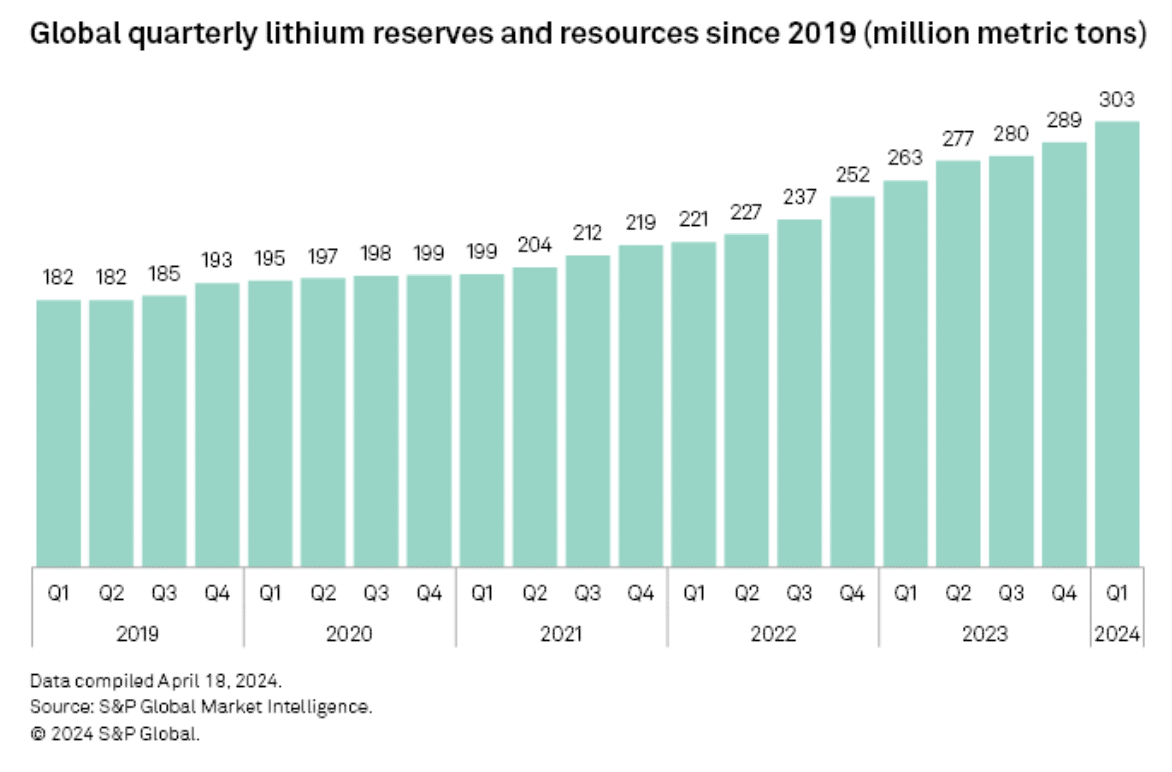

The worldwide lithium trade witnessed vital progress in reserves and assets through the first quarter of 2024, surging to 303.5 million metric tons, a exceptional 52.2% enhance in comparison with the identical interval in 2021, per S&P International Commodity Insights.

This uptrend aligns with the 2023 trajectory, the place lithium reserves and assets expanded by 36.9 million metric tons. Regardless of this surge, lithium costs skilled fluctuations. Whereas they soared to historic highs in 2022, reaching $79,650 per metric ton in China, they’ve since cooled down, resting at $15,250 per metric ton as of April 17, 2024.

Nonetheless, consultants counsel a prevailing upward trajectory in lithium demand and costs since 2016. Nevertheless, short-term challenges reminiscent of current value corrections and surpluses in battery metals have been famous.

Nonetheless, medium-term provide deficits are anticipated to maintain curiosity in lithium exploration regardless of these fluctuations.

Mining Titans: International Lithium Reserves Unearthed

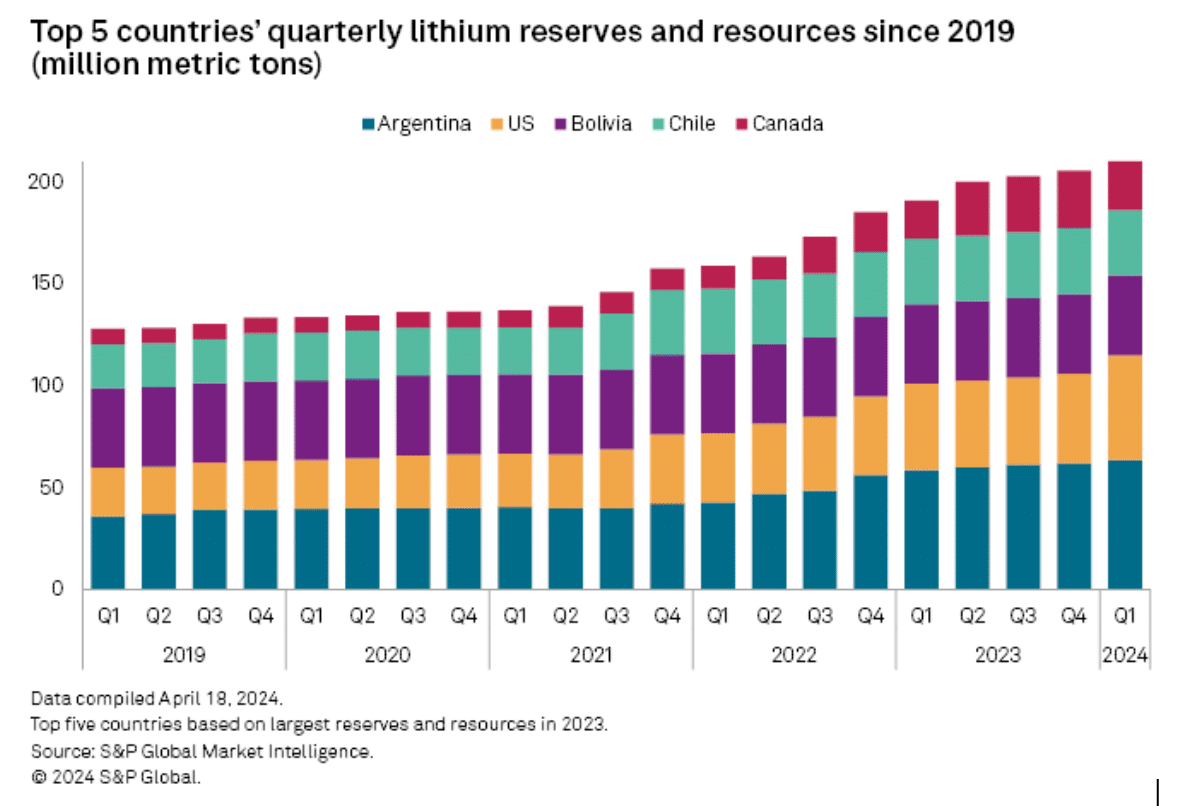

Geographically, Argentina emerges as the worldwide chief in lithium reserves and assets, contributing 29.6% within the Q1 of 2024. America comes second at 24.0% and adopted by Bolivia at 18.2%.

In the meantime, Australia, famend as the highest lithium producer globally, possesses 22.1 million metric tons of reserves and assets, securing the sixth place in world rankings.

Remarkably, Canada has proven substantial progress in its lithium sector. Its share of reserves and assets enhance by 273.1% since Q1 of 2019, amounting to twenty-eight.2 million Mt in Q1 of 2024. This progress is underpinned by a surge in lithium exploration budgets, which spiked by 120% in 2023, marking the third consecutive 12 months of enlargement.

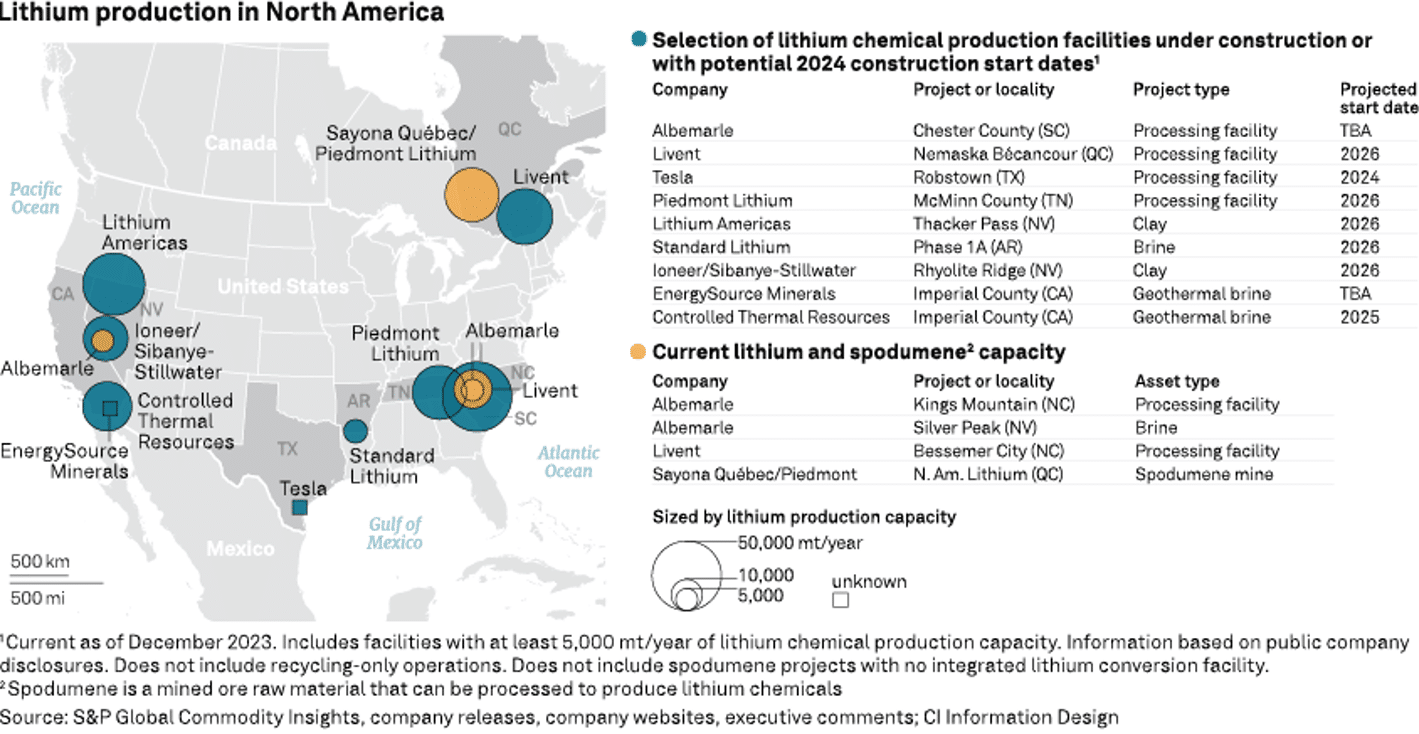

Canada, particularly Quebec, is displaying a powerful enthusiasm for the lithium and battery sectors. The nation focuses on establishing an entire provide chain from mining to electrical car (EV) manufacturing.

Jean-François Béland, Ressources Québec’s Vice President, highlighted the crucial of automotive electrification, noting the demand will likely be there, no matter occurs. He additional acknowledged that “lithium and critical minerals are, in the 21st century, what coal was in the 19th century and what oil was in the 20th century.”

Lithium’s Function within the EV Revolution

In accordance with the S&P International Commodity information, lithium-ion battery capacity is projected to succeed in 6.5 TWh by 2030. Lithium is acknowledged as a vital part in manufacturing EVs and is taken into account the cornerstone of reaching web zero emissions.

The demand for lithium-powered EV batteries is anticipated to develop yearly at a charge exceeding 22%. And the EV transport phase will seize 93% of the market share by 2030.

In response to the challenges posed by the pandemic and geopolitical tensions, firms are adopting these methods to manage:

- Reevaluating undeveloped lithium belongings,

- Expediting initiatives, and

- Exploring new alternatives.

This pattern has been additional fueled by nationwide authorities insurance policies that advocate for power transition and help battery provide chains.

The worldwide lithium exploration area has additionally witnessed vital monetary inflows. Exploration budgets skyrocketed to a historic excessive of $830 billion in 2023, marking a 77% enhance.

Notably, 4 international locations—Australia, Canada, Argentina, and the USA—every allotted over $100 million for lithium exploration in 2023. Collectively, they symbolize virtually 75% of the worldwide lithium exploration budgets for the 12 months.

Wanting forward, projections point out additional enlargement in lithium manufacturing. China anticipated to capitalize on lower-quality deposits and Bolivia is poised to raise its standing as a formidable lithium producer, leveraging its substantial lithium reserves of 39.0 million metric tons.

Balancing Demand and Manufacturing

In a separate report by Benchmark’s Stable-State and Lithium Steel Forecast, the global lithium metal production struggles to maintain tempo with the surging demand. The sector encounters challenges in securing enough lithium metallic for battery manufacturing, regardless of its substantial capability potential.

In 2024, if all viable lithium metallic produced had been allotted to batteries, it might probably help the manufacturing of 5 to 10 gigawatt-hours (GWh) of cells.

Nevertheless, a substantial portion of lithium metallic is directed in direction of different industries, leading to a provide shortfall this 12 months. This deficit is projected to escalate from almost 10 GWh in 2024 to about 60 GWh by 2026.

Curiously, buying and selling of the metallic on platforms like CME Group Inc. is witnessing a notable uptick. This has garnered extra curiosity from funds, whilst costs of battery metals decline, exhibiting market resilience.

The primary quarter of 2024 marks a pivotal second within the world lithium trade, with reserves and assets experiencing a exceptional surge. Regardless of value fluctuations, the upward trajectory in demand and costs stays evident as governments advocate for clear and sustainable power transition.