In a serious strategic transfer, Rio Tinto has agreed to accumulate U.S.-based Arcadium Lithium for $6.7 billion, marking a big step in reworking it into a world chief within the lithium market. The all-cash deal, providing a 90% premium to Arcadium’s share worth, positions Rio Tinto because the world’s third-largest producer of lithium which is a crucial element in electrical car (EV) batteries and power storage options.

Considerably, this acquisition, announced on October 9underscores Rio Tinto’s dedication to the power transition by increasing its footprint in low-carbon, high-demand uncooked supplies.

A MESSAGE FROM Li-FT POWER LTD.

Lithium Deposits That Can Be Seen From The Sky

Who’s Li-FT Energy? They’re one of many quickest creating North American lithium juniors with a flagship Yellowknife Lithium project positioned within the Northwest Territories.

Three causes to contemplate Li-FT Energy:

RESOURCE POTENTIAL | EXPEDITED STRATEGY | INFRASTRUCTURE

Li-FT is advancing 5 key tasks; all positioned within the extraordinarily protected and pleasant mining jurisdiction of Canada.

TXSV: LIFT | OTCQX: LIFFF | FROM: WS0

*** This content material was reviewed and permitted by Li-FT Energy Ltd. and is being disseminated on behalf of Li-FT Energy Ltd. by CarbonCredits.com. ***

Why Rio Tinto’s Second for Lithium is Now?

Lithium prices have lately dipped as a consequence of oversupply and slowed EV gross sales in China, however Rio Tinto’s CEO Jakob Stausholm stays assured about lithium’s long-term development. The corporate expects lithium demand to develop by over 10% yearly by means of 2040, pushed by the worldwide push towards electrification.

Jakob Stausholm, CEO of Rio Tinto CEO defined,

“Acquiring Arcadium Lithium is a significant step forward in Rio Tinto’s long-term strategy, creating a world-class lithium business alongside our leading aluminum and copper operations to supply materials needed for the energy transition. Arcadium Lithium is an outstanding business today and we will bring our scale, development capabilities, and financial strength to realize the full potential of its Tier 1 portfolio. This is a counter-cyclical expansion aligned with our disciplined capital allocation framework, increasing our exposure to a high-growth, attractive market at the right point in the cycle.”

The mining large has been going through challenges within the lithium market, notably with its Jadar project in Serbiawhich has encountered native opposition and regulatory delays. Thus, the acquisition of Arcadium is an immediate increase to Rio Tinto’s lithium manufacturing capability, giving the corporate entry to assets which are already operational or nearing completion.

This acquisition not solely strengthens Rio Tinto’s place within the quickly rising EV market but in addition offers entry to main automakers like Tesla, BMW, and Basic Motors.

Arcadium’s Position in Increasing Rio Tinto’s Lithium Capability

Arcadium Lithium has shortly turn into a world chief in sustainable lithium manufacturing. It has working assets in Argentina and Australia and downstream conversion belongings within the U.S., China, Japan, and the U.Ok. Notably, Within the U.S. the corporate has an unique built-in mine-to-metal manufacturing facility within the Western Hemisphere for high-purity lithium metallic.

The corporate leads the business in lithium extraction, excelling in hard-rock mining, brine extraction, and direct lithium extraction (DLE). It additionally makes a speciality of manufacturing lithium chemical compounds for high-performance functions.

Arcadium Lithium’s CEO Paul Graves expressed his sentiment,

“We are confident that this is a compelling cash offer that reflects a full and fair long-term value for our business and de-risks our shareholders’ exposure to the execution of our development portfolio and market volatility. This agreement with Rio Tinto demonstrates the value in what we have built over many years at Arcadium Lithium and its predecessor companies, and we are excited that this transaction will give us the opportunity to accelerate and expand our strategy, for the benefit of our customers, our employees, and the communities in which we operate.”

Harnessing Quebec’s Hydropower

Moreover, Arcadium’s operations, notably in Quebec, are well-aligned with Rio Tinto’s give attention to low-carbon options. Each firms make the most of Quebec’s hydropower assets, that are crucial for sustainable lithium manufacturing. This could assist Rio produce lithium with a decrease carbon footprint, thereby showcasing its sustainable mining practices.

With Arcadium’s plans to have 2X manufacturing capability by 2028, Rio Tinto is poised to play a serious position within the international provide of lithium sooner or later. As demand for clean energy supplies continues to rise, the corporate’s means to produce high-quality, sustainably produced lithium can be a key think about its success.

Strategic and Monetary Win: A Abstract

Rio Tinto’s acquisition of Arcadium will leverage its scale, improvement abilities, and monetary energy to maximise Arcadium’s portfolio. The press launch has summarized it considerably this manner:

Complementary Strengths

Rio Tinto’s monetary energy and confirmed undertaking administration will assist velocity up the event of Arcadium’s prime belongings. Each firms have a powerful presence in Argentina and Quebec, the place Rio Tinto plans to create world-class lithium hubs.

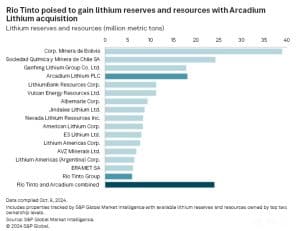

Then again, Arcadium’s Tier 1 belongings have constantly delivered excessive income. With these assets, the corporate expects to extend its capability by 130% by 2028. They envision to regulate the most important lithium useful resource base on this planet sooner or later.

Stable Monetary Positive aspects

Closing the Deal

The acquisition is predicted to shut by mid-2025 and is pending for regulatory approvals and shareholders’ consent. Each firms’ boards have unanimously permitted the deal, and early indications recommend a clean path to completion.

As soon as the deal closes, Rio Tinto plans to combine Arcadium’s operations with its current lithium belongings. Subsequently it will create a brand new enterprise unit targeted on lithium manufacturing and processing. The corporate has additionally expressed its dedication to retaining Arcadium’s workforce with the brand new starting.

Jakob Stausholm assured additional saying,

“We look forward to building on Arcadium Lithium’s contributions to the countries and communities where it operates, drawing on the strong presence we already have in these regions. Our team has deep conviction in the long-term value that combining our offerings will deliver to all stakeholders.”

Projections from the Worldwide Vitality Company (IEA) point out that lithium demand will considerably enhance, with the EVs and grid battery storage sectors—presently liable for about 60% of complete demand. That is anticipated to rise to roughly 90% by 2050 underneath each the Said Insurance policies (STEPS) and Web Zero Emissions (NZE) situations.

Supply: Procured from Arcadium’s sustainability report, initially from IEA.

Thus, we hope by the point the market reboundsRio Tinto can be well-positioned to fulfill hovering demand with an expanded and diversified lithium portfolio.