Inexperienced Star Royalties, the world’s first carbon credit score royalty and streaming firm boasts funding top-notch North American nature-based local weather options. It’s a three way partnership between Star Royalties Ltd. Agnico Eagle Mines Restricted, and Cenovus Vitality Inc.

In a current announcement, Star Royalties, through its associate Inexperienced Star, signed a “definitive royalty agreement” with NativState LLC to accumulate a number of gross income royalties on a carbon offset-issuing portfolio of Improved Forest Administration (IFM) initiatives within the southeastern United States.

NativState, an Arkansas-based forest carbon mission developer, gives small to medium landowners a possibility to understand the total carbon potential of their forests. They mixture them into IFM initiatives registered below the American Carbon Registry (ACR).

Inexperienced Star’s Royalty Portfolio: Unlocking the Funding Plan

Green Star expects the royalties to generate high-quality voluntary carbon offsets over 20 years. The overall fee of $5.6 million shall be made in a number of installments in U.S. {dollars} until specified in any other case.

The important thing methods of the funding plan outlined by Inexperienced Star are:

1. Increasing Inexperienced Star’s North American nature-based portfolio:

Buying the Royalties on NativState’s IFM initiatives enhances and broadens Inexperienced Star’s current portfolio of North American nature-based carbon offset options.

2. First carbon offset-issuing royalty for Inexperienced Star

Inexperienced Star’s first carbon offset-issuing funding, Venture ACR 783 in Arkansas, is projected to ship round 180,000 carbon offsets in 2024. It contains roughly 120,000 carbon offsets upon closing. Inexperienced Star anticipates that about 75% of its share of carbon offsets from the Royalties will happen throughout the first 5 years.

3. Aligned and defensive royalty construction

Inexperienced Star and NativState have established defensive mechanisms, together with minimal carbon credit score volumes to be delivered all through the 20-year royalty time period.

4. A number of Royalties with robust funding metrics

The Royalties embody a 20% Royalty on Venture ACR 783 and a ten% Royalty on a further 60,000 acres throughout Arkansas, Louisiana, Mississippi, and Missouri, slated for growth by NativState and registration as future ACR initiatives. At prevailing carbon offset costs, the Royalties are anticipated to yield vital web current worth accretion and provide a lovely payback interval.

5. Secure and rising demand for premium North American carbon offsets

Premium North American nature-based carbon offsets are witnessing growing demand amidst restricted provide. Present market pricing for these premium avoidance and elimination carbon offsets are roughly $13-15/t CO2e and over $20/t CO2e, respectively.

6. Partnership with a quickly rising carbon developer

NativState, managing over 300,000 acres, goals to become the biggest U.S. aggregator of small-to-medium forest landowners. Inexperienced Star is happy to forge a long-term partnership with NativState, financing American forest landowners keen to interact in each IFM practices and voluntary carbon markets.

Transaction Phrases and Influence on Inexperienced Star’s Carbon Offset and Income Profiles

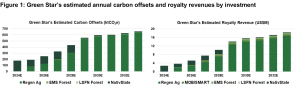

The transaction instantly supplies Inexperienced Star with carbon offsets that may be monetized. Over the following 20 years, they’ll maintain getting extra offsets, with about 75% of them coming within the first 5 years.

supply: Inexperienced Star Royalties

Nevertheless, the transaction phrases and circumstances are vital for the monetary good points of each events. They embrace:

- Inexperienced Star will purchase the Royalties for $5.6 million, with funds made in installments tied to ACR registration milestones.

- In return for its funding, Inexperienced Star will obtain a 20% Royalty on Venture ACR 783 and a 10% Royalty on a further 60,000 acres, slated for enrollment by NativState as ACR initiatives.

- Every Royalty will span a 20-year time period ranging from the primary carbon offset issuance date of the ACR mission.

- Carbon offsets will function the direct fee methodology for the Royalties.

- Inexperienced Star and NativState have agreed to defensive mechanisms, together with minimal carbon offset supply necessities over the 20-year royalty interval.

Enhancing Carbon Sequestration via Improved Forest Administration (IFM)

Improved forest administration encompasses strategies that both scale back emissions from forests or improve carbon elimination and storage. Strategies similar to reducing harvest volumes, extending forest rotations, and many others. decrease emissions from forests. They generate credit for the curbed emissions.

The conservation plans additionally elevate carbon storage above the baseline, guaranteeing wonderful carbon sequestration.

From an financial perspective,

- These initiatives obtain elevated web carbon shares by both sequestering carbon via photosynthesis from expanded or maintained forest cowl in comparison with the baseline or by curbing greenhouse gasoline emissions via diminished timber harvesting.

- Acceptable IFM practices, like extending rotations, implementing thinning, adopting hearth prevention strategies, and altering harvesting strategies, should adjust to the chosen carbon registry methodology.

CarbonDirect stories,

“Improved forest management has the potential to increase total stored carbon annually by 200 million to 2.1 billion tonnes without compromising the wood product and ecosystem benefits that come with managed forestlands.”

In america, timber harvesting is probably the most widespread disruption throughout forested areas, with many of the harvested timber sourced from non-public lands. Due to this fact, vital selections about forest and land administration can profoundly affect the capability of forests to sequester carbon.

Presently, “premium avoidance carbon offsets” within the U.S. market are valued at about $13 to $15 per metric ton of carbon dioxide equal (t CO2e), whereas elimination carbon offsets fetch over $20 per t CO2e.

Carbon Offsets and Habitat Safety: The Mission of Venture ACR 783

Venture ACR 783, often known as the S&J Taylor Forest Carbon Venture spreads throughout 18,000 acres of sustainably managed forestland in Southcentral Arkansas.

Forest mission: work in progress

supply: NativState

-

Inexperienced Star holding a 20% Royalty stake in Venture ACR 783, is anticipating to provide ~ 1.5 million carbon offsets over the following twenty years.

Notably, Venture ACR 783 focuses on sustaining forest carbon shares via licensed and sustainable administration practices to realize vital carbon sequestration within the designated areas.

With its associate NativState, they’re aiming to generate sustainable income streams via forest administration and voluntary carbon markets (VCMs). The latter dedicates itself to conserving invaluable hardwoods similar to oak, gum, cypress, hickory, and pine forests throughout the Gulf Coastal Plain eco-region.

In addition to carbon revenues, Venture ACR 783 may even promote:

- Panorama stability

- Elevated biodiversity, and

- Enhanced habitat safety for crucial species

Alex Pernin, CEO of Star Royalties, has extremely applauded NativState’s strategy to the sustainable enterprise mannequin and its carbon offset issuance profile. He famous,

“We are proud to announce this multi-royalty investment in NativState’s portfolio of high-integrity IFM projects in the southeastern United States. This thoughtful transaction transitions Green Star into free cash flow generation and provides desirable economic returns while expanding and diversifying our existing premium North American portfolio.”