The lithium market has entered a interval of value decline, primarily due to weaker demand situations and an oversupply of lithium carbonate in key areas.

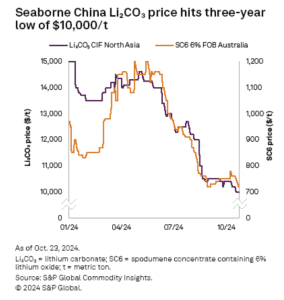

In October, seaborne lithium carbonate costs for Asia dropped by 3.8%hovering round $10,000 per metric tonbased on S&P International Commodity Insights evaluation.

The price dip displays the seasonal winding down of demand usually seen on the finish of the 12 months when electrical automobile (EV) producers put together for a slowdown in post-peak gross sales. Whereas September noticed relative value stability, October’s downward shift reveals how the availability chain dynamics are urgent lithium markets. That is very true in China’s case, which has been the dominant participant in world EV gross sales in 2024.

- The slowdown underscores the lithium market’s key challenge: sustaining demand development and stabilizing costs amid fluctuating EV gross sales patterns.

China’s lithium marketthe most important globally, noticed costs fall by 3.3% in October, settling at about 73,000 yuan per ton. Whereas a short rebound was noticed towards the top of the month, costs proceed to replicate the underlying pressures of oversupply. This surplus is compounded by excessive inventories and the slower-than-expected uptake in EV markets outdoors of China.

The worldwide market’s present incapability to soak up extra provide successfully units the tone for a persistent price slumpprobably extending into the subsequent a number of years.

Li-FT Power Ltd. (TSXV: LIFT) lately introduced its first-ever Nationwide Instrument 43-101 (NI 43-101) compliant mineral useful resource estimate (MRE) for the Yellowknife Lithium Challenge (YLP), situated within the Northwest Territories, Canada.

An Preliminary Mineral Useful resource of fifty.4 Million Tonnes at Yellowknife.

This maiden estimate is a serious milestone for the corporate and marks a major step ahead within the undertaking’s improvement. Li-FT Energy’s upcoming mineral useful resource is anticipated to additional solidify Yellowknife as one in every of North America’s largest laborious rock lithium assets.

Click to learn more about lithium and Li-FT Power Ltd. >>

Strategic Changes Amongst Lithium Producers

In response to those challenges, main lithium producers are taking motion to handle prices and manufacturing ranges.

Corporations like Sinomine Useful resource Group have opted to chop manufacturing in higher-cost areas. In Zimbabwe, for example, Sinomine has minimized its petalite mining operations to prioritize spodumene extraction, which has a decrease manufacturing price. This shift displays a broader business development, the place corporations concentrate on streamlining their operations to guard revenue margins as market costs dip.

One other important strategic transfer throughout the business was the current acquisition of Arcadium Lithium by Rio Tinto. It’s a substantial shift within the firm’s method to the lithium sector. This acquisition is especially essential for Rio Tinto because it extends the corporate’s footprint in lithium manufacturing past its current initiatives in Serbia and Argentina, permitting it to focus on markets outdoors of China extra successfully.

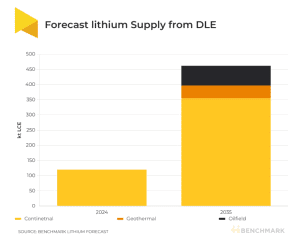

Certainly one of Arcadium’s predominant aggressive benefits lies in its exploration of direct lithium extraction (DLE) know-how. DLE can revolutionize the lithium market by unlocking reserves in brine deposits beforehand thought of troublesome to take advantage of utilizing conventional strategies.

Presently, there are 13 DLE initiatives in operation, with complete output projected to succeed in about 124,000 tonnes in 2024. In keeping with Benchmark’s dataDLE know-how can account for 14% of the worldwide lithium provide by 2035, producing round 470,000 tonnes of LCE. This development underscores the growing function of DLE in assembly lithium demand for battery and EV markets.

International Investments and Increasing Lithium Provide Chain

Investments in lithium manufacturing proceed to develop regardless of the present market downturn, which alerts optimism about long-term demand.

In October, General Motors made a notable transfer by growing its stake within the Lithium Nevada undertaking to 38% with a further $625 million funding. This initiative speaks of a long-term dedication to safe native lithium provides. It aligns with the U.S. authorities’s strategic push to strengthen home EV battery manufacturing and cut back reliance on imports.

The U.S. Division of Power has already prolonged a considerable mortgage of $2.26 billion to assist section 1 development of this undertaking. The determine reveals the essential significance of home lithium assets for nationwide power objectives.

Whereas conventional strategies dominate present manufacturing, the lithium market can be more and more exploring technological developments. Normal Motors and different business stakeholders are actively pursuing direct extraction strategies to unlock difficult lithium deposits.

By experimenting with DLE, the U.S.-based Lithium Nevada undertaking goals to cut back environmental impacts and shorten manufacturing timelines. These technological investments point out that regardless of present pricing challenges, there’s confidence in lithium’s long-term demand potential. Extra in order EV adoption grows and world inexperienced power transitions speed up.

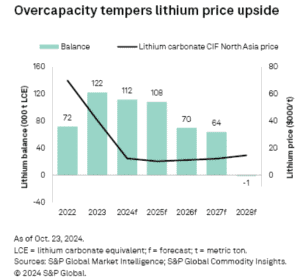

Lengthy-Time period Market Forecast and Anticipated Worth Restoration

Wanting forward, lithium prices may stay in a decent vary. S&P International Commodity Perception’s forecasts recommend that the value of lithium carbonate will keep between $9,924 and $11,627 per metric ton till 2026. This projection displays the business’s cautious outlook as corporations anticipate that demand development will take time to stability the present surplus.

- Analysts predict {that a} substantial value restoration could not materialize till 2028, with a forecasted rise to $14,659 per metric ton, or a few 20.8% improve, because the market lastly shifts right into a deficit.

The anticipated long-term provide scarcity is essentially tied to the anticipated improve in EV adoption and the renewable energy transition. Each of those demand drivers require important lithium assets.

Nevertheless, automakers worldwide are adjusting their manufacturing methods to stability profitability with sustainable development. This brings uncertainty to the precise timing of the demand shift that may take in right now’s extra provide.

In abstract, the lithium market in 2024 displays a fancy mix of challenges and alternatives. Costs stay low because of oversupply and fluctuating EV demand, particularly outdoors of China, however the long-term outlook for lithium nonetheless holds promise.

The lithium business’s potential to adapt to right now’s market situations will form the longer term panorama of this important useful resource, making certain its place within the world shift towards a sustainable power future.