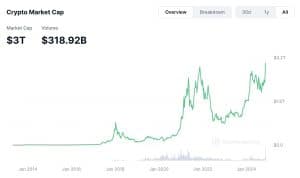

The worldwide cryptocurrency market has surpassed $3 trillion, fueled by renewed investor optimism following Donald Trump’s re-election as U.S. President. Alongside this, Bitcoin has reached an all-time excessive at $93,434.

In response to CoinMarketCapthe overall market cap presently sits at $3 trillion, up 4% prior to now day. CoinGecko stories an excellent larger determine of $3.15 trillion, monitoring over 15,000 cryptocurrencies, in comparison with CoinMarketCap’s 10,000.

The $3T Surge: What’s Driving the Crypto Increase?

This milestone marks an all-time excessive, surpassing the 2021 bull run. The surge, dubbed the ‘Trump Bump,’ displays expectations of a pro-crypto regulatory surroundings beneath the brand new administration.

Trump’s marketing campaign guarantees, together with making the U.S. a worldwide crypto hub and establishing a nationwide Bitcoin reserve, have strengthened market confidence.

Institutional urge for food for digital belongings continues to develop. A current survey of 400 world institutional traders revealed that 57% plan to extend their crypto allocations, with many aiming to take action throughout the subsequent 6 months.

Corporations like MicroStrategy have additionally made vital investments, just lately buying $2 billion in Bitcoin.

Analysts predict additional progress however warning in opposition to potential corrections, citing exterior dangers like weak U.S. financial knowledge.

Bitcoin’s Document-Breaking Rally: Is $100K Subsequent?

Bitcoin has been a key driver of this crypto rally, hitting a brand new all-time excessive (ATH) of $93,434 on November 13. Its market cap now stands at virtually $1.8 trillion, comprising 60% of the overall crypto market.

Altcoins are additionally experiencing vital beneficial properties, contributing to the broader market’s upward momentum.

Maksym Sakharov, CEO of DeFi platform WeFi, attributes the surge to “Bitcoin’s price rally above $93,000, growing demand, and regulatory clarity.” Bitcoin has greater than doubled in 2024, fueled by the launch of spot Bitcoin ETFs and elevated institutional curiosity.

Many crypto analysts counsel Bitcoin’s rally is much from over. Some predict it might hit $100,000 within the coming months.

Galaxy Digital CEO Mike Novogratz affords an excellent bolder outlook, forecasting a possible surge to $500,000—if Bitcoin beneficial properties traction as a nationwide reserve asset within the U.S.

Bitcoin Surpasses Silver, Turns into World’s eighth Largest Asset

Much more outstanding, Bitcoin has reached a brand new milestone. It surpassed silver with a market cap of $1.8 trillion, positioning itself because the world’s eighth largest asset. This marks a major leap in Bitcoin’s trajectory, because it now trails solely main gamers like gold, Apple, and Microsoft, in response to Corporations Market Cap.

The surge comes as Bitcoin’s worth hit over $93,000, with much more bullish projections forward. In distinction, silver fell by 2%, serving to Bitcoin safe its spot forward of the valuable metallic.

Institutional Momentum Drives Bitcoin’s Rise

Institutional exercise performed an important function in in the present day’s rally. BlackRock’s iShares Bitcoin Belief (IBIT) recorded $4.5 billion in buying and selling quantity, reflecting the rising curiosity in Bitcoin from main monetary gamers.

Bloomberg’s Eric Balchunas highlighted this pattern, noting that Bitcoin ETFs and associated belongings, together with MicroStrategy and Coinbase, reached a mixed buying and selling quantity of $38 billion.

Optimism within the crypto market has surged following Donald Trump’s re-electionwith analysts suggesting his pro-crypto stance might pave the best way for favorable rules. This sentiment has fueled predictions that Bitcoin might surpass the $100,000 mark by the tip of 2024.

Nonetheless, behind all this hype with the crypto trade, significantly Bitcoin’s sudden surge, lurks the digital asset’s environmental impression.

Crypto’s Environmental Toll: Balancing Development and Sustainability

The rising power consumption of crypto mining has sparked world concern as a consequence of its environmental impression. The White House’s 2022 report highlighted the substantial electrical energy calls for of cryptocurrency mining, which now rival the power consumption of nations like Poland.

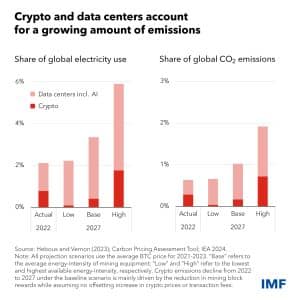

In an evaluation by the International Monetary Fund (IMF)crypto mining and knowledge facilities made up 2% of worldwide electrical energy demand in 2022. This determine might rise to three.5% inside three years, matching Japan’s present electrical energy utilization—the fifth highest on the planet—in response to projections from the Worldwide Vitality Company.

- Bitcoin’s proof-of-work (PoW) consensus mechanism is a major contributor, with world electrical energy use for PoW estimated between 97 and 323 terawatt-hours yearly. This interprets to vital greenhouse fuel emissions, with Bitcoin alone answerable for round 88 million metric tons of CO₂ every year.

The U.S. accounts for almost 46% of Bitcoin mining emissions, releasing about 15.1 million metric tons of CO₂ yearly. Different main contributors embody China and Kazakhstan, emphasizing the worldwide nature of the problem.

The mining course of additionally has oblique environmental impacts, corresponding to digital waste and water utilization, with one Bitcoin transaction consuming 1000’s of gallons of water.

Efforts to scale back Bitcoin’s carbon footprint embody transitioning to much less energy-intensive consensus mechanisms like proof-of-stake (PoS) and adopting renewable energy sources for mining.

Nonetheless, regional emission discount efforts usually fall quick because of the world provide chain’s carbon depth. As an example, even international locations with cleaner power grids, like Norway, face oblique emissions from imported mining gear manufactured in coal-reliant areas like China.

Curiously, current research problem the notion of Bitcoin mining’s environmental impression.

Bitcoin Mining’s Position in Carbon Discount

Research from the Bitcoin Policy Institute (BPI) highlights how mining more and more depends on renewable power, turning surplus power right into a useful useful resource. Through the use of extra energy from renewable sources like wind and solarmining helps stabilize grids and cut back power waste, proving that it could contribute to carbon discount relatively than exacerbating emissions.

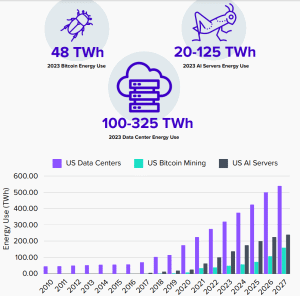

The researchers additionally in contrast the power use of Bitcoin mining, knowledge facilities, and AI server power within the U.S. in 2023. Bitcoin used 48 TWh in 2023, whereas AI servers consumed between 20 and 125 TWh. Then again, data centers have the most important energy consumption, starting from 100 to 325 TWh.

The next chart reveals the historic outcomes and forecasts as much as 2027.

One other report from the Digital Belongings Analysis Institute (DA-RI) reveals flaws in previous analysis on Bitcoin’s power use. It critiques outdated fashions that neglected miners’ shift to renewable power, leading to sensational headlines and misinformed insurance policies.

The brand new findings urge regulators to base selections on empirical knowledge, underscoring Bitcoin’s potential to align with world carbon discount objectives.

These research counsel that sustainable Bitcoin mining might play an important function in inexperienced initiatives. By leveraging clear power, mining might evolve right into a climate-friendly trade, providing each financial and environmental advantages. As this angle beneficial properties traction, policymakers might undertake extra balanced rules, supporting sustainable progress within the crypto sector.