The European Union’s (EU) upcoming carbon border tax is inflicting waves of tension amongst British inexperienced power producers. As per the brand new directive, “British wind and solar farms exporting power to continental Europe from 2026 could face CO2 fees, despite producing no emissions, unless the UK and EU agree to amend the carbon border tax.”

Thus, business leaders concern that this new coverage might penalize the UK’s inexperienced power sector. They’re apprehensive that their efforts to fight local weather change could possibly be undermined, probably disrupting commerce relationships.

What’s the Carbon Border Tax?

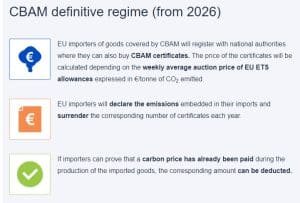

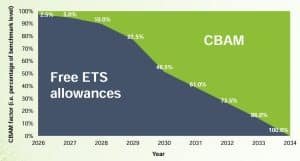

The EU’s carbon border taxformally often called the Carbon Border Adjustment Mechanism (CBAM), is designed to forestall “carbon leakage”. This occurs when corporations shift manufacturing to international locations with weaker local weather laws, thereby undermining international efforts to cut back emissions. The tax goals to stage the enjoying subject by imposing charges on imported items from international locations with much less stringent local weather insurance policies.

Will the EU CBAM Influence British Renewable Exports?

A couple of days in the past, Reuters reported that business consultants revealed how prices outlined in a little-known clause of the CO2 levy legislation might impression the revenues of renewable power tasks within the UK. This might additional add to already-high EU energy costs and even result in increased emissions.

Andy Berman, deputy director of the business group Vitality UK identified that it’s a two-way drawback. She added,

“(It) disincentivizes clean power in the UK at the moment in which we’re trying to ramp up the provision of clean power, and it’s going to increase (power) prices in northern Europe.”

Catherine Stewart, the UK Treasury’s deputy director for commerce coverage additionally expressed her views on EU’s tax coverage by stating,

“It is an issue that we are conscious of and one that we have raised, that the UK has raised, with the EU.”

Regardless of the UK’s dedication to decreasing emissions and its strong inexperienced power sector, business leaders concern that the carbon border tax may negatively impression British corporations. The priority is that the tax will probably be utilized to all imports, whatever the exporting nation’s inexperienced credentials and carbon footprint.

supply: Carbon Border Adjustment Mechanism – European Fee (Europa.eu)

Let’s elaborate on the potential impression on the renewable business and commerce relations at giant.

Financial Feasibility at Threat

Analysts warn that the extra prices might render it “uneconomic” to export surplus clear energy from Britain to Europe, particularly in periods of low demand, excessive renewable technology, and low energy costs.

Aurora Vitality Analysis’s evaluation, shared with Reuters, signifies:

- As much as 3 GWh of renewable energy could possibly be curtailed by 2030 if the price discourages exports. This capability is sufficient to provide 2,000 houses yearly.

- Including a tax on exports basically reduces the revenue margin each time exports happen. By 2030, the carbon border price might scale back the income British renewable tasks earn for his or her energy by 5%.

The analysis agency highlighted key info concerning the renewable capability buildout based mostly on authorities coverage and market forces.

1. Growing energy demand

Europe goals to decarbonize and obtain Internet Zero emissions by 2050, primarily by electrifying its economic system and increasing renewable power to chop emissions. Rising demand for Energy Buy Agreements (PPAs) boosts funding in renewables. Enhanced power effectivity lowers energy demand.

2. Sturdy coverage help and Authorities ambition

Authorities ambition pushes deploying renewables and strong coverage help fosters investor confidence. Sudden coverage adjustments or lack of help can hurt investor confidence in renewables inside a rustic.

3. Rising gas and carbon costs

Excessive fuel costs have led to a change again to coal technology. New market gamers have elevated hypothesis and volatility, a pattern anticipated to proceed. Impartial Commodity Intelligence Providers (ICIS) estimates carbon costs will attain €90 per tonne by 2030.

4. Section-out of thermal capability

As Europe phases out coal and older, unabated fuel property to satisfy decarbonization objectives, it creates alternatives for low-carbon alternate options to satisfy rising energy demand. The retirement of thermal capability strains system necessities like frequency and voltage management, which can’t be absolutely met by renewables alone.

Influence on Wholesale Costs and Emissions

Market Screener has reported two attention-grabbing analyses:

Aurora Analysis: The corporate analyzed the consequence of the discount in low-cost British electrical energy exports. It could possibly probably spike wholesale energy costs by as much as 4% in markets like Eire and Northern Eire which rely closely on UK imports.

AFRY Providers: The analysis agency indicated that if European international locations improve coal and fuel energy technology to cowl the shortfall, CO2 emissions might rise by 13 million tonnes yearly. This improve is equal to the emissions of 8 million vehicles.

The determine exhibits that: Failure to take away renewables limitations results in 80% increased CO2 worth in 2030 considerably elevating wholesale electrical energy costs for European business & shoppers.

sources: Aurora Vitality Analysis, EIKON, S&P

sources: Aurora Vitality Analysis, EIKON, S&P

Can Renewable Exports Keep away from CO2 Charges?

A European Fee spokesperson acknowledged that renewable energy exports might keep away from CO2 charges in the event that they meet particular standards and show their origin. Nonetheless, business consultants argue that is difficult. They assume that almost all electrical energy traded throughout interconnectors is nameless, making it troublesome to calculate the carbon content material.

They’ve additionally voiced issues, stating the tax penalizes sectors main the combat in opposition to local weather change. RenewableUK confused the necessity for a system that rewards inexperienced power credentials with out pointless limitations. They known as for insurance policies that contemplate the precise carbon footprint of imports quite than making use of a blanket method.

Linking Carbon Markets: A Viable Answer

One potential answer is linking the EU and UK carbon markets, which might exempt UK energy producers from the tax.

Alistair McGirr, SSE’s Group Head of Coverage and Advocacy famous,

“Linking the carbon markets could prevent UK exporters from paying a tax to the EU that could otherwise benefit the UK budget.”

Regardless of this suggestion, neither Brussels nor London has proven enthusiasm for the concept.

Former UK local weather change minister Graham Stuart additionally spoke in favor of linking carbon markets that could possibly be explored underneath the post-Brexit Commerce and Cooperation Settlement. The European Fee spokesperson added that the EU is open to linking its carbon market with others, however it “must stem from a mutual wish from both parties.”

Inexperienced Enhancing, Not Inexperienced Washing: Bolstering EU’s Carbon Markets

We found a big side of tax implication on business and shoppers from the newest press launch of the Council of EU.

Notably, the Council adopted its place on the Inexperienced Claims Directive to sort out greenwashing and assist shoppers make knowledgeable greener decisions. The directive units minimal necessities for substantiating, speaking, and verifying environmental claims. This transfer follows a 2020 examine revealing that over half of environmental claims are imprecise, deceptive, or unfounded. Thus, dependable, comparable, and verifiable claims are important for knowledgeable client choices.

Alain Maron, Minister of the Authorities of the Brussels-Capital Area, chargeable for local weather change, setting, power, and participatory democracy has commented on this transfer,

“Today, we reached an important agreement to fight greenwashing by setting rules on clear, sufficient and evidence-based information on the environmental characteristics of products and services. Our aim is to help European citizens to make well-founded green choices.”

Organizations like Anew Local weather, Rubicon Carbon, and others, hailed the EU’s progress on the Inexperienced Claims Directive (GCD) however known as for additional motion to make sure it helps clear and credible inexperienced claims, important for reaching web zero. Key suggestions embody:

- Dependable Inexperienced Claims: Guarantee claims are dependable, comparable, and verifiable throughout the EU to forestall greenwashing.

- Simplified Framework: Keep away from pointless administrative burdens and help using all varieties of carbon credit, not simply EU-originated elimination credit.

- Uniformity in Requirements: Align with present frameworks just like the CRCF and ICVCM to keep away from overlap and improve worldwide consistency.

They collectively consider adopting these measures will enhance voluntary private-sector funding in local weather mitigation. It will additionally advance the Inexperienced Deal and strengthen Europe’s aggressive market.

supply: EU-CBAM

supply: EU-CBAM

This evaluation emphasizes the necessity for dialogue between UK and EU policymakers to make sure the tax doesn’t sabotage the worldwide combat in opposition to local weather change. Moreover, a balanced method is essential for British Inexperienced Vitality to acknowledge its efforts whereas minimizing commerce disruption. Total, the way forward for UK-EU commerce and the worldwide local weather agenda hinges on reaching this equilibrium.