Essential minerals, together with lithium, nickel, cobalt, copper, and uncommon earths, are important within the manufacturing of unpolluted power applied sciences, spanning from wind generators to electrical autos (EVs). Over the past twenty years, the annual commerce in energy-related important minerals has surged from $53 billion to $378 billion.

Nevertheless, US imports of lithium supplies and important minerals, essential parts for EV batteries, noticed a decline in 2023 in comparison with the earlier 12 months, per knowledge from S&P International Market Intelligence. This displays the subdued demand for EVs.

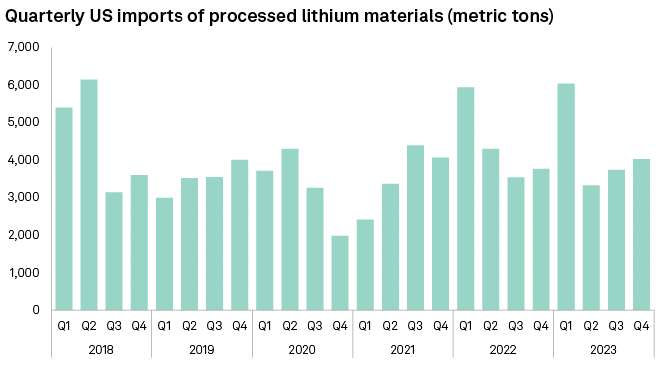

In 2023, imports of processed and refined lithium totaled 17,130 and 57,210 metric tons, respectively, marking decreases of two.4% and 20.5% in comparison with 2022, as reported by Market Intelligence knowledge.

US processed lithium imports noticed an uptick within the 4th quarter of 2023 following an increase within the third quarter. Nevertheless, import ranges remained beneath the report excessive set within the March quarter of the identical 12 months.

The primary quarter of 2023 witnessed a report in US imports of lithium-ion batteries as seen within the chart beneath. That is primarily as a result of market anticipation of strong EV gross sales for the 12 months forward.

Components Behind US Import Decline of Essential Minerals

Analysts attribute the subdued gross sales progress in Europe and the US throughout the second half of 2023 to varied elements. These embody a better rate of interest setting and a higher value premium for battery electrical autos in comparison with inside combustion engine autos.

Nevertheless, there are expectations for an uptick in EV demand in 2024.

Based on a February report by S&P International Mobility, the event of battery-electric automobile (BEV) gross sales within the US is predicted to proceed to develop via 2024. This projection almost doubles the variety of BEV fashions accessible by the tip of the 12 months in comparison with 2022.

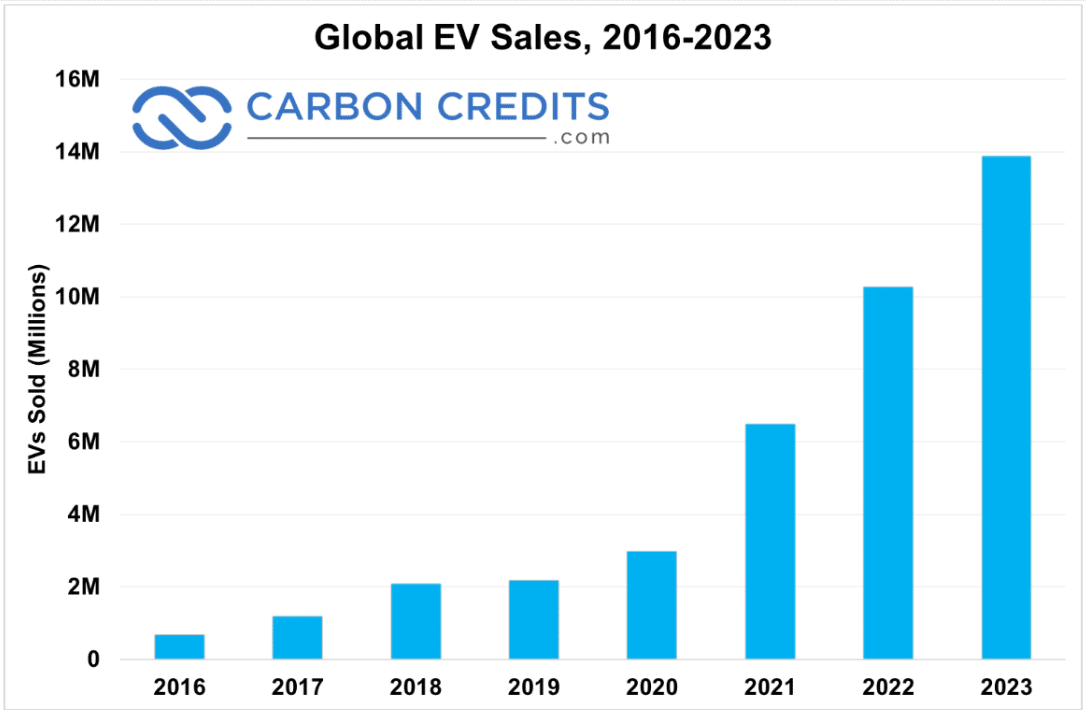

Whereas it’s true that progress within the world EV market has been decelerating, it’s essential to keep up the proper perspective. In 2021, EV gross sales greater than doubled, experiencing a rare progress charge of almost 120%.

Remarkably, in January of this 12 months, over 1.1 million EVs have been bought worldwide, in comparison with 660,000 bought throughout the identical interval final 12 months, marking a brand new month-to-month world gross sales report. This represents a exceptional 69% year-over-year progress, considerably surpassing the common progress charge noticed within the earlier 12 months.

This progress pattern in EV gross sales means lithium production should additionally sustain.

Tendencies in US Lithium Imports and Battery Market

Within the fourth quarter of 2023, US imports of processed lithium totaled 4,026 metric tons, marking a 6.8% enhance 12 months over 12 months. Market Intelligence knowledge reveals that Argentina and Chile contributed 51.6% and 46.1% of those imports, respectively.

Uncooked lithium undergoes processing and subsequent refinement into chemical compounds appropriate to be used as cathode supplies and electrolyte options in batteries. Through the December quarter, the US imported 15,960 metric tons of refined lithium. That represents a 3.5% enhance from the 15,426 metric tons imported throughout the identical interval in 2022.

Canada accounted for 63.4% of the US imports of refined lithium within the fourth quarter, based on the information.

Based on forecasts from Commodity Insights, China would see a decline in its market share in lithium-ion battery manufacturing between 2023 and 2030.

In the meantime, North America’s lithium-ion battery capability is anticipated to develop at a charge of twenty-two% throughout this era. The majority of this progress would happen in america, with two initiatives additionally slated for Canada.

Moreover, US imports of important minerals amounted to 612,590 metric tons in 2023. That represents a big decline of 39.1% 12 months over 12 months.

US Dependency in Essential Mineral Imports

Market Intelligence knowledge additional reveals that important mineral imports totaled 195,805 metric tons within the 4th quarter of 2023. That accounts for a 6.6% enhance from the 183,621 metric tons recorded within the fourth quarter of 2022. Notably, Gabon accounted for 47.1% of US imports of important minerals throughout the identical quarter.

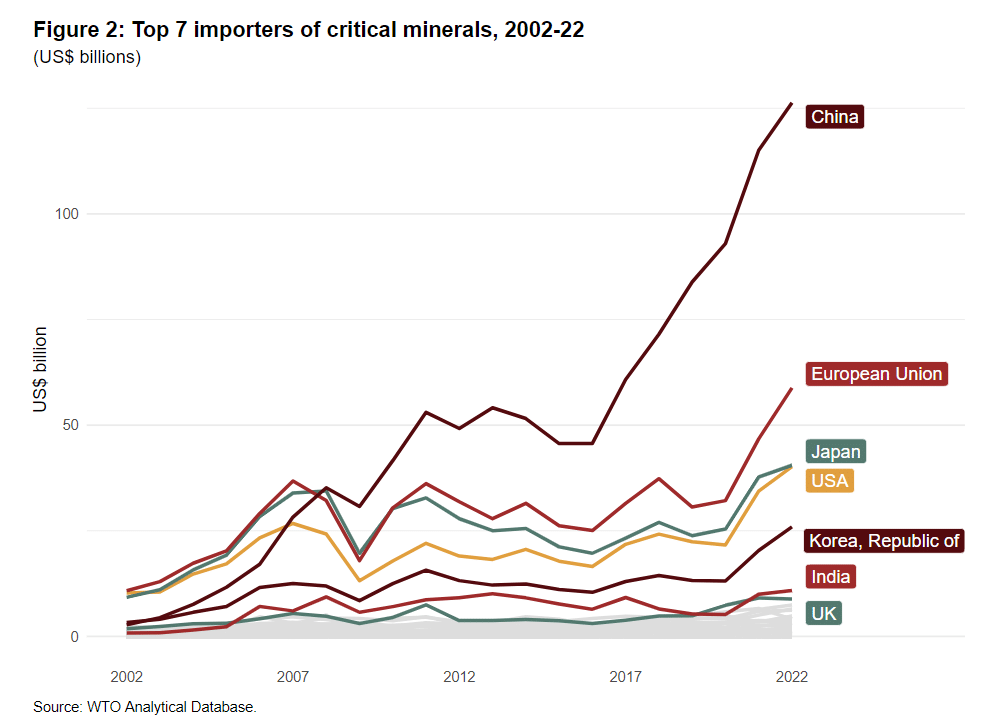

Globally, commerce in important minerals has skilled substantial progress over the previous twenty years, with a median annual progress charge of 10%. The worth of imports has almost doubled in 5 years, hovering from $212 billion in 2017 to $378 billion in 2022, based on World Trade Organization data.

Notably noteworthy is the numerous enhance in commerce in helium and lithium which confirmed spectacular annual progress charges of as much as 53% throughout the identical interval.

In 2022, China emerged as the biggest importer of important minerals, comprising 33% of the worldwide complete. Following China, the European Union accounted for 16%, whereas Japan and america each stood at 11%.

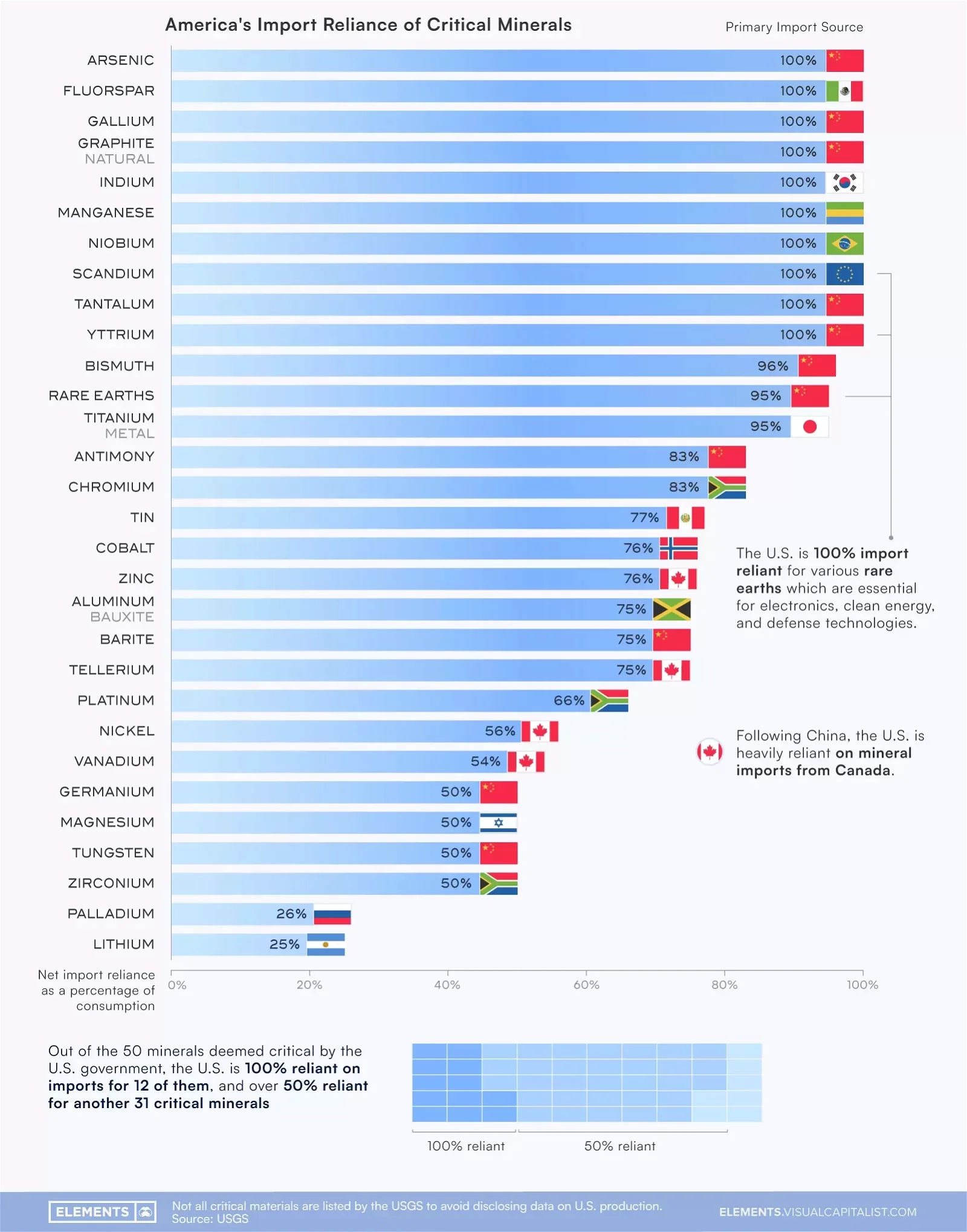

The transition in direction of a extra sustainable future necessitates entry to varied important minerals very important for transitioning to the inexperienced economic system. Nevertheless, the US at present faces a big reliance on imported nonfuel minerals, doubtlessly exposing vulnerabilities within the nation’s provide chains.

Based on knowledge from the U.S. Geological Survey (USGS)america is totally depending on imports for at the very least 12 key minerals recognized as important by the federal government. Notably, China emerges as the first supply of imports for a lot of of those important minerals, in addition to quite a few others.

The graphic illustrates America’s import dependence for 30 key nonfuel minerals, highlighting the first import sources for every mineral.

The decline in US important minerals imports amidst EV market fluctuations underscores provide chain complexities. Regardless of subdued demand in 2023, projections recommend future progress. International commerce in important minerals surges, emphasizing the necessity for strategic home useful resource administration to safe a steady provide for the inexperienced economic system.