Xpansiv’s verified carbon market (VCM) skilled notable dynamics final week, with a rise in consumers and aggressive worth bids. A participant highlighted this “dynamism in the market,” which was evidenced by a big variety of trades matched on the CBL spot alternate.

The info offered on this report is from Xpansiv Information and Analytics, which gives complete spot agency and indicative bids/presents, in addition to transaction information.

Xpansiv helps the CBL, the world’s largest spot environmental commodity alternate, providing a day by day and historic bid, provide, and transaction information for carbon credit, compliance, and voluntary renewable power certificates, and Australian Carbon Credit score Models (ACCUs) traded on the CBL platform. The spot information is enriched by ahead costs from high market intermediaries, aggregated registry statistics, and scores from main suppliers.

Key Carbon Credit score Transactions and Costs

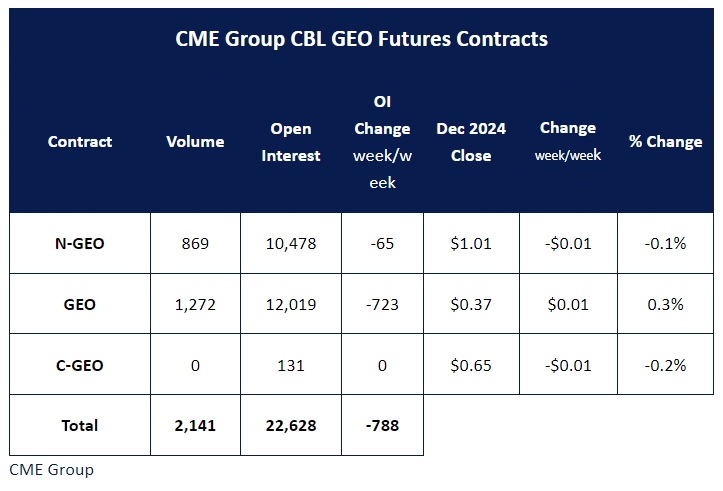

A noteworthy transaction included a 5,000 metric ton spot N-GEO commerce at $1.15, aligning with the costs of over 200,000 tons of N-GEO-eligible credit score OTC transactions settled through the alternate. This carbon price degree was greater than double the contract settlement from the earlier week.

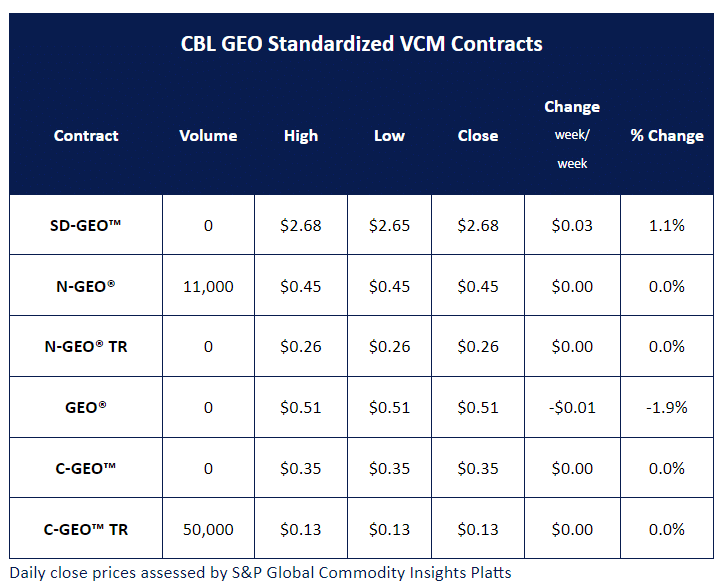

In the meantime, CME Group’s CBL N-GEO December futures settled at $1.01, displaying a uncommon low cost to the spot N-GEO. The CBL N-GEO, CBL GEO, and CBL C-GEO futures all closed the week with minor actions of $0.01 on mild buying and selling quantity.

A number of project-specific credit had been additionally matched on the CBL display screen. These included:

- VCS 2250 classic 2020 Pakistani Delta Blue carbon credit: 3,678 credit matched at $30.00.

- VCS 674 classic 2018 Indonesian Rimba Raya credit: 6,363 credit transacted at $7.80.

- VCS 595 classic 2020 United States Anew Elk Forestry Mission credit: $18.00.

- VCS 1477 classic 2019 Indonesian Katingan credit: $5.50.

- Classic 2015 Katingan credit: $5.00.

- VCS 2886 classic 2022 Malawi cookstoves credit: $3.99.

- ACR 556 classic 2019 United States Industrial Course of credit: $2.75.

- VCS 1115 classic 2018 Brazilian AFOLU credit: $2.50.

- ACR 455 classic 2018 United States Industrial Course of items: $2.00.

- VCS 1753 classic 2020 Indian bundled photo voltaic credit: $1.25.

An extra 200,000-plus tons of OTC transactions had been settled through CBL’s automated post-trade settlement infrastructure, bringing the alternate’s complete quantity to 325,079 tons.

The 20-day shifting common worth for recent-vintage nature credit stood at $7.03, whereas know-how devices averaged $1.30.

What’s Occurring in North American REC Market?

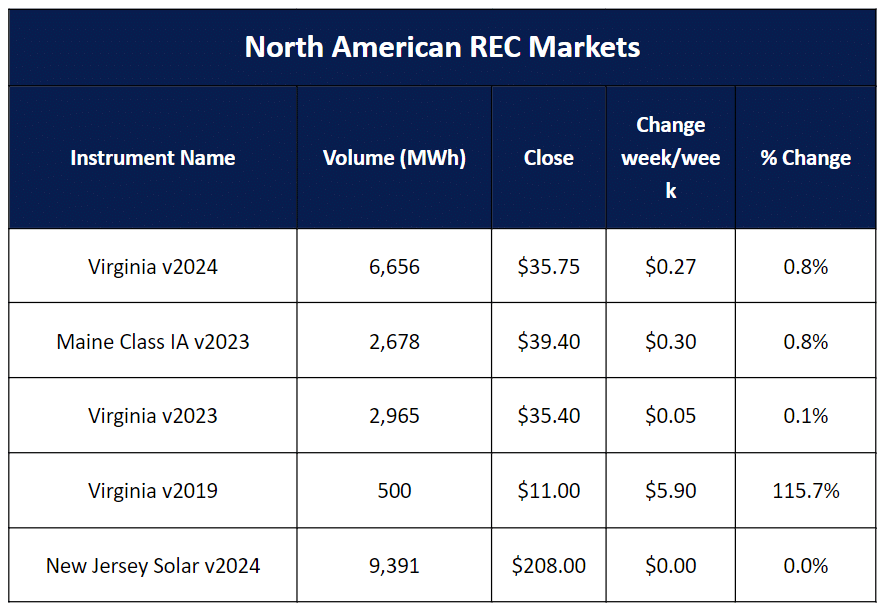

PJM REC market exercise noticed important buying and selling, significantly with Virginia REC trades and bigger New Jersey photo voltaic REC transactions. Pricing remained steady throughout PJM, with New Jersey photo voltaic RECs closing at $208.00 as power yr 2024 concluded. This confirmed an uptick on the finish of the week.

Virginia markets skilled slight worth will increase for 2023 and 2024 vintages, closing at $35.40 and $35.75, respectively.

Virginia markets skilled slight worth will increase for 2023 and 2024 vintages, closing at $35.40 and $35.75, respectively.

In NEPOOL markets, Massachusetts photo voltaic REC II traded at $243.00, up from $230.00 in late Could. In the meantime, Massachusetts photo voltaic REC I and Class I markets had been comparatively quiet. Maine Class I markets noticed a 0.8% enhance week-over-week, closing at $39.40.

The VCM demonstrated elevated exercise and aggressive buying and selling final week, indicating rising curiosity and engagement from market individuals. Xpansiv continues to offer important information and analytics, supporting knowledgeable buying and selling choices within the carbon and renewable power markets.