The American automaker reported 179,588 new car gross sales in April, which displays a slight lower of two.4% year-over-year. Nonetheless, within the first 4 months of the yr, Ford recorded 687,671 car gross sales, marking a 4.2% improve in comparison with the identical interval final yr.

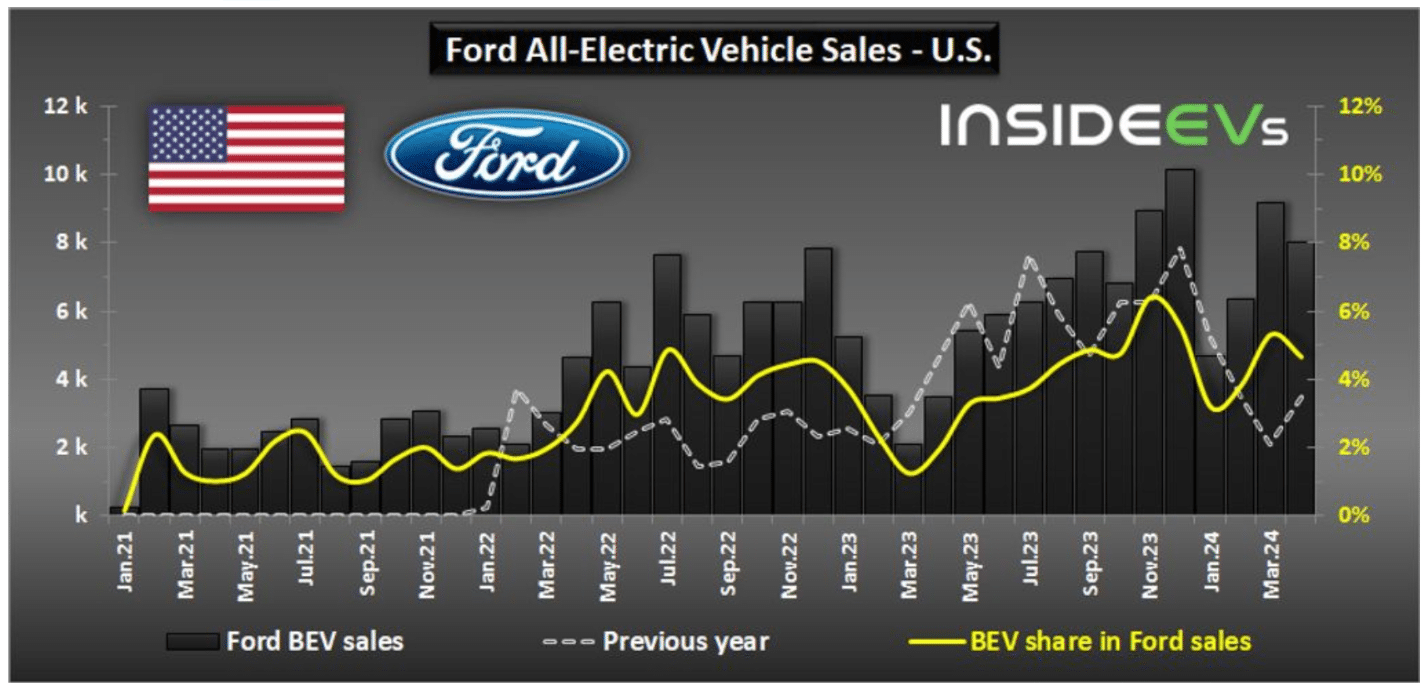

Regardless of the general softer efficiency in comparison with the earlier yr, Ford’s sales of electric vehicles (EVs) notably surged.

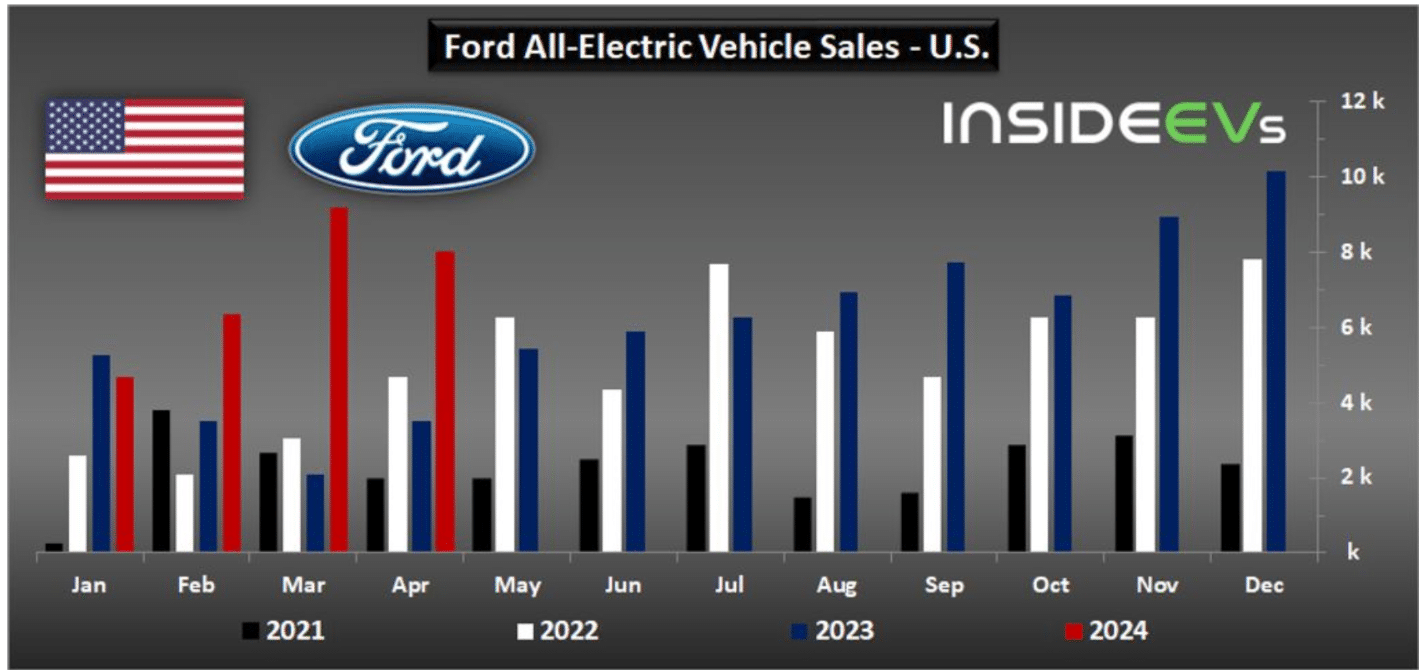

In April, Ford achieved a notable improve in EV gross sales, with 8,019 items bought, representing a exceptional 129% progress from the earlier yr. This surge in EV gross sales is promising for the corporate’s efficiency within the second quarter.

Moreover, the proportion of EVs out of Ford’s whole gross sales quantity elevated considerably, reaching 4.7%, up from 2.0% a yr in the past.

All three of Ford’s EV fashions contributed to this progress. The corporate bought 4,893 items of the Mustang Mach-E (up 205% year-over-year), 2,090 items of the F-150 Lightning (up 57% year-over-year), and 1,036 items of the E-Transit (up 86% year-over-year).

Within the U.S. market, Ford has bought over 28,000 all-electric autos up to now this yr, marking a considerable 97% improve from the earlier yr. These EV gross sales represent about 4.3% of Ford’s whole gross sales quantity.

Trying forward, Ford goals to succeed in 100,000 items of EV gross sales this yr. The corporate anticipates additional progress, significantly within the gross sales of the F-150 Lightning, regardless of a slower begin in 2024 in comparison with expectations. Ford not too long ago resumed transport the 2024 mannequin yr of the F-150 Lightning after a hiatus of over two months, accompanied by new pricing changes.

In April, the Ford Mustang Mach-E gross sales reached 4,893 items, reflecting a major 205% improve from the earlier yr. Nonetheless, manufacturing ranges of the Mach-E in Mexico have decreased in comparison with final yr, presumably as a consequence of provide outpacing demand.

The Ford E-Transit van additionally skilled strong gross sales progress in April, with 1,036 items bought, marking an 86% improve year-over-year. Nonetheless, Ford doesn’t disclose gross sales figures for different plug-in fashions, such because the Ford Escape PHEV, and Lincoln’s PHEV gross sales knowledge stays undisclosed as effectively.

Powering the EV Surge

Similar with different automakers, Ford’s EV surge depend on a crucial mineral hailed as “white gold” – lithium. Lithium is a key part within the batteries that energy EVs.

In response to a report by S&P World, lithium prices noticed a slight improve in March. This uptick might be attributed to a number of elements, together with manufacturing cuts, public sale outcomes, and a extra optimistic outlook concerning demand for traction batteries.

Many lithium producers have highlighted the problem of precisely predicting the costs they may obtain for his or her merchandise throughout their fourth-quarter 2023 earnings calls. In response to altering market situations, the world’s largest lithium producers adjusted or modified their funding methods.

Nonetheless, strategic investments aimed toward securing future lithium provide are on the rise, with main automakers and lithium producers committing over $1 billion in 2023 alone.

For instance, GM invested $650 million in Lithium Americas, whereas Albemarle allotted $110 million to lithium developer Patriot Battery Metals. Projections say this development will persist as corporations try to make sure their entry to uncooked supplies for EV batteries.

Securing Lithium for World EV Enlargement

As EV penetration expands worldwide, the demand for lithium is projected to surpass provide, significantly as EVs grow to be mainstream.

The German luxurious carmaker, Mercedes-Benznot too long ago revealed its all-electric truck, the G-Wagon. In the meantime, the EV large, Teslareported a dip in its income with decrease car gross sales, however manufacturing targets stay sturdy.

Batteries represent a considerable portion of EV prices, presenting a possibility for EV makers to both increase income per car bought or, extra seemingly, scale back costs to remain aggressive as opponents do the identical. Decrease costs sometimes entice extra consumers, resulting in elevated demand for lithium.

Ford’s latest gross sales report reveals a blended efficiency in total car gross sales however reveals a major surge in EV gross sales, signaling promising progress whereas underlining Ford’s dedication to electrical mobility that aligns with broader EV market developments.

As Ford targets 100,000 items of EV gross sales this yr, strategic investments in securing future lithium supply and the worldwide growth of EV penetration are pivotal.