As we edge nearer in direction of a extra sustainable world, the demand for nickel is skyrocketing. Nickel’s inherent properties equivalent to energy, ductility, and resistance to warmth and corrosion make it indispensable throughout numerous industries, notably the manufacturing of stainless-steel.

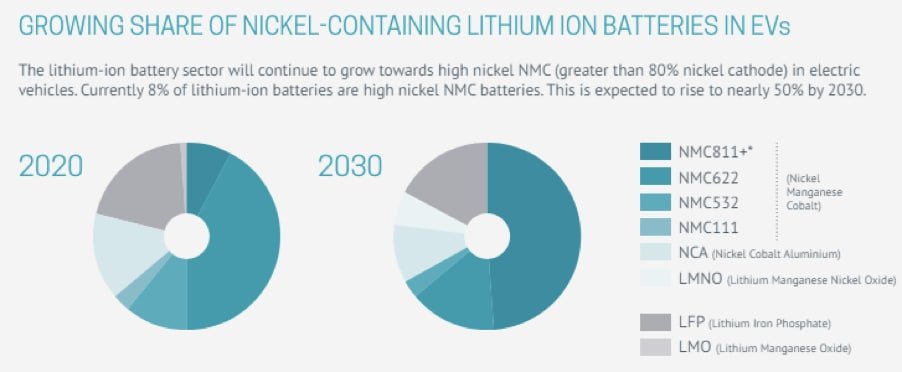

However extra importantly, nickel performs a pivotal position within the make-up of the lithium-ion batteries utilized in electrical autos (EVs). With its key position in clear power transition, in addition to common industrial use, nickel was added to the U.S. authorities’s important minerals record in 2022.

This record is the results of the Power Act of 2020, which outlined important minerals as these:

“essential to the economic or national security of the United States; have a supply chain that is vulnerable to disruption; and serve an essential function in the manufacturing of a product, the absence of which would have significant consequences for the economic or national security of the U.S.”

There’s rather a lot to chew on there, however in easy phrases: important minerals are people who the U.S. can’t operate with out, or people who the U.S. relies upon an excessive amount of on antagonistic overseas powers for.

It’s not simply the U.S., both – a number of different international locations have their very own important minerals lists, equivalent to Canada, the EU, South Korea, and Japan – and so they all have nickel on them.

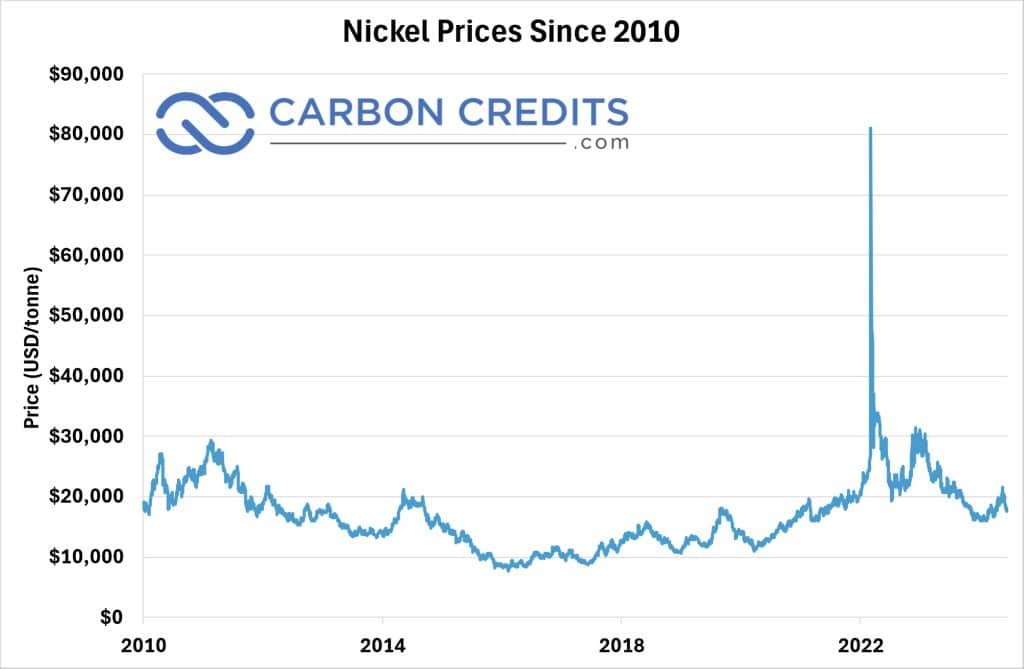

However regardless of a quick spike in early 2022 when the Russian invasion of Ukraine drove costs up on fears of a possible provide disruption, nickel costs have stayed pretty steady over many of the previous decade, usually buying and selling within the band between $10,000-$20,000.

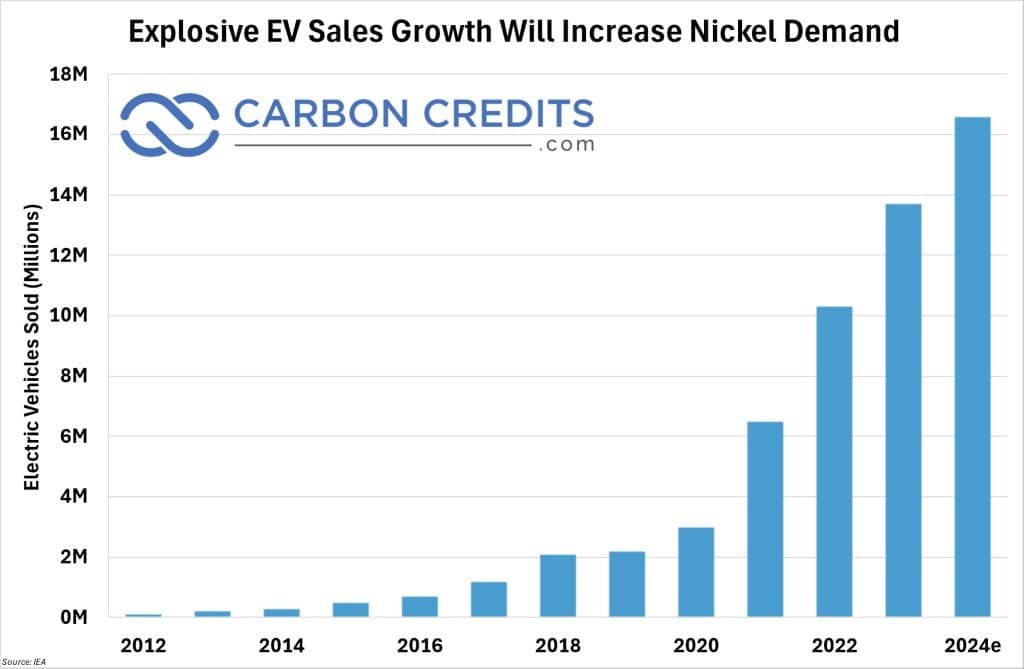

Although nickel is certainly essential to our web zero future, a wholesome surplus of mine provide mixed with a worldwide hunch in metal demand have offset the sturdy development of the EV market (proven beneath), resulting in nickel’s present weak value setting.

Nonetheless, although the near-term outlook for nickel isn’t sturdy, the inexperienced transition is predicted to widen the hole between provide and demand.

Worldwide Power Company (IEA) Forecast

The Worldwide Power Company (IEA) has forecasted that on the present tempo of improvement, nickel demand will outstrip provide by roughly 25% in 2030, yielding a extra optimistic long-term nickel prices outlook.

Within the meantime, right here’s an in depth have a look at the highest three nickel shares which can be poised to capitalize on this rising demand, with a deal with their manufacturing capabilities, market positioning, and forward-looking methods.

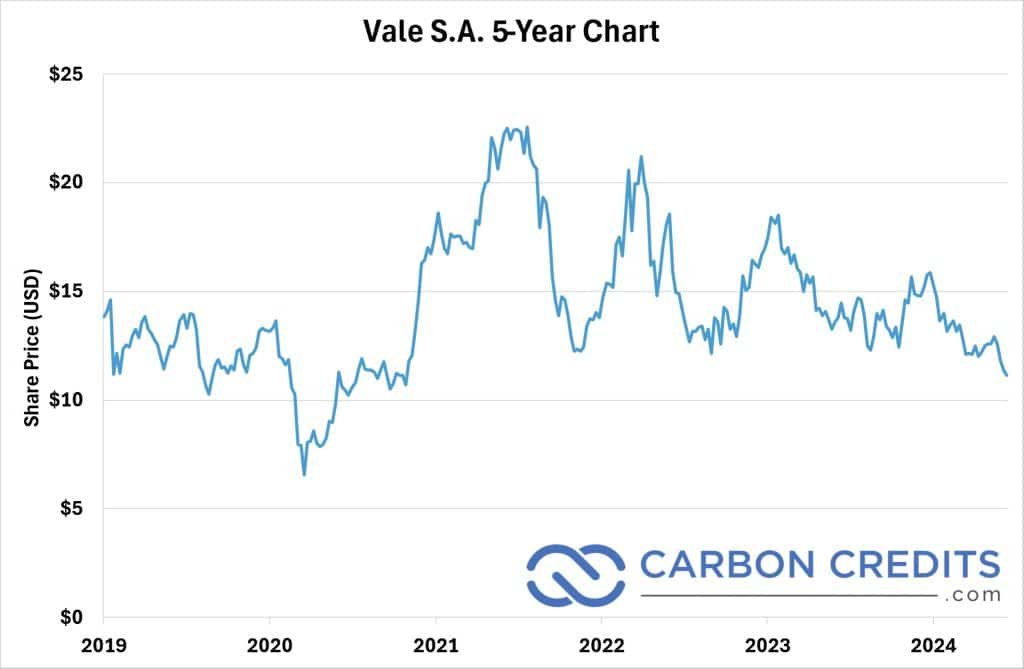

1. Vale SA (NYSE: VALE) Market Cap: US$48 Billion

Because the world’s second largest producer of nickel in 2023, Vale stands out with operations spanning Brazil, Canada, Indonesia, and New Caledonia.

- Notably, the corporate’s Lengthy Harbour nickel processing plant in Canada set a benchmark in low-carbon nickel manufacturing, emitting a few third of the trade’s common CO2 ranges.

Final yr, Vale produced 164,900 tonnes of nickel, 8% decrease than the yr earlier however according to steerage on account of ongoing improvement at a few of its mines.

This scale, mixed with its dedication to sustainability, positions Vale robustly within the face of escalating demand, particularly from the EV battery sector. The corporate’s technique to broaden nickel output whereas adhering to environmental requirements makes it a compelling alternative for buyers specializing in sustainable development.

The principle downside with Vale lies in the truth that the corporate is a diversified miner that additionally produces iron ore and copper. Particularly, nickel solely represented 8.8% of the corporate’s working income in 2023.

Nonetheless, this inclusion of different enterprise segments isn’t essentially a nasty factor, because it does assist decrease the danger of the corporate as an funding. These on the lookout for a extra conservative decide that also retains publicity to the expansion of the nickel market can positively contemplate Vale as a decide for his or her portfolios.

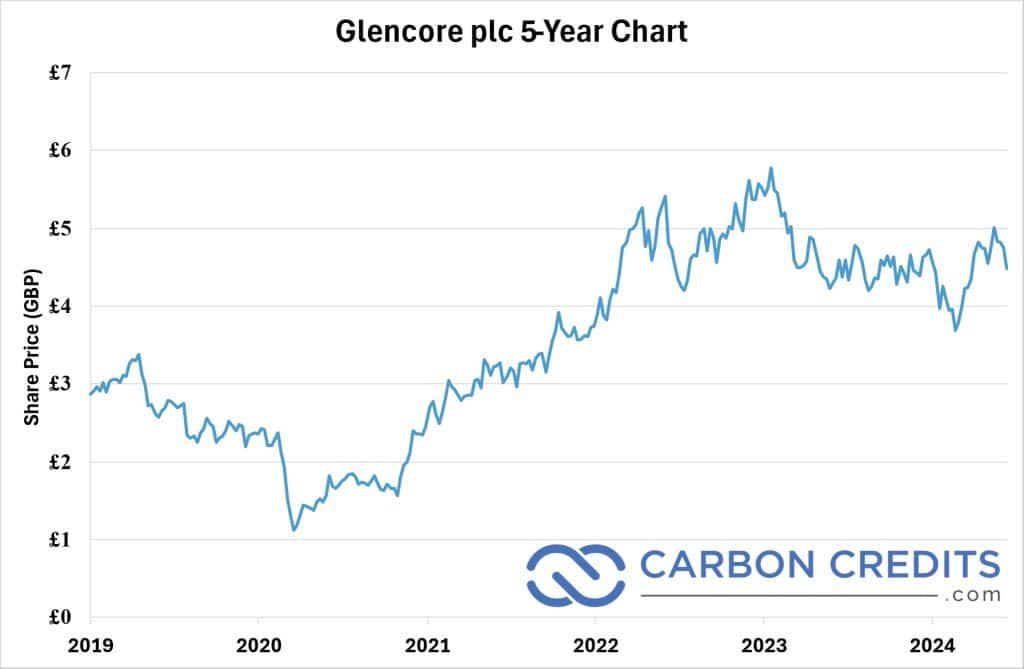

2. Glencore plc (LON: GLEN | OTC: GLNCY) Market Cap: US$70 Billion

Subsequent on our record is the world’s third-largest producer of nickel, UK-based Glencore. Like Vale, Glencore is a diversified miner that operates in a number of completely different markets.

Final yr, Glencore produced 97,600 tonnes of nickel. Whereas that solely accounted for a modest 4.2% of Glencore’s complete income for 2023, one factor that units Glencore other than Vale is that it’s considerably extra diversified than the latter, with an power section on high of its metals and minerals section.

Glencore’s broad mandate mixed with its dimension make it a comparatively protected funding, and the corporate has carried out very effectively because the post-COVID market lows. The corporate has additionally acquired optimistic consideration for its very aggressive emissions discount targets that embrace a 25% discount in Scope 1, 2, and three emissions by the top of 2030 and a 50% discount by year-end 2035 in opposition to a 2019 baseline.

Many main corporations nonetheless refuse to even report Scope 3 emissions, not to mention set near-term emissions discount targets for them, so Glencore is certainly forward of the curve with their local weather motion plan.

Final however not least, Glencore’s main itemizing on the London Inventory Trade makes it simpler for Europe-based buyers on the lookout for nickel publicity, although the corporate additionally has overseas odd shares and ADRs listed on the U.S. OTC market.

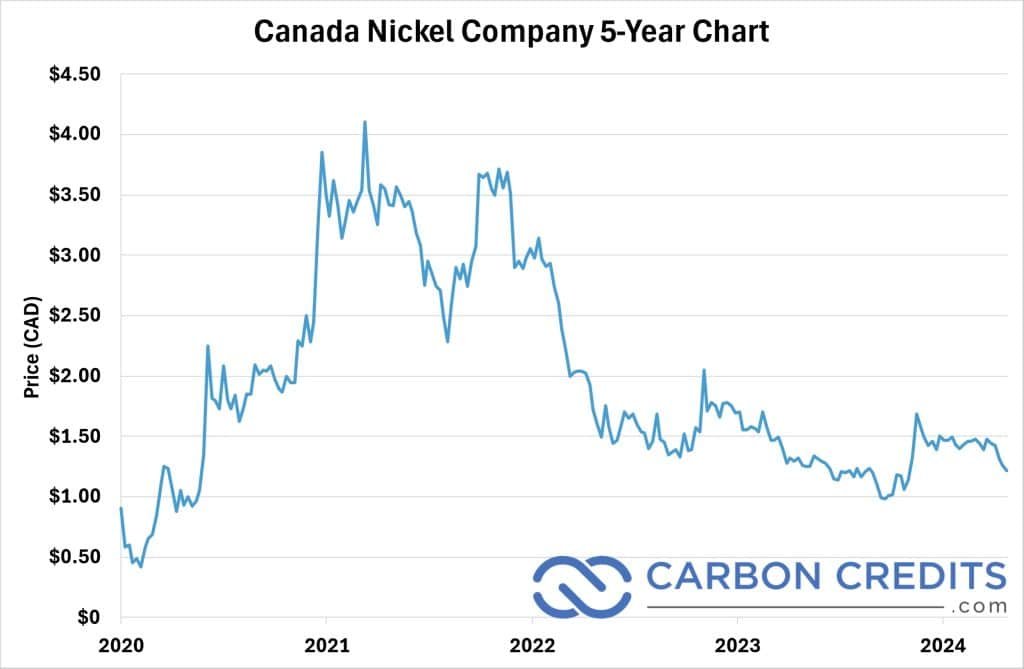

3. Canada Nickel Firm (TSXV: CNC | OTC: CNIKF) Market Cap: US$160 Million

Lastly, our final firm is one for aggressive buyers with a wholesome urge for food for threat, who’re on the lookout for extra direct publicity to the expansion of the nickel market in comparison with the diversified miners talked about above.

Canada Nickel is a junior nickel miner primarily based out of – you guessed it, Canada. Whereas this may occasionally not seem to be it warrants a particular point out, it’s price noting that the U.S. imports over 40% of its nickel from its northern neighbour. This makes Canada an especially enticing jurisdiction for nickel producers, as a significant shopping for market is simply a brief hop throughout the border.

The Crawford Nickel Venture

The corporate has carried out a wonderful job of consolidating nickel tasks within the traditionally prolific Timmins mining camp in Ontario, one of many largest gold mining districts on the earth. Whereas nickel has historically been mined primarily as a by-product within the space, Timmins has struck proverbial gold with its flagship Crawford Nickel Venture.

- Proper now, Crawford is definitely the world’s second nickel operation by reserve dimension. Primarily based on its bankable feasibility research, it’s projected to be the third largest nickel mine on the earth when it comes to annual manufacturing as soon as it’s constructed.

At present, Canada Nickel remains to be ending the funding and allowing course of for Crawford. The ultimate choice on whether or not or to not construct the mine is predicted to occur mid subsequent yr, with first manufacturing anticipated by year-end 2027 if all goes in keeping with plan.

Although Canada Nickel has acquired quite a few different tasks within the space, Crawford is certainly the primary draw right here. It’s anticipated to be a low-cost mine with strong economics and a prolonged 41-year mine life. The corporate’s novel strategy to carbon storage, built-in into its mine plan, would additionally make Crawford not only a low-carbon-emission mine, however really web carbon destructive over its lifetime.

Nearly as good as all this sounds, nonetheless, it’s vital to keep in mind that as a junior miner that isn’t even producing any nickel but, Canada Nickel is a extremely speculative funding that ought to solely be thought of by buyers with excessive threat tolerance.

Whereas quite a few main corporations have already got their eyes on Canada Nickel, with massive names like Agnico Eagle, Samsung, and Anglo American taking important possession stakes, there’s no assure that Canada Nickel will have the ability to safe the funding and permits obligatory to construct a mine at Crawford, or that the corporate will succeed even when they do.

Nonetheless, in the event you’re on the lookout for an funding with pure play publicity to nickel and have the appropriate threat profile, Canada Nickel is one firm you don’t wish to miss.

A Transient Notice on Norilsk Nickel (Nornickel)

Now, these of you who’ve seemed on the corporations above is likely to be questioning one thing: why wasn’t the world’s largest nickel producer, Norilsk Nickel a.ok.a. Nornickel, included?

Sadly, regardless of its attractiveness because the world’s largest nickel producer that’s additionally the closest factor you may get to a pure play main, there’s one main concern with Nornickel: it’s a Russian firm.

Following the Russian invasion of Ukraine in 2022, Nornickel was one in all a number of corporations sanctioned by the Westresulting in the inventory getting delisted from each the American in addition to the London inventory markets.

As of June 2024, Nornickel remains to be listed on the Moscow Trade. Nevertheless, on condition that the Russian authorities has restricted overseas buyers in “unfriendly” international locations from shopping for and promoting securities on the Moscow Trade, the corporate is inaccessible to the typical investor for the foreseeable future.

Nickel’s Significance in a Zero Emissions World

The worldwide transition in direction of renewable power and the exponential development of the EV market are key drivers for demand development for nickel. And lets not neglect about lithium’s significance in “lithium ion” batteries together with nickel for brand spanking new EVs.

RELATED: LiFT Energy ($LIFFF), a quick growing North American lithium junior, is price a glance within the lithium house.

The businesses listed above aren’t simply mining companies – they’re additionally strategic gamers within the world shift in direction of sustainable power. Investing in these shares affords potential publicity to a important useful resource that powers each at this time’s industries and tomorrow’s applied sciences.

Every firm’s deal with increasing manufacturing capabilities whereas sustaining environmental and moral requirements gives a powerful basis for development.

As the online zero transition continues accelerating the tempo of EV adoption and therefore the expansion of the nickel market, be sure to preserve your eyes on these three corporations.