On September 23, Uranium Power Corp (UEC) made a historic announcement to purchase 100% of Rio Tinto’s Wyoming property. These property embody the absolutely licensed Sweetwater Plant and a number of other uranium mining tasks with about 175 million kilos of uranium assets. This enormous acquisition will need to have an enormous price ticket connected. So, what’s its value?

Unlock under.

Unlocking the UEC and Rio Tinto Deal Worth

The entire price of the deal is $175 million, which UEC can pay utilizing its accessible funds. UEC disclosed within the press release that it’s shopping for 100% of the shares in two Rio Tinto subsidiaries that maintain its Wyoming uranium property. As a part of the deal, UEC will change $25 million in surety bonds for future reclamation prices. The deal is anticipated to shut within the fourth quarter of 2024 after fulfilling all the usual situations.

Amir Adnani, President and CEO, said:

“Expanding our production capabilities with the acquisition of highly sought after and fully licensed uranium assets in the U.S. is an important and timely milestone, especially in Wyoming, where we have recently restarted ISR production. These assets will unlock tremendous value by establishing our third hub-and-spoke production platform and cement UEC as the leading uranium developer in Wyoming and the U.S.”

UEC Expands Its Uranium Portfolio, Builds the third Hub within the U.S.

Donna Wichers, Vice President of Wyoming Operations remarked exuberantly,

”In my 46 years of working expertise in Wyoming, that is the primary time that such a big portfolio of property has been consolidated with one firm, providing a pathway to near-term manufacturing, improvement and untapped exploration potential.”

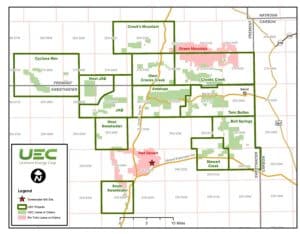

UEC has gained 12 uranium tasks in Wyoming’s Nice Divide Basin. By buying Rio Tinto’s Sweetwater Plant and uranium tasks, UEC creates its third U.S. hub-and-spoke manufacturing platform, unlocking the potential of its in depth property. It contains entry to licensed uranium services and mining assets.

Notably, The Sweetwater Plantable to processing 3,000 tons per day and 4.1 million kilos yearly, presents flexibility for each ISR and standard mining. As stated earlier than, a full acquisition provides round 175 million kilos of uranium assets. Half could be mined utilizing cost-effective ISR strategies, which UEC will prioritize, whereas typical mining will present future development alternatives. Thus, there’s plenty of flexibility within the manufacturing course of.

On September 15, 2022, UEC filed the S-Okay 1300 Technical Report Abstract, revealing assets for its Wyoming Hub-and-Spoke ISR Platform.

A MESSAGE FROM URANIUM ROYALY CORP.

NASDAQ’s Sole Uranium Centered Royalty Firm

The corporate is Uranium Royalty Corp., buying and selling as (NASDAQ: UROY, TSX: URC), holding a powerful portfolio contains strategic acquisitions in uranium pursuits with royalties, streams, fairness in uranium corporations, and bodily uranium buying and selling. Their strategic method goals to help cleaner, carbon-free nuclear power whereas fostering long-term relationships based mostly on sustainability rules.

Learn about the company’s portfolio of royalty assets and uranium holdings >>

NASDAQ: UROY | TSX: URC

*** This content material was reviewed and authorised by Uranium Royalty Corp. and is being disseminated on behalf of Uranium Royalty Corp. by CarbonCredits.com for business functions. ***

Different Uranium Tasks Bolstering UEC’s Useful resource Base in The Nice Divide Basin

UEC additionally features 53,000 acres of land and helpful geological information from Rio Tintorising its exploration footprint to 108,000 acres in Wyoming’s Nice Divide Basin. Apart from the Sweetwater Plant, UEC can be including Purple Desert and Inexperienced Mountain uranium tasks to its portfolio.

Purple Desert Uranium Venture

The Purple Desert Venture covers 20,005 acres in Wyoming’s Nice Divide Basin. The venture has about 42 million kilos of uranium assets throughout three deposits, with potential for extra discoveries close to the Sweetwater Plant. These deposits are conducive for ISR mining, because the uranium lies under the water desk in sands confined by impermeable layers.

Inexperienced Mountain Uranium Venture

Positioned 22 miles from the Sweetwater Plant, the Inexperienced Mountain Venture spans 32,040 acres of mining and exploration rights. It holds an estimated 133 million kilos of uranium assets throughout 5 deposits. Some areas are appropriate for ISR mining, whereas others are higher for typical strategies.

Adnani additional added,

“With this Transaction, we are building upon our transformative acquisition of Uranium One Americas in 2021, which added a large portfolio of holdings in the Great Divide Basin of Wyoming. We recognized early on that there are meaningful development synergies with the Rio Tinto assets, particularly the Sweetwater Plant.”

Map: Exhibits the place of Rio Tinto’s property relative to the present UEC portfolio within the Nice Divide Basin

Supply: UEC

Empowering America’s Uranium Future: A Stronger Home Provide

On Could 13, President Biden signed the Prohibiting Russian Uranium Imports Act, a major regulation to reinforce America’s power and financial safety by lowering reliance on Russian nuclear energy. This laws reestablishes U.S. management within the nuclear sector and secures the nation’s power future. With $2.72 billion in fundingit will increase home enrichment capability and demonstrates a dedication to long-term nuclear development whereas selling a various marketplace for dependable business nuclear gasoline.

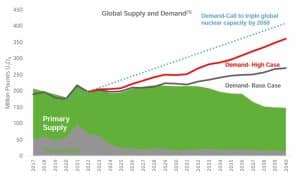

With rising clean energy demand and a U.S. ban on Russian uranium, UEC is well-positioned to fulfill the rising want for home uranium. One other current massive information was Microsoft’s partnership with Constellation Power to revive Three Mile Island by 2028, producing over 800 megawatts of carbon-free power.

Three Mile Island (TMI) in Pennsylvania is a major website in nuclear power historical past, identified for the extreme accident in 1979 that led to the closure of TMI-Unit 2. TMI-Unit 1 continued operations till 2019 when it was shut down resulting from financial causes. Nonetheless, it is a enormous initiative amid the surge in nuclear power, uranium demand, and after all AI enlargement.

- With international development in nuclear power and demand for uranium, the US is at the moment the most important shopper of uranium.

Supply: UEC

In conclusion, this current acquisition of Rio Tinto showcases UEC’s dedication to establishing itself because the main uranium firm in North America, whereas additionally strengthening home provide chains to fulfill the rising demand for clear power.