The U.S. lately expanded a producing tax credit score to cowl extraction and materials prices, benefiting steel refiners however excluding pure mining firms. This replace was introduced in remaining rules by the Treasury Division and Inside Income Service (IRS).

The credit score, often called the Part 45X Superior Manufacturing Manufacturing Credit score, is a part of the Inflation Reduction Act. It goals to assist the home manufacturing of fresh vitality merchandise, together with renewable parts, battery supplies, and 50 important minerals crucial to the vitality transition.

What’s Part 45X Tax Credit score and How Does It Work?

Since its inception, the Advanced Manufacturing Production Credit has already spurred private-sector investments. It has pushed $126 billion in funding bulletins, together with $6 billion focused for crucial minerals, in line with the Treasury Division.

The 45X tax credit score presents monetary advantages for producing photo voltaic and wind parts, battery elements, and refining or recycling crucial minerals. Producers earn credit primarily based on unit manufacturing, electrical capability, or manufacturing prices. Importantly, these credit are transferable, permitting firms to maximise their advantages.

- Beginning in 2023, the credit score is accessible till 2032, with most items phasing all the way down to 75% of the credit score worth in 2030, 50% in 2031, and 25% in 2032, although crucial minerals are exempt from this discount.

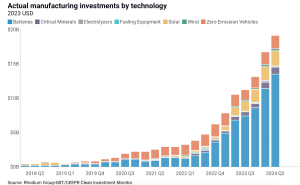

This steady, decade-long credit score has inspired long-term investments, with manufacturing investments rising 305%. In line with Clear Funding Monitor knowledge, they reached $89 billion in 2023-2024 from $22 billion in 2020-2022.

The 45X tax credit score works by offering a selected tax credit score worth for every eligible element below IRS tips. To qualify, producers should guarantee their merchandise meet the necessities outlined within the 45X regulation. Moreover, for the tax credit score to be claimed, the element have to be offered to an unrelated third get together.

The Expanded Scope of 45X Tax Credit score

Initially, the tax credit didn’t cowl extraction or materials prices. Nonetheless, after in search of {industry} enter, the Biden administration determined to broaden the credit score’s software.

With this modification, the tax credit score now contains prices associated to supplies and extraction for qualifying minerals and electrode supplies, supplied they meet particular situations. The Treasury Division acknowledged that this determination is meant to encourage funding in U.S. crucial mineral extraction and processing. The broader purpose is to reinforce U.S. vitality safety and strengthen clear vitality provide chains.

The ten% manufacturing value tax credit score applies to extremely refined metals. This transfer is a part of a U.S. technique to construct provide chains that assist vitality transition sectors, like electrical autos and inexperienced vitality. Eligible minerals embrace important battery metals resembling nickel, lithiumand graphite, together with rare earth elements like neodymium.

Treasury Secretary Janet Yellen commented that the ultimate rules will assist firms investing within the U.S. clean energy economic system. Moreover, the Treasury confirmed that the tax credit score extends to parts made with foreign-sourced supplies. This side of the rule is meant to make sure flexibility for U.S. producers, notably in sectors the place sure uncooked supplies are tough to supply domestically.

A Increase for Important Mineral Refiners, However Pure Miners Miss Out

Nickel manufacturing, together with different battery metals, would vastly profit from the tax credit. This comes well timed after main nickel manufacturing, which incorporates ferronickel for steelmaking and intermediates for EV batteries, noticed vital development.

S&P World Commodity Insights reported that the highest 5 publicly listed nickel producers reached a mixed output of 158,937 metric tons. It represents a considerable 35.6% improve from Q2 2023. This enhance is essentially attributed to the rising demand for refined nickel merchandise, particularly to be used in EV batteries.

The current nickel price droop has hit profitability industry-wide, but firms are hesitant to chop manufacturing. They concern that doing so could result in a loss in market share.

With the expanded 45X credit, main nickel producers could have extra causes to speed up their manufacturing.

Nonetheless, the ultimate guidelines of the expanded credit score haven’t gone far sufficient within the eyes of many within the mining sector. Particularly, pure-play mining firms, which focus solely on extraction with out refining, stay ineligible for the credit score.

Stimulus for Clear Vitality Objectives, But Hole Stays

The Nationwide Mining Affiliation (NMA) has expressed disappointment, arguing that the rules don’t align with the unique intent of Congress to strengthen your complete U.S. mineral supply chain.

The group had beforehand requested that the tax credit score apply to all home mining firms, no matter whether or not additionally they refine supplies. Nonetheless, the brand new guidelines restrict credit score solely to producers who each mine and refine supplies. This determination leaves out U.S.-based miners who would not have refining capabilities, and the credit score nonetheless applies to imported supplies.

Wealthy Nolan, president and CEO of the NMA, criticized this limitation. He acknowledged that the rule doesn’t adequately assist efforts to deal with strategic vulnerabilities in U.S. mineral provides, particularly because it permits credit score for foreign-sourced supplies.

The NMA argues that this oversight hinders U.S. competitiveness, notably towards international locations like China and Russia that dominate international mineral provide chains with cheaper supplies.

Because the clear vitality market grows, balancing pursuits throughout the sector will stay difficult. Guaranteeing {that a} numerous vary of home mining firms can profit from the tax credit score might be important to attaining a resilient, self-sustaining U.S. crucial mineral provide chain.