Zefiro Methane Company introduced that its widespread shares began buying and selling on the Cboe Canada Trade below the ticker image ZEFI. This milestone follows Zefiro Methane’s profitable Preliminary Public Providing (IPO), as revealed in its April 11 press launch.

Zefiro Methane is a personal methane offsets originator devoted to decommissioning orphaned and deserted oil and fuel wells in america.

Why Plug Wells?

Zefiro’s main mission revolves round mitigating methane fuel emissions, a greenhouse fuel considerably stronger than carbon dioxide. Leveraging its experience in asset retirement and environmental markets, Zefiro stands as the only absolutely built-in supplier devoted to addressing the pervasive challenge of methane leaks throughout numerous websites all through North America.

Methane is the second most prevalent greenhouse fuel (GHG) globally, trailing solely behind CO2. It contributes to about 20% of complete GHG emissions. Remarkably, its heat-trapping efficiency surpasses CO2 by at the least 25 occasions, scaling as much as over 8x.

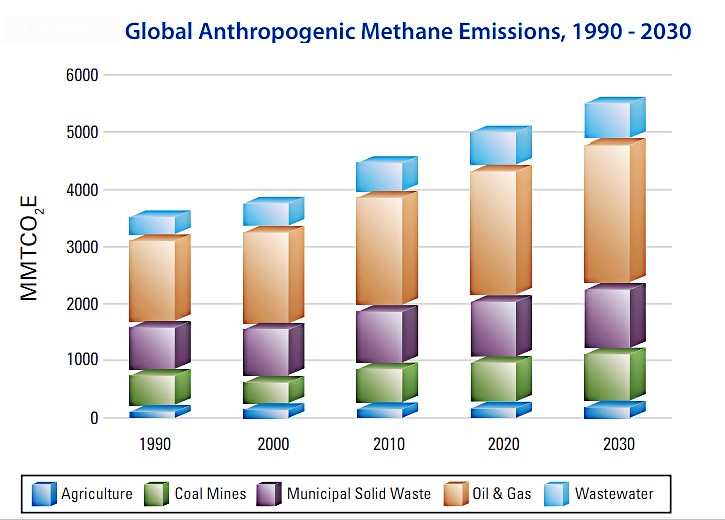

Methane concentrations within the ambiance have surged considerably. This prompted issues amongst scientists who view escalating methane emissions as a formidable impediment to sustaining world temperatures under the 1.5°C threshold. The World Methane Initiative (GMI) forecasts that methane emissions from human actions will enhance by 2030.

The surge in methane air pollution largely comes from human actions, with one outstanding wrongdoer – the deserted oil and fuel wells.

Latest estimates paint a troubling image, indicating the existence of over 4 million orphaned oil and fuel wells scattered throughout 26 U.S. states. A study sheds gentle on the distribution of those wells in Canada and the U.S.

These deserted and unplugged wells function potent sources of methane leakage, posing grave threats to air high quality. Authorities assessments equate the quantity of leaking methane to the combustion of over 16 million barrels of oil, underscoring the magnitude of the environmental problem posed by uncared for effectively websites.

By decommissioning these wells, Zefiro Methane generates high-quality carbon offsets out there on the market in voluntary carbon markets.

Zefiro’s Strategic Enlargement in Environmental Companies

Notably, a considerable federal allocation of US$4.7 billion has been earmarked for effectively web site plugging, remediation, and restoration efforts, aiming to fight methane emissions. All through 2023, Zefiro expanded its operational framework as an environmental companies chief by way of strategic acquisitions. These embrace Vegetation & Goodwin, Inc. based mostly in Bradford, Pennsylvania, and Appalachian Properly Surveys, Inc. in Cambridge, Ohio.

These acquisitions have positioned Zefiro as a completely built-in entity. Additional underscoring its dedication, Zefiro secured a presale settlement for licensed carbon credit with Mercuria Power America, LLC, a major participant within the world power and commodities panorama.

Moreover, Zefiro performed a pivotal position within the United Nations Local weather Change Convention in Dubai, internet hosting a noteworthy occasion throughout the “Blue Zone.”

Reflecting on the bell-ringing ceremony, CEO Talal Debs expressed pleasure for Zefiro Methane going IPO and its trajectory as an rising environmental companies powerhouse. He emphasised the corporate’s distinctive place as a complete supplier tackling the methane emissions problem head-on, remarking:

“By leveraging our team’s decades of operational experience both in the field and in the boardroom, Zefiro is forging an innovative toolkit to reduce methane emissions and help remediate critical air, land, and water resources…and we will continue working with key public and private sector stakeholders to achieve these goals.”

Zefiro’s Public Debut Opens Doorways for Inexperienced Buying and selling

With Zefiro’s itemizing, institutional and retail traders alike acquire entry to the Lively Sustainability motion. Wanting forward, Zefiro anticipates a dynamic future as a publicly traded entity on the Cboe Canada trade.

Erik Sloane, World Head of Company Listings at Cboe World Markets commented on this celebratory occasion, saying:

“As governments across the world take steps to monitor and manage commitments to reduce greenhouse gas emissions, Zefiro Methane is positioning themselves with an expert management team, access to capital, and creating an interesting opportunity for investors.”

The corporate’s strategic partnerships with business stakeholders, state our bodies, and federal businesses are poised to bolster income and EBITDA progress for its shareholders.

Traders eager on buying and selling shares of ZEFI can accomplish that by way of their typical funding channels, together with low cost brokerage platforms and full-service sellers.

Cboe Canada boasts over 270 distinctive listings, together with among the most revolutionary Canadian and worldwide progress corporations. It additionally trades ETFs from Canada’s largest ETF issuers, and Canadian Depositary Receipts (CDRs). The trade facilitates over 15% of all quantity traded in Canadian-listed corporations and over 20% of all quantity traded in Canadian ETFs.

Zefiro Methane Company’s IPO itemizing on the Cboe Canada Trade represents greater than only a monetary milestone—it marks a major step ahead within the world effort to fight methane emissions. Because the world grapples with the pressing want to deal with local weather change, Zefiro’s mission to decommission orphaned oil and fuel wells and mitigate methane leaks stands on the forefront of environmental stewardship.