Join daily news updates from CleanTechnica on e mail. Or follow us on Google News!

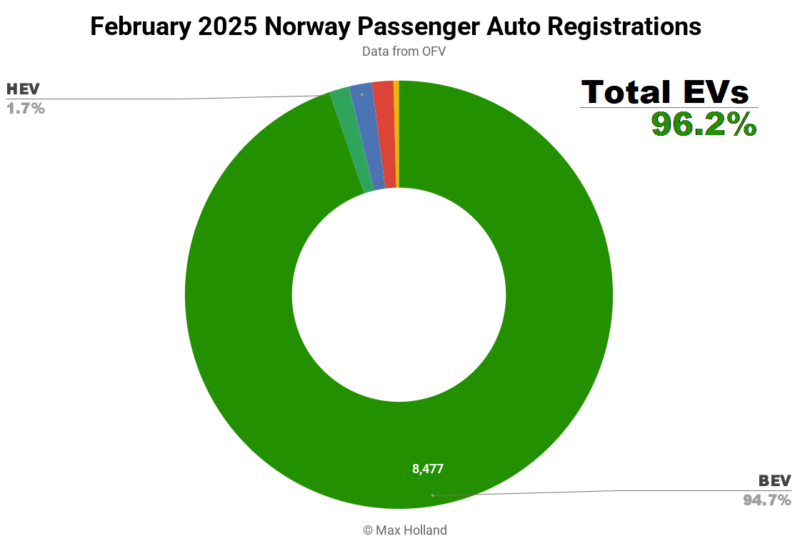

The February auto market noticed plugin EVs take 96.2% share in Norway, up from 92.1% year-on-year. BEVs proceed to squeeze out different powertrains, although diesels and HEVs at the moment are outperforming PHEVs. General auto quantity was 8,949 items, a rise of 21% YoY. One of the best-selling BEV in February was the Nissan Ariya.

February’s gross sales noticed mixed EVs take 96.2% share in Norway, with 94.7% full battery electrics (BEVs), and 1.5% plugin hybrids (PHEVs). These examine with YoY figures of 92.1% mixed, with 90.1% BEV and a couple of.0% PHEV.

BEVs proceed to slowly displace all different powertrains. Sadly, for the few folks not prepared – for no matter causes – to modify over to BEVs, shopping for a brand new diesel or plugless hybrid (HEV) is now most popular over shopping for a PHEV (or EREV). Yr-to-date, the market share of the non-BEVs has been:

- 1.54% for Diesels

- 1.52% for HEVs

- 1.26% for PHEVs

- 0.38% for Petrols

This isn’t nice, because the plugin hybrids can readily journey 80+% of their annual km on electrical energy, while nonetheless being versatile sufficient to provide assurance to anxious people (or technophobes), in every kind of utmost circumstances. Against this, all of the non-plugins are clearly absolutely depending on gasoline combustion for all their power.

As mentioned in December’s report2024’s car weight taxes (specifically aimed at targeting PHEVs) made PHEVs notably costlier, a lot so that buyers now favor diesels and HEVs over PHEVs. Whereas some had been obsessing about PHEVs, diesel share in full yr 2024 was 2.28%, barely dented from the two.45% of 2023. Simply to be clear, the objective needs to be to incentivize BEV > PHEV > HEV > ICE (clearly).

New tax insurance policies will come into impact from April 1st 2025 that are designed to additional tweak the motivation buildings. Let’s hope the policy-makers will not be throwing out the newborn with the bathwater and in observe not making diesels and HEVs a preferable alternative in comparison with PHEVs (once more). This type of simplistic absolutism (“we want all-BEVs right now”), and focusing on PHEVs for a scarcity of purity, reminds us of Weber’s distinction between Views support and Ethics of duty.

The previous, Views supportis a extra ideological moralistic stance – interesting as “simple messaging” when beginning a motion, however taken too far, turns into (dysfunctional) puritanicalism and monomania. The latter, Ethics of dutyis concentrated extra on sensible moral outcomes, and considers penalties. My evaluation is that the mistaken method prevailed, relating to PHEVs.

All this might sound educational now that Norway is close to the top of the transition, and certainly these are comparatively minor points within the grand scheme of issues. However exactly as a result of Norway has been the pioneer, these are exactly the steps (and some mis-steps) that different nations can be taught from and enhance upon, in their very own transitions. Let’s keep watch over how the April insurance policies form the Norwegian market.

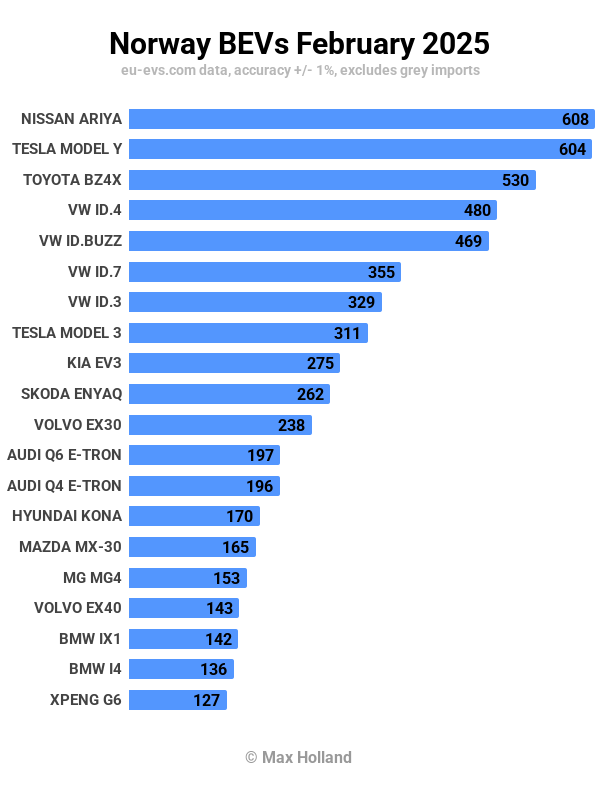

Finest-Promoting Fashions

The Nissan Ariya was a uncommon winner of the highest rank in February, with 608 items delivered, climbing up from third final month. February’s 608 items consequence was really beneath the Ariya’s latest peak quantity of 630 items in October (solely sufficient for fifth rank again then). This time round, with different fashions at extra modest volumes, the Ariya gained the highest spot.

In second place, shut behind, was the Tesla Mannequin Y, with 604 items, presumably nonetheless all of the outgoing model, because the refresh is because of arrive in March. The Toyota BZ4X was in third with 530 items.

There have been solely a few notable strikes within the prime 20. Crucial was certainly the Kia EV3 climbing into the highest ten (ninth spot), with 275 items, in solely its fourth month on sale. It is a nice consequence – and the EV3 could climb additional nonetheless.

There have been 4 new fashions that made their debuts in February. The best quantity debutant was the Hongqi EHS7, which got here in robust with 50 preliminary items. The EHS7 is a big SUV (4,925 mm) which begins at simply 479,900 NOK (€40,780) for the 2WD 88 kWh (gross) “Comfort” variant. This entry variant has a WLTP vary of 475 km and 250 kW peak DC charging, able to recovering from 10% to 80% SOC in round 20 minutes. It is a nice worth bundle for these needing a bigger car.

There’s additionally the “Premium” trim, a 4WD variant with the identical battery 88 kWh, for just below 500,000 NOK (coming in underneath the upper tax threshold). On the prime finish, there’s a 111 kWh “Exclusive” variant rated at 540 km WLTP. Each these 4WD choices have round 620 PS, so are fairly quick in a straight line. As some Norwegian reviewers have statedyou’re getting a car roughly within the phase of the unique Audi e-tron, however for Tesla Mannequin Y cash.

Subsequent up was the brand new Skoda Elroq, which noticed 42 beginning items. I’ve detailed the Elroq elsewhere; it’s mainly an Enyaq however foreshortened on the rear by 20 cm. It begins from 299,900 NOK (€25,400) for the 50 kWh (usable) variant.

The Cupra Tavascan has additionally simply made its first sale in Norway, with a modest 4 items. That is Cupra’s tackle the mid-sized MEB-based SUV, at 4,644mm – nearly the identical size because the Skoda Enyaq. The Tavascan comes solely in a smoothed off coupe-back form, in contrast to most of its MEB cousins (which supply selections on form). The beginning value is from 469,000 NOK (€39,850) with a 77 kWh battery.

The ultimate debutant was the brand new Renault 5, with simply 2 preliminary items. These are doubtless testing items for now, we must always anticipate increased volumes when true buyer deliveries begin within the subsequent couple of months. The pricing begins from NOK 249,900 (€21,230). As I requested in regard to the Hyundai Inster, in final month’s report, I don’t know whether or not autos the dimensions of the Renault 5 (at 3,922 mm) could be thought of by many to be a bit too small to be “the only car you need” in Norway. Not less than the Hyundai Inster has a little bit of floor clearance to keep away from clumps of winter snow and ice, extra so than the Renault 5. I’ll have an interest to observe how these two get on, relative to one another.

Speaking of the Hyundai Inster, in its second month of registrations, it stepped as much as 62 items, consequence. Let’s see how a lot additional it climbs. One other latest newcomer, the Audi A6 e-tron, grew to 34 items in February. The Zeekr X, having solely seen a skinny scattering of items over the previous 3 months, lastly stepped as much as an honest 27 items in February.

Let’s now flip to the 3-month rankings:

Primarily based on their giant December volumes, the Tesla Mannequin Y and Mannequin 3 nonetheless lead the chart. The Volkswagen ID.4 is available in a detailed third.

There aren’t many huge strikes in comparison with the prior interval (August to November), although two stand out. The Ford Explorer noticed good volumes within the lead as much as the top of 2024 (as a member of the EEA, Norway is a part of the emissions area which counts for EU emissions rules), however has since decreased considerably, and dropped from tenth all the way down to nineteenth. That is but extra proof that almost all legacy auto makers are solely doing “just enough to meet regulatory requirements”, and will not be critical about transitioning to EVs.

The opposite notable transfer was a constructive one for the brand new Kia EV3, which – again in November – had solely simply debuted. It has now entered the highest 20 for the primary time, in 18th spot. It can climb farther from right here, and should get near, maybe inside, the highest 10.

It’s too early to foretell whether or not newer fashions just like the Hyundai Inster will maintain month-to-month volumes enough to completely enter the highest 20 chart (past maybe an occasional huge cargo interval). The BEV market is pretty mature now in Norway (although there’s nonetheless loads of room for enhancements in value and segment-diversity). I might guess that – on this market – we will solely anticipate two or three situations of all-new fashions difficult established members of the highest 20 (in a sustained method) per yr any more.

Don’t take this conservatism as a information to all automotive markets, nevertheless. There’s clearly enormous disruption nonetheless in retailer for many auto markets world wide within the years forward. A part of the distinctive elements of Norway’s case – aside from being already close to the top level of the EV transition – is that it’s a very rich market, so smaller automobiles (the best promoting automobiles in lots of world markets) will not be essentially the best quantity fashions in Norway. Added to that, the big distances and lengthy, chilly winter (with heavy precipitation) are further the reason why small-and-affordable automobiles have a decrease demand in Norway, in comparison with nearly all different markets.

That being stated, only a step above the small-and-affordable sector, there are compact, succesful, and nice worth automobiles that may nonetheless be amongst the best quantity sellers, even in Norway. Europe is now on the level the place these sorts of fashions have already began to be BEV-ified (the Volvo EX30 final yr, the Kia EV3 this yr). That is the price-point of the market which is being disrupted now, and because of this, after this subsequent yr or so, the long run prospects of later arrivals on this phase constantly displacing these BEV leaders will solely get narrower. It can nonetheless occur often, however not practically as continuously as previously few years – when all segments had been contemporary spring pastures for BEVs.

Exterior of Europe, the BEV transition has allowed the core BEV applied sciences to see value enhancements which now permit for worthwhile (and compelling) fashions even in small-and-affordable segments. Witness the various spectacular small-and-affordable BEV fashions that exist within the Chinese language market, for instance. While Norway will not be the perfect marketplace for these smaller segments, these BEVs are beginning to be (and can more and more be) the key disruptors in lots of different markets. We’ve seen the BYD Dolphin Mini topping the BEV charts in Brazil and Colombia (and elsewhere in South America), and these sorts of inexpensive automobiles would be the enormous disruptors all through Africa and Asia additionally.

Outlook

As we noticed above, the auto market expanded in February, by 21% YoY. The broader Norwegian economic system really noticed a YoY contraction in This fall 2024, of detrimental 0.3%. Observe that, in Norway’s case, the macro financial information may be closely swayed by authorities expenditures, and by fossil gasoline export volumes (and world costs) – such that headline GDP figures can swing wildly, so we will’t learn an excessive amount of right into a single quarter. Norway’s inflation was steady at 2.3% in January (newest), and rates of interest remained at 4.5%. Manufacturing PMI improved to 51.9 factors in February, from 51.3 in January.

It’s fascinating to trace Norway’s transition into the end-game of BEV adoption, and see the assorted dynamics enjoying out. If anybody has detailed insights into the upcoming new tax and incentive insurance policies (due April 1st), the “thinking” behind them, and predictions for the way they’ll affect the powertrain shares going ahead, please tell us beneath.

Relating to the fleet standing, the newest information continues to be from the top of 2024, when BEVs held 27.7% fleet share, with PHEVs holding a further 7.2% share. This was up from 24.2% BEV share 12 months prior (and word that PHEV share was unchanged YoY).

What are your ideas on Norway’s auto market? Please soar into the feedback part to share your perspective.

Whether or not you’ve solar energy or not, please full our latest solar power survey.

Chip in a number of {dollars} a month to help support independent cleantech coverage that helps to speed up the cleantech revolution!

Have a tip for CleanTechnica? Need to promote? Need to recommend a visitor for our CleanTech Speak podcast? Contact us here.

Join our each day publication for 15 new cleantech stories a day. Or join our weekly one if each day is simply too frequent.

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.

CleanTechnica’s Comment Policy