Tesla delivered better-than-expected Third-quarter earnings and earnings, bringing reduction to buyers whereas reversing a pattern of declining earnings. The electrical automobile (EV) maker noticed its first year-over-year revenue development in 2024, beating expectations in its 2024 Q3 report.

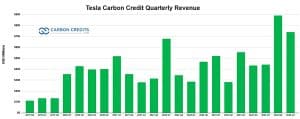

Extra remarkably, Tesla reveals a formidable $739 million carbon creditadditionally known as regulatory credit, income for the mentioned quarter. The corporate reaffirmed its plans to make its EVs extra reasonably priced, which added to investor enthusiasm.

Tesla Recharges Earnings with Money Circulate from Carbon

The EV big’s income rose 7.8% year-over-year to $25.18 billionthough this fell in need of analyst forecasts. Nevertheless, the corporate outperformed on its backside line.

It reported adjusted earnings of $0.72 per share versus the $0.60 anticipated, up from $0.66 a yr in the past, with a web earnings of $2.5 billion. This beat analyst expectations, which had an estimated $0.59 per share and $2.01 billion in web earnings.

Tesla’s working margin climbed to 10.8% of gross sales, up from 6.3% within the earlier quarter and seven.6% in Q3 of final yr. The corporate’s web earnings grew by 8% in comparison with final yr, breaking a streak of 4 consecutive quarters of declining earnings.

Tesla famous that it’s at the moment between “two major growth waves,” suggesting optimism for the long run. It additionally shared an upbeat outlook on automobile deliveries, predicting “slight growth” this yr. This got here as a shock since market forecasts had anticipated deliveries to dip from 1.81 million in 2023 to 1.78 million.

Following this announcement, Tesla’s stock jumped about 12% in after-hours buying and selling, including about $81 billion to the corporate’s market worth.

One other large standout from the earnings report is Tesla’s carbon credit revenue totaling $739 million. The determine is nicely above the $539 million analysts had predicted and a rise of 33% year-over-year.

How Carbon Credit score Gross sales Boosted Tesla’s Income

Extra notably, these credit carry full earnings to the corporate and account for nearly 34% of its web earnings ($2,183 million). This Q3 carbon credit score sale is the second-highest since Tesla began promoting them in 2009. The best was through the earlier quarter.

These credit, which Tesla sells to conventional carmakers to assist them meet emissions obligations, present vital earnings as they are often bought at 100% full margins. Thus, carbon credit have performed a pivotal position in Tesla’s total monetary efficiency.

Because the EV maker started promoting carbon credit to different corporations, this income stream has became a billion-dollar alternative. Up to now yr, Tesla earned $1.79 billion from carbon creditsmarking its highest-ever annual earnings from automotive regulatory credit score gross sales.

Whereas particulars about Tesla’s carbon credit score patrons are sometimes undisclosed, Chrysler is thought to have bought $2.4 billion price of credit by 2022. Stellantis, a serious auto group, has additionally been concerned, shopping for vital credit to offset emissions because it targets zero emissions by 2038. This highlights the challenges automakers face in lowering carbon footprints, given the excessive emissions related to key EV elements like batteries, metal, and aluminum.

China stays one other important marketplace for Tesla’s carbon credit score gross sales. Reviews point out {that a} three way partnership between Volkswagen and FAW Group in China may need bought credit from Tesla, doubtlessly incomes Tesla round $390 million in 2021. Nevertheless, particulars about particular patrons in China stay unclear.

Driving Ahead: Tesla Eyes 25-30% Supply Progress

The constructive momentum continued as CEO Elon Musk addressed buyers through the earnings name. Musk forecasted a 25% to 30% improve in Tesla deliveries for subsequent yr and introduced plans to roll out a self-driving taxi, Robotaxi, service in California and Texas by 2025.

Tesla had beforehand introduced that it delivered 462,890 automobiles in Q3, with manufacturing totaling 469,796 models. About 3% of those deliveries have been beneath working lease accounting.

This determine compares to 443,956 automobiles delivered in Q2 of this yr and 435,059 in Q3 of final yr. Tesla’s all-time supply file stays at 484,507 models, achieved in This fall 2023.

Wanting ahead, Tesla emphasised that its plans to provide new, extra reasonably priced automobile fashions stay on observe, with manufacturing anticipated to start within the first half of 2025.

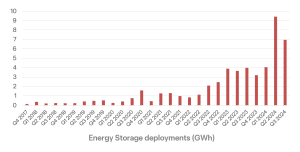

Past EVs: Power Storage Units New Information

Tesla’s power storage enterprise additionally confirmed sturdy efficiency. Though power storage deployments decreased sequentially in Q3, they hit a file 6.9 GWh, up 75% year-over-year.

Tesla highlighted that power companies and different segments are more and more contributing to the corporate’s profitability. It anticipates continued revenue development from these segments as power storage merchandise scale up and its automobile fleet expands.

Moreover, Tesla superior its efforts at Gigafactory Texas, the place it’s constructing a high-performance 29,000 H100 cluster, aiming for 50,000 H100 capability by the top of October.

The energy storage market considerably influences Tesla’s technique, particularly because it diversifies into power options past EV manufacturing. This shift is clear in Tesla’s development in power storage deployments, with key merchandise just like the Powerwall and Megapack battery techniques.

- In 2023 alone, Tesla deployed 14.7 GWh of power storage, producing $6.035 billion in income—a 3x improve since 2020.

Tesla’s power storage phase’s development aligns with the broader clear power transition, particularly as demand for storage options rises to stability renewable power manufacturing.

Tesla’s Q3 2024 earnings report reaffirms that carbon credit score income stays a vital a part of its monetary efficiency. It permits the carmaker to spice up earnings whereas persevering with its push towards extra reasonably priced EVs and expanded power options.