US utility analysts anticipate that discussions on first-quarter 2024 earnings calls will proceed to be pushed by synthetic intelligence (AI) and information heart energy demand. Analysts highlighted information facilities as a key theme, anticipating talks on numerous points surrounding it.

Knowledge Facilities Powering Up Utility Investor Pleasure

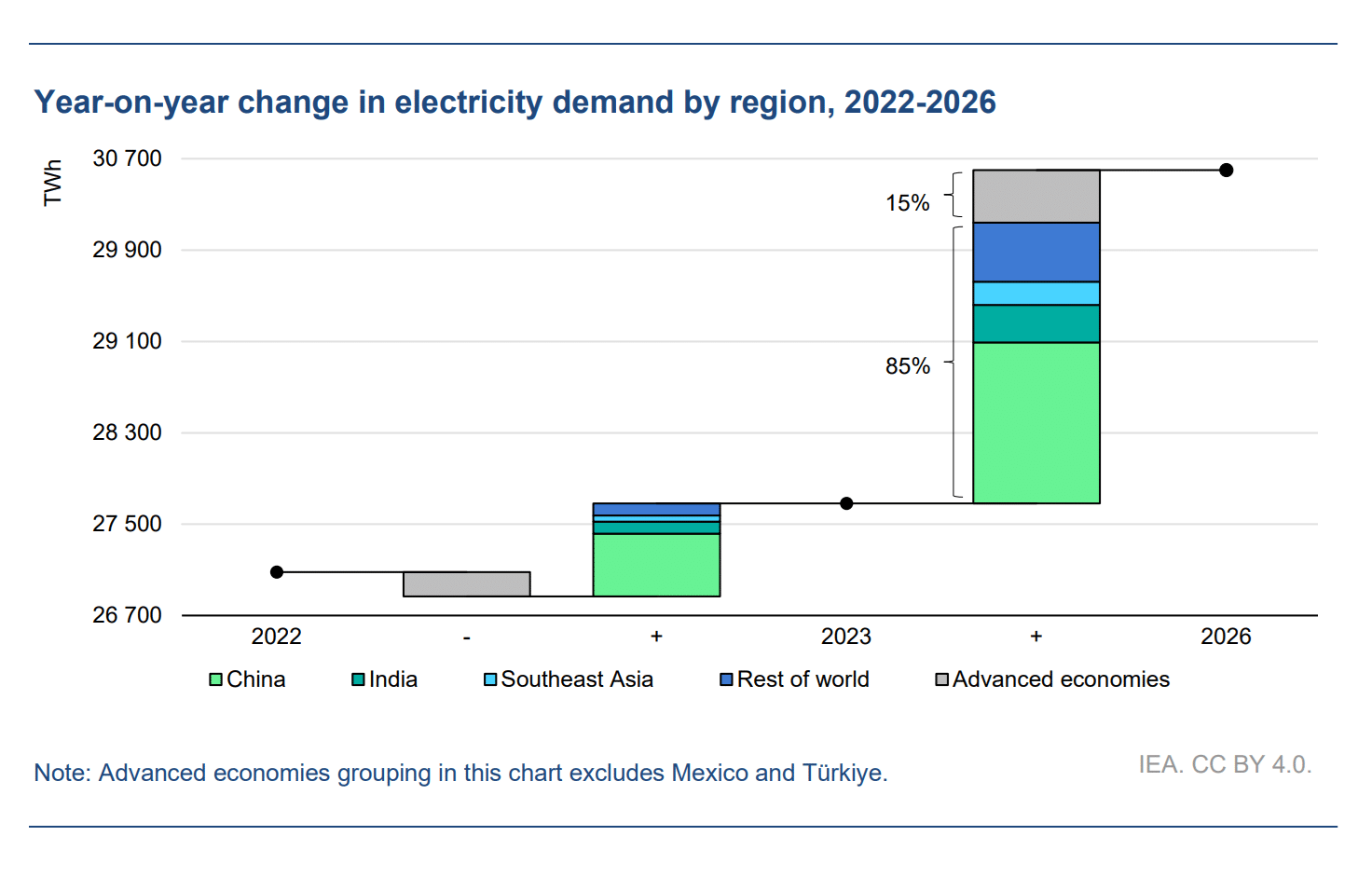

Knowledge facilities are power-hungry and their exploding power wants create ripple results on the ability sector. The International Energy Agency estimates that energy use in information facilities will enhance from 200 terawatt-hours (TWh) in 2022 to 1,050 TWh in 2026, the identical power demand as Germany.

The corporate serving the most important information heart market on the earth, Dominion Vitality Inc.at the moment focuses on constructing the Coastal Virginia Offshore Wind mission, the nation’s largest as soon as operational. The corporate has proposed delaying fossil gas retirements and including fuel capability on account of anticipated development in its service areas.

Dominion has additionally outlined a $43.2 billion capital plan for 2025–2029 following a 16-month enterprise evaluate.

One other analyst at Scotia Capital (USA), Andrew Weisel, famous that information facilities’ strong demand for steady energy generates pleasure amongst utility buyers. Nonetheless, questions stay about how prospects can pay for elevated capital expenditure (capex) and the way corporations will elevate capital. These issues come up from stubbornly excessive rates of interest.

Whereas Scotia Capital lowered goal costs throughout the US utility sector on account of rising rates of interest, analysts anticipate corporations to stay to their 2024 and long-term monetary forecasts. Furthermore, consultants emphasised that utilities are usually in an excellent monetary place and are more likely to reaffirm their development plans.

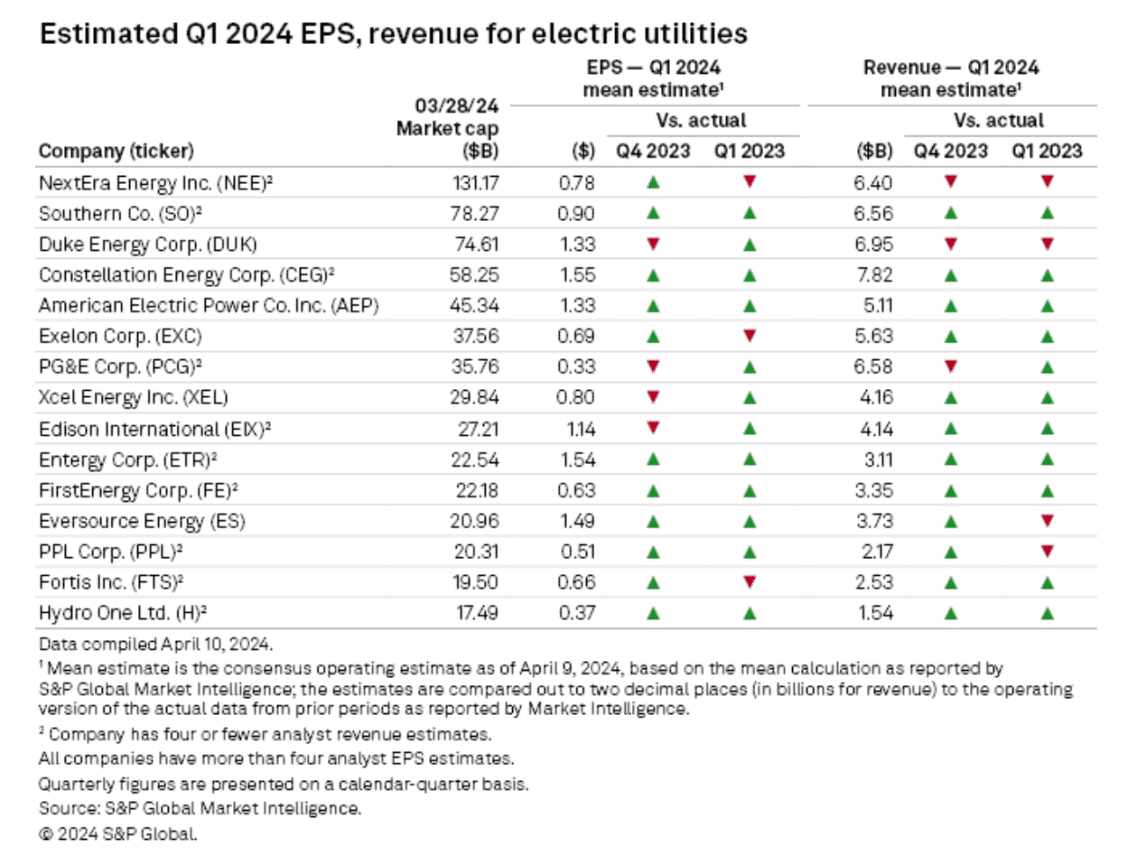

NextEra Vitality Inc., the most important electrical utility primarily based on market cap, reported first-quarter 2024 adjusted earnings that surpassed expectations and reaffirmed its 6% to eight% long-term earnings per share (EPS) development price. The corporate expects adjusted EPS of $3.23 to $3.43 for 2024, adopted by adjusted earnings of $3.45 to $3.70 per share for 2025 and $3.63 to $4.00 for 2026.

Analysts at BMO Capital Markets famous that the advance in ahead energy costs has outpaced the motion in regional fuel hub pricing. This means tightening situations within the energy market and validating buyers’ optimistic outlook on the sector.

BMO expects Constellation, NRG Vitality, and Vistra Corp. to expertise a 33% enhance in EPS in comparison with the earlier 12 months. Moreover, NextEra Vitality, with almost 60 GW of renewable technology capability, may benefit from the rising electrical energy wants of information facilities.

Capitalizing on AI Growth and Surging Vitality Demand

Amongst impartial energy producers, analysts anticipate a big give attention to methods to capitalize on the rising demand for AI. This follows Talen Vitality Corp.’s affiliate Cumulus Development Holdings LLC’s sale of a hyperscale information heart campus in Pennsylvania to Amazon Net Providers Inc. for $650 million.

The ability boasts a capability of as much as 960 MW for information facilities and will likely be powered by Talen’s 2,494-MW Susquehanna Nuclear energy plant in Luzerne County, Pennsylvania.

Latest studies from Morgan Stanley counsel that comparable offers might emerge, highlighting the potential for service provider nuclear power crops to offer on-site technology for tech corporations setting up information facilities within the US. The studies determine technology belongings totaling almost 22 gigawatts (GW) as well-positioned to reap the benefits of this development.

The studies additionally projected that AI energy demand inflicting large development of information facilities will rise to an annual common of 70% by 2027. Thus, electrical utilities, notably the regulated ones would spend money on renewable power and storage initiatives to deal with the demand.

In truth, renewable energy builders secured contracts for no less than 4,012.6 MW of capability within the 12 months. Tech corporations will use them to energy US information facilities partially or solely, per S&P World Commodity Insights information.

Lagging Behind the Fast Tempo

Whereas some utilities are racing to energy information facilities, some will not be fast sufficient to maintain tempo.

Rudy Garza, CEO of CPS Vitality, highlights the urgency of assembly the large energy calls for of those services, which regularly require lots of of megawatts of electrical energy briefly timeframes, not like conventional industrial crops with longer lead instances.

This quick want for energy presents a formidable problem for utilities striving to maintain tempo with the relentless development of data-driven industries.

Philip Nevels of AES Corp. echoes this sentiment, emphasizing the monumental process of accommodating the anticipated surge in capability wants pushed by AI and information facilities. Nevels additional acknowledges the inherent limitations in scaling up renewables quick sufficient to satisfy the escalating demand.

In the meantime, Kevin Chandra of Austin Vitality underscores the significance of collaborative planning to handle the spatial distribution of information heart hundreds successfully. Shaun Hoyte of Consolidated Edison Inc. emphasizes the crucial function of redundancy and resiliency in grid planning to mitigate potential disruptions attributable to the rising focus of information facilities.

Sunny Elebua of Exelon Corp. acknowledges the advantages of load development in advancing decarbonization efforts and optimizing grid utilization. Nonetheless, Elebua additionally highlights the challenges posed by the retirement of baseload technology and the evolving provide stack, emphasizing the significance of guaranteeing useful resource adequacy amidst these transitions.

In navigating these complexities, utilities acknowledge the necessity for state-level help to streamline regulatory processes and facilitate the fast deployment of power infrastructure to satisfy information heart calls for.

In abstract, the proliferation of AI and information facilities is reshaping the energy landscapepresenting each alternatives and challenges for utilities worldwide. Because the demand for data-driven providers continues to escalate, proactive collaboration, strategic planning, and revolutionary options are important to make sure a resilient and sustainable power future.