Fortescue Metals Group is forging forward with its daring plan to attain “real zero” emissions by 2030, a transfer that might generate substantial monetary rewards below the Australian authorities’s new carbon credit score scheme. This initiative, often known as Safeguard Mechanism Credit (SMCs), is a part of the Albanese authorities’s broader technique to incentivize companies to chop emissions and meet the nation’s local weather targets.

If Fortescue succeeds in assembly its formidable emissions objectives, it may earn between $50 million and $150 million yearly from promoting the carbon credits.

Fortescue’s Daring “Real Zero” Ambition

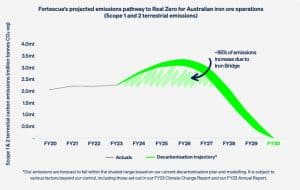

Chairman Andrew Forrest has made it clear that Fortescue’s final aim is to attain “real zero” by eliminating all Scope 1 and Scope 2 emissions from its iron ore mining operations by 2030. That is distinct from “net zero,” the place firms can depend on carbon offsets to stability out hard-to-abate or unavoidable emissions.

Forrest is a long-time critic of carbon offsets and suggests they do little to drive precise reductions in emissions. As an alternative, Fortescue’s focus is on attaining real emissions reductions by the transformation of its operations.

The mining big’s dedication to decarbonization consists of an intensive plan to overtake its power sources, transitioning from fossil fuels to renewable energy to energy its operations. Fortescue estimated in 2022 that attaining “real zero” in its Pilbara mining district would require an funding of $US6+ billion.

The corporate’s technique additionally entails the electrification of its mining fleet, investments in green hydrogenand revolutionary expertise options to scale back its carbon footprint.

Regardless of Forrest’s aversion to carbon offsets, Fortescue’s progress towards “real zero” may result in the corporate changing into a significant beneficiary of the Safeguard Mechanism Credits program.

The Clear Vitality Regulator will enable firms to earn carbon credit in the event that they exceed their mandated emissions discount targets. For Fortescue, this might imply producing round 1.4 million SMCs by 2030. It’s because its projected emissions may very well be considerably decrease than the regulatory allowance for its iron ore manufacturing.

What’s The Safeguard Mechanism Credit Scheme?

The Safeguard Mechanism, set to start in 2024, is a key element of the Albanese authorities’s technique to scale back nationwide greenhouse gasoline emissions. This system rewards firms that reduce their emissions past the required ranges by granting them SMCs. These credit can then be offered to different firms that fail to fulfill their emissions discount targets, making a market-based strategy to driving local weather motion.

- Analysts challenge that the worth of those credit may very well be substantial, with a government-imposed ceiling worth of $75 per tonne.

If Fortescue succeeds in its decarbonization plans, it may generate tens of tens of millions of {dollars} by promoting SMCs to firms struggling to fulfill their very own emissions discount targets. In response to projections, the miner can be permitted to emit round 1.4 million tonnes of carbon dioxide by 2030.

Nevertheless, if the corporate manages to attain its “real zero” aim, it is going to have reduce all emissions. And thus, it may earn 1.4 million credit in that yr alone. Given the worth of $75/tonne, that might whole about $105 million value of carbon credit.

Whereas the monetary windfall from promoting SMCs is enticing, Fortescue hasn’t but determined whether or not to take part on this carbon market.

Andrew Forrest mentioned that Fortescue remains to be finalizing its place on the Safeguard Mechanism, noting that:

“We will do this consistent with our broader approach to voluntary and compliance carbon markets, which is that the core focus must always be the delivery of real reductions in emissions.”

He reiterated that Fortescue’s core focus stays on attaining real emissions reductions, not on offsets or carbon capture technologies.

Decarbonization Challenges Amid Rising Emissions

Fortescue’s path to attaining “real zero” is fraught with challenges. Whereas the corporate is making strides in decarbonizing its operations, it nonetheless has a protracted option to go.

Within the yr to June 2024, Fortescue’s Scope 1 and Scope 2 emissions—the direct emissions from its mining actions and people related to its power use—rose by about 7%. This enhance in emissions led to the corporate exceeding its government-mandated emissions cap by about 120,000 tonnes. Subsequently, the iron miner was compelled to buy $4.2 million value of Australian Carbon Credit Units (ACCUs) to adjust to the legislation.

Regardless of the setbacks, Fortescue has reaffirmed its dedication to decarbonization and has emphasised that it’s going to solely buy carbon offsets when legally required. The corporate insists that it’s going to not depend on carbon credit to attain its 2030 goal. It is going to stay centered on lowering emissions on the supply.

The corporate has additionally pledged to not depend on carbon capture and storage (CCS) applied sciences, which it views as an inadequate resolution for addressing the local weather disaster.

Rival Approaches within the Mining Trade

Fortescue’s aggressive push towards “real zero” stands in distinction to a few of its rivals within the mining trade. Rival miner Rio Tinto, as an illustration, has set a goal to halve its carbon emissions by 2030, at an estimated price of $US6 billion.

Rio Tinto has been in main partnerships not too long ago with its lithium enlargement. Nonetheless, although Rio Tinto’s plans are substantial, they don’t match the extent of ambition proven by Fortescue, which is aiming for full decarbonization in the identical time-frame.

Fortescue Metals Group’s “real zero” goal is a landmark initiative that might set a brand new normal for the mining trade. It may additionally generate important monetary advantages by Australia’s Safeguard Mechanism Credit program. The corporate’s dedication to real emissions reductions, mixed with its potential to earn tens of millions from selling carbon creditsmakes Fortescue a key participant within the international transition to a low-carbon financial system.