As soon as a reliable path to satisfy local weather targets, carbon offsets are shedding favor amongst many high firms. Firms like Delta Airways, Googleand EasyJet had been as soon as high patrons of those credit. However now they’ve stepped again or have fully stopped buying offsets associated significantly to renewable vitality initiatives.

Renewable-Vitality Offsets Lose Steam

This transformation in mindset displays that such carbon offsets don’t ship the environmental advantages they promise. As a substitute of shopping for offsets, many firms try to instantly scale back their emissions. This course of is more durable and costlier than shopping for offsets.

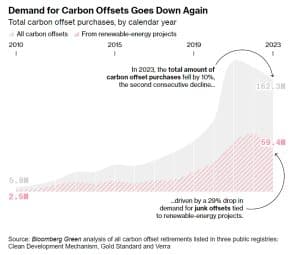

A Bloomberg Inexperienced evaluation of public offset transaction data reveals a big gross sales decline for the second consecutive 12 months. This clearly indicated a development in the direction of fewer offset purchases.

Lambert Schneider, a carbon markets knowledgeable from Öko-Institut in Germany, emphasised that scientific experiences have repeatedly questioned the “credibility” of such offsets, casting doubt on their contribution to real emissions discount.

A more in-depth take a look at the carbon offset market reveals a pointy decline in renewable-energy credit, which dropped 29% in 2023. Traditionally, these offsets funded wind, photo voltaic, and hydroelectric initiatives. Nonetheless, critics argue that many of those initiatives can be financially viable with out the credit. Thus, their extra environmental advantages are questionable.

These issues prompted the Integrity Council for the Voluntary Carbon Market (ICVM) to refuse its “Core Carbon Principles” label to renewable-energy offsets earlier this 12 months.

This determination labeled many of those credit as “junk” or ineffective for the setting and main firms like Chevron, JetBlue, and BP withdrew from them.

New Carbon Markets May Provide Renewable Offsets a Second Life

Bloomberg has give you one other fascinating evaluation. Regardless of dwindling curiosity in renewable-energy credit, these offsets might see a revival. They might nonetheless entice patrons in a brand new regulatory setting. This framework goals to standardize worldwide carbon buying and selling and maintain firms accountable.

On the upcoming COP29 local weather summit in Azerbaijan, discussions will revolve round establishing a UN-backed carbon buying and selling marketplace for international locations and firms with local weather commitments.

New registries, corresponding to Qatar’s World Carbon Council are stepping in and regenerating curiosity in renewable-energy credits. Nonetheless, many environmental specialists warn that these registries might perpetuate “junk” credit that present no significant local weather influence. Consequently undermining the credibility of the offset market.

Huge Names Step Again, however Not All Abandon Carbon Offsets

As Bloomberg highlighted the businesses that ditched these renewable carbon offsets, a number of firms nonetheless again these credit. TotalEnergies, Shell, and Engie nonetheless help renewable-energy offsets, expressing confidence of their effectiveness and investments.

New patrons like Japan’s Kobe Yamato Transport and Colombia’s Grupo Argos, have additionally entered the market regardless of the rising skepticism.

However, some firms are transferring completely away from offsetting and specializing in verified carbon-removal applied sciences, which draw carbon instantly from the ambiance.

For instance, Jet2 is shifting its sources in the direction of sustainable aviation gasoline (SAF), whereas Ernst & Younger is halting renewable-energy offset purchases altogether. As public scrutiny grows, extra firms are selecting to put money into impactful sustainability options moderately than low cost credit.

Danny Cullenward, a researcher on the Kleinman Middle for Vitality Coverage, emphasizes the necessity for accountability. He mentioned,

“The problem won’t disappear until there’s greater responsibility for misleading claims in the voluntary carbon market.”

The Way forward for Carbon Offsets: An Evolving Market

On account of opposition to renewable vitality offsets, the biggest public registries, corresponding to Worse and Gold Standardhave stopped collaborating within the majority of renewable vitality initiatives and are proscribing the credit’ origins to the least developed nations.

As companies reassess their sustainability plans, the way forward for carbon offsets remains to be unclear. The marketplace for premium carbon reductions is increasing, however the demand for cheap credit is declining.

In response to Bloomberg, solely credit with verifiable environmental advantages will keep long-term market curiosity. Some companies, in the meantime, are clinging to the prospect that the carbon offset sector would finally get credibility and order from UN-backed guidelines.

Till then, firms that worth credible, science-based approaches to sustainability are more and more stepping away from conventional offsets. On a optimistic be aware, they’re setting extra impactful and direct emissions discount targets to battle local weather change.

CONTENT SOURCE: Carbon Offsets See Falling Demand but COP29 May Open New Market – Bloomberg