On Might 10, Zeekr’s shares soared virtually 35% above their preliminary public providing worth, marking a strong debut for the electrical automobile (EV) producer. That is the primary vital U.S. market debut by a China-based firm since 2021. Zeekr’s profitable U.S. flotation goals to differentiate it from the competitors of Chinese language EV makers vying for a bigger European market share.

Zeekr, a high-end EV model underneath Geely, the dad or mum firm of Volvo and Lotus, has been gaining consideration for its luxurious electrical sedans and SUVs. The corporate’s flagship mannequin, the Zeekr 001, boasts options like speedy acceleration, superior driving help programs, and a fast-charging battery, making it a robust contender within the premium section.

Excessive Stakes: Chinese language EV Giants Eye Premium Market to Navigate US Tariffs

US Tariffs and Market Technique

Up to now 12 months, Chinese language electrical automotive producers have shifted their focus from producing small, cheap automobiles to focusing on the premium market. This transition coincides with a brand new 100% import duty imposed by the US on Chinese EVsposing a big problem as these corporations start their international enlargement with high-end automobiles.

Zeekr’s debut comes because the Biden administration plans to extend tariffs on Chinese language automobile imports.

ZEEKR’s CEO, Conghui “Andy” An, has mentioned that,

“ZEEKR plans to enter six European countries in 2024, including Germany, Sweden, and the Netherlands, and is targeting another 38 markets across Southeast Asia and the Middle East.”

Consequently, some corporations may halt US enlargement plans as a consequence of elevated prices, whereas others might set up manufacturing services in Mexico to bypass tariffs.

Zeekr’s Strategic Leap: Robust IPO and International Ambitions Amid EV Competitors

CATL Partnership

A key issue behind Zeekr’s enchantment is its cutting-edge know-how. The corporate advantages from a detailed relationship with CATLChina’s largest battery producer, offering early entry to the latest battery developments. This partnership ensures that Zeekr automobiles have a aggressive vary and efficiency, essential for fulfillment within the high-end market.

Growth Plans Past China

Zeekr was established to fulfill the rising demand for premium fashions in China. Whereas the high-end EV model has seen robust gross sales progress at dwelling, the corporate now goals to develop internationally. The US debut marks a key step in Zeekr’s technique to seize a share of the profitable North American EV market. This entry coincides with rising client demand for electrical automobiles, pushed by rising environmental consciousness and supportive authorities insurance policies.

Intense competitors in China amongst home EV makers and with Tesla has squeezed income, pushing corporations to discover worldwide markets.

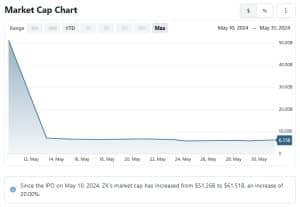

As highlighted by Zeekr, the IPO debut achieved a completely diluted valuation of $6.8 billion, about half of the $13 billion valuation from a funding spherical final 12 months.

Within the aggressive market, Chinese language automakers like BYD, SAIC, and Nice Wall Motor are additionally focusing on Europe. They’re launching electrical fashions to compete with established European producers. This is the reason Chinese language EV gross sales in Europe have grown considerably in recent times.

supply: Inventory evaluation

Zeekr’s Inventory Soars: Stellar Market Efficiency Amidst EV Growth

Newest market studies state that Zeekr’s shares peaked at $29.36 after opening at $26, effectively above the IPO worth of $21, closing at $28.26, up 34.6%.

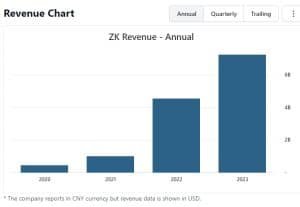

In 2023, Zeekr Clever Expertise Holding achieved spectacular monetary outcomes. Listed here are the important thing highlights:

Annual Income:

- Zeekr’s annual income in 2023 reached $7.29 billion.

- This represents a exceptional 59.24% progress in comparison with the earlier 12 months.

supply: Inventory Evaluation

supply: Inventory Evaluation

Quarterly Efficiency:

- For the quarter ending December 31, 2023, Zeekr reported income of $2.31 billion.

- The year-over-year progress charge for this quarter was a formidable 75.69%.

EV Gross sales:

Zeekrs is famend for specializing in electrical mobility. By the top of 2023, Zeekr had delivered over 100,000 electrical automobiles. The model unveiled its third mannequin, the Zeekr X, and commenced delivering automobiles to customers in Europe.

Considerably, this 12 months Zeekr goals to 2x its annual gross sales with a goal of over 200,000 models.

Zeekr has outpaced its rivals in deliveries for the reason that starting of the 12 months. By April 30, Zeekr delivered 49,148 automobiles, surpassing Xpeng’s 31,214 models and Nio’s 45,673 automobiles throughout the identical interval.

The corporate’s IPO comes amid rising geopolitical tensions between the U.S. and China, involving commerce, mental property, Taiwan, and China’s stance on the Russia-Ukraine battle.

In April Zeekr witnessed a exceptional achievement by surpassing Tesla in automotive gross sales.

This strongly indicated potential competitors for the American EV big. The achievement additional highlights Zeekr’s robust home presence and its means to problem established trade leaders.

On this stellar efficiency, Zeekr CEO Andy An commented:

“Our sales gap with Tesla keeps on narrowing,”

Regardless of the spectacular gross sales efficiency, Zeekr faces fierce competitors from Tesla and others within the EV market, amid geopolitical tensions and commerce uncertainties. But, its give attention to luxurious options, modern tech, and a profitable IPO alerts optimism and powerful investor curiosity amidst broader market losses.

The corporate mentioned in its SEC submitting:

“Through developing and offering next-generation premium BEVs and technology-driven solutions, we aspire to lead the electrification, intelligentization, and innovation of the automobile industry.”

Trying ahead, Zeekr’s ~ 35% surge in its US market debut marks a promising begin for the Chinese language EV maker. Zeekr is dedicated to delivering high-quality, technologically superior EVs because it navigates the aggressive panorama and expands its worldwide footprint Traders and customers alike will likely be watching carefully to see how Zeekr leverages this momentum within the coming months.