Arcadium Lithium PLC introduced spectacular first-quarter earnings, revealing a median realized pricing of over $20,000 per metric ton for its international lithium carbonate and hydroxide gross sales.

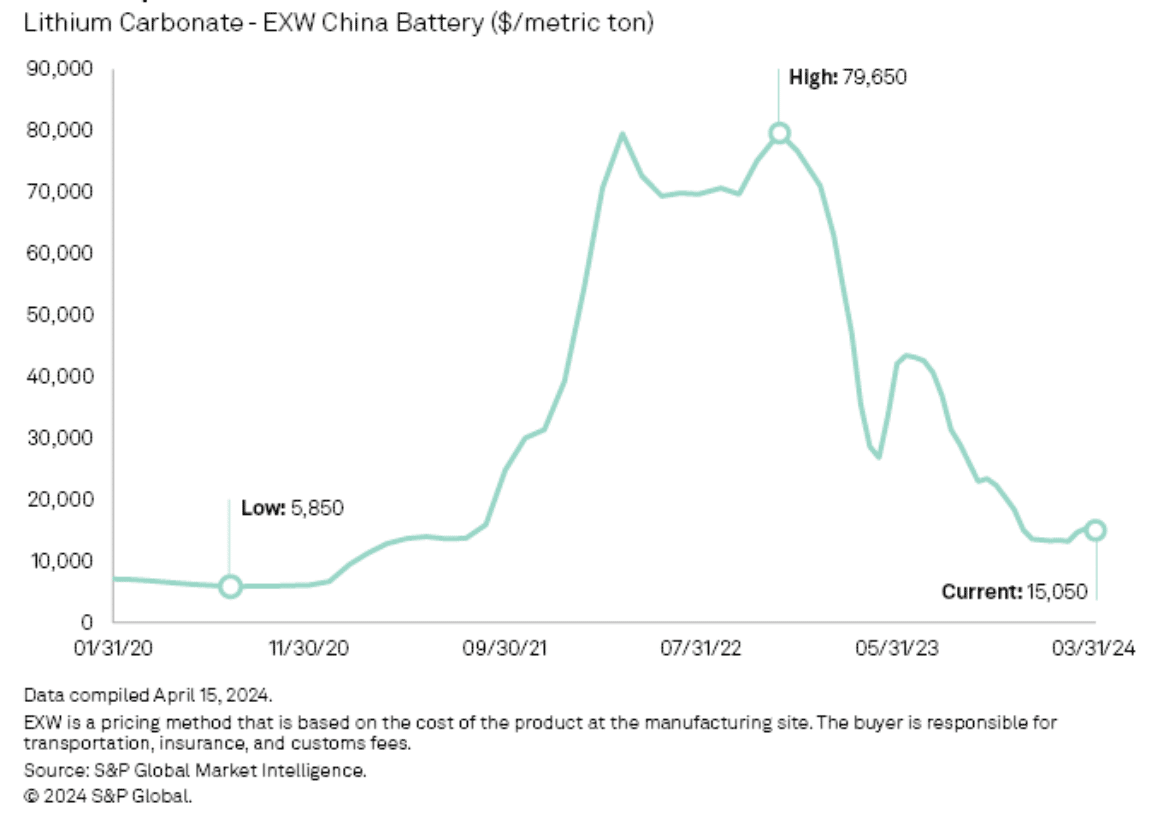

CEO Paul Graves famous this exceeded seaborne lithium prices for the interval, indicating constructive market tendencies. Platts assessed the lithium carbonate CIF North Asia worth at $14,600/t on Could 7, the very best stage since January 11.

The corporate stays optimistic, with Graves highlighting encouraging indicators within the lithium market and powerful underlying demand fundamentals. He particularly famous that:

“Prices have increased from the cycle bottom and appear to have stabilized at levels that are notably higher than what we saw in the last downturn.”

Lithium Elevate-Off: Arcadium’s Document-Breaking 1st Qtr

Arcadium’s efficiency is especially noteworthy given its latest formation from the merger of Livent Corp. and Allkem Ltd. in January. Nonetheless, it noticed a decline in gross sales volumes as a consequence of manufacturing cuts on the Mt Cattline mine in Western Australia.

Nonetheless, the corporate reported a internet earnings of virtually $20 million on gross sales of over $261 million within the first quarter, in comparison with $115 million earnings on gross sales of $253 million in the identical interval final 12 months.

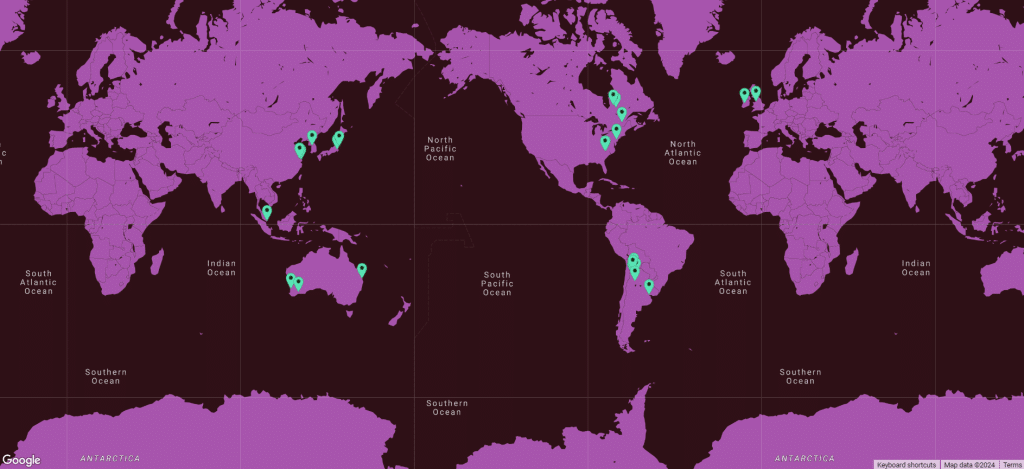

Arcadium is poised for important growth, with plans to finish new capability constructions and expansions by 2025 and 2026. This effort goals to realize a complete manufacturing capability of 170,000 metric tons yearly throughout its international operations by 2026.

The expansions will enhance nameplate manufacturing functionality by round 95,000 metric tons per 12 months on a lithium carbonate equal foundation. This contains additions in Argentina, with 25,000 metric tons throughout the Fénix and Sal de Vida initiatives, and in Canada, with 70,000 metric tons throughout the Nemaska and James Bay initiatives.

Latest milestones embody commissioning a ten,000-metric-ton carbonate growth at Fénix and a 25,000-metric-ton carbonate growth at Salar de Olaroz in Argentina.

Moreover, expansions are underway for hydroxide manufacturing. The corporate has a 5,000-metric-ton growth on the Bessemer Metropolis plant within the US and a 15,000-metric-ton unit on the Zhejiang plant in China present process qualification.

CEO Paul Graves expressed confidence within the firm’s progress trajectory, emphasizing their strategic investments in engaging belongings throughout market cycles.

Arcadium’s enthusiasm for lithium, which consultants undertaking extra growth on this electrical metallic’s manufacturing, is mirrored broadly within the trade. Statesman report estimates the worldwide lithium supply will rise to over 2 million metric tons by 2030.

Resolving Rifts, Reviving Manufacturing

In Australia, mining firm Leo Lithium has finalized the sale of its remaining stake within the Goulamina lithium property in Mali to China’s Ganfeng Lithium Group, resolving a chronic dispute with the native authorities and paving the way in which for the undertaking to renew manufacturing this 12 months.

This settlement marks the second occasion in Could of an Australian miner resolving disputes with African governments. It resolved AVZ Minerals’ imminent delisting as a consequence of a property possession dispute with the Democratic Republic of the Congo.

Below the deal, Ganfeng will purchase Leo Lithium’s 40% stake within the Goulamina undertaking for US$342.7 million, pending approval from Leo Lithium shareholders and Chinese language regulators. This equates to 43 Australian cents per Leo Lithium share. The corporate’s shares have been suspended at 51 Australian cents in September 2023 amid the dispute.

Moreover, Leo Lithium reached a US$60 million settlement with Mali’s junta authorities. This offers away its offtake proper however securing a 1.5% gross income charge over 20 years from Ganfeng.

With the Goulamina undertaking set to start spodumene focus manufacturing within the third quarter, Leo Lithium emphasizes adherence to Mali’s new mining code. This will increase potential authorities undertaking curiosity to 30%.

Optimism Amidst Market Challenges

Whereas acknowledging shareholder considerations, trade analysts see the deal as the very best end result amid difficult sovereign and safety dangers.

For example, they recommend that regardless of present warning, the attract of potential returns could finally immediate buyers to rethink African investments, particularly if belongings are priced attractively relative to money move.

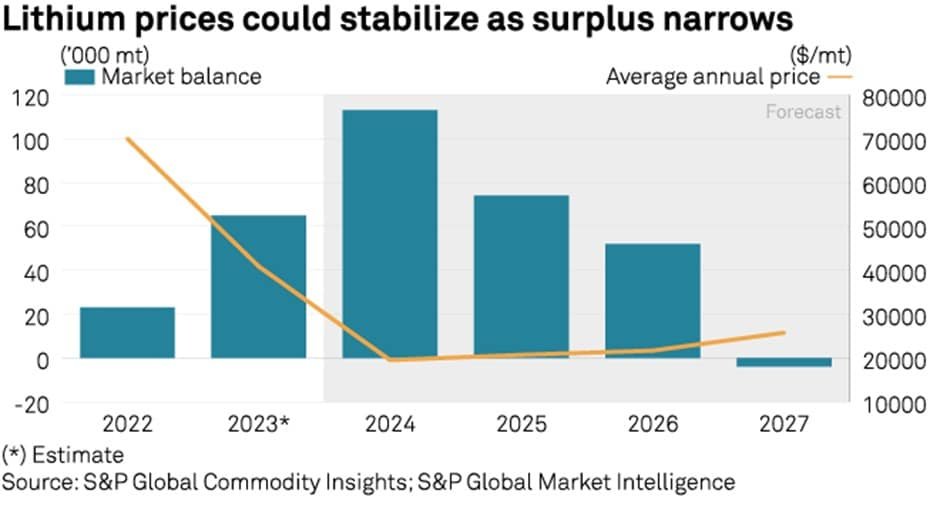

Additionally they underscore the worth for Leo Lithium shareholders and Ganfeng’s strategic funding in securing a considerable resource base for future trade progress. Extra remarkably, they continue to be optimistic about Australia’s place in lithium asset improvement, anticipating renewed curiosity as lithium costs get better within the coming quarters and years forward.

As Arcadium Lithium celebrates unprecedented earnings and Leo Lithium resolves disputes, the lithium market exhibits indicators of sturdy progress. Analysts stay optimistic, foreseeing a constructive trajectory for each lithium corporations amidst evolving market circumstances.