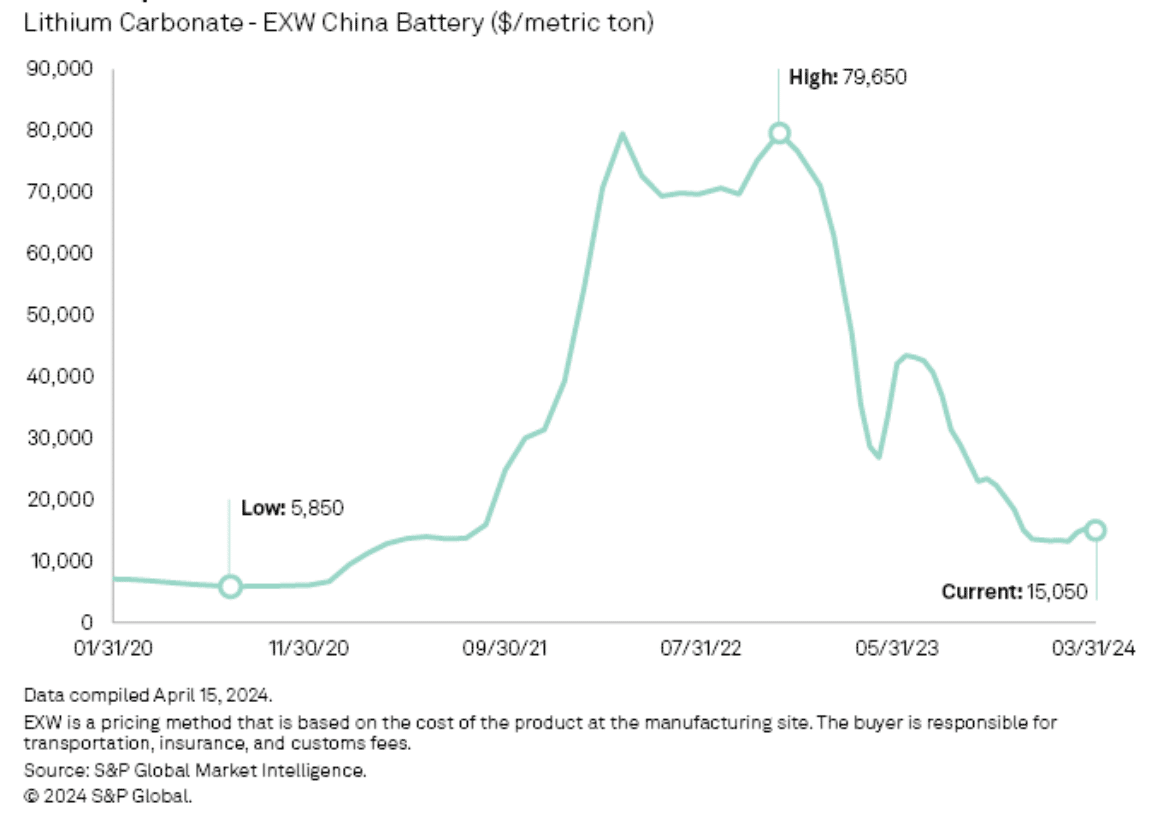

Analysts anticipate that lowering royalty charges might present much-needed reduction for lithium producers grappling with plummeting costs. The decline in lithium costs because the starting of 2023 has been vital, with battery-grade lithium carbonate costs dropping by over 80% by April 2023.

Amid this downturn, decrease royalty obligations to native governments might assist alleviate monetary pressures on mining firms.

Decrease royalty funds would immediately cut back miners’ value of gross sales, notably as lithium costs decline, thus bolstering profitability amidst difficult market circumstances. This adjustment is seen as a short-term measure to help miners till lithium costs stabilize or recuperate.

Lithium Challenges Amidst Value Decline

The financing panorama for lithium initiatives in the USA can also be encountering hurdles amid sustained low lithium prices. This might impede the present administration’s efforts to strengthen the home battery provide chain.

Regardless of plans for round 100 lithium mine initiatives throughout the US, the attraction of those ventures has diminished because of the vital decline in lithium costs.

Knowledge from S&P International Market Intelligence reveals an 81.7% lower in lithium costs from their peak in 2022. This extended interval of low costs has made quite a few initiatives much less interesting to buyers, affecting the general viability of the event pipeline. Because of this, financing for these initiatives is going through challenges, whereas impacting the home battery provide chain within the US.

Components contributing to the present market dynamics embody elevated manufacturing capability in 2023 alongside slower-than-expected development in electrical automobile gross sales. These circumstances have led to a state of affairs the place lithium costs are anticipated to stay subdued till there’s a notable enchancment in EV affordability.

Consequently, mining firms alter their methods. Some high-cost miners exit the market whereas others reduce enlargement plans and give attention to cost-saving initiatives.

The Royalty Realities in a Unstable Market

The fluctuation in lithium costs has a direct impression on royalty funds made by producers.

Royalties are funds made by a 3rd celebration to the proprietor of a product or patent for using that product or patent. These funds are sometimes outlined in a licensing settlement, which specifies the phrases and circumstances beneath which the third celebration can use the product/patent.

The royalty charge, which determines the quantity of the royalty cost, is calculated as a proportion primarily based on numerous elements. These embody the exclusivity of rights, the worth of the expertise or mental property, and the supply of different choices.

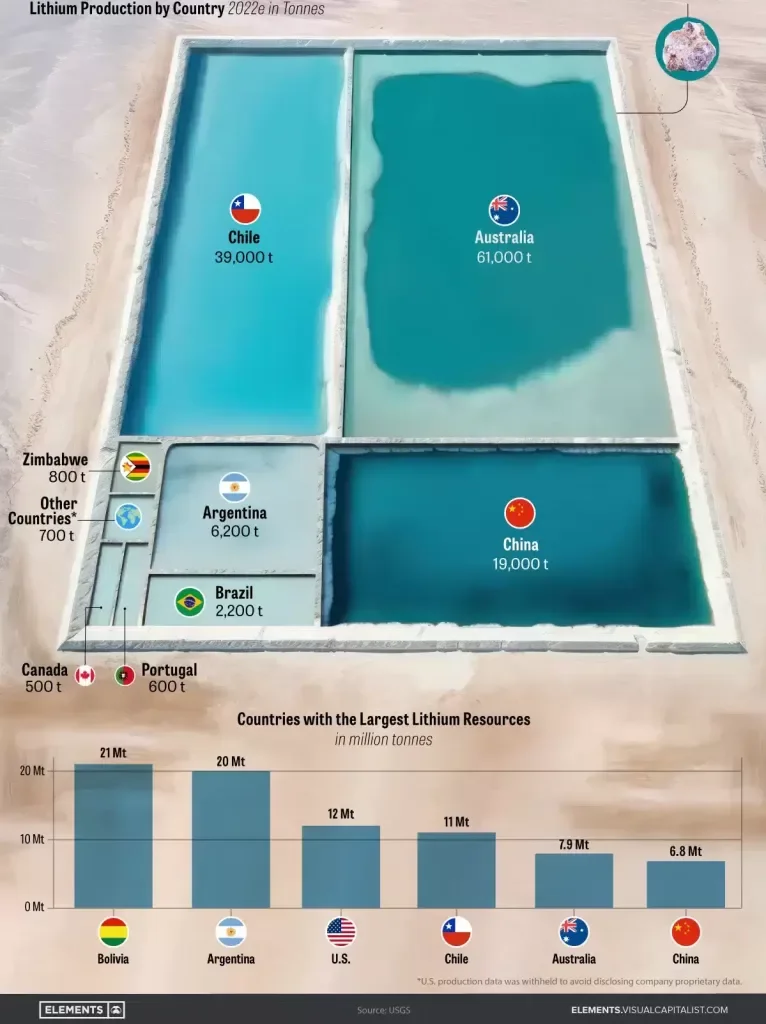

Royalty constructions for lithium extraction fluctuate throughout main producing nations, with most using variable programs that alter with market costs.

In Argentina, royalties fluctuate by province however are capped at 3%. In the meantime, Western Australia and Zimbabwe set theirs at 5%, with choices for partial cost in minerals.

Chiledwelling to vital lithium reserves, implements a novel royalty system by means of its manufacturing growth company, CORFO. Operators like SQM and Albemarlemain gamers within the Salar de Atacama, face variable royalty charges starting from 6.8% to 40%, linked to market costs. This strategy goals to help miners throughout worth fluctuations.

Regardless of Chile’s comparatively excessive royalty charges, investments in lithium initiatives there and in Argentina stay engaging. In truth, most initiatives in these nations keep profitability even amid present worth ranges. Chile is the second largest lithium producer whereas Argentina takes the fourth spot.

Because the lithium market evolves, variable royalty programs are gaining recognition for his or her adaptability to cost volatility and help for the mining sector.

The Impression on Lithium Miners’ Backside Line

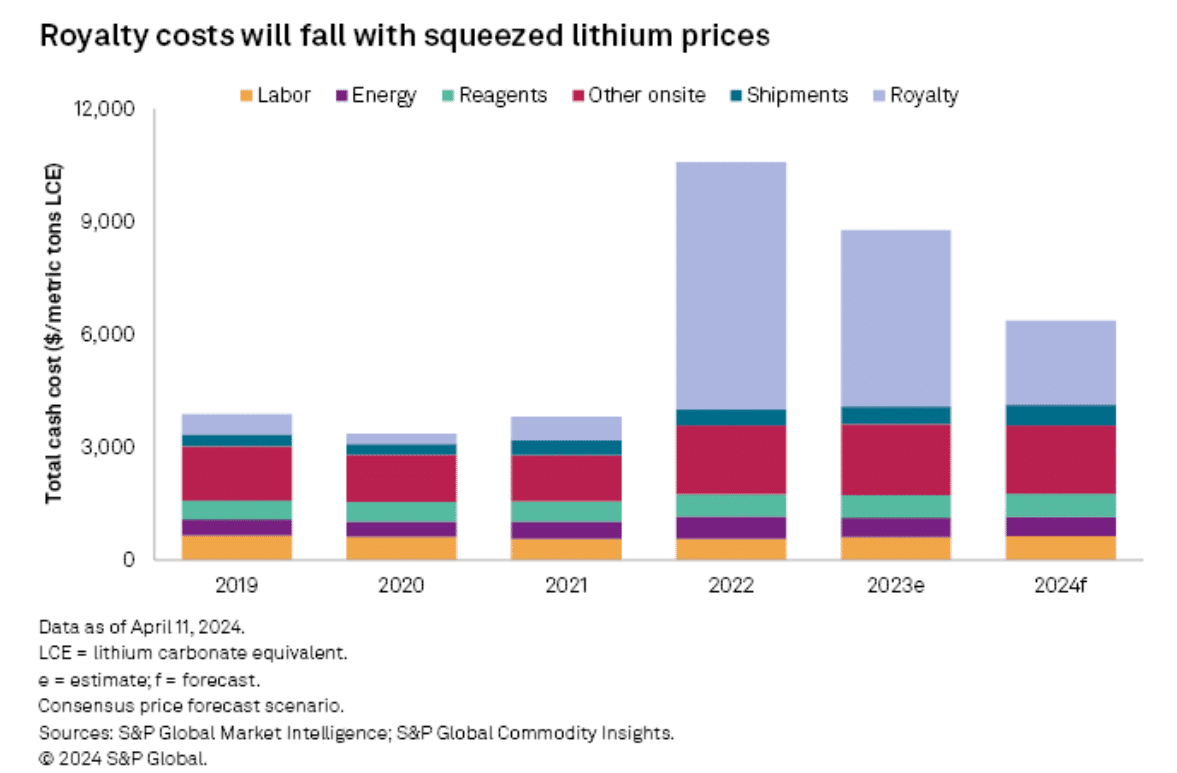

In 2022, when lithium costs soared to historic highs, miners noticed their royalty funds surge by a staggering 960.1% in comparison with the earlier yr. This improve in royalties considerably elevated general miners’ manufacturing prices, with royalties accounting for over 60% of whole money prices.

Whereas miners have been capable of soak up these extra prices in the course of the peak worth interval, the chance of lithium costs returning to such ranges within the close to future is unsure. As lithium costs normalize, royalty changes are anticipated to have a lesser impression on miners’ profitability. That is notably prevalent in a market characterised by decrease costs.

Decrease royalty charges in a depressed worth setting can present miners with some reduction. This can enable them to protect margins regardless of difficult market circumstances.

Market projections counsel a lower in common royalty funds and whole money prices, offering a positive outlook for lithium producers. Extra remarkably, buyers nonetheless proceed to point out sturdy curiosity in lithium initiatives amid short-term worth challenges, foreseeing their long-term potential.

As lithium costs proceed to plummet, the decision for decreased royalty charges emerges as a lifeline for struggling producers. With royalties comprising a good portion of mining prices, decreasing these obligations might inject much-needed stability into the trade.