies Corp., which operates the one uncommon earth mine within the US and is constructing a manufacturing facility to fabricate magnets in Texas, CEO James Litinsky:

“These market conditions have now destroyed most of the hoped-for projects from just a couple of years back.”

Nevertheless, even with home mining in place, refining and processing are nonetheless predominantly underneath Chinese language management, underscoring the dominance of China’s provide chain.

Within the face of those market challenges, Laura Taylor-Kale, the US Assistant Secretary of Protection for Industrial Base Coverage, promised earlier this 12 months that the US would set up a “sustainable mine-to-magnet supply chain capable of supporting all US defense requirements by 2027.”

- She additional highlighted that the Lynas undertaking in Texas might produce round 25% of the world’s provide of uncommon earth oxides as soon as operational.

China’s Dominance: Strategic Value Manipulation at Play

China’s management over the uncommon earth market stems from its aggressive mining and refining actions, supported by authorities insurance policies. Per Katusa Analysis report, the nation merged its 5 largest producers right into a single entity, additional tightening its grip on the world’s uncommon earth provide.

The Chinese language Ministry of Pure Assets, together with its business ministry, raised mining quotas for uncommon earths in 2023 and 2024, driving down world costs and making use of additional stress on competing initiatives. The outcome has been a market atmosphere during which many uncommon earth mines wrestle to interrupt even, forcing early-stage initiatives into delays and funding shortfalls.

The present scenario has echoes of previous geopolitical maneuvers. In 2011, China quickly reduce off uncommon earth provides to Japan over a territorial dispute. This transfer pushed Japan to hunt diversification in its uncommon earths provide chain, ultimately investing in Lynas. The occasion exhibits how geopolitics and market management can intersect in ways in which considerably impression world provide chains.

Regardless of securing substantial investments, some uncommon earth initiatives exterior China are already encountering setbacks. Arafura Uncommon Earths is one such firm. It obtained an A$840 million (roughly $560 million) mortgage from the Australian authorities and signed agreements with two Korean auto corporations in 2022 to produce uncommon earths from its Nolans undertaking in Australia.

Nevertheless, building has but to start, largely because of funding gaps. CEO Darryl Cuzzubbo talked about that whereas debt and approvals are in place, the “one missing piece is the equity.” The corporate goals to safe half of the required fairness from cornerstone traders earlier than turning to the broader marketplace for the remaining funds. Cuzzubbo hopes to finalize the fairness by the tip of the 12 months to start out building in early 2025.

The Key to Uncommon Earth Provide Chain Independence

Japan’s expertise gives crucial insights into the complexities of building an unbiased uncommon earth provide chain. Following China’s 2011 export restrictions, Japan invested $250 million in Lynas, permitting the corporate to start out trial manufacturing two years later.

Nevertheless, it took Lynas till 2018 to turn out to be worthwhile, highlighting the prolonged timeline and appreciable monetary backing required for such initiatives.

Lynas CEO Amanda Lacaze emphasised the necessity for “patient capital” when venturing into the uncommon earths market. That is significantly true for initiatives breaking new floor. Current delays with the Texas facility because of points with wastewater permits highlights the obstacles dealing with new uncommon earth initiatives within the West.

The US’s push to construct a aggressive uncommon earths provide chain faces headwinds in each market situations and geopolitical maneuvering. As the worldwide uncommon earth costs stoop and China’s strategic management persist, the event of a strong, unbiased provide chain stays an unsure endeavor. The Western world’s purpose of constructing a aggressive provide chain would require not simply funding however strategic persistence and worldwide cooperation.