Elon Musk’s Tesla continues to capitalize on the necessity of its opponents to adjust to emissions requirements, a enterprise mannequin that has confirmed extremely worthwhile for the electrical car (EV) firm. Because the EV big incurs minimal prices to earn these carbon credit, the income from their sale interprets to pure revenue.

Whereas the particular recipients of those credit stay undisclosed, this income stream has been important for Tesla’s monetary success.

Tesla’s Inexperienced Money Move: Cashing in on Emissions Compliance

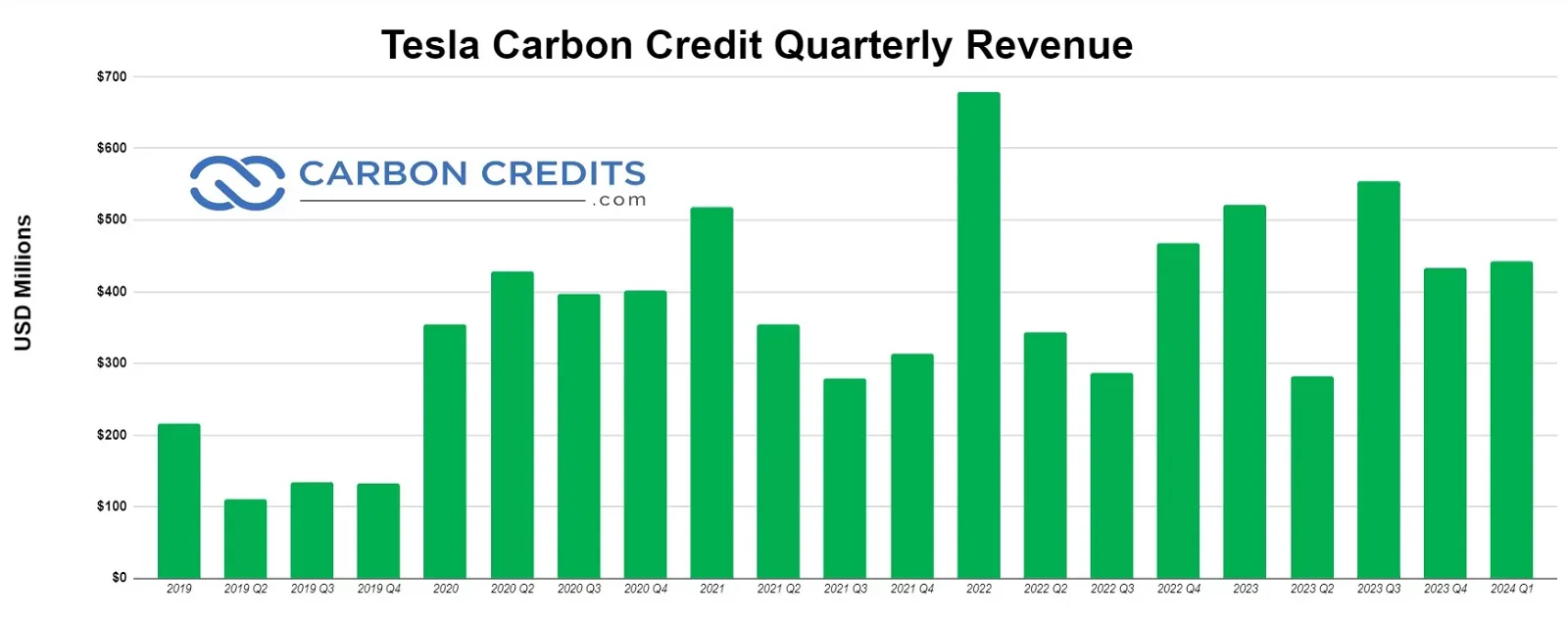

In its latest first-quarter 2024 filingsthe corporate reported a $442 million revenue from the sale of carbon credit (automotive regulatory credit). This determine represents a slight 2% improve from the earlier quarter of This autumn 2023, which is $433 million.

- Remarkably, this credit score income accounts for a whopping 38.6% of the corporate’s Q1 2024 web revenue ($1,144 million).

Nevertheless, Tesla’s income took a major hit within the first quarter, falling 55% to $1.13 billion in comparison with a yr in the past. This decline was attributed to a protracted technique of slicing EV costs and numerous unexpected challenges that impacted the corporate’s monetary efficiency.

Regardless of reporting income of $21.3 billion in Q1 2024, representing a 9% drop from the earlier yr, Tesla’s earnings fell in need of analysts’ expectations. Working revenue additionally decreased by 54% to $1.2 billion in comparison with the identical interval final yr.

The gradual ramp-up of the up to date Mannequin 3 manufacturing on the Fremont manufacturing unit in California contributed to the difficulties. The corporate additionally famous that world EV gross sales confronted stress as many automakers prioritized hybrids over electrical automobiles.

In a report by S&P World Commodity Insights, automakers are more and more embracing plug-in hybrid EVs as a extra reasonably priced short-term answer on their journey towards full electrification.

In China, the share of battery electrical automobiles (BEVs) inside the plug-in electrical car (PEV) market declined by 10% factors to 57.0% in February in comparison with the identical interval final yr. This pattern of declining BEV share can also be noticed in america and Germany. Each the U.S. and the European Union (EU) are adapting their PEV targets primarily based on suggestions from the trade.

Behind the dipping monetary outcomes, Tesla managed to generate extra income from its regulatory credit. And the hybrid method of different carmakers means they must buy carbon credit from the EV big. The price for the carbon credit stays discreet between Tesla and the consumers.

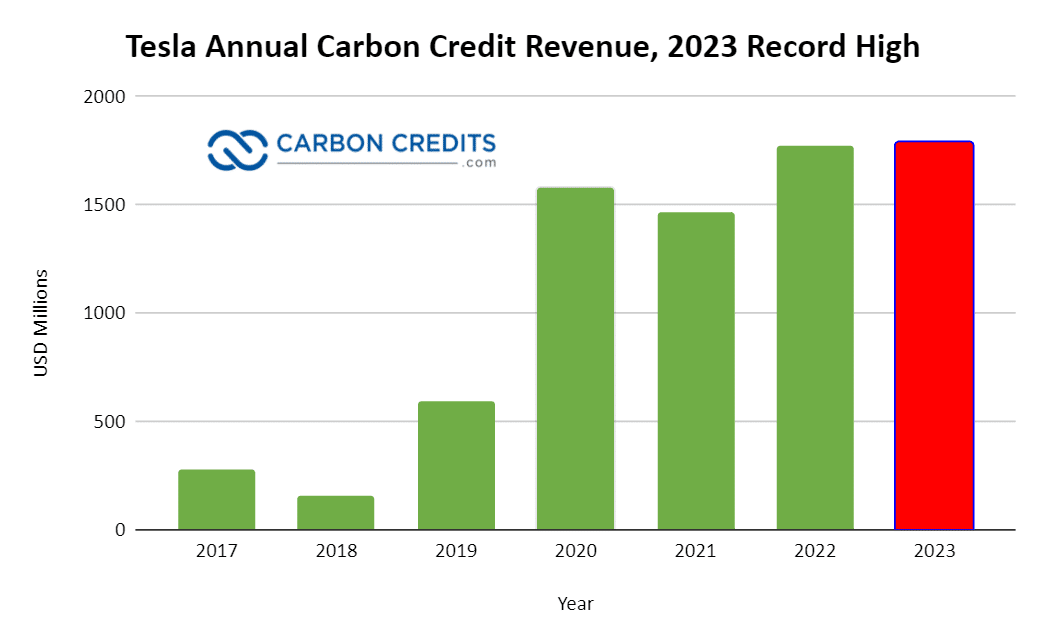

Because the firm began promoting carbon credit to its friends, this income stream has change into a billion-dollar bonanza for Tesla. Final yr, the automaker generated a complete annual revenue from carbon credit amounting to $1.79 billion. That’s a document excessive thus far for the corporate’s automotive regulatory credit score income.

Past Automobiles: Tesla’s Surge in Vitality Storage Deployment

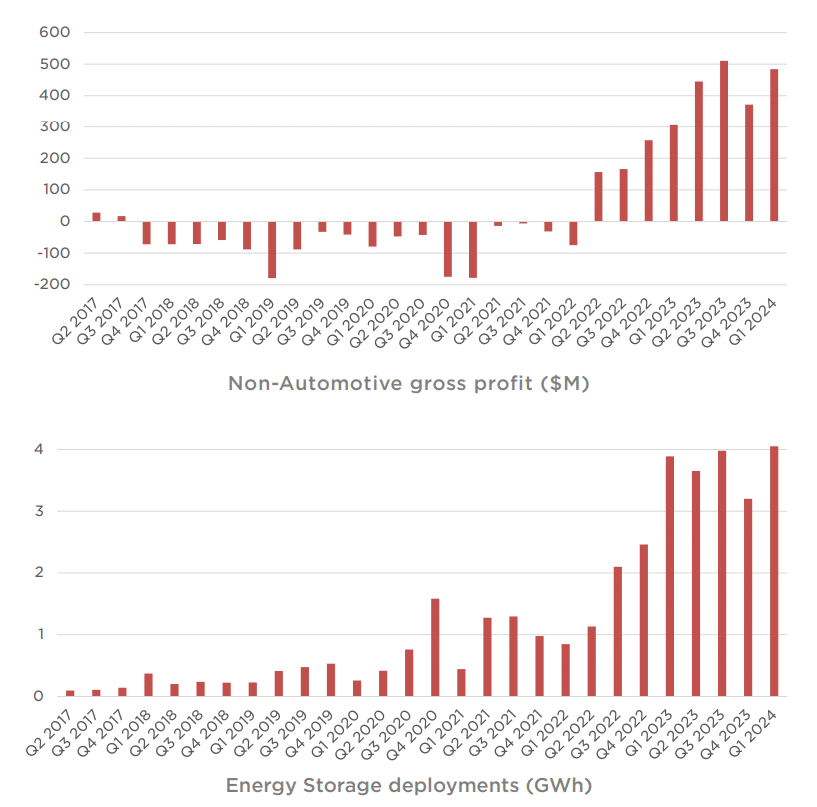

Whereas automotive revenues skilled a decline, Tesla noticed development in different segments of its enterprise, significantly in vitality storage, which is changing into more and more worthwhile for the corporate. As Megapack installations proceed to extend and fleet expands, Tesla anticipates constant revenue development on this phase.

In Q1 2024, vitality storage deployments reached a document excessive of 4.1 GWh. Moreover, income and gross revenue from Vitality Technology and Storage reached all-time highs.

In comparison with the identical interval final yr, revenues had been up 7% to $1.6 billion, and gross revenue surged by 140%. This development was primarily pushed by elevated Megapack deployments, though there was a slight lower in photo voltaic installations. Vitality Technology and Storage stays Tesla’s highest margin enterprise.

As well as, Tesla generated $2.28 billion in income from companies, which incorporates revenue from its Supercharger community. This income stream is anticipated to develop additional as extra automakers, corresponding to Ford, GM, Rivianand VW, undertake Tesla’s North American Charging Customary know-how.

Tesla’s Carbon Credit score Surprises and Future Improvements

Regardless of earlier expectations that carbon credit income would decline as opponents ramped up electrical car (EV) manufacturing, Tesla has been stunned by sustained income on this space.

In 2020, the corporate’s former CFO Zachary Kirkhorn anticipated a lower within the significance of this income stream over time. Nevertheless, opposite to those predictions, Tesla’s earnings from regulatory carbon credit haven’t skilled a major decline. In reality, final yr’s earnings barely exceeded the revenue from the earlier yr.

Regardless of the revenue dip, Tesla used its earnings report to focus on its future initiatives. Notably, it emphasizes give attention to developments in autonomy by AI and the introduction of recent merchandise constructed on a next-generation car platform. The corporate considerably elevated its analysis and improvement spending, allocating $1.1 billion within the first quarter, a 49% rise from the identical interval in 2023.

Elon Musk underscored the corporate’s dedication to investing sooner or later, regardless of present challenges. Tesla goals to expedite the event of a brand new car lineup, with manufacturing anticipated to start in early 2025.

Musk emphasised that these new automobiles, together with extra reasonably priced fashions, will leverage points of each the next-generation platform and the present ones. This permits for manufacturing on the identical manufacturing strains as the present car lineup.

Tesla’s Q1 outcomes, although exhibiting a decline in income, sparked a surge in share costs, rising by as a lot as 12% following the announcement. Buyers appeared extra considering Tesla’s forward-looking statements relating to future merchandise, significantly introduction of cheaper automobiles by 2025.

Musk emphasised through the earnings name that whereas some automakers are shifting in the direction of plug-in hybrids, Tesla believes that battery electric vehicles will finally dominate the market. And their technique stays centered on EVs regardless of the challenges confronted within the trade.