The surge in copper demand is pushed by its pivotal function in renewable vitality era, electrical automobiles, and grid infrastructure essential for attaining internet zero emissions. Market dynamics and international provide considerations have propelled copper costs upward, with prime firms witnessing vital development.

Copper Surge and Market Dynamics

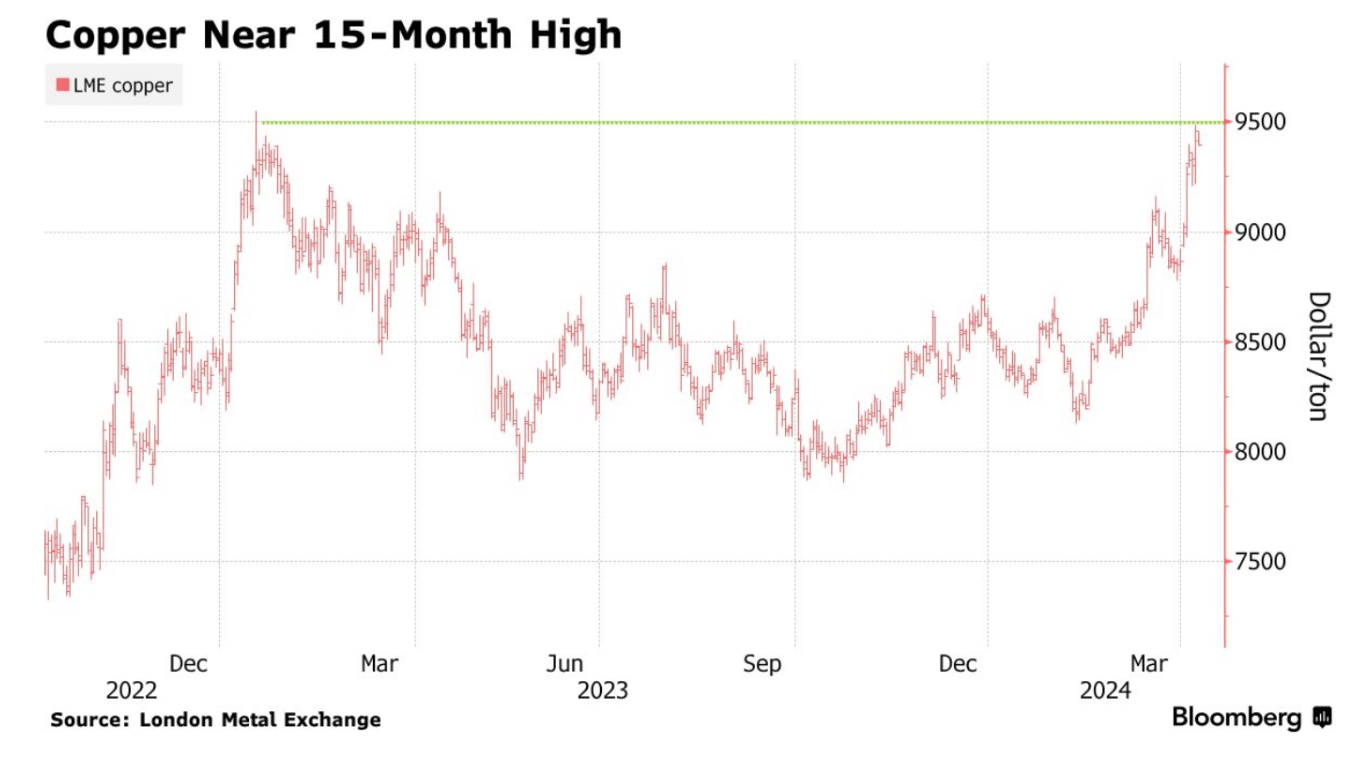

One key occasion that influenced copper market dynamics was the closure of the Cobre Panama mine, a considerable international copper supply. This closure shifted market expectations from surplus to deficit, contributing to the upward trajectory of copper prices.

Moreover, in March, Chinese language smelters determined to scale back output amid a focus scarcity, additional boosting costs.

Market analysts attribute this pattern to a mixture of speculative shopping for and real provide constraints, suggesting the potential for a sustained bullish marketplace for copper. Many copper-focused equities are presently buying and selling at or close to their 52-week highs, indicating investor confidence within the sector’s future prospects.

Whereas the rally in copper costs is encouraging for traders, analysts warning that the market must validate this pattern past short-term momentum. The sector’s efficiency might considerably affect earnings, notably if copper maintains its value above $4 per pound.

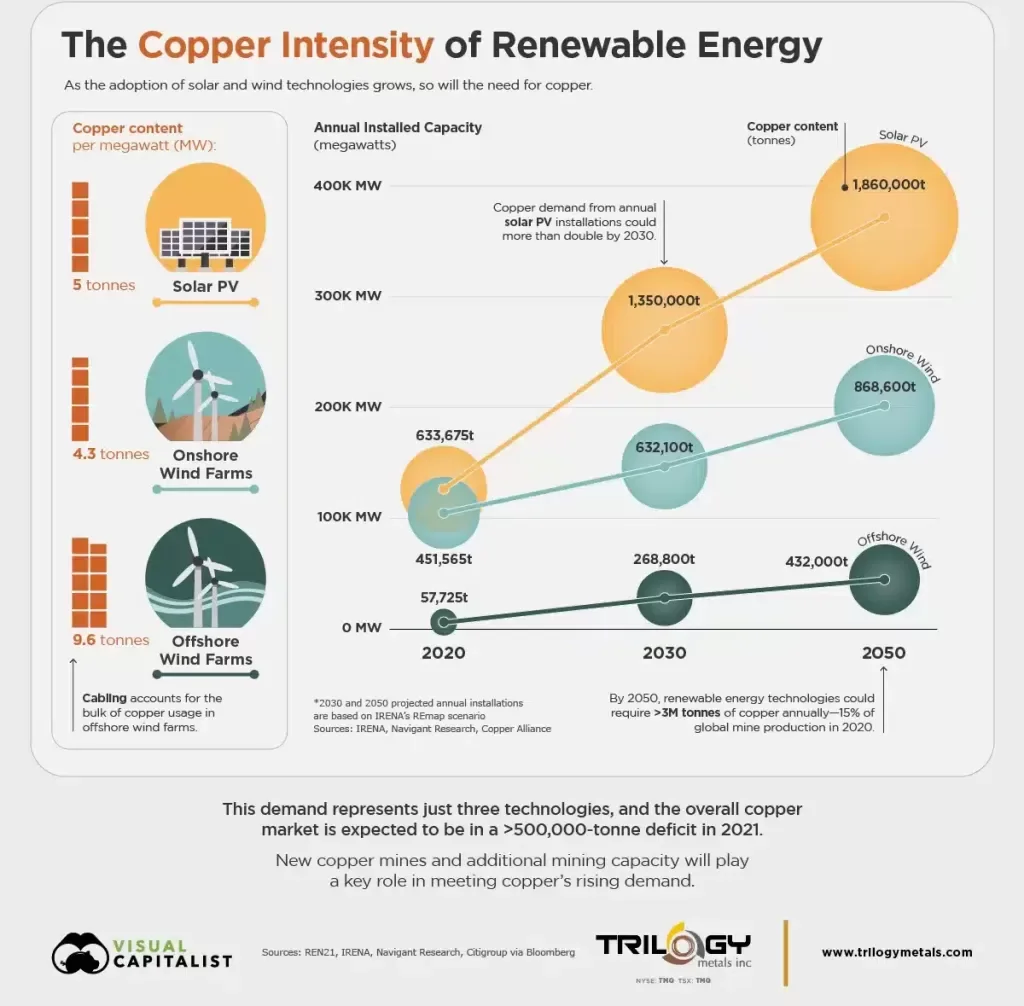

Copper’s significance within the transition to net zero emissions can’t be overstated. Its indispensable properties, together with excessive electrical conductivity, thermal effectivity, and recyclability, make it important for renewable vitality methods, electrical automobiles, and infrastructure improvement.

Renewable energy applied sciences, akin to photo voltaic photovoltaics and wind generators, require vital quantities of copper for environment friendly transmission and distribution of electrical energy. Electrical automobiles additionally rely closely on copper for elements like motors, inverters, and electrical wiring.

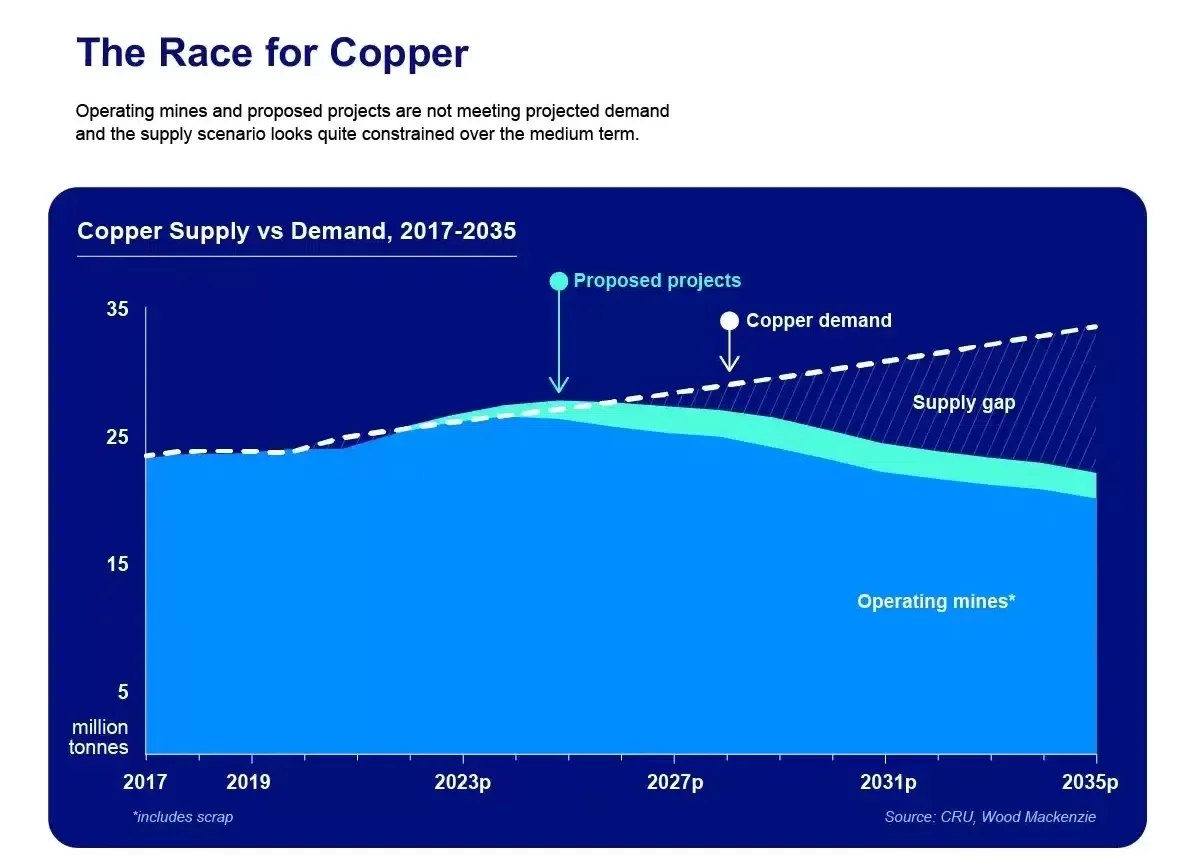

Regardless of its essential function, the demand for copper is projected to outpace provide development, resulting in considerations about potential shortages. Addressing these challenges requires strategic investments in copper manufacturing and recycling to help the worldwide shift towards sustainable vitality sources and obtain internet zero emissions objectives.

Driving Decarbonization Efforts

Regardless of the provision of less expensive options like aluminum, copper stays unparalleled in its effectivity and effectiveness for varied purposes essential for decarbonization efforts.

From family home equipment to EVs and renewable vitality infrastructure, copper is in all places. The common automotive accommodates about 65 kilos (29 kilograms) of copper, whereas a typical family boasts over 400 kilos.

Nevertheless, it’s within the building of superior grid methods able to managing electrical energy from decentralized renewable sources the place copper really shines. Photo voltaic and wind farms, masking huge areas, require extra copper per unit of energy generated in comparison with conventional energy stations.

To satisfy bold internet zero targets by 2035, annual copper demand could must double to 50 million metric tons, based on trade estimates. Even conservative projections anticipate a one-third enhance in demand over the subsequent decade, pushed by substantial investments in decarbonization initiatives by each private and non-private sectors.

Nevertheless, assembly this escalating demand poses vital challenges. Whereas copper recycling is rising, it’s unlikely to suffice, leaving main mining as the first supply. But, increasing copper mining faces obstacles.

Ore grades are declining, necessitating extra intensive mining operations to yield the identical output. Furthermore, environmental considerations surrounding mining actions dampen funding enthusiasm.

Nonetheless, the surge in copper costs has heightened hypothesis a couple of potential provide crunch. Addressing an anticipated annual provide shortfall of 8 million tons over the subsequent decade might require a staggering $150 billion funding, based on estimates. Nevertheless, reaching such funding ranges would possible necessitate copper costs to achieve report highs.

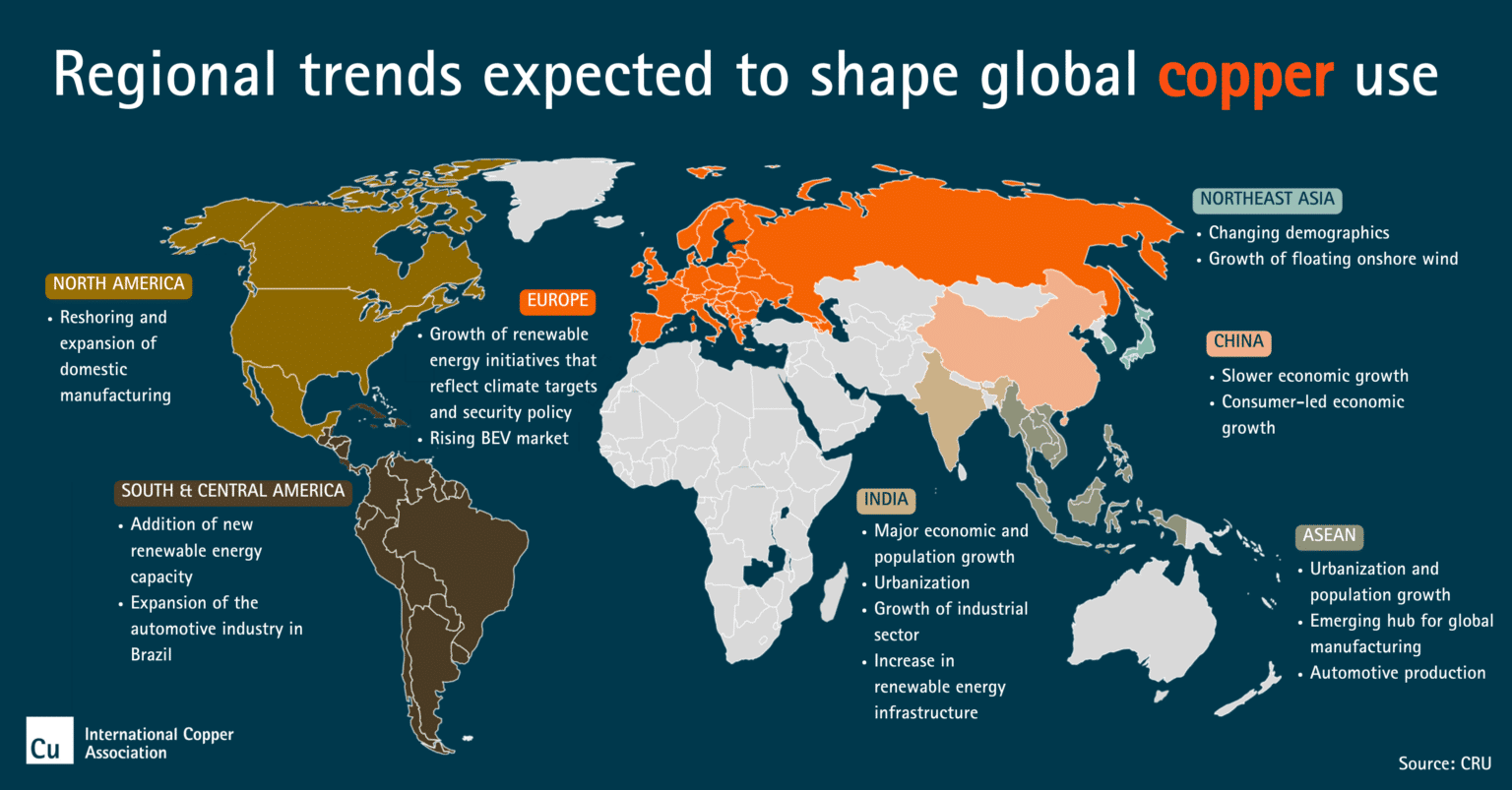

Market consultants additional noticed that whereas international demand for copper will rise, development charges range considerably throughout completely different areas. They underscored that regional macroeconomic circumstances sometimes affect copper demand, as proven within the map under.

Components Affecting Copper Costs in 2024 and Past

The uncertainties surrounding China’s financial restoration, notably the challenges within the property sector evidenced by the liquidation order in opposition to China Evergrande Group, pose a big headwind for copper costs in 2024.

Regardless of expectations for extra stimulus, the Chinese language authorities opted for a development goal of 5%, emphasizing “high-quality development.” The Worldwide Financial Fund (IMF) tasks China’s financial development to sluggish to 4.6% in 2024.

Chinese language copper smelters have initiated manufacturing cuts to deal with uncooked materials shortages, indicating potential provide constraints. In the meantime, the US Federal Reserve’s financial coverage choices are intently monitored, with expectations of price cuts probably impacting copper costs.

Analysts forecast an upward trajectory for copper costs in 2024 and past, pushed by supply-demand imbalances, the US rate-cutting cycleand rising demand from the inexperienced vitality sector.

- BMI tasks copper to common $8,800 per ton in 2024, whereas ANZ Analysis expects $8,950 per ton.

Waiting for 2025, analysts anticipate continued value development, with BMI projecting $9,300 per ton, whereas ING forecasts round $9,050 per ton. Lengthy-term copper value forecasts are unsure however are anticipated to stay excessive on account of rising demand pushed by the energy transitionnotably in EVs and renewable energy.

As copper more and more shapes international financial dynamics, nations are vying for entry to restricted future provides, notably contemplating that a good portion of copper ore is mined in Latin America and Africa. This underscores the strategic significance of securing home or pleasant sourcing and refining capabilities for important metals like copper.

As renewable vitality infrastructure and electrical automobile adoption continues to develop, strategic investments in copper manufacturing and recycling are essential to fulfill rising demand and obtain internet zero emissions objectives.