VCM spot quantity skilled an uptick final week, largely as a result of acquisitions from Australian companies gearing up for end-of-month and annual reporting obligations, in accordance with Xpansiv information. These purchases contributed to a complete CBL spot VCM quantity of 394,632 metric tons, a notable enhance from the earlier week’s tally of slightly below 120,000.

Xpansiv offers sturdy market information from CBL, the world’s largest spot environmental commodity trade. These embrace day by day and historic bids, provides, and transaction information for varied environmental commodities traded on the CBL platform.

Xpansiv’s VCM Spot Quantity

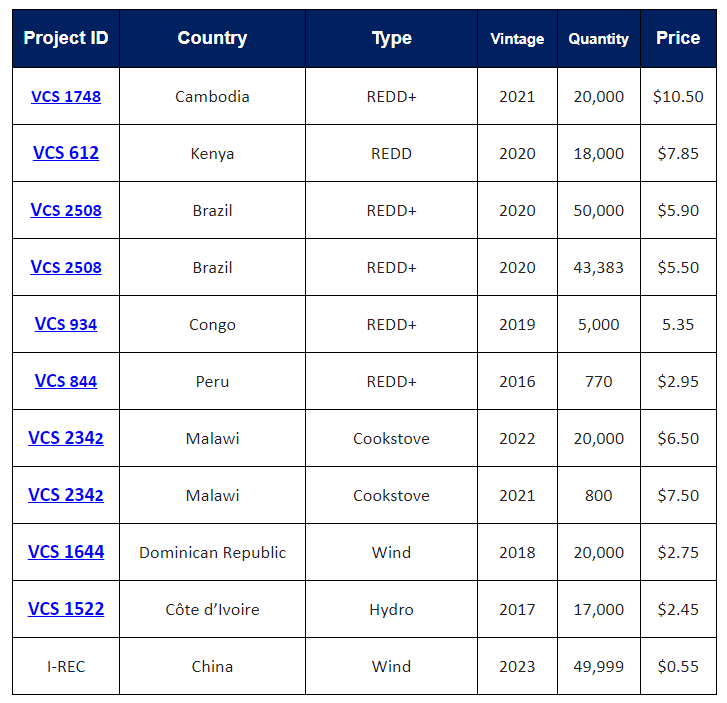

The majority of buying and selling exercise for the week centered round over-the-counter (OTC) blocks of Latin American nature credit. Newer-vintage REDD+ credits commanded costs as excessive as $7.50 per ton, whereas older classic AFOLU credit had been noticed crossing at $0.37.

Notably, vintage-specific mispricings had been noticed within the Katingan and Rimba Raya challenge credit. The older vintages are buying and selling at premiums in comparison with newer ones.

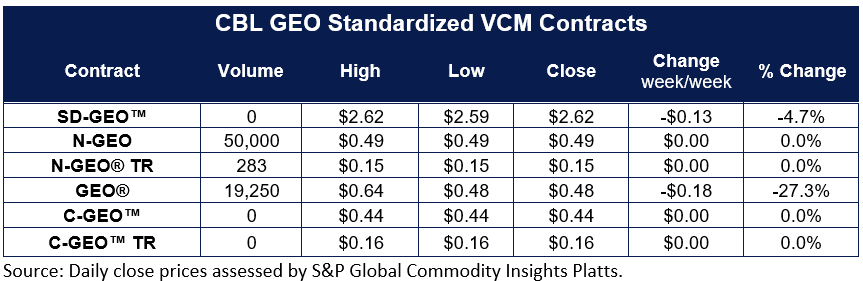

In the meantime, CBL GEO costs noticed a major decline of over 20%. The pilot-phase LANE bellwether spot and December futures contracts closed at $0.48 and $0.38, respectively.

Final Thursday witnessed the majority of buying and selling exercise, with 1,612,000 tons exchanged, together with 1,462,000 Dec 2024-2025 calendar spreads priced between -$0.16 and -$0.19.

Amidst a backdrop of cautious optimism, market contributors in Europe mentioned progress with varied initiatives reminiscent of ICVCM, VCMI, ICAO, and SBTi. Nevertheless, there remained uncertainty relating to the timing of elevated company VCM participation, with discussions revolving across the theme of “Survive to 2025”.

When it comes to new listings, REDD+ challenge credit dominated, with carbon prices ranging between $10.50 and $2.95. Notable choices included 20,000 Cambodia classic 2021 REDD+ credit and almost 95,000 cut up classic Brazilian REDD+.

Moreover, 45,000 China hydro classic 2023 I-RECs had been listed at $0.55.

RECord Breaker: Xpansiv Units New Requirements in Renewable Power Buying and selling

At a renewable vitality occasion in Amsterdam, CBL introduced report Renewable Energy Credits (REC) volumes in Q1, signaling bullish sentiment out there.

REC quantity on its CBL spot trade set a report of 494,249 MWh in Q1 2024. A report 61,600 California Low Carbon Gasoline Customary contracts had been additionally traded on the spot trade.

Remarking on this achievement, Ben Stuart, Chief Business Officer, Xpansiv, famous that:

“Development of our compliance REC enterprise continues to show the utility of Xpansiv infrastructure to the US renewables markets. Our robust place because the platform of selection for corporates in search of merchandise to fulfill reporting obligations and net-zero commitments continues to make Xpansiv a necessary accomplice for the worldwide vitality transition

Within the North American compliance market, NEPOOL RECs resumed buying and selling on CBL, with over 62,000 credit exchanged for This fall 2023 era. Rhode Island new era credit led in quantity, adopted by 2023 Massachusetts class 1 and photo voltaic 2 credit.

In PJM markets, Maryland 2024 class 1 credit and Ohio photo voltaic credit had been actively traded. Lastly, over 80,000 NAR credit had been exchanged by way of CBL, consisting primarily of 2023 US-sited wind credit with some CRS eligibility.