Join daily news updates from CleanTechnica on e mail. Or follow us on Google News!

A brand new report explores how Europe can efficiently construct a sustainable battery worth chain

Govt abstract

As Europe is decarbonising its economic system, it’s going through a monumental problem to rebuild the fossil-based system right into a carbon free one. Batteries and the supplies that go into making them are central to our effort to scrub up vehicles, vehicles and buses in addition to to broaden renewable vitality networks. A 12 months in the past, as T&E estimated that two-thirds of Europe’s introduced battery plans are in danger, the EU introduced a raft of measures in response to the US Inflation Discount Act. So one 12 months on, what does the progress in constructing battery provide chains appear to be? This report analyses the progress, in addition to challenges related to onshoring this provide chain, offering an industrial footprint for governments to construct an area, resilient and sustainable battery provide chain.

Key findings embrace:

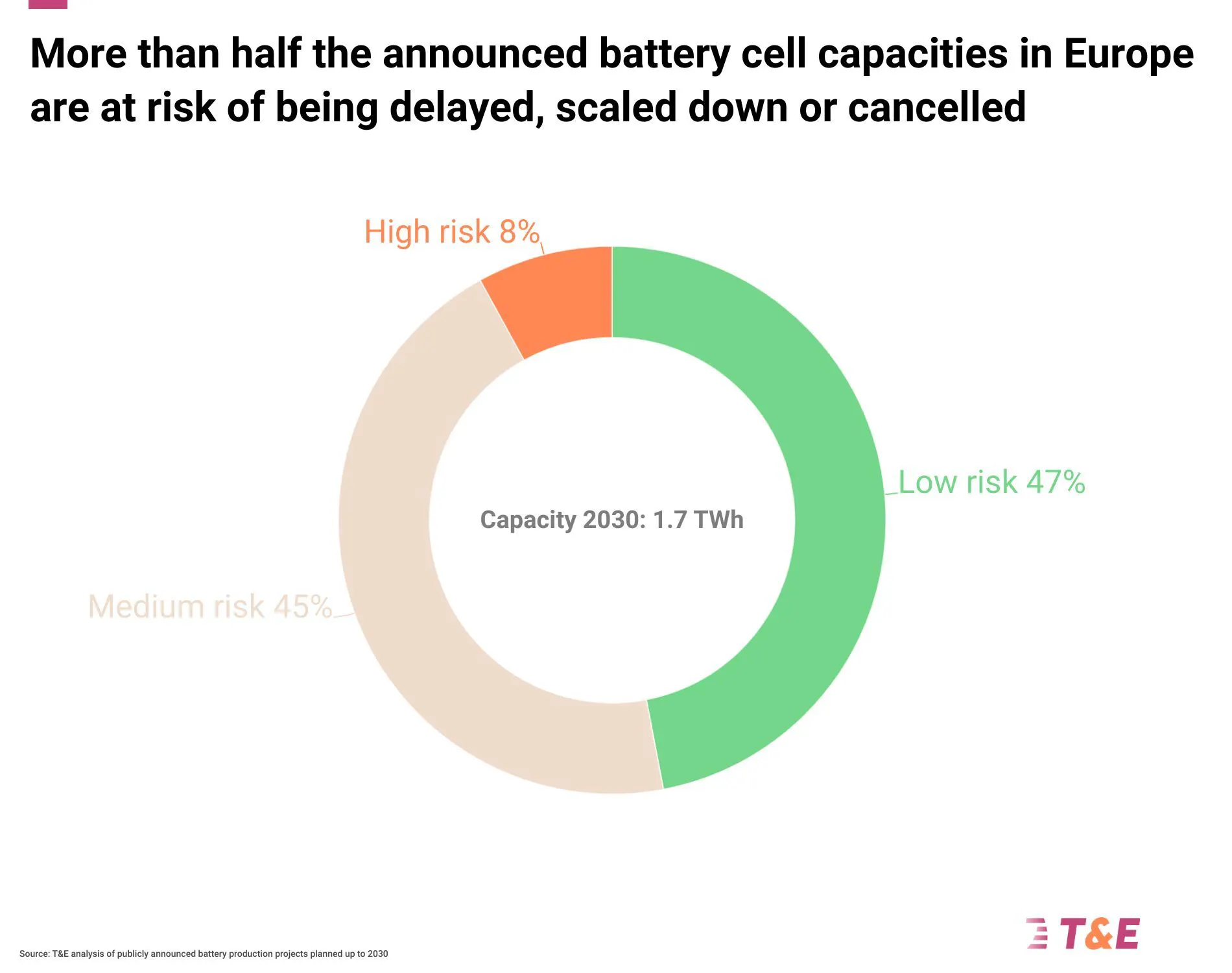

- Europe can turn into self-sufficient in battery cells by 2026, and manufacture most of its demand for key elements (cathodes) and supplies equivalent to lithium by 2030. However over half of gigafactory plans in Europe stay prone to both being delayed or cancelled, down from near two-thirds a 12 months in the past.

- Onshoring the battery provide chain gives vital local weather advantages: 37% discount in carbon emission when utilizing the EU grid, or 133 Mt of CO2 by 2030 in comparison with China. When counting on predominantly renewable vitality sources, the reductions double to 62%.

- Nevertheless, lots of the introduced initiatives stay unsure and, given the nascent nature of this trade in Europe, wouldn’t occur with out stronger authorities motion.

- The economic coverage blueprint ought to embrace sustaining the funding certainty (by way of the 2035 clear automobile purpose), offering EU-level funding assist and stronger made in EU provisions for best-in-class initiatives.

Europe shouldn’t be ranging from scratch. Years of bold coverage to safe an area electrical car market, in addition to the efforts of the European Battery Alliance, have resulted in dozens of battery investments and bulletins all through the provision chain.

Chapter 1

Vital native potential exists

Europe shouldn’t be ranging from scratch. Years of bold coverage to safe an area electrical car market, in addition to the efforts of the European Battery Alliance, have resulted in dozens of battery investments and bulletins all through the provision chain.

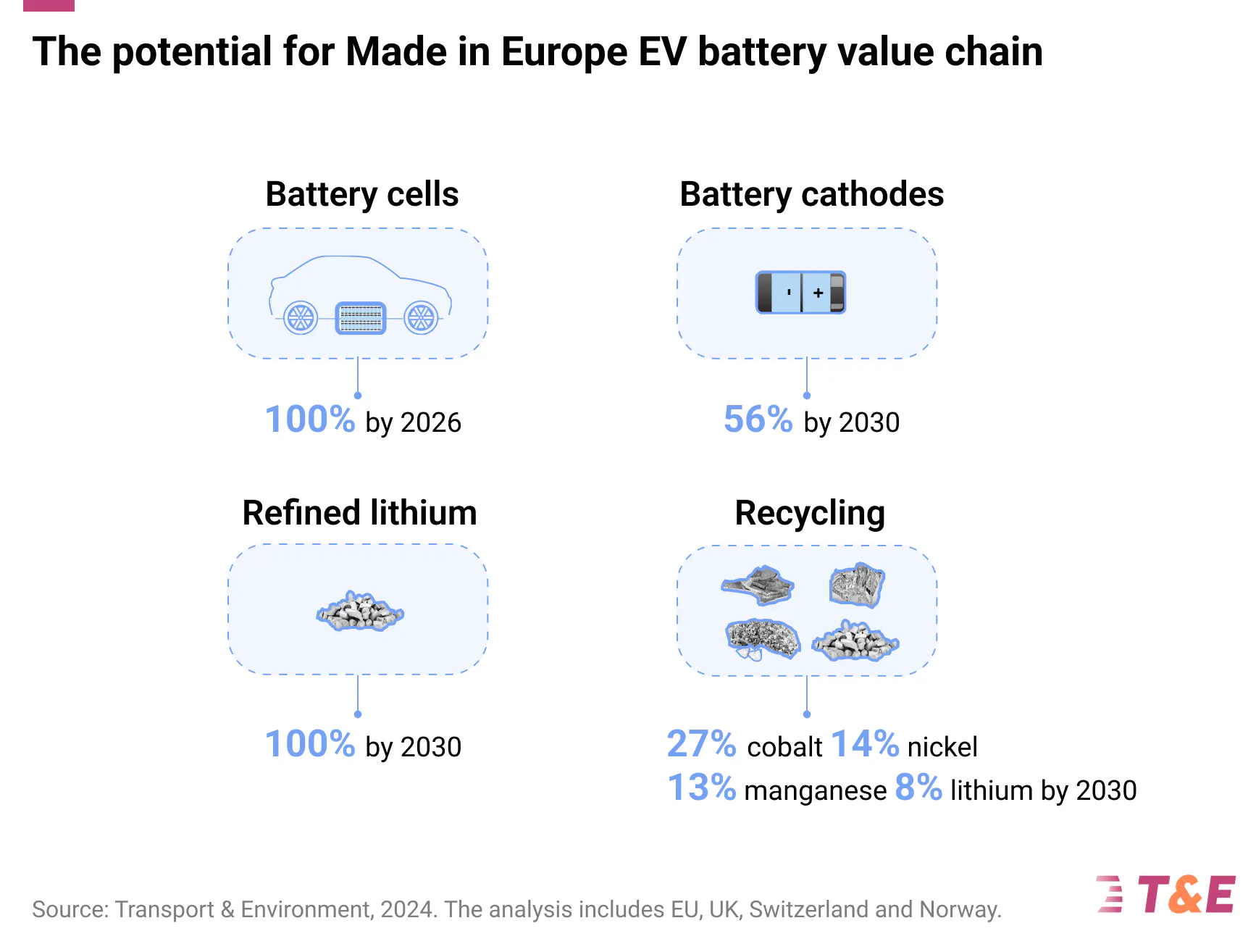

Based mostly on the newest bulletins, Europe can:

- Grow to be self-sufficient in native battery cell provide from as early as 2026

- Provide over half (56%) of battery’s most useful elements – cathodes – by 2030, into which important minerals equivalent to nickel and lithium are processed

- Provide all of its processed lithium wants by 2030, and

- Safe between 8% and 27% of battery minerals provide from domestically recycled sources by 2030.

However these plans are all at completely different phases of maturity and require long-term political imaginative and prescient and focused industrial technique to materialise. On prime, Europe shouldn’t be working in a vacuum: a fierce “battery arms race” is occurring the world over, from China’s overcapacity leading to imports of low cost EVs and batteries into Europe to rising useful resource nationalism throughout the International South. The dangers to Europe’s onshoring ambition are many-fold.

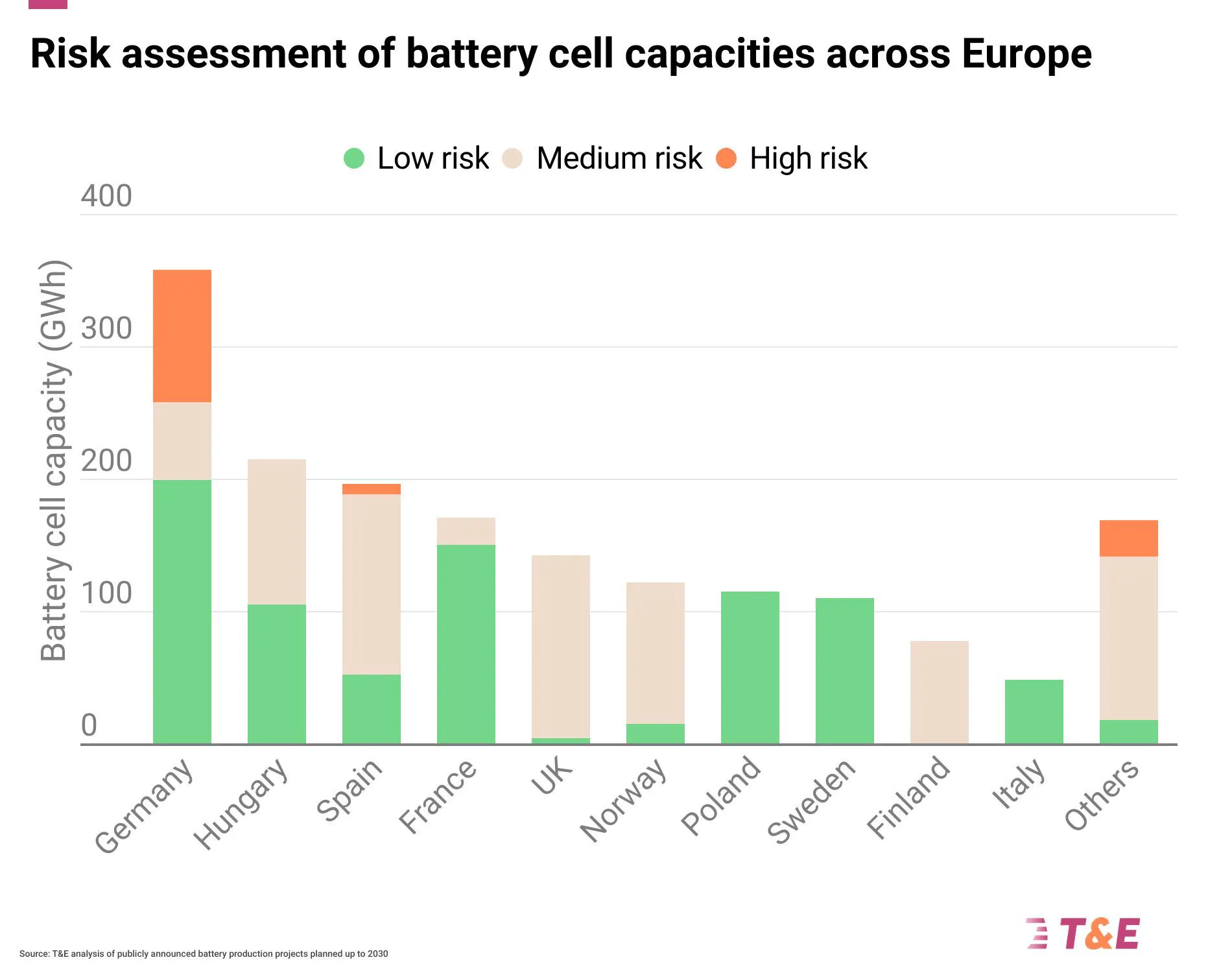

A 12 months since T&E began assessing the viability of battery plans, over half of gigafactory plans in Europe stay prone to both being delayed or cancelled, down from near two-thirds a 12 months in the past. That is an enchancment of 15%. ACC in France kicked off manufacturing within the final 12 months, whereas Northvolt’s second gigafactory in Germany was saved due to the German state’s beneficiant subsidy to counter the US IRA. Due to an analogous assist package deal in France, Verkor is about to begin business manufacturing in France. Then again, some corporations – notably Freyr and VW’s PowerCo – have downgraded their plans. Total, the capacities at low threat quantity to round 815 GWh, adequate to energy 13.6 million electrical vehicles.

Throughout Europe, Finland, the UK, Norway and Spain, with initiatives by the Finnish Minerals Group, West Midlands Gigafactory, Freyr and Inobat, have the best shares of capability at excessive or medium threat. Then again, France, Germany and Hungary have made probably the most progress in securing capability in comparison with final 12 months.

Going additional mid- and up-stream reveals extra dangers. Whereas plans to construct cathode lively materials amenities throughout Europe exist, these have skilled much less improvement than cells, with the area going through important gaps when it comes to challenge improvement. These symbolize over half of the battery’s worth with their manufacturing virtually completely concentrated in China immediately. This highlights the urgency of creating home capabilities to permit Europe to seize the total worth chain. However solely Umicore in Poland and BASF in Germany have began business operations up to now, with Northvolt piloting a small batch manufacturing in Sweden. Nevertheless, within the final 12 months plenty of corporations, predominantly Chinese language, have introduced plans to arrange cathode amenities on the continent.

Taking a look at battery metals, lithium refining initiatives maintain excessive potential for Europe’s self-sufficiency. From a really restricted lithium chemical substances manufacturing immediately, the introduced capacities may cowl the area’s wants by 2030. The most important capacities are situated within the UK (e.g. Tees Valley Lithium and Inexperienced Lithium), Germany (e.g. Vulcan Vitality Sources and Livista Vitality) and France (e.g. Lithium de France and Imerys). However many of those initiatives are nonetheless in early phases of improvement. Within the nickel house, the prevailing nickel sulphate plans can probably cowl a fifth of future demand from electrical car and vitality storage batteries.

Chapter 2

The advantages of onshoring are vital

Onshoring the battery provide chain gives extra management over how issues are completed. Native manufacturing means Europe can set and implement environmental and social requirements, in addition to stipulate the efficient and significant engagement of native communities. Localising the battery worth chain can even result in shorter provide chains and lowered transportation-related emissions, on prime of Europe’s comparatively excessive share of renewables to profit cleaner processes.

From a pure local weather perspective, manufacturing among the extra vitality intensive and useful elements in Europe may even cut back carbon emissions. Producing battery cells domestically in comparison with China on common saves 20-40% of carbon emissions, whereas onshoring cathode manufacturing would save as much as a fifth moreover. Native sources of nickel can be 85-95% decrease in emissions than the present provide from Indonesia, whereas lithium will include an as much as 50% enchancment to Australian ore processed in China. Total, the carbon advantages of onshoring into Europe are within the order of 37% carbon emission discount based mostly on the EU grid, rising to over 60% when predominantly renewable vitality sources are used. In comparison with a completely imported provide chain, producing Europe’s demand for battery cells and elements domestically would save an estimated 133 Mt of CO2 by 2030, corresponding to the emissions produced by whole Chile or the Czech Republic in 2022.

Chapter 3

But it surely gained’t be simple

However reaping these local weather and industrial advantages is not going to be simple. Vital challenges in scaling the European battery worth chain exist. First, securing the battery uncooked supplies themselves. T&E estimates that the obtainable home provide from main mined and secondary sources can on common cowl 35%-70% of finish use battery demand (or 45%-100% of cathode processing demand) by 2030, however many mining initiatives stay unsure and face native opposition. Finally, a world uncooked supplies technique and sharp diplomacy shall be wanted to safe the supplies for Europe’s ambition with each Europe’s pursuits and native improvement targets in thoughts.

One of many key questions requested is that if Europe can develop the experience and abilities crucial to construct up this capability. Whereas some progress has been made on cell making (with over half of Europe’s wants already produced domestically by European and Asian corporations), the midstream worth chain is much less sure. Nevertheless, T&E evaluation exhibits that lots of innovation and abilities can be found domestically. E.g. a lot progress is occurring within the space of lithium processing, with Europe being one of many main continents in growing the clear direct lithium extraction applied sciences (15% of all lithium initiatives plan to make use of that), and the primary continent that goals to commercialise the cleaner bioheap leaching route for nickel refining (in Finland).

Whereas China undoubtedly has a lead in cathode making, European corporations do have the required experience in chemical substances and hydrometallurgy essential to scale this sector. The present efforts are focusing on effectivity and course of step discount, in addition to utilizing cleaner processes, to cement a European edge. On abilities, T&E finds that whereas there’s a scarcity of direct metallurgical staff, the adjoining abilities will be drawn from the petrochemicals, prescribed drugs and materials science sector amongst others. A few of these adjoining industries – notably oil and automotive catalysts – are anticipated to say no within the coming years, so provide a terrific reskilling alternative.

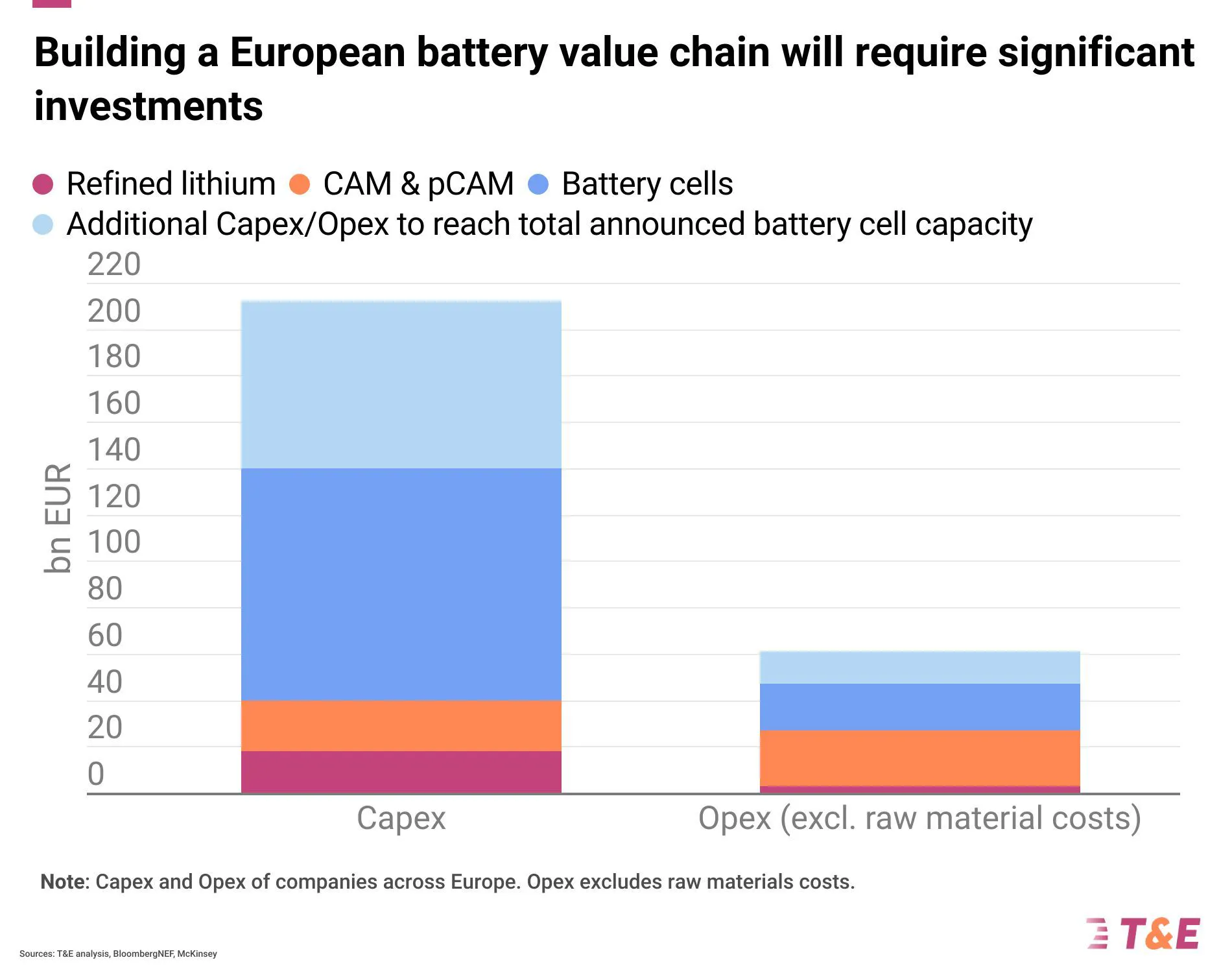

On the identical time, each capital expenditure (CAPEX) and operating, or operational (OPEX) prices, of constructing and operating battery cell, element and materials amenities are among the highest in Europe. This is because of much less experience constructing these amenities, in addition to because of greater vitality and labour prices (a minimum of in comparison with China). T&E estimates that growing all of the introduced plans for battery cell manufacturing, cathode and precursor amenities and lithium refining in Europe (together with non-EU international locations) would require EUR 215 billion in CAPEX and EUR 61 billion in annual OPEX, coming primarily from non-public funding. If Europe aimed, for instance, to match the operational assist offered beneath the US IRA, it could want to offer round EUR 2.6 bn in OPEX assist on an annual foundation alone.

Chapter 4

Key suggestions

In a nutshell, whereas the numerous potential to construct an area and clear battery provide chain exists, the dangers are manifold. With out political management and robust insurance policies Europe will wrestle to create the enterprise case amidst the fierce international competitors.

T&E presents its personal industrial blueprint for the governments throughout Europe.

s Europe.

- Clear coverage and long-term imaginative and prescient are paramount to safe funding into battery provide chains. This contains the 2025-2035 automobile CO2 ambition that should stay unchanged, in addition to further ambition to impress fleets and create a European compact BEV trade.

- Sturdy insurance policies to safe native manufacturing, away from overreliance on imports. This contains robust sustainability necessities to reward native clear manufacturing (such because the upcoming battery carbon footprint guidelines), sooner implementation of initiatives beneath CRMA and NZIA and a revamped commerce coverage. Crucially, complete funding assist shall be important to construct the provision chain throughout Europe, together with higher devices beneath the European Funding Financial institution and a rapidly operationalised EU Battery Fund.

- All of this should be completed sustainably, breaking with the previous practices in metallic provide chains the world over. This implies constructing the worldwide uncooked materials partnerships on excessive requirements and supporting native worth add in resource-rich international locations. Europe also needs to decide to convey its personal mining practices according to international greatest follow, notably on tailings administration.

Batteries, and metals that go into them, are the brand new oil. European leaders will want laser sharp focus, robust and joint up pondering and, above all, stepping out of the consolation zone to succeed. The prices of failing are excessive and may end up in Europe shedding out on whole industrial sectors. Some progress has been made within the final 12 months, however the subsequent European Fee and Parliament have a monumental job of ending the job.

Report courtesy of Transport & Environment

Have a tip for CleanTechnica? Wish to promote? Wish to recommend a visitor for our CleanTech Speak podcast? Contact us here.

Newest CleanTechnica.TV Video

CleanTechnica makes use of affiliate hyperlinks. See our coverage here.