Following Nvidia’s first-quarter earnings report, the corporate’s CEO Jensen Huang emphasised that it’s dealing with overwhelming demand somewhat than a lull. This occurs as the corporate transitions from its Hopper AI platform to the extra superior Blackwell system. Huang dismissed considerations a few potential slowdown in demand, stating,

“People want to deploy these data centers right now. They want to put our (graphics processing units) to work right now and start making money and start saving money. And so that demand is just so strong.”

Surpassing Expectations with Stellar Q1 Outcomes

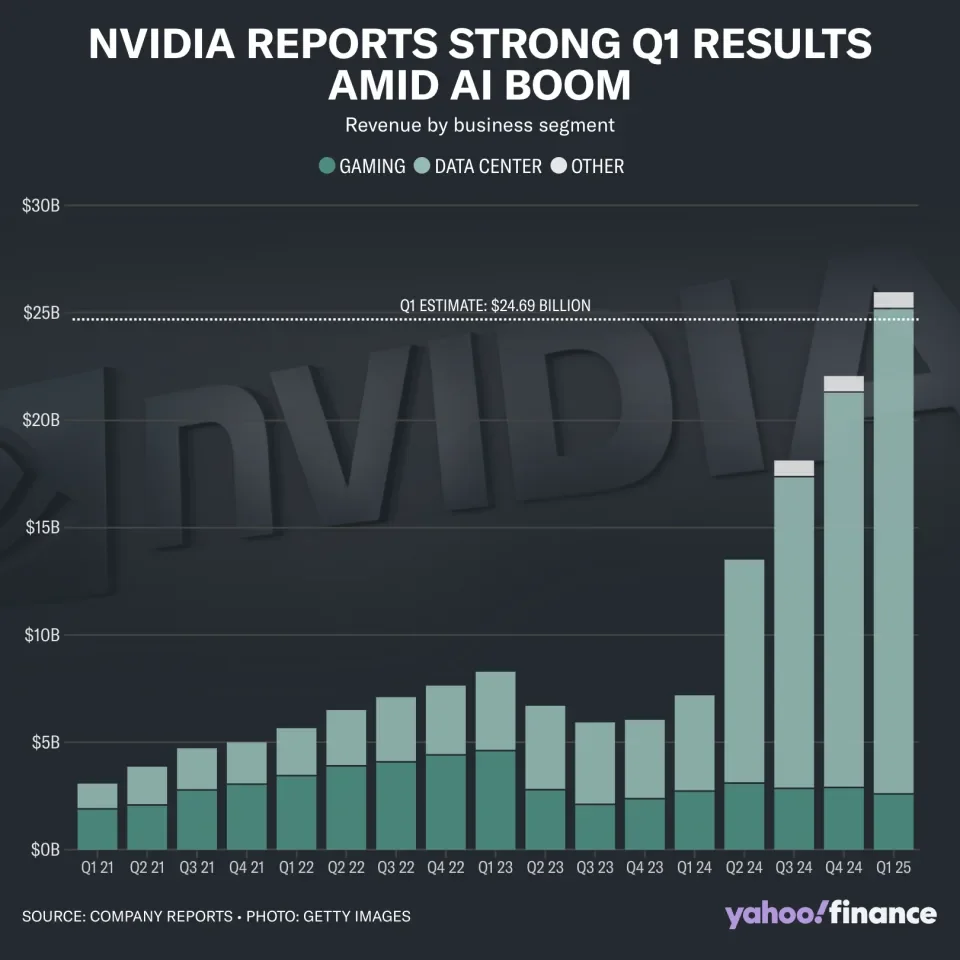

For the primary quarter, Nvidia reported stellar outcomes. Adjusted earnings per share reached $6.12 on income of $26 billion, representing year-over-year will increase of 461% and 262%, respectively. Non-GAAP working earnings was $18.1 billion for the quarter.

Nvidia expects its income for the present quarter to be round $28 billion, plus or minus 2%, surpassing analysts’ expectations of $26.6 billion.

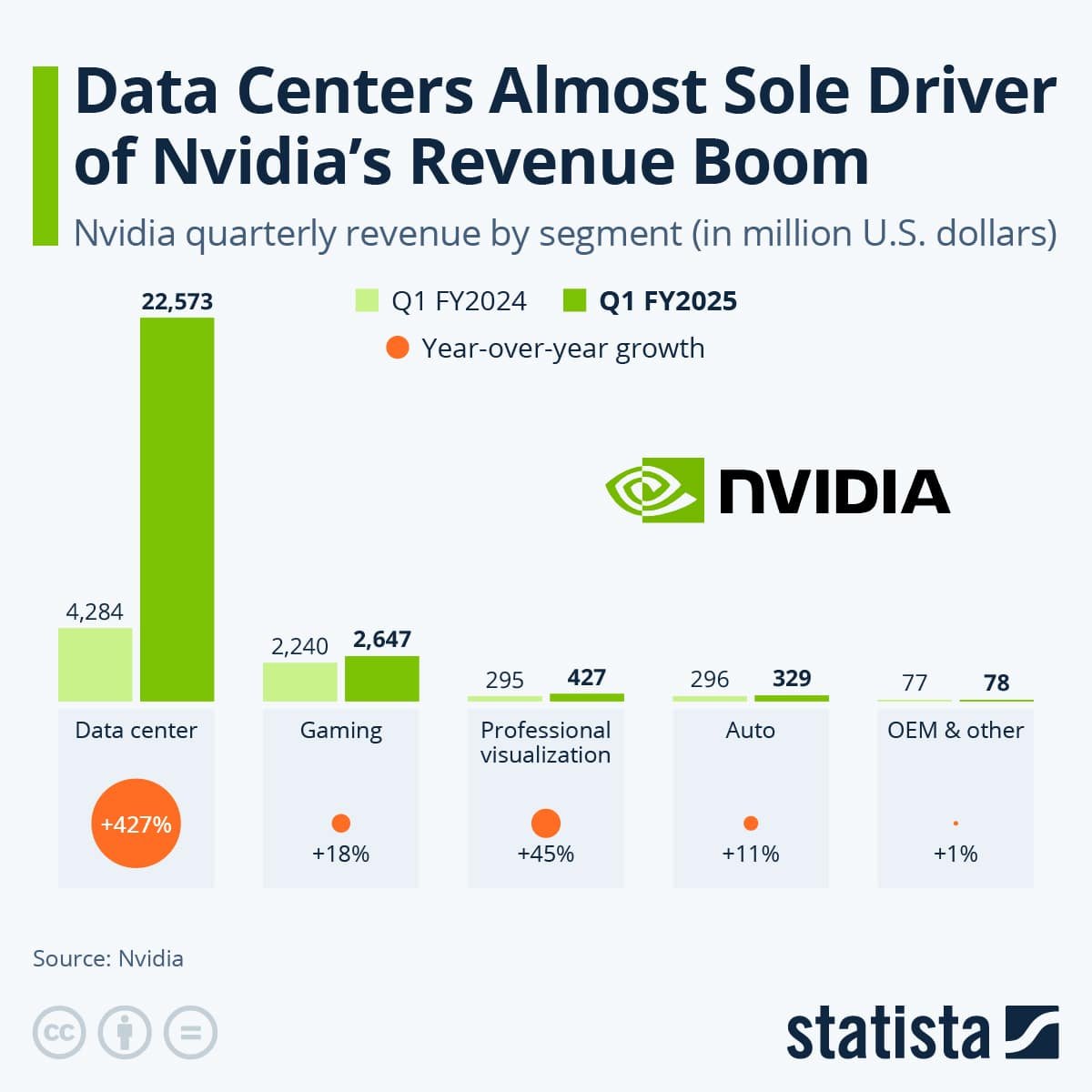

Nvidia’s knowledge middle section, essential for AI and reliant on high-powered server farms, generated $22.6 billion or 87% of its income between February and April 2024. Different segments additionally noticed progress, with gaming and visualization options growing by 18% and 45%, respectively, in comparison with fiscal Q1 2024. Nonetheless, the information middle section’s progress was extraordinary, surging 427% year-over-year, as seen under.

As well as, Nvidia introduced a 10-to-1 inventory break up, efficient June 10 for shareholders as of June 7, and elevated its quarterly dividend to $0.10 per shareup from $0.04. Following the earnings report, Nvidia’s inventory rose by as a lot as 6% in prolonged buying and selling.

Furthermore, Huang highlighted the rising buyer base for Nvidia chips past the foremost cloud service suppliers, mentioning corporations like Meta, Tesla, and numerous pharmaceutical companies. He particularly identified the automotive trade as a major person of Nvidia’s data-center chips.

Setting New Requirements in Vitality Effectivity

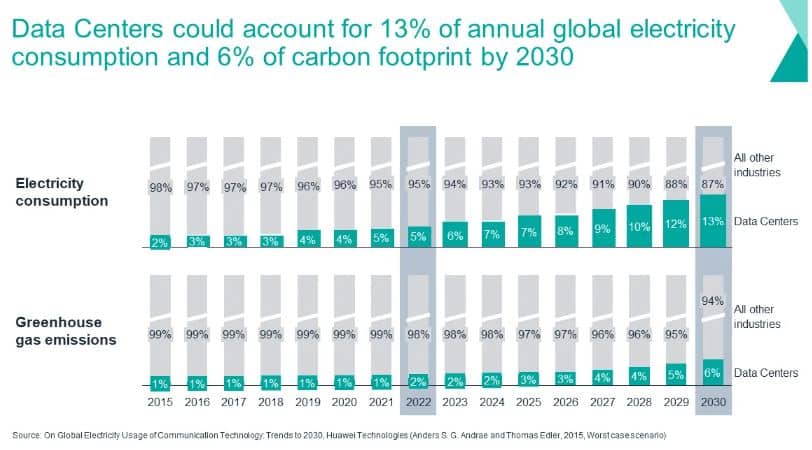

Practically 75% of world carbon emissions stem from the manufacturing and consumption of vitality, primarily as a result of burning of fossil fuels for electrical energy. Knowledge facilities, which presently eat 460 terawatt-hours of electrical energy yearly, contribute about 2% to this complete. Nonetheless, this share is predicted to almost triple to six% by 2030 as knowledge facilities proceed to develop.

Bettering vitality effectivity in knowledge facilities is essential for lowering their carbon footprint and mitigating their environmental influence. By adopting extra environment friendly applied sciences and practices, knowledge facilities can play a major position in decreasing general carbon emissions.

Nvidia goals to handle rising considerations about AI’s financial price and carbon footprint by highlighting Blackwell’s vitality effectivity.

One professional at Microsoft has recommended that the Nvidia H100s presently in deployment will eat as a lot energy as the complete metropolis of Phoenix by the top of this yr. What’s noteworthy in regards to the new Blackwell GPU is its energy effectivity, which Nvidia is now highlighting as a key promoting level.

Historically, extra highly effective chips have additionally required extra vitality, and Nvidia centered totally on uncooked efficiency somewhat than vitality effectivity. Nonetheless, when unveiling the Blackwell, CEO Jensen Huang emphasised its superior processing velocity, which considerably reduces energy consumption throughout coaching in comparison with the H100 and earlier A100 chips.

Huang famous that coaching ultra-large AI fashions with 2,000 Blackwell GPUs would eat 4 megawatts of energy over 90 days, whereas utilizing 8,000 older GPUs for a similar process would eat 15 megawatts. This discount interprets to the facility consumption of 8,000 houses in comparison with 30,000 houses.

Tech Titans Drive Nvidia’s AI Dominance

Undeniably, Nvidia stands on the forefront of the exploding demand for AI purposes, pushed by main tech giants like Tesla, Meta, Microsoft, and Alphabet. These corporations’ current administration commentary underscores the numerous potential for Nvidia’s enterprise growth within the AI sector.

Tesla’s bold plans to extend its Nvidia chip use by 140% spotlight the vital position of Nvidia’s GPUs in coaching AI fashions for its full self-driving capabilities and upcoming robotaxi launch. This substantial funding represents a significant endorsement of Nvidia’s expertise by Tesla CEO Elon Musk.

Equally, Meta’s aggressive spending to bolster its AI infrastructure aligns with CEO Mark Zuckerberg’s imaginative and prescient of building Meta as a number one AI firm globally. As Meta continues to develop its massive language mannequin (LLaMA) and Meta AI chatbot, Nvidia’s chips stay integral to its AI coaching efforts.

Microsoft can be experiencing surging demand for AI, outstripping its accessible capability. The tech large is investing in its personal AI growth utilizing OpenAI’s GPT mannequin. Nonetheless, it plans to ramp up spending to satisfy the rising demand, with Nvidia’s chips taking part in an important position in its cloud service choices.

Lastly, Alphabet’s substantial capital expenditures within the first quarter, primarily directed in the direction of Google Cloud and superior AI fashions, additional validate the significance of Nvidia’s expertise in powering AI-driven initiatives. Whereas Alphabet makes use of its chip designs for sure AI duties, it continues to depend on Nvidia chips to satisfy its cloud prospects’ wants.

Whereas most AI runs on renewable vitality, considerations persist about water consumption for knowledge middle cooling. As AI adoption grows, renewable vitality demand may outpace provide, prompting curiosity in expediting nuclear plant approvals, notably by Microsoft.

General, the overwhelming demand for AI compute presents a major alternative for Nvidia, mirrored in its sturdy monetary efficiency and hovering gross margins. And with the corporate’s dialogue of the Blackwell GPU’s vitality effectivity, it alerts that the corporate is beginning to contemplate AI’s sustainability.