In a major growth, Tesla has obtained approval from South Korea’s Ministry of Surroundings to promote regulatory automotive emission credit, additionally known as carbon credit domestically, marking a pivotal second for the electrical automobile large. This transfer creates new income alternatives for Tesla whereas demonstrating a deeper integration of EVs into the South Korean market.

As reported by Korea Financial system TV, Tesla at the moment possesses round 4 million grams/km of carbon credits in South Korea. Based mostly on present penalty charges, the credit are valued at as much as 200 billion gained (round $145 million). The carmaker can promote these credit to its friends and earn beginning this yr.

Driving In direction of Web Zero: South Korea’s Inexperienced Mobility Targets

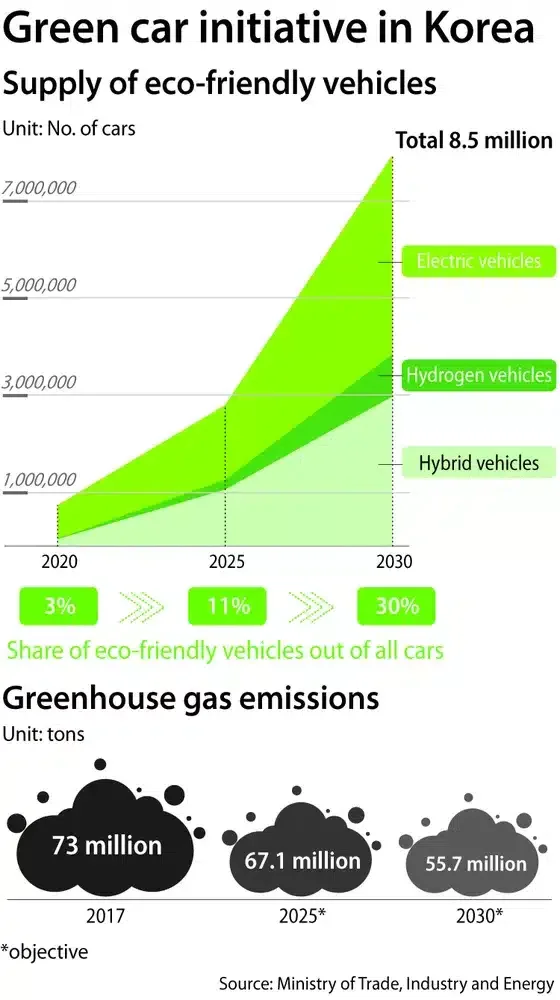

Korea’s ambitious push toward achieving 2050 net zero carbon emissions hinges on transitioning from inner combustion engines to eco-friendly autos.

The nation goals to bolster its fleet with an collected 2.8 million eco-friendly autos by 2025, encompassing battery-powered electrical autos (BEVs), fuel-cell EVsand hybrids. Waiting for 2030, the federal government targets a major growth, aiming for 7.85 million eco-friendly autos.

This may imply that 30% of all autos in Korea will draw energy from electrical energy. Moreover, a staggering 83% of newly offered vehicles in 2030 would must be eco-friendly fashions.

Such bold objectives usually are not merely symbolic; the federal government anticipates a 24% discount in GHG emissions over the subsequent decade. That is essential for the overarching goal of attaining net zero emissions by 2050.

In South Korea, rules mandate that automakers keep common greenhouse fuel (GHG) emissions under a specified commonplace. There are penalties for non-compliance, 50,000 gained per g/km, or the choice to buy credit from different firms.

The Ministry of Surroundings is accountable for implementing emission rules for engines and autos within the nation, with the Nationwide Institute of Environmental Analysis serving as an advisory physique.

Korea adopts emission requirements from both European or US sources relying on the appliance:

- Mild-duty gasoline autos adhere to US/California requirements.

- Mild-duty diesel autos observe European requirements.

- Heavy-duty vehicles and bus engines adjust to European rules.

- Cellular nonroad diesel engines adhere to US requirements.

Tesla’s Path to Carbon Credit score Approval

Tesla’s entry into the carbon credit score market in South Korea provides a brand new dimension to the nation’s efforts to deal with automotive emissions.

Nonetheless, Tesla confronted challenges in establishing itself in South Korea’s emission credit score market. The EV chief’s efforts have been initially hindered by regulatory limitations that restricted participation to automakers promoting over 4,500 autos yearly as of 2009.

However by way of persistent advocacy efforts, Tesla Korea efficiently lobbied for regulatory amendments in 2021 to allow its participation.

The ultimate hurdle was acquiring approval from the Ministry of Surroundings, which was granted earlier this yr. This clears the best way for Tesla to interact in carbon credit score buying and selling in South Korea. The Ministry highlighted the collaborative course of concerned, together with consultations with different governmental our bodies just like the Ministry of Commerce, Business, and Vitality.

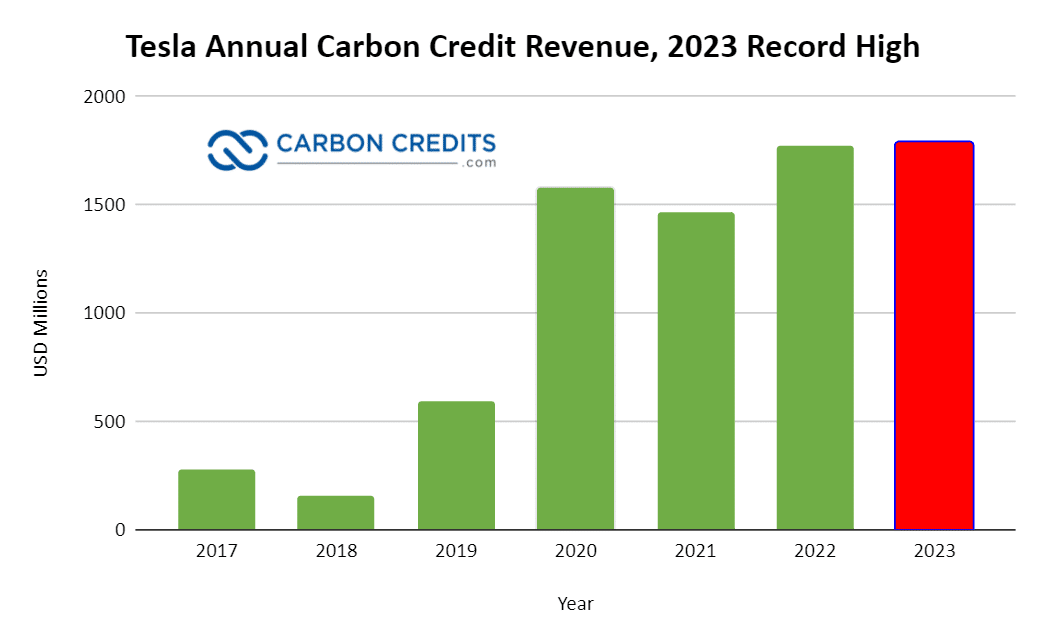

The sale of carbon credit has confirmed to be a profitable income stream for Tesla, with the chance to enter the Korean market poised to bolster the corporate’s place even additional.

Tesla’s Carbon Credit score Success

In 2023 alone, Tesla raked in $1.79 billion from the sale of carbon credit. Since 2009, the full income generated from this supply has amounted to just about $9 billion for Tesla.

In its first-quarter 2024 filings, Tesla disclosed a $442 million earnings from the sale of carbon credit. This quantity displays a modest 2% uptick from the previous quarter of This fall 2023, which stood at $433 million.

Notably, this income from credit constitutes a good portion of the corporate’s Q1 2024 web earnings, amounting to a staggering 38.6% of $1,144 million.

Tesla’s success in South Korea extends past emission credit, with the Mannequin Y’s reputation propelling Tesla to grow to be the nation’s second-largest automobile importer as of March 2024, surpassing established manufacturers like Mercedes-Benz. With 6,025 automobile registrations in March 2024, Tesla has firmly entrenched itself within the South Korean automotive market.

In abstract, Tesla’s entry into South Korea’s carbon credit score market represents a major milestone within the firm’s growth and sustainability efforts. Overcoming regulatory hurdles and securing approval positions Tesla to play an important function in shaping the way forward for automotive emissions in South Korea.