Uranium costs might have dropped lately, however the long-term outlook for this essential vitality useful resource is glowing. With game-changing applied sciences on the horizon and new uranium initiatives underway, the market is on for an thrilling comeback.

The uranium market has seen current short-term strain, with spot costs falling under $80 per pound after peaking at $107 in February. Regardless of this decline, uranium prices stay 30% larger than final 12 months, offering important returns for producers, in accordance with new evaluation from BMO Capital Markets.

The World Nuclear Association Symposium in London has highlighted combined market alerts, significantly provide chain points and delays. These are presently affecting the general sentiment, famous BMO analyst Alexander Pearce in a market commentary.

Uranium Spot Costs Dip, Lengthy-Time period Demand Surges

Though spot costs have softened, BMO Capital Markets initiatives a robust outlook for uranium demand. The funding banking subsidiary of BMO projected it to develop at an annual charge of two.9% by means of 2035. This improve is essentially pushed by China’s aggressive push to construct new nuclear reactors and the potential for reactor restarts in North America.

China, which is investing closely in nuclear energy as a cleaner various to coal, is anticipated to be a serious participant within the world uranium market.

Pearce emphasised the long-term demand outlook noting that they foresee a probably larger uranium demand over the medium to long run. This optimism is fueled by a number of components, together with:

- geopolitical shifts,

- rising world demand for clear vitality, and

- new nuclear applied sciences resembling small modular reactors (SMRs).

Provide Chain Challenges and Progress Projections

On the provision aspect, BMO anticipates 2024 will see the primary important improve in uranium provide in years. This development is anticipated to return from older uranium initiatives catching up with rising demand.

Whereas uranium costs stay under the height seen earlier in 2024, the overall pattern suggests a sturdy market with important upside potential, significantly as nuclear vitality performs an more and more very important position in world vitality methods.

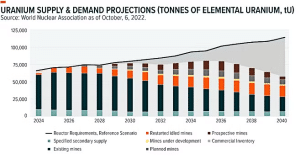

The World Nuclear Affiliation estimated that demand will proceed to extend by 2040 whereas provide can be restricted. Thus, there could be an enormous hole between the steel’s provide and demand necessities by that 12 months.

The Function of Superior Nuclear Applied sciences

OKa Sam Altman’s nuclear energy startup, is spearheading the event of SMRs. The California-based nuclear company highlighted the rising significance of superior nuclear applied sciences in assembly rising vitality wants.

In an interview, Brian Gitt, Oklo’s head of enterprise improvement emphasised the pressing want for dependable, clear vitality sources, significantly for energy-intensive industries like knowledge facilities and manufacturing. Gitt particularly said that:

“We’re seeing two big trends: rising power demand and the need for clean energy.”

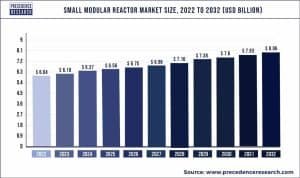

SMRs are rising as a versatile and environment friendly resolution for energy technology, significantly in areas with excessive vitality demand. By putting SMRs near energy-hungry services, corporations can keep away from the lengthy waits related to grid growth, offering quicker and extra localized vitality options.

Whereas nonetheless within the improvement part, SMRs maintain promise for revolutionizing how nuclear vitality is deployed, providing a cleaner and extra sustainable choice in comparison with conventional energy crops. Nevertheless, the widespread business adoption of SMRs continues to be a number of years away.

Gitt acknowledged this, stating that whereas the know-how reveals nice promise, its affect stays largely theoretical at this stage. But, the continued improvement of SMRs is seen as essential to addressing future vitality wants. That is significantly true as conventional vitality sources like pure fuel and coal face rising regulatory challenges and environmental considerations.

The U.S. Revives Its Nuclear Future with Oak Ridge Mega Challenge

Whereas the controversy over vitality coverage continues, it’s clear that nuclear power—each in its conventional kind and thru new applied sciences like SMRs—has an important position to play in the way forward for world vitality.

Only recently, in a major improvement for the vitality sector, French firm Orano USA introduced plans to construct a multibillion-dollar uranium enrichment facility in Oak Ridge, Tennessee. This funding marks the biggest single capital infusion in Tennessee’s historical past that may revitalize the area’s position as a frontrunner in nuclear innovation. Commentators thought-about this as harking back to the Manhattan Challenge throughout World Battle II.

Orano USA specializes within the uranium supply chain and nuclear gas cycle providers. This new Oak Ridge facility will give attention to producing low-enriched uranium for business nuclear reactors, not like the extremely enriched uranium as soon as used for weapons. The 920-acre website will home a 750,000-square-foot multi-structure plant.

The ability can be transferred from the U.S. Division of Power (DOE) to Orano USA by means of a tax incentive settlement. The plant is a essential a part of the U.S. government’s strategy to secure its nuclear future.

Congress lately allotted $2.8 billion to assist home uranium enrichment, and Orano USA will faucet into these funds. The corporate’s funding symbolizes the start of what many are calling the “second Manhattan Project,” as Oak Ridge as soon as once more takes heart stage within the race to advance nuclear know-how.

Oak Ridge, also known as the “Secret City,” is now a hub for greater than 150 nuclear corporations. These embrace NANO Nuclear Power and Kairos Energy, each of that are constructing superior reactors within the space.

Uranium and Nuclear on the Forefront of Clear Power

The announcement comes amid rising considerations over the U.S.’s capacity to compete with China and Russia in each nuclear energy and weapons know-how. Whereas China continues to increase its nuclear capabilities and Russia stays a dominant participant in uranium enrichment, the U.S. has seen a resurgence in nuclear analysis and improvement.

As international locations search for methods to satisfy their rising vitality wants whereas lowering carbon emissions, uranium and nuclear technology are more likely to stay on the forefront of this dialog.

BMO Capital Markets’ evaluation reveals that the demand for uranium will proceed to rise. Whereas supply-side challenges stay, the potential for important uranium manufacturing development presents hope for balancing demand. With current market improvement, the way forward for uranium appears brilliant, providing options to the world’s vitality challenges.