The U.S. inventory market noticed its largest weekly acquire in a yr only one week following Donald Trump’s re-election. Nonetheless, clear power shares tumbled as traders anxious Biden’s pro-renewables agenda would get replaced by Trump’s “drill, baby, drill” insurance policies. And just lately, Vivek Ramaswamy, recognized for his sturdy opposition to environmental, social, and governance (ESG) investing, was appointed to co-lead Trump’s authorities effectivity group.

A biotech entrepreneur Ramaswamy has lengthy criticized ESG requirements, arguing they harm financial development. His new place might imply main adjustments to environmental laws and company local weather reporting.

His position is to assist minimize laws, scale back authorities waste, and overhaul federal companies. This appointment alerts a shift in U.S. local weather and funding insurance policies.

ESG Underneath Fireplace: What It Means for Company Local weather Disclosure

The drop in clear power shares highlights the challenges for sustainable finance. Over the previous two years, Republicans have pushed again towards ESG investingmain a number of states to boycott ESG-focused asset managers.

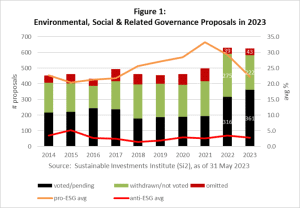

A Bloomberg Intelligence report highlights Trump’s potential efforts to limit shareholders from submitting ESG-related proposals. This follows extra lenient SEC guidelines which have pushed a 47% enhance in ESG proposals since 2021.

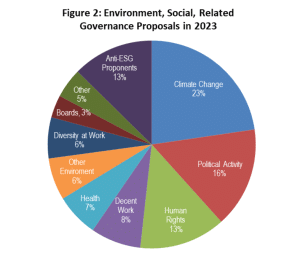

Referring to the chart above, two main tendencies stand out for 2023. First, local weather change proposals proceed to rise. Second, there’s a surge in resolutions on reproductive well being following the U.S. Supreme Court’s Dobbs choice, which has led to widespread restrictions.

In the meantime, anti-ESG proposals are rising (13% in 2023), although they lack assist and primarily intention to block ESG efforts without offering solutions. However with a second Trump administration will doubtless make massive adjustments.

Based on Rob Du Boff, a senior analyst at Bloomberg Intelligence, a Trump presidency might limit ESG-related shareholder proposals. He notably famous that:

“The bottom line is the Trump administration is anxious to undermine these ESG-related initiatives.”.

Whereas the SEC’s climate risk disclosure rule faces an unsure future beneath Trump’s presidency, U.S. corporations nonetheless want to organize for reporting necessities in California and Europe. These laws demand transparency about emissions and local weather dangers, no matter federal coverage shifts.

California’s laws require companies with over $1 billion in income, roughly round 5,344 corporations, to reveal Scope 1, 2, and three emissions beginning in 2026. They need to even have these emissions verified by third-party organizations.

Moreover, corporations with income exceeding $500 million, over 10,000 of them, should submit local weather danger stories explaining how excessive climate, provide chain points, and laws might have an effect on their operations.

These guidelines apply to hundreds of companies, forcing them to boost their local weather reporting efforts.

Authorized Battles and Compliance

Regardless of authorized challenges, California’s local weather legal guidelines stay on observe. Enterprise teams, together with the U.S. Chamber of Commerce, sued the state to dam these mandates, arguing they place an undue burden on corporations.

Nonetheless, a federal choose just lately allowed the case to proceed to trial, delaying any speedy reduction for opponents.

Michael Littenberg, a authorized professional on ESG, advises corporations to organize now. “Businesses are at different stages of readiness,” he mentioned, “but those operating in California must ensure compliance.”

International Traits in Local weather Reporting

Globally, climate disclosure guidelines are increasing. The European Union has already carried out strict laws, and 29 different international locations are in numerous levels of adopting comparable insurance policies. Collectively, these jurisdictions symbolize 55% of world GDP.

Steven Rothstein from the Ceres Accelerator for Sustainable Capital Markets notes that U.S. corporations with worldwide operations are already aligning with international requirements. Rothstein additionally defined that Canada, Australia, and Brazil have their disclosure necessities, too.

Consistency in reporting frameworks is important for company leaders planning many years forward. This international momentum ensures local weather information stays essential, no matter U.S. political adjustments.

What’s Subsequent for ESG and Local weather Coverage?

The ESG customary faces an unsure future within the U.S. Many Republican-led states have handed legal guidelines banning ESG issues in public investments, arguing they politicize monetary selections. Nonetheless, these legal guidelines have sparked authorized challenges from enterprise teams.

Consultants imagine the time period “ESG” may ultimately get replaced. It’s a politically charged time period however whereas different phrases exist, none have gained widespread acceptance.

Regardless of political opposition, sustainability information will proceed to information investments. Julie Anderson, previously of BlackRockemphasised the significance of local weather info. She mentioned that traders search any information that may affect monetary efficiency and if ESG elements have an effect on earnings, they’ll affect selections.

The Trump administration is predicted to weaken ESG-related insurance policies, together with revising a 2022 rule that enables retirement fund managers to think about ESG dangers. Nonetheless, specialists imagine the push for sustainability will persist within the non-public sector.

Extra notably, sure areas of local weather coverage like carbon removal, nuclear energyand critical minerals should still see progress on account of bipartisan assist.

Bipartisan Local weather Wins: Carbon, Nuclear, and Crucial Minerals

Carbon elimination applied sciences, comparable to direct air seize and enhanced carbon storage, are vital to lowering greenhouse fuel emissions. Bipartisan payments just like the CREST Act and the CREATE Act intention to advance analysis and growth on this house, benefiting each the economic system and the atmosphere.

Nuclear power is one other space with widespread bipartisan backing. With its potential to offer large-scale, low-carbon energy, nuclear power is seen as a key element of the clear power transition. Current legislative efforts, such because the ADVANCE Act, give attention to modernizing reactor applied sciences and growing home nuclear capability.

The vital minerals sector is one other point of interest on account of its significance for renewable energy applied sciences like wind generators, solar panels, and electrical car batteries.

Laws such because the Crucial Minerals Safety Act and the Crucial Mineral Entry Act seeks to boost mining and processing capabilities whereas supporting international initiatives that align with U.S. nationwide safety pursuits. These efforts mirror a shared dedication to making sure the provision of supplies essential for the clean energy transition.

Even with political shifts, the significance of ESG and local weather information isn’t going away. Traders and companies alike are recognizing that sustainability performs a vital position in long-term success and U.S. companies should adapt to remain aggressive because the world strikes towards higher local weather accountability.