ADNOC, the UAE’s main power firm, has accomplished its acquisition of OCI World’s majority stake in Fertiglobe. Now ADNOC has 86.2% possession of Fertiglobe, with 13.8% remaining publicly traded on the Abu Dhabi Securities Change (ADX). The acquisition marks a vital step in ADNOC’s technique to dominate the worldwide low-carbon ammonia market and additional its ambitions in chemical compounds.

Dr. Sultan Ahmed Al Jaber, ADNOC’s Managing Director and Group CEO, highlighted the significance of this acquisition, stating,

“ADNOC’s majority shareholding in Fertiglobe marks another milestone in the delivery of our ambitious international chemicals growth strategy and goal to become a top five chemicals player. Fertiglobe will be the vehicle through which ADNOC advances its low-carbon ammonia business, supporting our efforts to enable a just, orderly, and equitable global energy transition.”

Fertiglobe: A Rising Energy in Low-Carbon Ammonia

Ammonia is a key answer for decarbonizing industries like marine gasoline, energy, and agriculture, which account for 80% of worldwide emissions.

Finish praisethe world’s largest seaborne exporter of urea and ammonia, is a strategic asset in ADNOC’s chemical progress. It exports nitrogen merchandise to 53 international locations and holds a ten% share of worldwide ammonia and urea commerce. Final 12 months, the corporate shipped its first batch of ISCC PLUS-certified renewable ammonia from Egypt. This clear product will assist produce near-zero emissions soda ash for Unilever in India.

Moreover, the corporate has delivered a number of low-carbon ammonia shipments from the UAE, utilizing hydrogen and carbon seize know-how. Its renewable ammonia cuts emissions by 73%, accelerating the shift to cleaner power.

Fertiglobe lately achieved a significant milestone by securing a €397 million renewable ammonia offtake contract by means of the H2Global initiative. This contract is legitimate until 2033.

Supply: Fertiglobe

A Key Participant in ADNOC’s Low-Carbon Gas Ambition

Speaking concerning the acquisition, ADNOC plans to combine its stakes in present and upcoming low-carbon ammonia tasks into Fertiglobe.

- Considerably, this contains two main tasks in Abu Dhabi, which can add 2 million tons every year (mtpa) to Fertiglobe’s ammonia capability. The corporate’s complete capability will improve from 1.6 mtpa to eight.6 mtpa, with extra tasks within the pipeline.

Thus, with ADNOC’s backing, Fertiglobe can grow to be one of many prime 5 world leaders in chemical compounds markets and low-carbon ammonia manufacturing, which is a key gasoline within the energy transition.

Fertiglobe will proceed its enlargement underneath the management of CEO Ahmed El-Hoshy, who has been instrumental in constructing OCI’s ammonia and methanol enterprise within the U.S. and Europe. He’ll lead the subsequent enlargement section of Fertiglobe. The corporate’s present administration crew will stay intact as ADNOC rolls out the brand new technique.

Transferring on, Ahmed El-Hoshy, additionally highlighted the strategic significance of this transfer. He mentioned,

“This transaction reinforces our long-term outlook and ambition to meet global demand for low-carbon solutions. As part of ADNOC’s ecosystem, we are excited to unlock the full potential of our portfolio.”

Low-Carbon Fuels and Renewable Ammonia Growth

Business consultants predict demand for low-carbon ammonia will develop to 24 million tons by 2032 and Fertiglobe is simply capitalizing on this demand. It’s going to additional assist ADNOC attain its goal of capturing 5% of the worldwide low-carbon hydrogen market by 2030.

This aligns with the UAE’s Nationwide Hydrogen Technique. The corporate plans to unveil an in depth progress technique throughout its Capital Markets Day in Q1 2025, outlining its roadmap for additional enlargement and innovation.

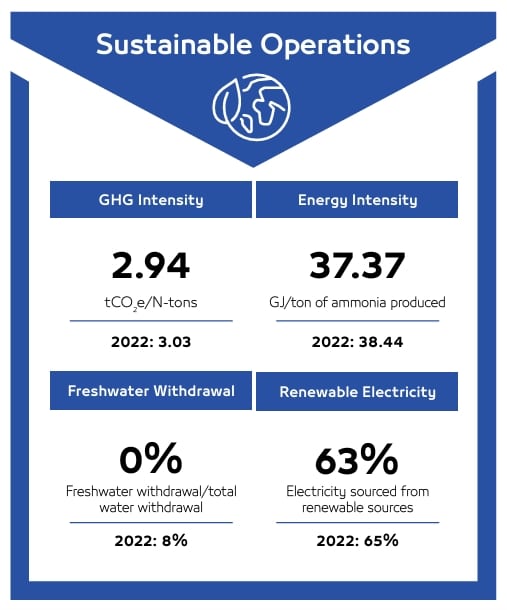

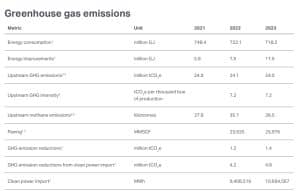

ADNOC’s Sustainability Milestones

We found from the corporate’s sustainability report that ADNOC is allocating $15 billion (AED 55 billion) to put money into varied decarbonization tasks, together with carbon seize, electrification, new CO₂ absorption know-how, hydrogen, and renewables.

This investment will improve to $23 billion (AED 84.4 billion) in early 2024. Moreover, the corporate has raised its carbon seize capability goal to 10 mtpa by 2030. That is 2x its earlier aim of 5 million tonnes.

Supply: ADNOC

By 2025, ADNOC goals to enhance energy effectivity by 5% (primarily based on 2018 ranges) and maintain upstream methane depth under 0.15%.

By 2030, it plans to provide 1 million tons of low-carbon ammonia yearly, scale back operational emissions depth by 25% (in comparison with 2019), and safely sequester 10 million tons of CO₂ per 12 months. ADNOC can be concentrating on a 5% share of the worldwide low-carbon hydrogen market and near-zero methane emissions in its operations.

By 2045, the corporate plans to deploy 100 GW of renewable power capability by means of Masdar, get rid of routine flaring, and obtain internet zero operational emissions.

In abstract, ADNOC’s acquisition positions Fertiglobe to steer within the low-carbon ammonia market. The plan holds immense promise for sustainable power progress in UAE and worldwide markets whereas delivering long-term worth to shareholders.