The world is quickly shifting in the direction of clear renewable power options, pushed by their immense potential to mitigate local weather change and obtain international web zero targets. Surprisingly, non-public fairness corporations are on the forefront of this pattern, investing closely in photo voltaic, wind, biomass, and different renewables.

These corporations are drawn not solely by the social and humanitarian advantages but additionally by the financial benefits of renewables, which embody low-cost energy, decreased reliance on imported fuels, and a safer, dependable power provide.

Personal Capital Takes Cost in Renewable Power Investments

Personal capital is experiencing a surge in buying renewable energy builders, more and more favoring equity-based take-private offers for leveraged buyouts on account of excessive rates of interest and rising electrical energy demand.

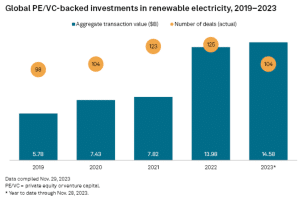

The statistics underscore this motion. In 2023, non-public fairness and enterprise capital transactions within the international renewable power sector almost reached $15 billion. That is the very best complete up to now 5 years, in accordance with S&P Global Market Intelligence data.

Furthermore, funds raised for renewable power tasks in recent times are approaching 25 occasions the worth of fossil gasoline asset fundraising, per one other trade report. This vital monetary dedication highlights the rising recognition of the financial viability and long-term advantages of renewable power investments.

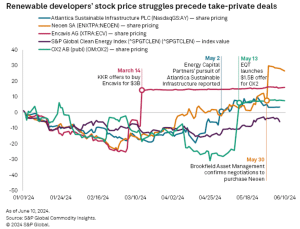

Key traders akin to KKR & Co. Inc., Brookfield Asset Administration Ltd., EQT AB, and Power Capital Companions LLC have actively bid for listed renewable platforms this yr, aiming to speed up the businesses’ put in capability within the coming years.

After a interval of restricted dealmaking exercise, asset managers and infrastructure funds at the moment are leveraging their venture improvement abilities as they develop extra comfy with the renewable energy sector. Brookfield Renewable Companions, for example, has a powerful monitor file of buying builders with vital pipelines within the US.

Peter Zhu, managing director at Macquarie Group Ltd.’s Inexperienced Funding Group, highlighted that the present greater rate of interest surroundings has adjusted fairness returns for renewables favorably, creating a horny funding window for main renewable platforms.

Final month, non-public fairness agency EQT supplied supplied to amass Swedish renewable power firm OX2 for $1.5 billion. The objective is to reinforce EQT’s renewable power portfolio and increase OX2’s development within the power sector.

This shift signifies a strategic pivot in non-public capital funding, specializing in the long-term potential and development capabilities of renewable power builders.

Challenges and Alternatives in Renewable Power Valuations

The renewable power sector has confronted substantial challenges in recent times, together with venture delays, commerce restrictions, provide chain disruptions, and rising rates of interest, affecting each US and European builders. These obstacles have negatively impacted the valuation of publicly traded renewable energy companies.

- As an illustration, inside Bloomberg Intelligence’s renewables peer group—which incorporates Brookfield goal Neoen SA and KKR goal Encavis AG—the enterprise-value-to-capacity a number of has declined from 1.5x in January 2023 to 1.1x.

A notable instance is Sweden’s OX2 AB, whose inventory value dropped by 24% in 2024 earlier than EQT AB made a $1.5 billion supply on Could 13.

In keeping with consultants, the present market situations have made the valuations of those publicly traded renewable energy builders extra enticing for traders. They highlighted that the earlier mixture of fast development in renewable energy and low rates of interest created alternatives for personal capital to amass renewable developers at extra favorable costs.

Data centers are a big driver of development within the renewable power sector. KKR’s $3 billion bid for Germany’s Encavis features a dedication to extend the corporate’s put in capability to 7 GW by the top of 2027, up from the earlier goal of 5.8 GW.

Equally, Brookfield has expressed intentions to “accelerate (Neoen’s) growth,” reflecting a broader pattern amongst funding giants to reinforce the capabilities of renewable power builders they purchase.

The Nordic market, significantly fitted to information facilities, is poised for development as a result of substantial energy calls for related to information middle improvement.

Brookfield lately entered into a worldwide 10.5-GW framework settlement with Microsoft, a deal almost 8x bigger than the most important single company PPA, underscoring the immense demand from hyperscale datacenters and industrial services.

Fueling the Exponential Development in Power Transition Offers

Power transition offers involving non-public fairness have surged dramatically over the previous 5 years, with complete deal worth growing by 7,300%. Within the U.S., non-public equity-backed power transition offers grew from lower than $500 million in 2018 to greater than $25.9 billion in 2023.

As compared, conventional non-public fairness power offers solely elevated by 53%, from $20.9 billion in 2018 to $32.0 billion in 2023. Though nonetheless behind, non-public fairness deal circulate within the power transition sector almost caught up with conventional power offers over this era.

Non-private fairness traders nonetheless dominate power transition deal circulate, however their development, whereas strong, was much less dramatic. The overall worth of those offers rose by 379%, from $8.9 billion in 2018 to $42.7 billion in 2023.

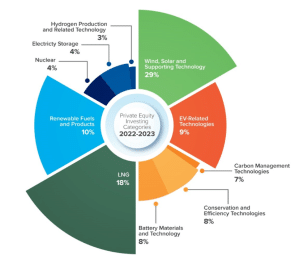

As for the way capital is being deployed, information suggests non-public fairness investing in power transition may be very broad in scope. Remarkably, many of the funds in 2022 and 2023 went to wind, photo voltaic, and supporting applied sciences ($12.8 billion).

The numerous enhance in non-public fairness investments within the power transition sector may drive these efforts ahead.

Personal fairness corporations are more and more investing within the renewable power sector, pushed by each financial and environmental advantages. Regardless of challenges like venture delays and rising rates of interest, the potential for development in renewable power stays robust. This surge in non-public capital is important for accelerating the worldwide transition to scrub power.