Excellent news for the electrical car (EV) industry- Common Motors (GM) and Lithium Americas have inked a $625 million three way partnership to develop the Thacker Go lithium undertaking in Nevada. This partnership is one other energy play to spice up the U.S. home provide chain for EV batteries and cut back reliance on lithium imports, notably from China.

The Background: Lithium Americas Secured $2.3B DOE Mortgage to Drive Thacker Go Improvement

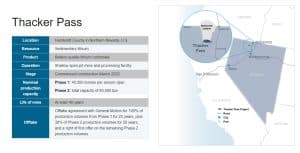

In March 2024, Lithium Americas secured a $2.3 billion mortgage from the U.S. DOE via its Superior Know-how Autos Manufacturing (ATVM) Mortgage Program. This funding will help the event of the Thacker Go lithium undertaking in Nevada.

Nonetheless, earlier than Lithium Americas can entry the mortgage, they have to contribute $195 million, which might be used to cowl bills for building and ramping up manufacturing. Moreover, Common Motors (GM) may also present a line of credit score to assist fund these necessities.

Common Motor’s Key Funding in 2023

Back in January 2023Common Motors made a considerable funding in Lithium Americas, agreeing to supply $650 million. This was divided into two elements: the primary $320 million was delivered instantly and used to advance the primary section of Thacker Go.

However the second a part of the funding, or Tranche 2, encountered some modifications. Each firms determined to revise the phrases because of an organization reorganization. Tranche 2 was presupposed to be accomplished by the top of 2023.

On August 30, 2024, Lithium Americas and GM prolonged the deadline for Tranche 2 of their funding settlement to discover higher choices for GM’s extra funding. They ended the unique settlement after they signed a brand new three way partnership deal. This new deal was introduced on October 16.

Unlocking the Newest JV

The most recent press release mentions that Common Motors has agreed to take a position $625 million in money and letters of credit score for a 38% stake within the Thacker Go undertaking. Lithium Americas, which can handle the undertaking, retains a 62% curiosity and can contribute $387 million to the three way partnership. The funds might be used to develop the primary stage of the undertaking, which could price round $2.9 billion.

Jonathan Evans, President and CEO of Lithium Americas

“Our relationship with GM has been significantly strengthened with this joint venture as we continue to pursue a mutual goal to develop a robust domestic lithium supply chain by advancing the development of Thacker Pass. Today’s joint venture announcement is a win-win for GM and Lithium Americas. GM’s JV Investment demonstrates their continued support and helps us to unlock the previously announced $2.3 billion DOE Loan. We will be working closely with GM to advance towards the final investment decision, which we are targeting by the end of the year.”

Home Lithium Provide to Assist GM’s EV Ambitions

One of many highlights of the three way partnership is GM’s expanded offtake settlement. It extends for as much as 100% of lithium manufacturing from Thacker Go’ first stage for 20 years. This settlement will assist GM guarantee a gentle provide of lithium for its future EV batteries.

GM additionally secured the suitable to accumulate as much as 38% of manufacturing from the undertaking’s second stage, with the flexibility to barter first provides for any remaining volumes.

The corporate’s funding in Thacker Go is pushed by the necessity to safe a long-term provide of lithium as the corporate continues to scale up its EV manufacturing.

Based on Jeff Morrison, SVP, of World Buying and Provide Chain of Common Motors remarked,

“We’re pleased with the significant progress Lithium Americas is making to help GM achieve our goal to develop a resilient EV material supply chain. Sourcing critical EV raw materials, like lithium, from suppliers in the U.S., is expected to help us manage battery cell costs, deliver value to our customers and investors, and create jobs.”

GM’s Web Zero Pathway

The Michigian-based EV maker goals to realize carbon neutrality of their international merchandise and operations by 2040.

Supply: GM

As described in GM’s sustainability reportimportant progress made to scale back Scope 3 emissions embrace:

- Battery manufacturing and enlargement via Ultium Cells LLC- JV with LG Vitality Answer, which is manufacturing cells for its Ultium Platform.

- Collaborating with Tesla to combine the North American Charging Commonplace (NACS) for his or her EVs. It can begin in 2025.

- Investing in residence, office, and public charging infrastructure within the U.S. and Canada.

- Investing in hydrogen gas cell know-how to scale back the carbon emissions of medium- and heavy-duty autos.

- Addressing the boundaries to EV possession in the USA via dealership schooling and engagement.

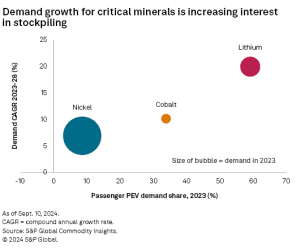

Lithium Costs and Market Challenges

Whereas the deal is progressing the lithium market can also be fluctuating concurrently.

MINING.COM reported that costs of battery-grade lithium hydroxide have skilled a pointy decline, falling to $9,800 per ton in October 2024 from $22,275 a 12 months earlier. This marked a big drop from the height costs which have been round $85,000 per ton in late 2022.

Regardless of these market challenges, Lithium Americas continues to advance the undertaking, positioning itself to profit from a projected long-term demand enhance for lithium because the EV market expands. The corporate’s shares noticed a 20.2% rise after the JV announcement. This confirmed investor confidence within the undertaking’s potential.

Thacker Go: The Gateway to North American Lithium Battery Provide Chain for EVs

The Thacker Go undertaking is properly underway, with roughly 40% of the engineering design already accomplished. Main website preparations are progressing, with earthworks for the method plant excavation nearing completion and preparations for concrete placement underway.

Positioned in northern Nevada’s Humboldt County, Thacker Go is residence to the most important identified lithium deposit in North America. 385 million tonnes of measured and indicated assets, equal to 6 million tonnes of lithium carbonate. The mine is predicted to provide sufficient lithium to energy a million electrical autos yearly, a vital contribution to the rising U.S. EV market.

Supply: Lithium Americas

Supply: Lithium Americas

Lithium Americas is concentrated on getting the undertaking prepared for ultimate funding selections by the top of the 12 months.

- The undertaking’s first section targets a manufacturing capability of 40,000 tonnes of lithium carbonate per 12 months, with important progress anticipated within the subsequent few years.

What’s Subsequent for Thacker Go?

The subsequent steps for the three way partnership embrace finalizing engineering designs and procurement contracts in addition to securing the ultimate funding resolution by the top of 2024. GM’s involvement within the undertaking will assist Lithium Americas unlock the DOE’s mortgage. Subsequently, this may present the mandatory monetary help to completely develop the undertaking.

As a part of the settlement, GM and Lithium Americas are working carefully with Bechtel, the undertaking’s engineering, procurement, and building administration contractor. It could actually create round 1,800 direct jobs throughout its three-year building interval.

Within the coming months, the Thacker Go undertaking will concentrate on de-risking and advancing building to make sure it meets its targets for lithium manufacturing. As soon as operational, the mine will important position in securing a home provide of lithium. Consequently, supporting the rising demand for EVs and pushing the U.S. clear power transition.

Key Implications sooner or later:

- Thacker Go might present lithium for as much as 800,000 EVs yearly, lowering U.S. reliance on overseas suppliers.

- It helps the U.S. aim of net-zero greenhouse gasoline emissions by 2050, aligned with President Biden’s local weather targets.

- A home lithium provide chain would decrease carbon emissions, transport prices, and provide chain dangers for U.S. automobile producers.

- Sustainably sourced battery supplies would assist produce electrical autos with a smaller carbon footprint.

Notably, Lithium Americas can also be in a robust place to satisfy the rising demand for EV batteries. It can proceed to safe extra funding to gas its motive. Nonetheless, at this second, partnering with GM will considerably influence the home lithium market and in a great way.

Supply: Lithium Americas News Release and General Motors Sustainability Report

SEE MORE: The Fastest Developing North American Lithium Junior