The excess of CORSIA-eligible carbon credit is projected to show damaging by 2030 until new provides change into accessible, in accordance with an evaluation by Abatable.

At present, the aviation sector contributes about 3% of worldwide emissions. As a sector that’s troublesome to decarbonize, it’s exploring direct low-carbon technological options like sustainable aviation fuel (SAF) and electrification. Nonetheless, these options face value and technological hurdles and can take time to change into widespread.

The Problem of Decarbonizing Aviation

To mitigate emissions within the meantime, the Worldwide Civil Aviation Group (ICAO) launched the Carbon Offsetting and Discount Scheme for Worldwide Aviation (LANE) in 2016. CORSIA goals to offset any development in aviation emissions above 85% of 2019 ranges.

CORSIA entered its first part in January this 12 months, after a pilot interval from 2021 to 2023. Part 1, which runs from 2024 to 2026, is voluntary for taking part states, whereas Part 2 can be necessary beginning in 2027.

- To conform, airways can buy SAF, improve fleet effectivity, or purchase CORSIA-eligible carbon credits.

Nonetheless, the rollout has been difficult. In March, main carbon credit score issuers Verra, Gold Customary, and Local weather Motion Reserve (CAR) have been solely conditionally accepted by ICAO’s Technical Advisory Physique. This standing can be reconsidered in September following a resubmission course of accomplished in April 2024.

At present, CORSIA Part 1 credit can solely be acquired by means of the American Carbon Registry (ACR) and ART TREES requirements. Moreover, CORSIA credit require Letters of Authorization from host international locations, additional limiting the availability.

As of now, the one latest issuance eligible for the scheme is 7.1 million Guyana ART credit. The ICAO Technical Advisory Physique’s choice means that this restricted provide state of affairs could persist all through 2024.

Demand to Outpace Provide by 2030

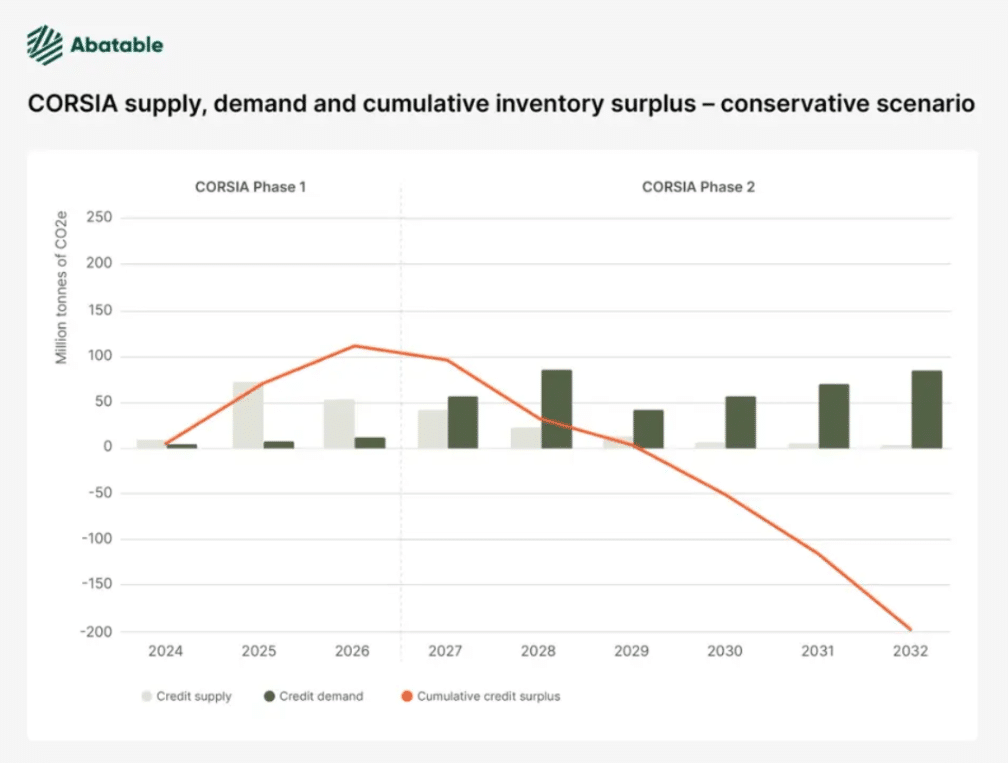

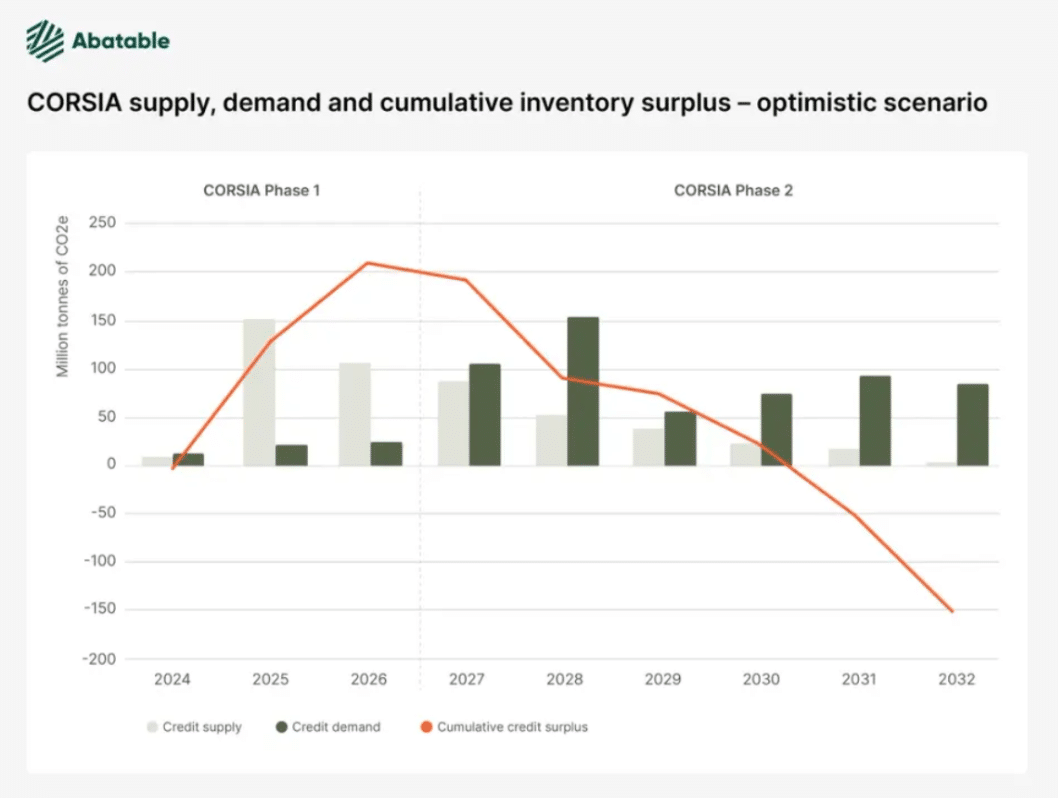

Abatable’s evaluation signifies that, beneath present market circumstances and with out new provides, demand for CORSIA credit will exceed provide by 2030. In Part 2 of the scheme, demand is projected to outpace provide between 2029 and 2030.

In a conservative state of affairs, CORSIA demand doesn’t exceed 100 million credit till after 2034. Nonetheless, provide peaks in 2025 and might solely meet demand till 2029. With out new tasks, demand in Part 2 could possibly be 14x bigger than provide.

In an optimistic state of affairs, aviation emissions return to 85% of 2019 ranges this 12 months, with CORSIA demand surpassing 100 million carbon credit in 2027. Provide, bolstered by tasks more likely to obtain corresponding changes, meets demand till 2030. With out new tasks, demand in Part 2 could possibly be 7x bigger than provide.

Abatable’s projections embody current tasks anticipated to fulfill the Integrity Council for the Voluntary Carbon Market’s Core Carbon Ideas and more likely to obtain corresponding changes. Provide from Verra, Gold Customary, and CAR is predicted from 2025.

CORSIA’s design interfaces with the Paris Settlement’s Article 6, permitting international locations to commerce emissions reductions to fulfill Nationally Decided Contributions (NDCs). Corresponding changes guarantee correct progress towards NDCs and forestall double counting. These changes are required for CORSIA credit, permitting them to be transferred internationally.

Nonetheless, delays in implementing Article 6 mechanisms might have an effect on CORSIA. Whereas particulars are being developed, tasks receiving Letters of Authorization can checklist on voluntary market registries as Article 6 compliant. Biennial UN stories will verify nationwide accounting and the appliance of corresponding changes.

A major problem is the legal responsibility for the revocation of approved credit. ICAO’s Technical Advisory Body means that requirements or venture proponents ought to assume legal responsibility, whereas requirements argue it ought to lie with the revoking nation. COP29 choices could affect this concern, doubtlessly inflicting much more delays.

Market Response and Developments

The market is reacting to those developments. New business constructions and carbon insurance coverage merchandise are beneath conception to mitigate dangers and encourage buying and selling exercise. These merchandise intention to offer confidence to market members and improve liquidity, particularly given the present market uncertainties.

So, what’s subsequent for this improvement in CORSIA carbon credit?

WorseGold Customary, and CAR have re-submitted their purposes, and the Technical Advisory Board will reassess these in September 2024. In the event that they fail, new provide sources can be delayed till 2025, extending past present projections.

To mitigate provide points, requirements ought to work towards approval whereas additionally constructing capability to assist international locations develop market infrastructure and governance for authorizing credit with corresponding changes. Massive CORSIA members may put money into upstream tasks, though this may require market understanding and time to generate a credit score stream and acquire obligatory changes.

Airways aren’t required to buy credit till Phase 1 concludes in January 2028. Nonetheless, some could purchase and retire credit prematurely, based mostly on projected obligations from historic emissions information. Last emissions stories and audits can be accomplished in 2027, indicating that the entire credit wanted, resulting in a rise in credit score retirements.

The supply of credit post-2027 will depend upon choices by ICAO, Article 6 negotiators, and governments, in addition to the emergence of recent provide sources. The actions taken within the interim can be essential for making certain there are sufficient carbon credit to fulfill future demand.

The way forward for the CORSIA carbon credit score market hinges on rising the availability of eligible credit. Abatable’s evaluation underscores the necessity for brand new tasks and corresponding changes to fulfill the rising demand by 2030. Whereas pursuing low-carbon applied sciences, the aviation sector should depend on carbon offsets within the interim.