Deputy Prime Minister and Finance Minister Chrystia Freeland introduced that the Canada Carbon Rebate for small companies won’t be taxed.

Freeland clarified this in a statement on Xfollowing issues from the Canadian Federation of Impartial Enterprise (CFIB) that the rebate can be thought of a taxable profit.

Freeland’s submit reaffirmed the federal government’s dedication to offering monetary reduction for small companies with out including tax burdens.

The CFIB posted on X that the federal government will tax the long-awaited $2.5 billion carbon tax rebate for small companies when it’s issued in December.

CFIB President Dan Kelly criticized the transfer, evaluating it to taxing a tax refund. He acknowledged that this undermines claims of the carbon tax being revenue-neutral, as the federal government will acquire vital company tax income from the rebate.

The Canada Income Company initially assured CFIB that the rebate can be tax-free, much like the Canada Carbon Rebate for people.

Nonetheless, the Division of Finance later declared the small enterprise rebate as taxable, contemplating it “government assistance.” Kelly argued that calling the rebate authorities help is absurd because it merely returns a portion of the taxes small companies have paid.

CFIB’s Marketing campaign Pays Off

The carbon tax system has lengthy been criticized for its unfairness to small companies. After initially promising 10% of complete carbon tax income as rebates in 2019, the federal government delayed issuing the funds for 5 years.

The rebate solely materialized after persistent lobbying by CFIB and widespread assist from enterprise homeowners, opposition leaders, and provincial premiers.

Including to the frustration, the carbon tax will improve once more on April 1, 2025. In the meantime, future rebates for small companies can be slashed from 9% to five% of complete income.

In response, CFIB has despatched an open letter to Finance Minister Chrystia Freeland, urging the federal government to reverse course. Kelly famous that:

“It’s clear why 83% of small business owners now oppose the carbon tax. Delaying, taxing, and reducing promised rebates make it evident that the carbon tax should be scrapped entirely.”

Enterprise homeowners can estimate their rebates and signal CFIB’s petition to abolish the tax utilizing the CFIB’s online calculator.

The Carbon Tax Controversy Continues

The Canada Carbon Rebate (CCR), previously the Local weather Motion Incentive Cost (CAIP), is a tax-free fee that helps people and households offset the federal carbon price. It features a base quantity, with an additional complement for these in small or rural communities.

The rebate quantity varies by province and is calculated yearly primarily based on projected carbon pricing revenue in every province.

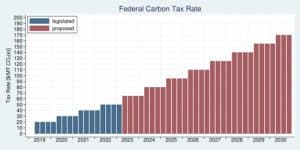

The federal carbon value at the moment will increase gasoline prices by about 17.6 cents per liter, however quarterly rebates assist Canadians handle these bills. The chart under outlines the federal government’s deliberate annual carbon value hikes, carried out each April 1st.

Canada’s carbon value is at the moment set at C$65 per tonne and can rise to C$80 per tonne on April 1. After that, it is going to improve by C$15 yearly, reaching C$170 per tonne by 2030. These incremental hikes intention to cut back emissions whereas producing income to assist local weather initiatives.